What Does 203k Eligible Mean?

Related Articles: What Does 203k Eligible Mean?

- World Population 2025: Projections, Trends, And Implications

- 2025 Kia Carnival Hybrid: Release Date, Specs, And Features

- Volvo XC60 2025: A Comprehensive Overview Of Its Specifications

- Around The World Cruises 2026: An Unforgettable Journey Of A Lifetime

- Small Ship Cruises 2025: Embark On Intimate And Unforgettable Voyages

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to What Does 203k Eligible Mean?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about What Does 203k Eligible Mean?

What Does 203k Eligible Mean?

Introduction

In the realm of home financing, there exists a unique loan program designed to assist homebuyers in purchasing properties that require substantial renovations or repairs. This program is known as the 203(k) loan, insured by the Federal Housing Administration (FHA). For those considering the 203(k) loan option, understanding its eligibility requirements is crucial. This article will delve into the intricacies of 203(k) loan eligibility, providing a comprehensive guide to its qualifications and benefits.

Eligibility Criteria

To qualify for a 203(k) loan, prospective homeowners must meet specific criteria established by the FHA. These criteria encompass the following:

1. Property Eligibility:

- The property must be a single-family home, a two-family home with one unit occupied by the borrower, or a condominium unit.

- The property must be located in an eligible area as determined by the FHA.

- The property must require eligible repairs or renovations.

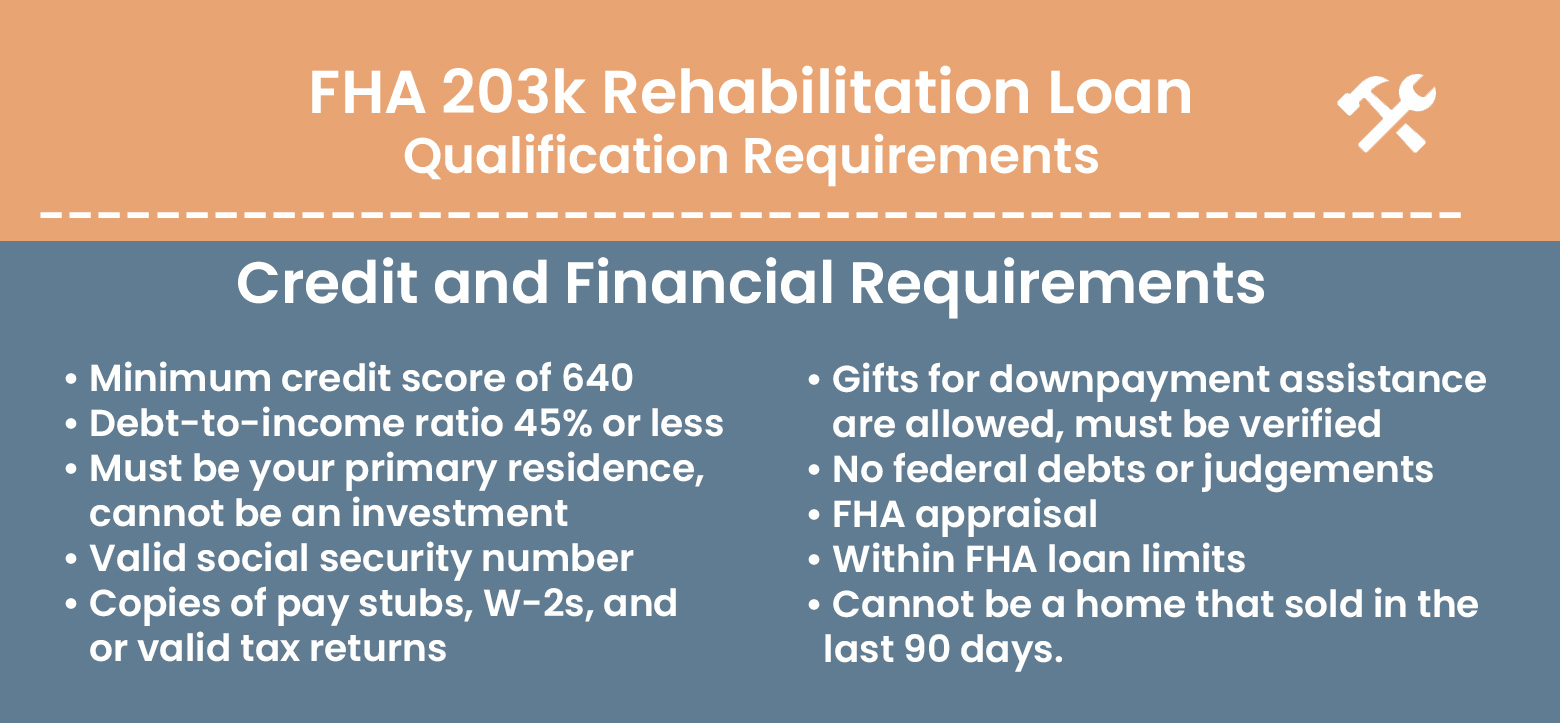

2. Borrower Eligibility:

- The borrower must have a good credit score and a stable income.

