Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis

Related Articles: Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis

- The Ultimate Guide To The Two-Year Pocket Planner 2024 And 2025

- The All-New 2025 Porsche Macan: A Revolution In Compact SUVs

- The Square Root Of Twenty-Five: A Mathematical Journey

- 2025 Ram 1500 Charger: The Ultimate Electric Pickup Truck

- 2025 BMW Z4 M40i: A Symphony Of Performance And Style

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis

- 2 Introduction

- 3 Video about Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis

- 4 Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis

- 4.1 Technical Analysis

- 4.2 Market Sentiment

- 4.3 Institutional Adoption

- 4.4 Regulatory Developments

- 4.5 Economic Conditions

- 4.6 Realistic Price Prediction

- 4.7 Conclusion

- 5 Closure

Video about Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis

Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis

Bitcoin, the world’s leading cryptocurrency, has captivated the financial landscape since its inception in 2009. Its decentralized nature, limited supply, and potential as a store of value have fueled its meteoric rise and volatility. As we approach 2025, analysts and investors are eagerly speculating about the future trajectory of Bitcoin’s price.

This article aims to provide a comprehensive analysis of realistic Bitcoin price predictions for 2025, considering various factors that could influence its value. We will explore technical indicators, market sentiment, institutional adoption, regulatory developments, and economic conditions to paint a well-rounded picture of Bitcoin’s potential price movements.

Technical Analysis

Technical analysis is the study of historical price data to identify patterns and trends that may predict future price movements. By examining Bitcoin’s price charts, analysts can make informed predictions about its future trajectory.

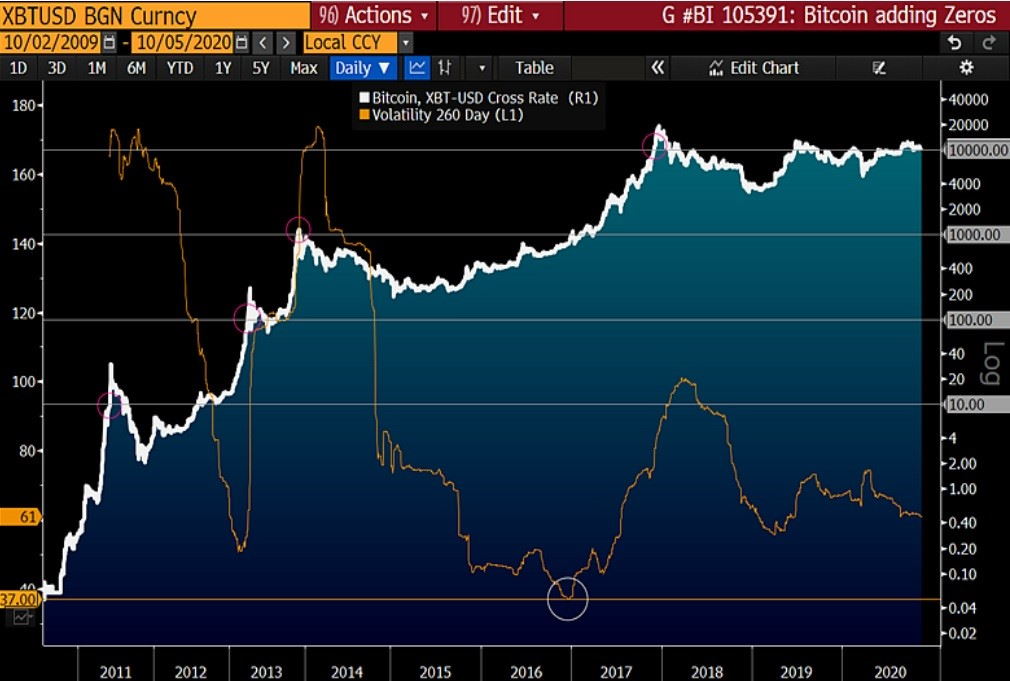

Several technical indicators suggest that Bitcoin’s price could experience significant growth in the coming years. The logarithmic growth curve, a popular indicator used to analyze Bitcoin’s long-term trend, suggests that the cryptocurrency is on track to reach new all-time highs in 2025.

