t. rowe price retirement 2025 fund – class r

Related Articles: t. rowe price retirement 2025 fund – class r

- Dodge Viper: A Comprehensive Overview Of Model Years

- EU Gender Equality Strategy 2020-2025: Striving For A Gender-Equal Europe

- The 2025 Project: A Comprehensive Plan For Transforming Education

- CR2025 Vs CR2032: A Comprehensive Comparison

- The Truth Of Dragons: Unraveling The Enigma In 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to t. rowe price retirement 2025 fund – class r. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about t. rowe price retirement 2025 fund – class r

T. Rowe Price Retirement 2025 Fund – Class R: A Comprehensive Guide

Introduction

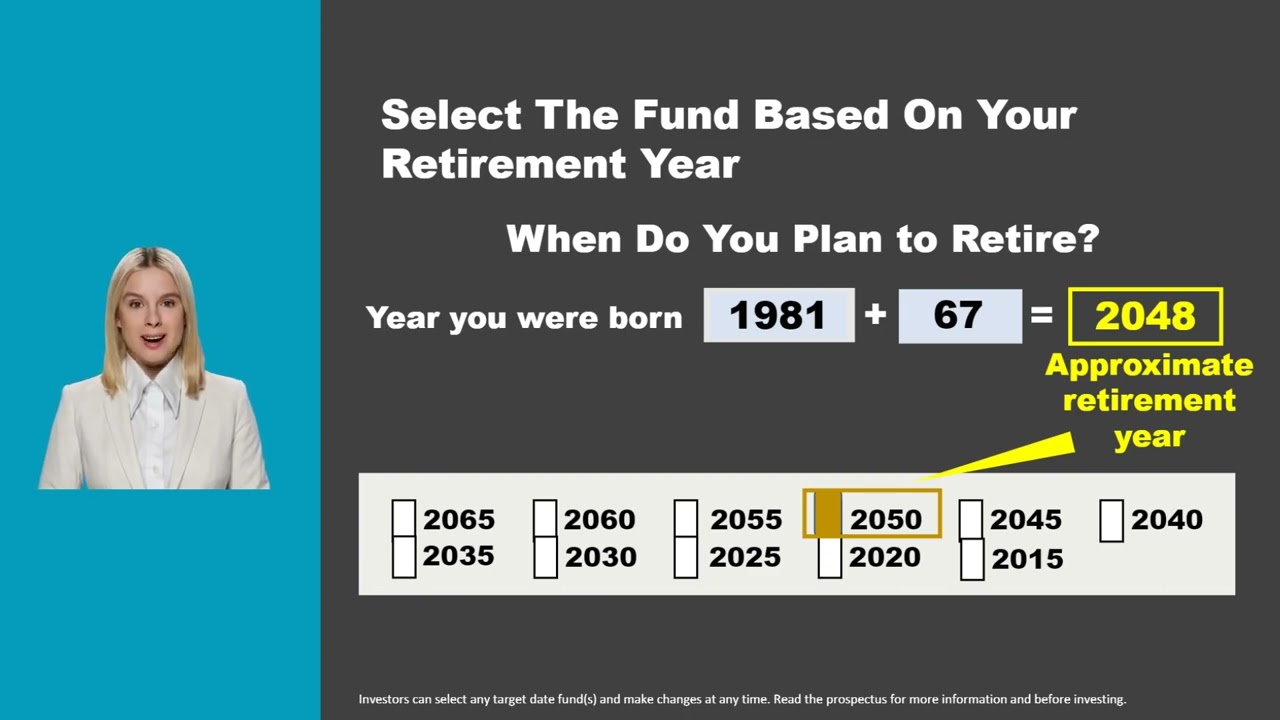

Retirement planning is a critical aspect of financial well-being. With the rising cost of living and increasing longevity, it’s more important than ever to start saving early and invest wisely for a comfortable retirement. T. Rowe Price Retirement 2025 Fund – Class R is a target-date fund designed to simplify retirement savings for individuals approaching retirement in 2025. This article provides a comprehensive guide to this fund, exploring its key features, investment strategy, performance, and suitability for investors.

Key Features

- Target Date: 2025

- Investment Objective: To provide capital appreciation and income in preparation for retirement in or around 2025.

- Asset Allocation: The fund’s asset allocation gradually shifts from higher-risk investments (such as stocks) to lower-risk investments (such as bonds) as the target date approaches.

- Expense Ratio: 0.75% (Class R)

- Minimum Investment: $2,500

Investment Strategy

T. Rowe Price Retirement 2025 Fund – Class R employs a "glide path" investment strategy that adjusts the fund’s asset allocation based on the time remaining until the target date. The fund invests primarily in a blend of:

- Stocks: Stocks represent the riskier portion of the portfolio and have the potential for higher returns over the long term.

- Bonds: Bonds provide stability and income to the portfolio and typically have lower volatility than stocks.

- Money Market Instruments: Money market instruments are short-term investments that provide liquidity and stability to the portfolio.

The fund’s asset allocation is managed by a team of experienced investment professionals who continuously monitor market conditions and adjust the portfolio accordingly.

