Should I Buy a House Now or Wait Until 2025?

Related Articles: Should I Buy a House Now or Wait Until 2025?

- V Street Washington Dc

- 2025 Nissan Kicks: A Compact Crossover With Advanced Features And Enhanced Performance

- Beldex Coin Price Prediction 2025: A Comprehensive Analysis

- California Building Code 2025: A Comprehensive Overview

- Cruises Around Japan: An Unforgettable Journey Through The Land Of The Rising Sun In 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Should I Buy a House Now or Wait Until 2025?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Should I Buy a House Now or Wait Until 2025?

Should I Buy a House Now or Wait Until 2025?

Introduction

Purchasing a home is one of the most significant financial decisions an individual can make. Timing the purchase can be crucial, as real estate markets are subject to fluctuations. With the uncertainty surrounding the housing market, many potential buyers are contemplating whether to buy now or delay their purchase until 2025. This article will delve into the factors to consider when making this decision, analyzing the potential benefits and risks of both options.

Current Market Conditions

The current real estate market is characterized by rising interest rates, low inventory, and high demand. These factors have led to a competitive market, with homes selling quickly and often above asking price. As a result, buyers may face challenges in finding a suitable home within their budget.

Interest Rates

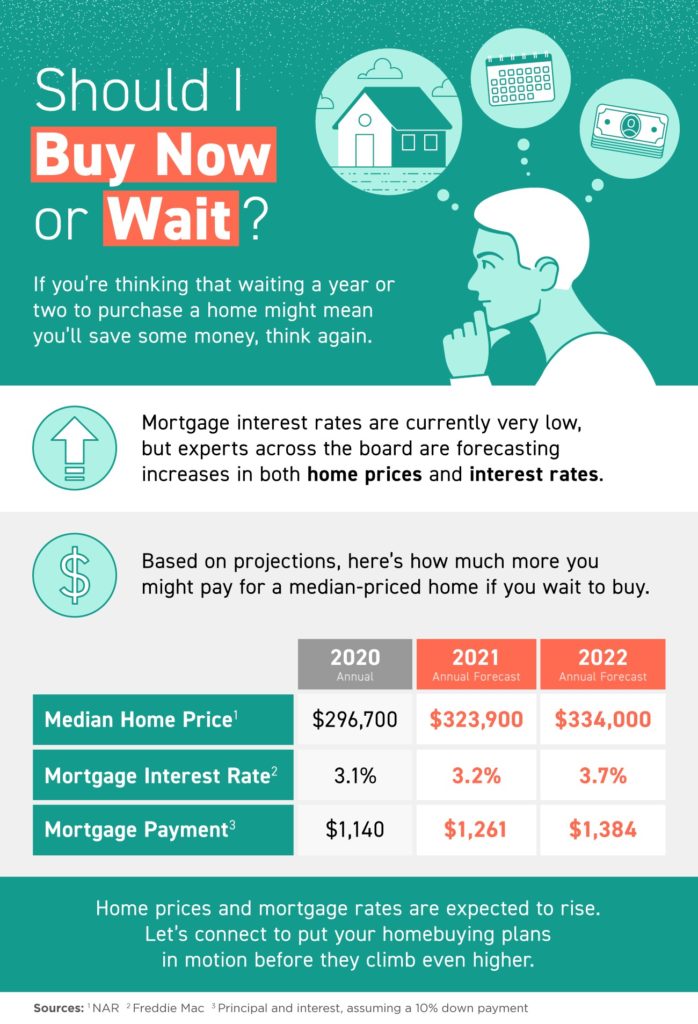

Interest rates play a significant role in determining the cost of a mortgage. Rising interest rates mean higher monthly payments and a more expensive overall mortgage. While rates are expected to continue rising in the near term, they are not anticipated to reach the record lows seen during the pandemic.

Home Prices

Home prices have been rising steadily in recent years and are projected to continue increasing, albeit at a slower pace. This means that buyers who purchase now may benefit from appreciation in the value of their home. However, it is important to note that home prices can fluctuate, and there is always the risk of a downturn in the market.

Inventory Levels

Low inventory levels have been a persistent issue in the housing market. This means that there are fewer homes available for sale, making it more difficult for buyers to find what they are looking for. As a result, buyers may need to compromise on their preferences or expand their search area.

Demand

Demand for housing remains strong, driven by a combination of factors such as low mortgage rates, millennial homebuyers, and a desire for more space. This high demand is putting upward pressure on home prices and making it more competitive for buyers.

Benefits of Buying Now

- Potential for appreciation: By purchasing a home now, buyers can potentially benefit from the continued rise in home prices. This can lead to an increase in the value of their investment over time.

- Low interest rates: While interest rates are rising, they are still relatively low compared to historical averages. Buyers who lock in a mortgage rate now may be able to secure a more favorable rate than if they wait.

- Tax benefits: Homeowners can deduct mortgage interest and property taxes on their federal income tax returns, which can provide significant tax savings.

- Building equity: Every mortgage payment you make builds equity in your home, giving you a financial stake in the property.

Risks of Buying Now

- Rising interest rates: As interest rates continue to rise, monthly mortgage payments will increase. This could make it more difficult to afford a home or require buyers to compromise on their budget.

- Overpaying: In a competitive market, buyers may feel pressured to offer above asking price or waive contingencies to secure a home. This can lead to overpaying for the property or taking on more risk than necessary.

- Limited inventory: The low inventory levels can make it challenging to find a home that meets your needs and budget. You may need to compromise on your preferences or expand your search area.

Benefits of Waiting Until 2025

- Potential for lower interest rates: It is possible that interest rates will decline by 2025, making mortgages more affordable. This could lead to lower monthly payments and a more manageable overall cost of homeownership.

- Increased inventory: Over time, more homes are likely to come onto the market, providing buyers with a wider selection to choose from. This could reduce the competitiveness of the market and make it easier to find a suitable home.

- More financial stability: By waiting until 2025, you may have more time to save for a down payment and improve your credit score. This can put you in a stronger financial position to purchase a home.

Risks of Waiting Until 2025

- Rising home prices: Home prices are projected to continue rising, albeit at a slower pace. By waiting until 2025, you may miss out on the potential appreciation in home value that could occur in the meantime.

- Missed tax benefits: Homeowners can deduct mortgage interest and property taxes on their federal income tax returns. By waiting to purchase a home, you will miss out on these tax savings for several years.

- Increased competition: Demand for housing is expected to remain strong in the coming years. Waiting until 2025 could mean facing even more competition from other buyers, making it more difficult to secure a home.

Conclusion

The decision of whether to buy a house now or wait until 2025 is a complex one that depends on a variety of factors. There are both potential benefits and risks associated with each option.

If you have a stable financial situation, are comfortable with the current market conditions, and are prepared for the potential risks, buying a house now may be a good option. You could potentially benefit from low interest rates, tax savings, and home price appreciation.

However, if you are concerned about rising interest rates, limited inventory, or overpaying for a home, it may be more prudent to wait until 2025. By that time, interest rates may have declined, inventory levels may have increased, and you may have more financial stability.

Ultimately, the best decision for you will depend on your individual circumstances and financial goals. It is recommended to consult with a financial advisor and a real estate agent to gather information and make an informed decision that aligns with your long-term financial objectives.

Closure

Thus, we hope this article has provided valuable insights into Should I Buy a House Now or Wait Until 2025?. We thank you for taking the time to read this article. See you in our next article!