Property Price Forecast 2025: A Comprehensive Outlook

Related Articles: Property Price Forecast 2025: A Comprehensive Outlook

- Upcoming Horror Movies Of 2025: A Spine-Tingling Preview

- What Will Interest Rates Be In 2025 UK?

- IRFC Share Price Prediction 2025: A Comprehensive Analysis

- Toyota Camry 2025 Vs 2025 Reddit

- Can You Interchange 2032 With 2025 Battery? A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Property Price Forecast 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Property Price Forecast 2025: A Comprehensive Outlook

Property Price Forecast 2025: A Comprehensive Outlook

Introduction

The real estate market is a complex and dynamic landscape, subject to a multitude of factors that influence property prices. As we approach 2025, it is imperative to assess the potential trajectory of property prices to make informed investment decisions. This article provides a comprehensive forecast of property prices for 2025, considering various economic, demographic, and market trends.

Economic Factors

Economic conditions play a crucial role in shaping property prices. A strong economy typically leads to increased demand for housing, resulting in higher prices. Conversely, an economic downturn can dampen demand and put downward pressure on prices.

- Interest rates: Interest rates directly impact the cost of borrowing for mortgages. Low interest rates make it more affordable to purchase a property, stimulating demand and potentially pushing up prices. Conversely, higher interest rates can increase the cost of borrowing, reducing demand and leading to a potential decline in prices.

- Inflation: Inflation erodes the purchasing power of money, making it more expensive to buy a property. High inflation can lead to increased demand for real assets, such as property, as investors seek to hedge against inflation. However, if inflation becomes too high, it can also reduce consumer confidence and spending, potentially dampening demand for housing.

- Economic growth: A growing economy generally leads to increased job creation and higher incomes, which can boost demand for housing and support property prices. Conversely, a stagnant or contracting economy can reduce demand and put downward pressure on prices.

Demographic Factors

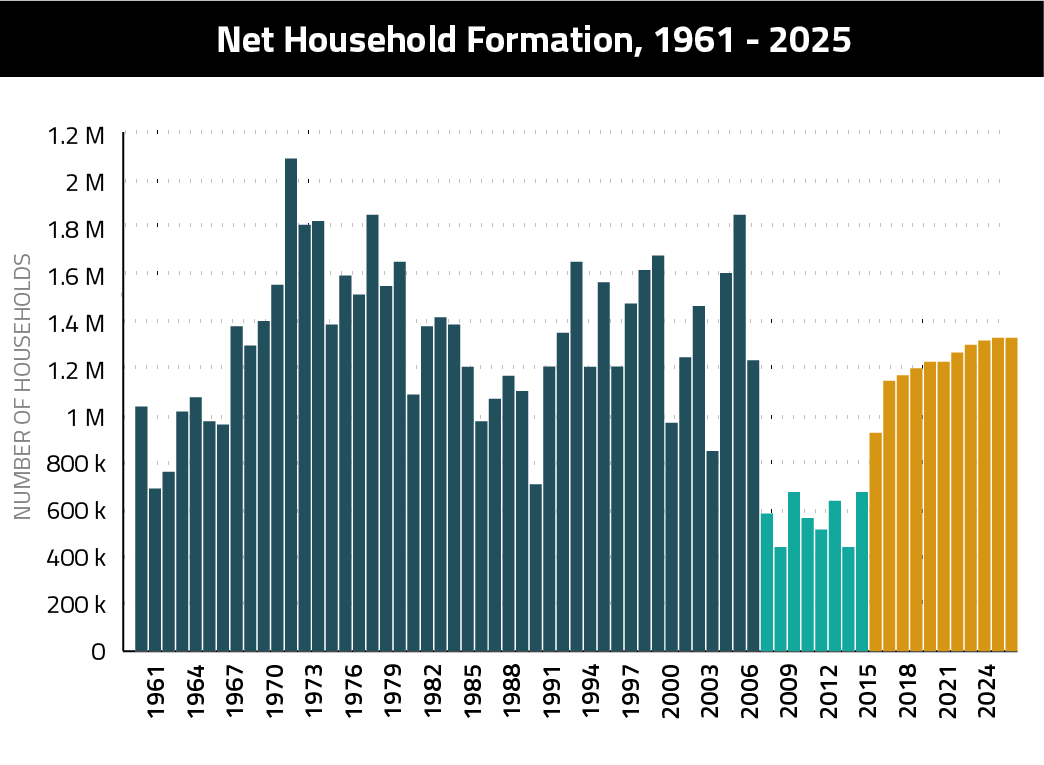

Demographic trends also significantly influence property prices. Changes in population size, age distribution, and household formation patterns can impact the demand for housing and, consequently, prices.