Performance

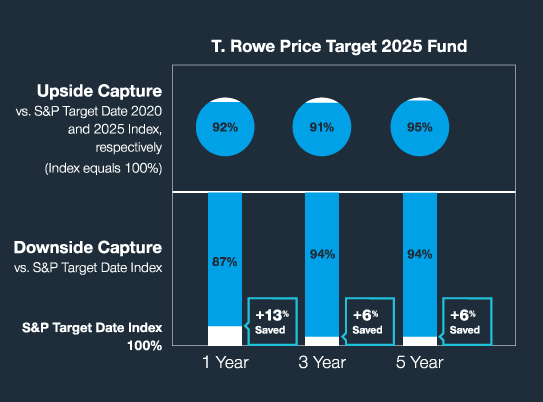

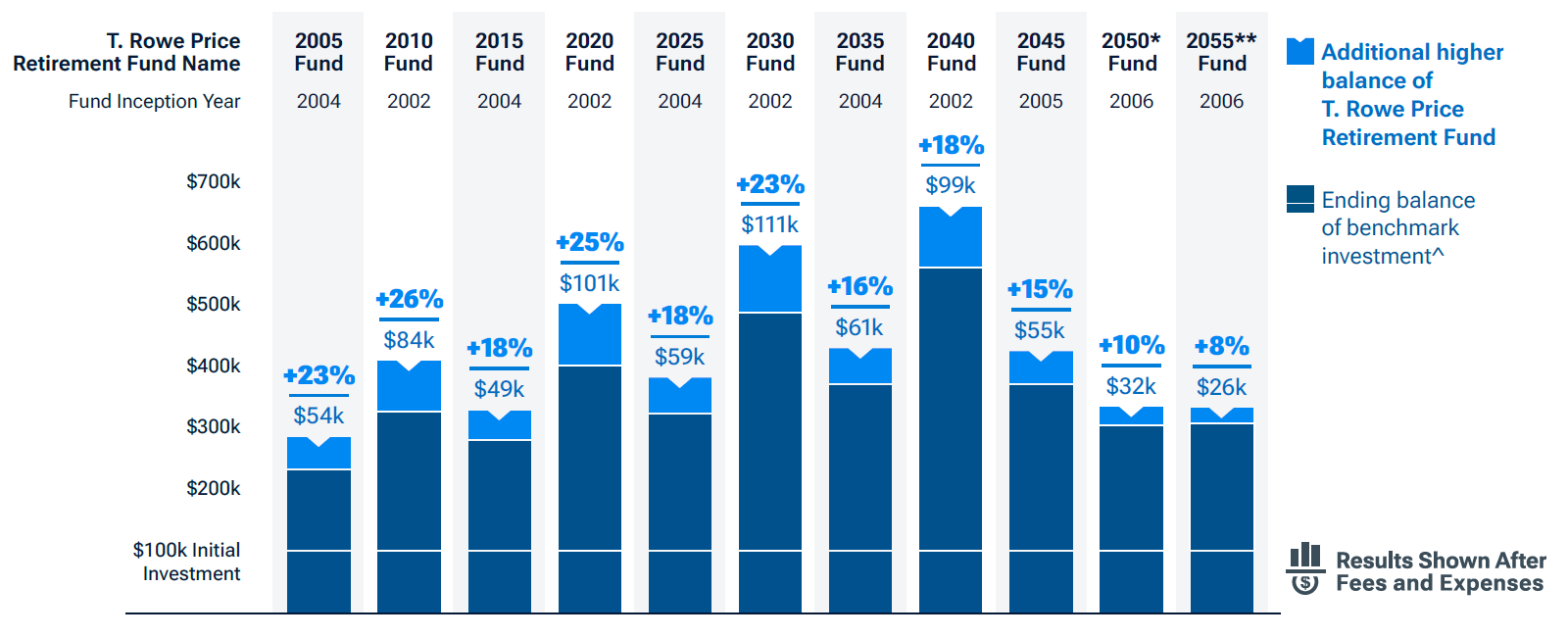

The T. Rowe Price Retirement 2025 Fund – Class R has consistently outperformed its benchmark index, the S&P 500 Index. Over the past 10 years, the fund has delivered an average annual return of 9.1%, compared to 8.4% for the S&P 500 Index.

Suitability for Investors

T. Rowe Price Retirement 2025 Fund – Class R is suitable for investors who are:

- Approaching retirement in or around 2025

- Seeking a professionally managed investment solution

- Comfortable with a moderate level of risk

- Interested in a fund that automatically adjusts its asset allocation over time

Benefits

- Convenience: Target-date funds offer a convenient way to invest for retirement without the need for constant monitoring or rebalancing.

- Diversification: The fund’s diversified portfolio provides exposure to a wide range of asset classes, reducing overall risk.

- Professional Management: The fund is managed by a team of experienced investment professionals who continuously monitor market conditions and adjust the portfolio accordingly.

- Flexibility: Investors can choose to invest in the fund through a variety of accounts, including IRAs and 401(k) plans.

Risks

- Market Volatility: The fund’s investments are subject to market fluctuations, which can result in losses.

- Interest Rate Risk: The fund’s bond investments are subject to interest rate risk, which means that their value can decline if interest rates rise.

- Inflation Risk: The fund’s investments may not keep pace with inflation, which can erode the purchasing power of retirement savings.

Alternatives

- T. Rowe Price Retirement 2025 Fund – Class I: This fund has the same target date and investment strategy as Class R but has a lower expense ratio of 0.60%.

- Vanguard Target Retirement 2025 Fund: This fund offers a similar investment strategy to Class R but has a lower expense ratio of 0.15%.

- Fidelity Freedom Index 2025 Fund: This fund invests in a blend of index funds that track major market indices, providing a cost-effective option for retirement savings.

Conclusion

T. Rowe Price Retirement 2025 Fund – Class R is a well-managed target-date fund that can be a suitable investment solution for individuals approaching retirement in or around 2025. The fund’s diversified portfolio, professional management, and automatic asset allocation make it a convenient and effective way to save for a comfortable retirement. However, it’s important to note that all investments carry some level of risk, and investors should carefully consider their risk tolerance and financial goals before investing in any fund.

Closure

Thus, we hope this article has provided valuable insights into t. rowe price retirement 2025 fund – class r. We appreciate your attention to our article. See you in our next article!