- The borrower must be able to afford the monthly mortgage payments, including the cost of repairs and renovations.

- The borrower must be willing to live in the property as their primary residence.

Eligible Repairs and Renovations

The 203(k) loan program covers a wide range of eligible repairs and renovations, including:

- Structural repairs, such as foundation work, roof replacement, and exterior wall repairs.

- Plumbing and electrical upgrades.

- Kitchen and bathroom remodeling.

- Energy-efficient improvements, such as new windows and insulation.

- Accessibility modifications, such as ramps and grab bars.

Types of 203(k) Loans

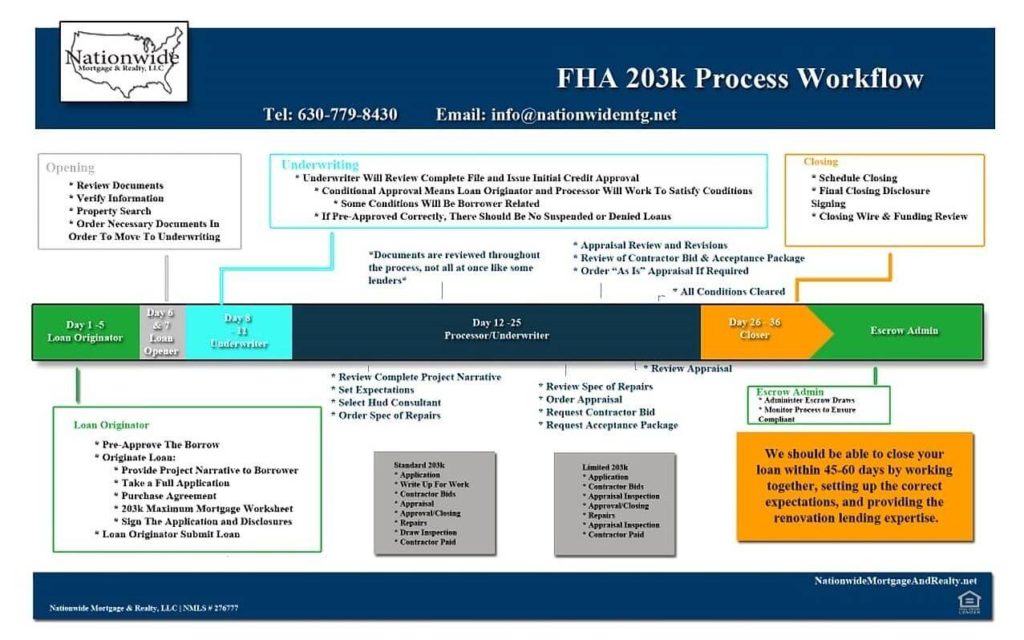

There are two primary types of 203(k) loans:

1. Limited 203(k) Loan:

- This loan is suitable for projects with a total cost of up to $35,000.

- The repairs or renovations must be completed within six months.

- The borrower must obtain a contractor’s estimate for the project.

2. Standard 203(k) Loan:

- This loan is available for projects with a total cost exceeding $35,000.

- The repairs or renovations must be completed within 12 months.

- The borrower must work with a HUD-approved consultant to develop a detailed plan for the project.

Benefits of 203(k) Loans

The 203(k) loan program offers several advantages to eligible homeowners:

- Financing for Repairs and Renovations: Borrowers can finance the cost of repairs and renovations into their mortgage, avoiding the need for additional loans or out-of-pocket expenses.

- Lower Down Payment: The FHA allows for a down payment as low as 3.5%, making homeownership more accessible for first-time buyers.

- Energy Efficiency: The 203(k) loan encourages energy-efficient improvements, potentially reducing monthly utility bills.

- Increased Property Value: Renovations and repairs can significantly increase the value of the property, providing homeowners with a long-term investment.

- Accessibility Modifications: The 203(k) loan can help homeowners create a more accessible living environment for individuals with disabilities or mobility impairments.

Conclusion

The 203(k) loan program offers a valuable opportunity for homebuyers to purchase and renovate properties that require substantial repairs or upgrades. By meeting the eligibility criteria and understanding the available loan options, prospective homeowners can harness the benefits of the 203(k) loan to achieve their homeownership dreams. Whether it’s a structural repair, a kitchen remodel, or an accessibility modification, the 203(k) loan provides a comprehensive solution for those seeking to transform their house into a home.

Closure

Thus, we hope this article has provided valuable insights into What Does 203k Eligible Mean?. We thank you for taking the time to read this article. See you in our next article!