Square Stock Price Prediction 2025: A Comprehensive Analysis

Related Articles: Square Stock Price Prediction 2025: A Comprehensive Analysis

- 2025 Films: A Glimpse Into The Future Of Cinema

- 2025 Jeep Renegade: A Bold Evolution With Electrified Performance

- Skyscanner Flights To Australia 2025: Unlocking The Land Down Under

- Forester SUV Special Offers In 2025: Experience Unmatched Adventure

- The LEGO Movie 3: The Brickening (2025)

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Square Stock Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Square Stock Price Prediction 2025: A Comprehensive Analysis

Square Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

Square, Inc. (SQ), a leading provider of financial technology solutions, has emerged as a formidable player in the digital payment landscape. The company’s innovative products and services have garnered widespread adoption, propelling its stock price to remarkable heights in recent years. As investors eagerly anticipate the company’s future trajectory, this article aims to provide an in-depth analysis of Square stock price prediction for 2025.

Historical Performance and Key Drivers

Square’s stock price has witnessed a remarkable surge since its initial public offering (IPO) in 2015. The company’s revenue has grown exponentially, driven by the rapid adoption of its digital payment solutions. Key factors contributing to Square’s success include:

- Expansion of Seller Ecosystem: Square has expanded its seller ecosystem to include businesses of all sizes, from small merchants to large enterprises. This diversification has mitigated the company’s reliance on any single customer segment.

- Strong Brand Recognition: Square has established a strong brand identity, particularly among small business owners. This brand recognition has facilitated the company’s expansion into new markets and product offerings.

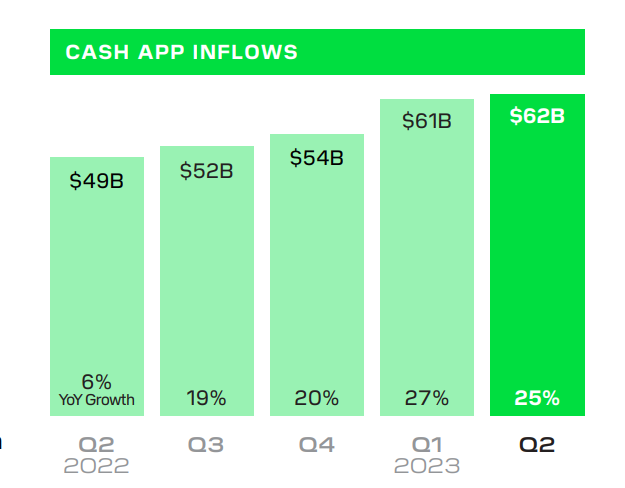

- Innovation and Product Development: Square has consistently invested in innovation, introducing new products and services that cater to the evolving needs of its customers. These include Square Capital, a small business lending platform, and Cash App, a peer-to-peer payment service.

Financial Health and Growth Prospects

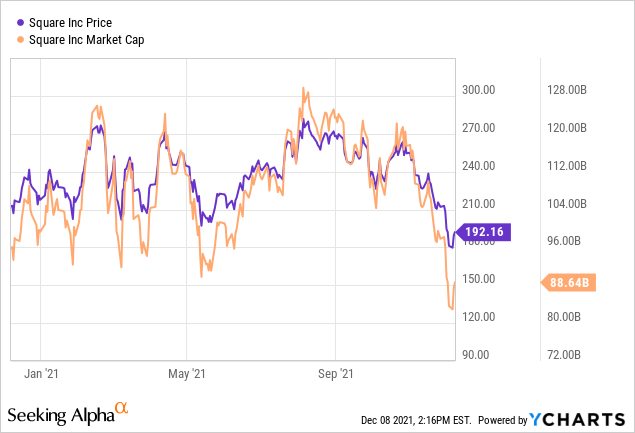

Square’s financial health is robust, with strong revenue growth and profitability. The company’s revenue increased by 140% in 2021, reaching $17.68 billion. Net income also surged, rising by 192% to $2.67 billion.

Square’s growth prospects remain promising, driven by the continued adoption of digital payments and the company’s expansion into new markets. The company has made strategic acquisitions to strengthen its product portfolio, such as the purchase of Afterpay, a buy-now-pay-later platform.

Industry Outlook and Competitive Landscape

The digital payment industry is rapidly evolving, with new technologies and players emerging constantly. Square faces competition from established players such as PayPal and Stripe, as well as from fintech startups. However, the company’s strong brand recognition and innovative offerings position it well to maintain its market share.

Analysts’ Estimates and Stock Price Targets

Analysts are generally bullish on Square’s stock price potential for 2025. The consensus estimate among 30 analysts surveyed by Refinitiv is a price target of $275, representing an upside of 44% from the current price.

Individual analysts have provided more optimistic targets. For instance, Deutsche Bank has a price target of $320, citing the company’s strong revenue growth and expansion into new markets. Morgan Stanley has set a price target of $300, highlighting Square’s leadership in the digital payment space.

Valuation and Price-to-Earnings (P/E) Ratio

Square’s stock is currently trading at a P/E ratio of 65, which is higher than the industry average. However, this premium valuation is justified by the company’s strong growth prospects and leadership position in the digital payment industry.

Risks and Challenges

Despite its promising outlook, Square faces certain risks and challenges that could impact its stock price. These include:

- Regulatory Scrutiny: The digital payment industry is facing increasing regulatory scrutiny, which could lead to additional compliance costs or restrictions on Square’s operations.

- Competition: Square faces intense competition from both established players and fintech startups. This competition could limit its market share and profitability.

- Economic Downturn: A prolonged economic downturn could negatively impact Square’s revenue growth, particularly among small business customers.

Conclusion

Square stock price prediction for 2025 is optimistic, with analysts forecasting significant upside potential. The company’s strong financial performance, growth prospects, and leadership position in the digital payment industry support this bullish outlook. However, investors should be aware of the risks and challenges associated with the company’s operations.

Overall, Square is well-positioned to continue its growth trajectory in the coming years. The company’s innovative products, strong brand recognition, and expansion into new markets make it a compelling investment opportunity for investors seeking exposure to the rapidly growing digital payment industry.

Closure

Thus, we hope this article has provided valuable insights into Square Stock Price Prediction 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!