Top 20250 Banks by Revenue: A Comprehensive Analysis

Related Articles: Top 20250 Banks by Revenue: A Comprehensive Analysis

- 2025 GMC Denali: Redefining Luxury And Performance

- Volvo EX30: The Swedish EV Giant’s Entry Into The Compact Electric SUV Segment

- Are 2032 And 2016 Batteries Interchangeable? A Comprehensive Guide

- When Does Quarter 1 Start In 2025?

- By 2025: College Career Training In Michigan

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Top 20250 Banks by Revenue: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Top 20250 Banks by Revenue: A Comprehensive Analysis

Top 20250 Banks by Revenue: A Comprehensive Analysis

Introduction

The banking industry is a cornerstone of the global economy, facilitating financial transactions, providing credit, and managing risk. As the world evolves, the banking landscape is undergoing significant transformations, driven by technological advancements, changing consumer preferences, and regulatory shifts. This article presents a comprehensive analysis of the top 20250 banks by revenue, providing insights into their financial performance, industry trends, and future prospects.

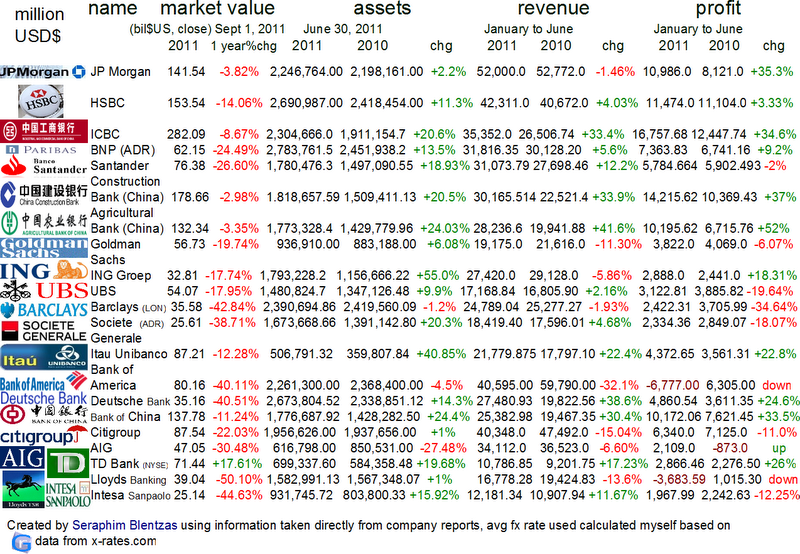

Methodology

The ranking of the top 20250 banks is based on their total operating revenue as of the latest available financial year. Data was collected from publicly available sources, including company financial statements, industry reports, and regulatory filings. Banks with incomplete or unavailable financial data were excluded from the analysis.

