Standard Deduction for Single Taxpayers Over Age 65 in 2025

Related Articles: Standard Deduction for Single Taxpayers Over Age 65 in 2025

- Which IIT Will Conduct JEE Advanced 2028: A Comprehensive Analysis

- 2025 Ford Escape Redesign: A Comprehensive Overview

- Next Year’s Super Bowl Halftime Show: A Glimpse Into The Future Of Entertainment

- The New GLE 2025: Mercedes-Benz’s Revolutionary SUV

- The 2025 NFL Draft: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Standard Deduction for Single Taxpayers Over Age 65 in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Standard Deduction for Single Taxpayers Over Age 65 in 2025

Standard Deduction for Single Taxpayers Over Age 65 in 2025

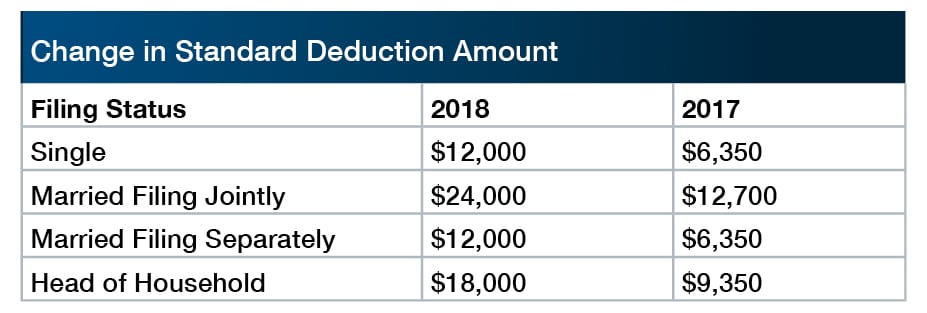

The standard deduction is a specific amount that taxpayers can deduct from their taxable income before calculating their tax liability. It is a simplified method of deducting certain expenses, such as unreimbursed employee expenses, certain state and local taxes, and charitable contributions. For single taxpayers over age 65, the standard deduction is significantly higher than for younger taxpayers.

Amount of the Standard Deduction for Single Taxpayers Over Age 65 in 2025

In 2025, the standard deduction for single taxpayers over age 65 will be $14,350. This is an increase of $1,350 from the standard deduction for single taxpayers under age 65, which will be $13,000 in 2025.

Benefits of the Standard Deduction

The standard deduction provides a number of benefits to taxpayers, including:

- Simplicity: The standard deduction is a simple and easy way to reduce your taxable income. You do not need to itemize your deductions to claim the standard deduction.

- Convenience: The standard deduction is automatically applied to your tax return. You do not need to take any special steps to claim it.

- Savings: The standard deduction can save you money on your taxes. By reducing your taxable income, you can reduce the amount of tax you owe.

Who Can Claim the Standard Deduction?

Most taxpayers can claim the standard deduction. However, there are some exceptions. For example, taxpayers who itemize their deductions cannot also claim the standard deduction.

How to Claim the Standard Deduction

You can claim the standard deduction on your tax return by checking the box on line 12 of Form 1040.

Conclusion

The standard deduction is a valuable tax break for single taxpayers over age 65. It can save you money on your taxes and make it easier to file your tax return.

Closure

Thus, we hope this article has provided valuable insights into Standard Deduction for Single Taxpayers Over Age 65 in 2025. We appreciate your attention to our article. See you in our next article!