Quarter 2 2025: A Glimpse into the Future

Related Articles: Quarter 2 2025: A Glimpse into the Future

- Will 2025 Be A Leap Year?

- 2025 Mini Countryman John Cooper Works: A Compact Powerhouse

- University Of Oregon: Embracing Excellence In The 2024-2025 Academic Year

- HP CP2025 Toner Cartridges: A Comprehensive Guide

- Ohio Football Recruits 2025: A Comprehensive Guide To The Buckeye State’s Top Talent

Introduction

With great pleasure, we will explore the intriguing topic related to Quarter 2 2025: A Glimpse into the Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Quarter 2 2025: A Glimpse into the Future

Quarter 2 2025: A Glimpse into the Future

Introduction

The second quarter of 2025 is fast approaching, and with it comes a wave of anticipation and speculation. As the global economy continues to evolve, it is essential to consider the potential implications and opportunities that lie ahead. This article provides a comprehensive analysis of Quarter 2 2025, exploring key trends, economic indicators, and their potential impact on businesses, individuals, and society as a whole.

Global Economic Outlook

The global economy is expected to continue its recovery in Quarter 2 2025. The International Monetary Fund (IMF) forecasts global GDP growth to reach 3.9% for the year, with a slight acceleration in growth during the second quarter. This growth will be driven by a combination of factors, including:

- Easing of COVID-19 restrictions: As vaccination rates increase and the pandemic subsides, governments are expected to gradually lift restrictions on businesses and travel. This will boost economic activity in sectors such as tourism, hospitality, and retail.

- Fiscal and monetary stimulus: Governments and central banks have implemented unprecedented levels of fiscal and monetary stimulus to support the economy during the pandemic. This stimulus will continue to provide a boost to economic growth in the coming quarters.

- Pent-up demand: Consumers and businesses have accumulated significant savings during the pandemic. As restrictions ease, this pent-up demand is likely to be unleashed, leading to a surge in spending.

Key Economic Indicators

Several key economic indicators will provide insights into the health of the global economy in Quarter 2 2025:

- GDP growth: GDP growth is the primary measure of economic output. A strong GDP growth rate indicates a healthy and expanding economy.

- Inflation: Inflation is the rate at which prices rise. Moderate inflation is generally considered healthy for economic growth, but excessive inflation can erode purchasing power and harm consumers.

- Unemployment: Unemployment measures the percentage of the workforce that is unemployed. A low unemployment rate indicates a tight labor market and strong demand for workers.

- Interest rates: Interest rates are set by central banks to influence economic activity. Low interest rates stimulate borrowing and investment, while high interest rates discourage borrowing and slow economic growth.

Implications for Businesses

Businesses will need to adapt to the changing economic landscape in Quarter 2 2025. Key implications include:

- Increased competition: As the economy recovers, competition is likely to intensify. Businesses will need to differentiate themselves through innovation, customer service, and operational efficiency.

- Labor market challenges: A tight labor market may make it difficult for businesses to find and retain skilled workers. Businesses will need to implement strategies to attract and develop talent.

- Supply chain disruptions: Global supply chains have been disrupted by the pandemic and geopolitical tensions. Businesses will need to diversify their supply chains and explore alternative sourcing options.