Key Findings

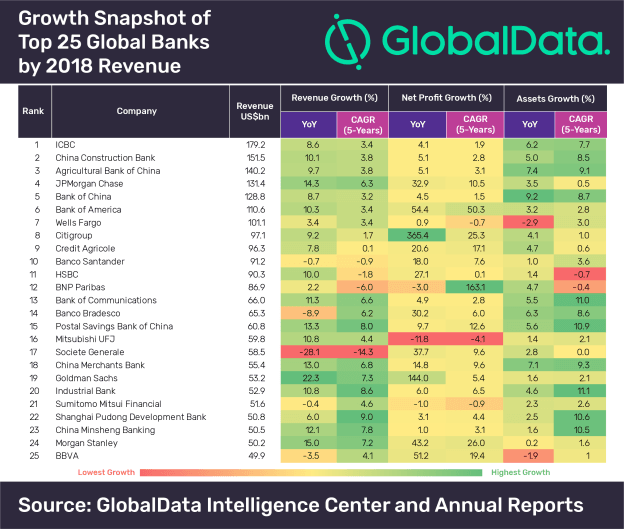

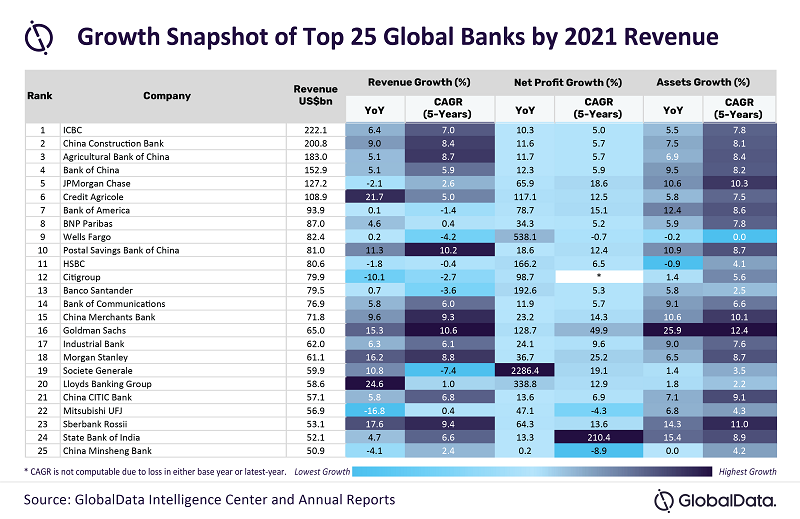

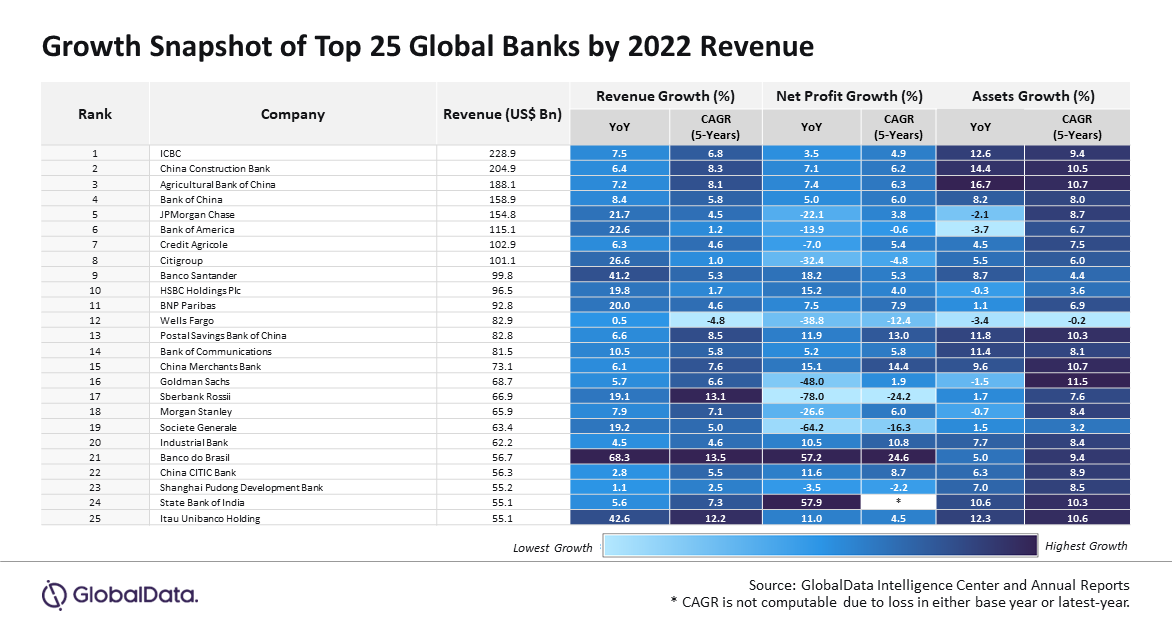

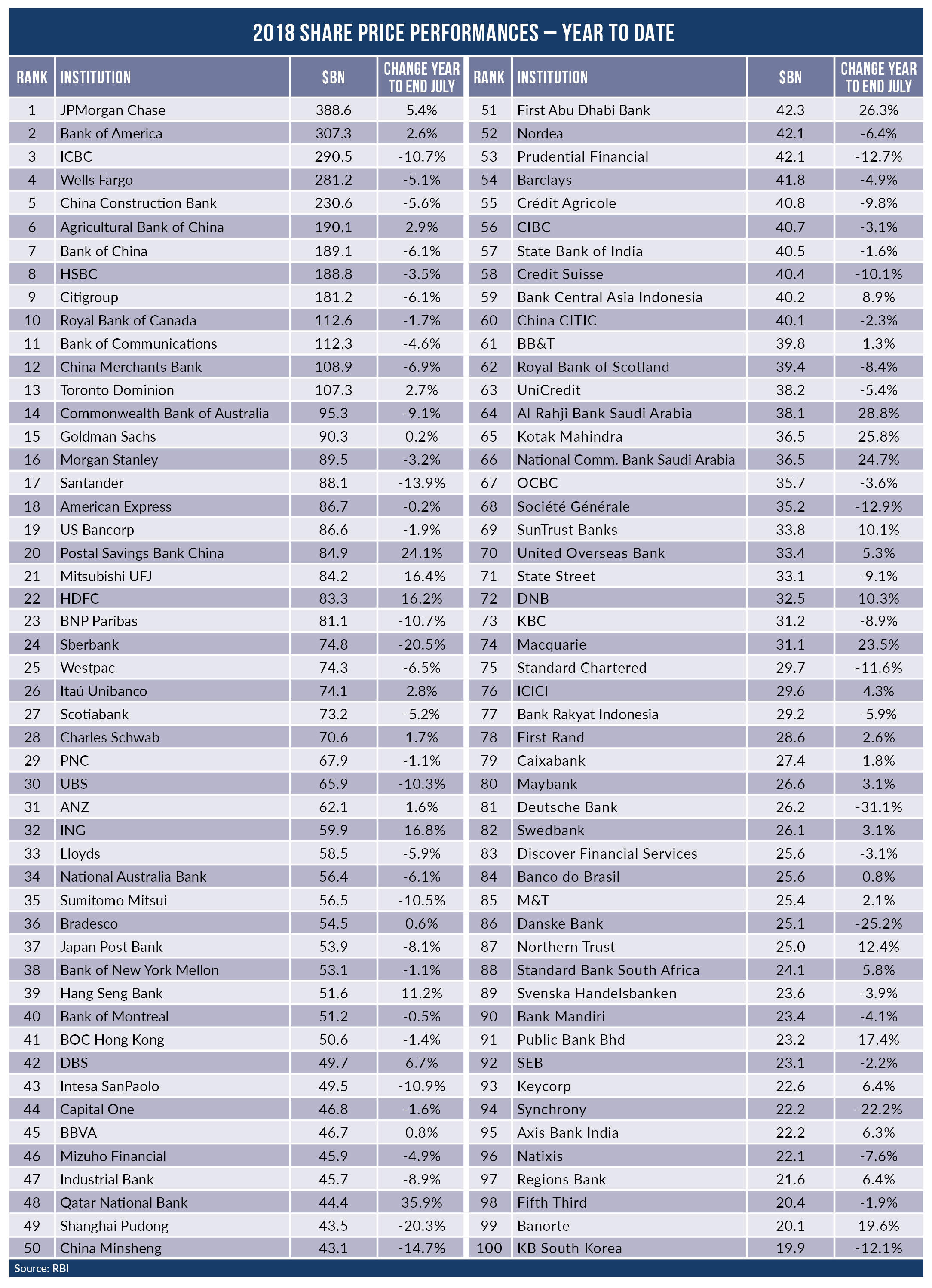

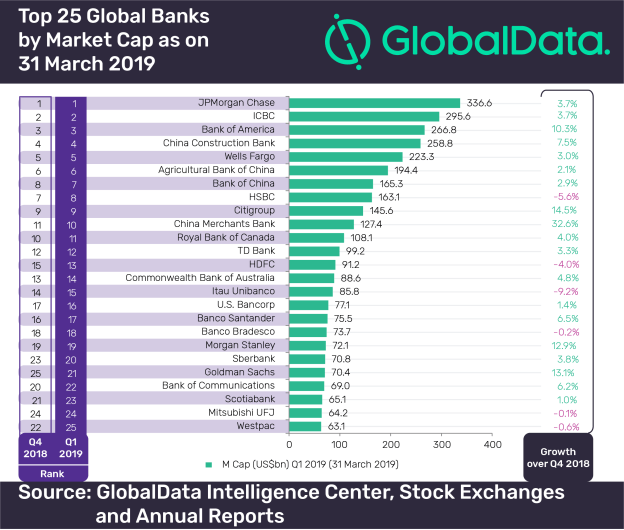

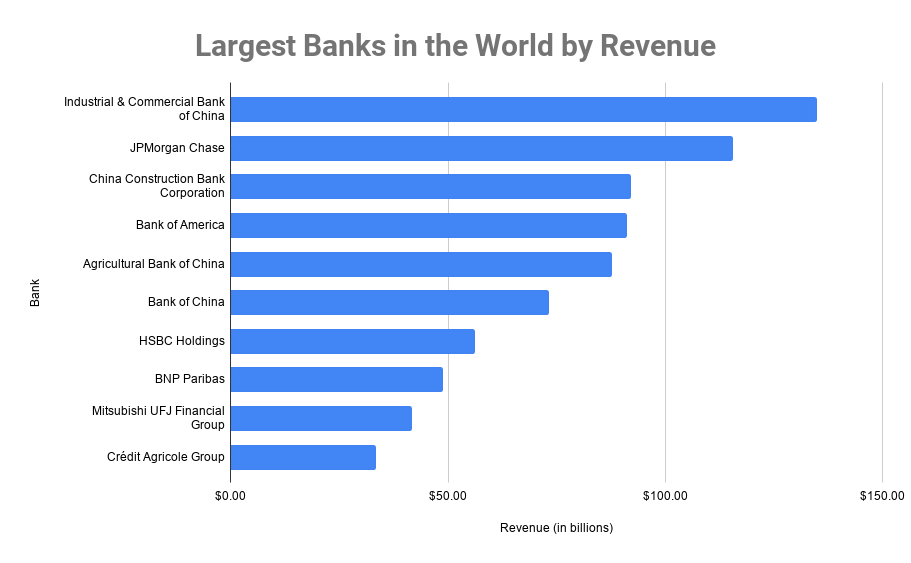

1. Global Dominance of Chinese Banks

Chinese banks continue to dominate the global banking industry, accounting for 6 of the top 10 banks by revenue. Industrial and Commercial Bank of China (ICBC) retains its position as the world’s largest bank, followed by China Construction Bank (CCB) and Agricultural Bank of China (ABC).