Additionally, Bitcoin’s Relative Strength Index (RSI), a momentum indicator that measures the magnitude of price changes, is currently in a bullish zone, indicating that buyers are in control of the market. The RSI has historically been a reliable predictor of future price increases.

Market Sentiment

Market sentiment plays a crucial role in driving the price of Bitcoin. Positive sentiment, fueled by bullish news and optimistic market expectations, tends to push prices higher, while negative sentiment can lead to sell-offs and price declines.

Current market sentiment towards Bitcoin is generally positive. The cryptocurrency has been gaining mainstream acceptance, with major companies and institutions embracing its potential as an investment and a medium of exchange. This positive sentiment is likely to continue in the coming years, supporting Bitcoin’s price growth.

Institutional Adoption

Institutional adoption is a key factor that could significantly impact Bitcoin’s price in 2025. As more institutional investors, such as hedge funds, pension funds, and asset managers, recognize the value of Bitcoin, they are likely to allocate a portion of their portfolios to the cryptocurrency.

Institutional adoption brings several benefits to Bitcoin. It increases liquidity, reduces volatility, and enhances the credibility of Bitcoin as a legitimate investment asset. As more institutions embrace Bitcoin, its price is expected to rise.

Regulatory Developments

Regulatory developments can have a significant impact on the price of Bitcoin. Clear and supportive regulations can provide stability and legitimacy to the cryptocurrency, while uncertain or restrictive regulations can create uncertainty and hinder its growth.

The regulatory landscape for Bitcoin is evolving, with different countries taking different approaches. Some countries, such as El Salvador, have adopted Bitcoin as legal tender, while others, such as China, have implemented strict restrictions.

In 2025, we may see more countries adopting clear and supportive regulations for Bitcoin. This could provide a boost to the cryptocurrency’s price by reducing uncertainty and attracting more investors.

Economic Conditions

Economic conditions, particularly inflation and interest rates, can also influence the price of Bitcoin. Inflation erodes the purchasing power of fiat currencies, making Bitcoin and other cryptocurrencies more attractive as a store of value.

Interest rates play a dual role in Bitcoin’s price dynamics. Low interest rates tend to support Bitcoin’s price, as investors seek alternative investments with higher returns. Conversely, rising interest rates can make Bitcoin less attractive, as investors may shift their funds to more traditional assets.

In 2025, economic conditions are expected to be volatile, with inflation remaining a concern and interest rates likely to fluctuate. These conditions could create both opportunities and challenges for Bitcoin’s price.

Realistic Price Prediction

Considering the aforementioned factors, we can formulate a realistic Bitcoin price prediction for 2025. While it is impossible to predict the exact price with certainty, we can identify a range of possible outcomes based on historical data and current market conditions.

Conservative Estimate: $100,000

This estimate assumes a gradual increase in Bitcoin’s price, driven by continued institutional adoption and positive market sentiment. It takes into account the potential impact of regulatory uncertainties and economic headwinds.

Moderate Estimate: $250,000

This estimate assumes a more significant increase in Bitcoin’s price, fueled by a surge in institutional adoption and a favorable regulatory environment. It also considers the potential for Bitcoin to become a widely accepted medium of exchange.

Bullish Estimate: $500,000

This estimate assumes a highly bullish scenario, where Bitcoin experiences a parabolic rise in price, driven by extreme market euphoria and widespread acceptance. It is important to note that this estimate is highly speculative and should be treated with caution.

Conclusion

Predicting the price of Bitcoin is an inherently challenging task due to its volatility and the numerous factors that influence its value. However, by carefully analyzing technical indicators, market sentiment, institutional adoption, regulatory developments, and economic conditions, we can formulate realistic price predictions that can guide our investment decisions.

While the future of Bitcoin remains uncertain, the cryptocurrency’s strong fundamentals and growing acceptance suggest that it has the potential to continue its upward trajectory in the coming years. Investors should approach Bitcoin with a long-term perspective and be prepared for volatility along the way.

![[New Research] Bitcoin Price Prediction 2025: Bitcoin In 5 Years](https://img.currency.com/imgs/articles/1472xx/shutterstock_763067344.jpg)

Closure

Thus, we hope this article has provided valuable insights into Realistic Bitcoin Price Prediction for 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!