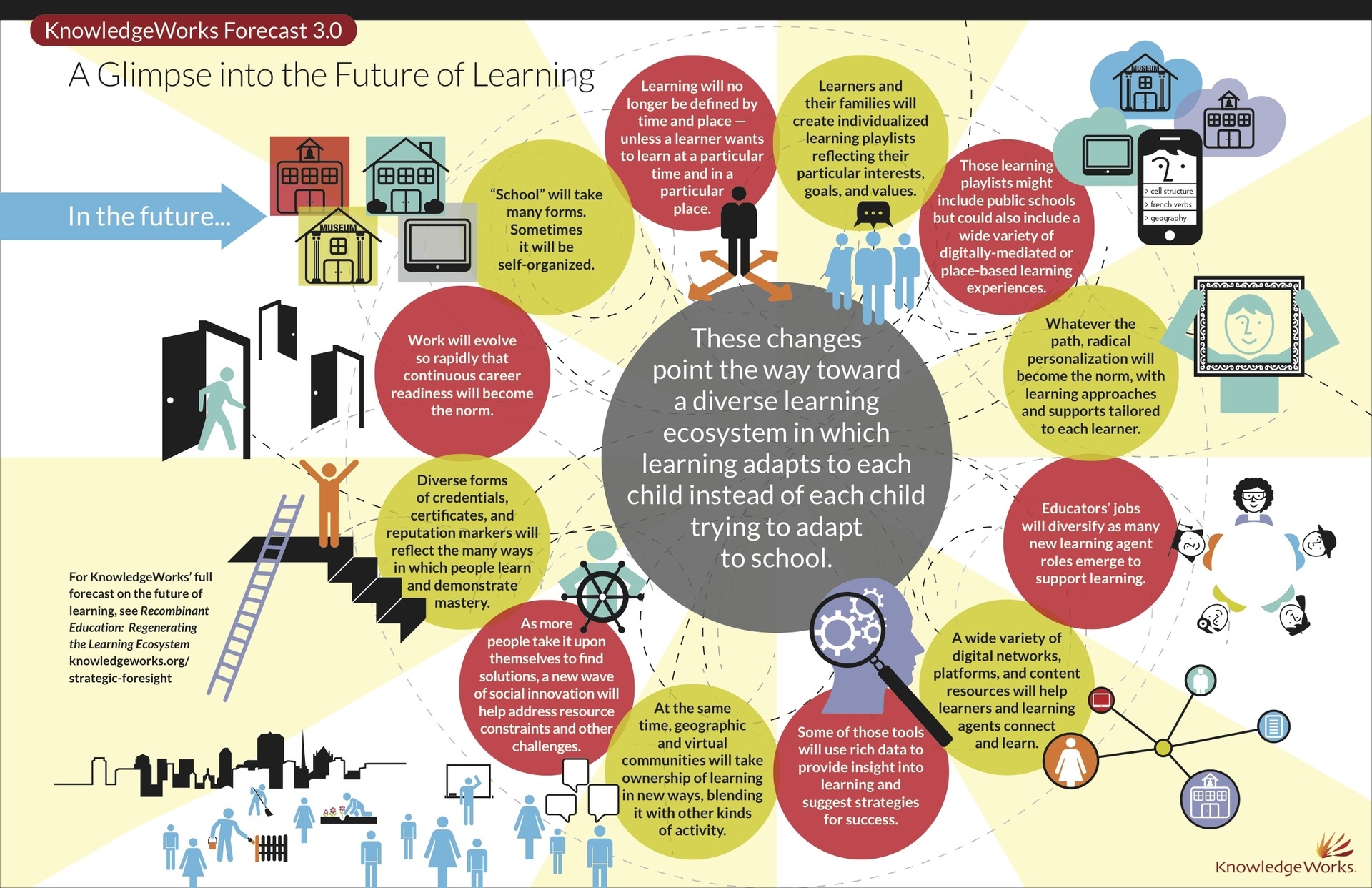

- Digital transformation: Digital transformation will continue to accelerate, with businesses adopting new technologies to improve efficiency, enhance customer experiences, and drive innovation.

Implications for Individuals

Individuals will also be affected by the economic trends in Quarter 2 2025:

- Job opportunities: A growing economy will create new job opportunities. Individuals with skills in high-demand fields will have the best prospects.

- Rising wages: As the labor market tightens, wages are likely to rise. This will benefit workers and boost consumer spending.

- Inflationary pressures: Inflation may erode purchasing power, making it more difficult for individuals to afford basic necessities.

- Investment opportunities: The recovery of the global economy may present investment opportunities for individuals. However, it is important to conduct thorough research and seek professional advice before making any investment decisions.

Societal Implications

The economic trends in Quarter 2 2025 will have broader societal implications:

- Increased inequality: The pandemic and economic recovery may exacerbate income inequality. Governments and policymakers will need to implement measures to address this issue.

- Environmental sustainability: As the economy grows, it is essential to prioritize environmental sustainability. Businesses and governments will need to adopt green technologies and practices.

- Social mobility: A tight labor market may create opportunities for social mobility, as individuals from diverse backgrounds have access to better-paying jobs.

- Technological advancements: Continued technological advancements will transform society in various ways, from the way we work to the way we interact with the world around us.

Conclusion

Quarter 2 2025 is a pivotal period for the global economy. The recovery from the pandemic, coupled with ongoing economic trends, will create both opportunities and challenges for businesses, individuals, and society as a whole. By understanding the key trends and their potential implications, we can better prepare for the future and navigate the complexities of the evolving economic landscape.

![Timeline Of The Far Future [Infographic] - Visualistan](https://2.bp.blogspot.com/-232BsA-rIWs/UtUDZKuCcgI/AAAAAAAAIes/8wr8iL9zLXk/s640/Timeline-Of-The-Far-Future-Infographic.png)

Closure

Thus, we hope this article has provided valuable insights into Quarter 2 2025: A Glimpse into the Future. We appreciate your attention to our article. See you in our next article!