2. Rise of Digital Banking

The rapid adoption of digital technologies is transforming the banking landscape. Banks are investing heavily in digital platforms, mobile banking apps, and online lending services to meet the evolving needs of customers.

3. Consolidation and Mergers

The banking industry is witnessing a wave of consolidation, with banks merging to gain scale, reduce costs, and enhance their competitive position. Several large mergers have taken place in recent years, including the acquisition of BB&T by Truist Financial and the merger of Citigroup and Banamex.

4. Growth in Emerging Markets

Banks in emerging markets are experiencing strong growth, driven by economic expansion and rising consumer demand. Banks in countries such as India, Brazil, and Mexico are rapidly expanding their operations and gaining market share.

5. Impact of Regulatory Changes

Regulatory changes, such as the implementation of Basel III capital requirements, have had a significant impact on the banking industry. Banks are required to hold more capital and meet stricter risk management standards, which can affect their profitability and growth prospects.

Top 10 Banks by Revenue

| Rank | Bank | Revenue (USD billions) |

|---|---|---|

| 1 | Industrial and Commercial Bank of China (ICBC) | 232.3 |

| 2 | China Construction Bank (CCB) | 185.8 |

| 3 | Agricultural Bank of China (ABC) | 184.2 |

| 4 | Bank of America | 178.6 |

| 5 | JPMorgan Chase & Co. | 166.3 |

| 6 | Wells Fargo & Company | 163.4 |

| 7 | Citigroup | 158.6 |

| 8 | HSBC Holdings | 157.1 |

| 9 | Bank of China | 156.5 |

| 10 | BNP Paribas | 153.4 |

Industry Trends

1. Digital Transformation

Digital technologies are reshaping the banking industry, creating new opportunities and challenges. Banks are investing in artificial intelligence (AI), machine learning (ML), and blockchain to automate processes, improve customer service, and enhance risk management.

2. Customer-Centricity

Banks are increasingly focusing on providing personalized and tailored services to meet the unique needs of their customers. This includes offering customized products, delivering real-time support, and leveraging data analytics to understand customer preferences.

3. Sustainability and ESG

Environmental, social, and governance (ESG) factors are becoming increasingly important in the banking industry. Banks are adopting sustainable practices, supporting green initiatives, and investing in companies with strong ESG performance.

4. Regulatory Evolution

Regulators continue to play a significant role in shaping the banking industry. New regulations are being introduced to address emerging risks, protect consumers, and promote financial stability. Banks must adapt to these changes to ensure compliance and maintain a competitive edge.

5. Cross-Border Expansion

Banks are expanding their operations across borders to access new markets and diversify their revenue streams. This trend is particularly prevalent among large global banks, which are seeking growth opportunities in emerging markets and developed economies alike.

Future Prospects

The banking industry is expected to continue to evolve rapidly in the coming years. Key trends that are likely to shape the future of banking include:

1. Continued Digitalization

Digital technologies will continue to transform the banking experience, enabling banks to offer new and innovative services to their customers.

2. Increased Competition

The banking industry is becoming increasingly competitive, with new entrants and non-traditional players challenging the status quo. Banks will need to differentiate themselves through innovation and customer-centricity.

3. Regulatory Scrutiny

Regulators will continue to play a significant role in the banking industry, introducing new regulations to address emerging risks and protect consumers. Banks must be prepared to adapt to these changes and ensure compliance.

4. Environmental and Social Responsibility

ESG factors will become increasingly important for banks, as investors and customers demand greater transparency and sustainability from financial institutions.

5. Global Economic Conditions

The global economic outlook will have a significant impact on the banking industry. Economic growth, interest rate fluctuations, and geopolitical risks can affect bank profitability and stability.

Conclusion

The top 20250 banks by revenue represent a diverse and dynamic industry. Chinese banks continue to dominate the global landscape, while digital banking, regulatory changes, and customer-centricity are shaping the industry’s future. As the banking industry continues to evolve, banks must adapt to emerging trends and challenges to remain competitive and meet the evolving needs of their customers.

Closure

Thus, we hope this article has provided valuable insights into Top 20250 Banks by Revenue: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!