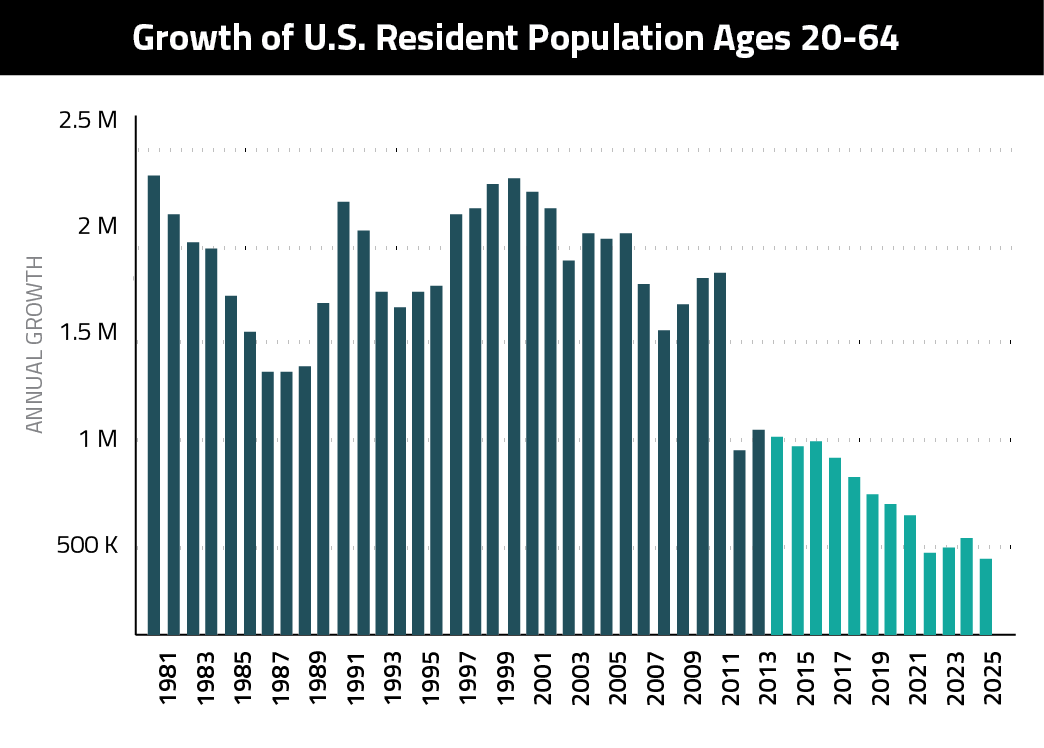

- Population growth: A growing population increases the demand for housing, as more people seek accommodation. This can lead to upward pressure on prices, especially in urban areas with limited land supply.

- Age distribution: The aging population is a significant demographic trend that affects property prices. As people retire, they may downsize their homes, freeing up larger properties for families and younger buyers. This can lead to increased demand for smaller properties and a potential decline in prices for larger homes.

- Household formation: The rate of household formation influences the demand for housing. Factors such as marriage, divorce, and immigration can impact the number of households seeking accommodation, thereby affecting property prices.

Market Trends

Specific market trends can also drive property prices. These trends include changes in supply and demand, as well as technological advancements and regulatory policies.

- Supply and demand: The balance between supply and demand is a fundamental determinant of property prices. A shortage of housing supply relative to demand can lead to price increases, while an oversupply can put downward pressure on prices.

- Technological advancements: Technological advancements, such as virtual tours and online property marketplaces, have made it easier for buyers to find and purchase properties. This increased transparency and accessibility can potentially increase demand and support property prices.

- Regulatory policies: Government policies, such as zoning regulations and tax incentives, can impact property prices. Changes in these policies can influence the supply of housing, the cost of development, and the demand for properties.

Regional Variations

Property price forecasts can vary significantly across different regions. Factors such as local economic conditions, population trends, and market dynamics can lead to divergent price movements.

- Urban vs. rural areas: Property prices in urban areas tend to be higher than in rural areas due to higher demand, limited land supply, and better amenities.

- Coastal vs. inland areas: Coastal properties often command a premium due to their scenic beauty, recreational opportunities, and perceived investment potential.

- Luxury vs. affordable housing: The price trajectory of luxury properties can differ from that of affordable housing, depending on the specific market conditions and demand from high-net-worth individuals.

Factors to Consider

When assessing property price forecasts, it is essential to consider the following factors:

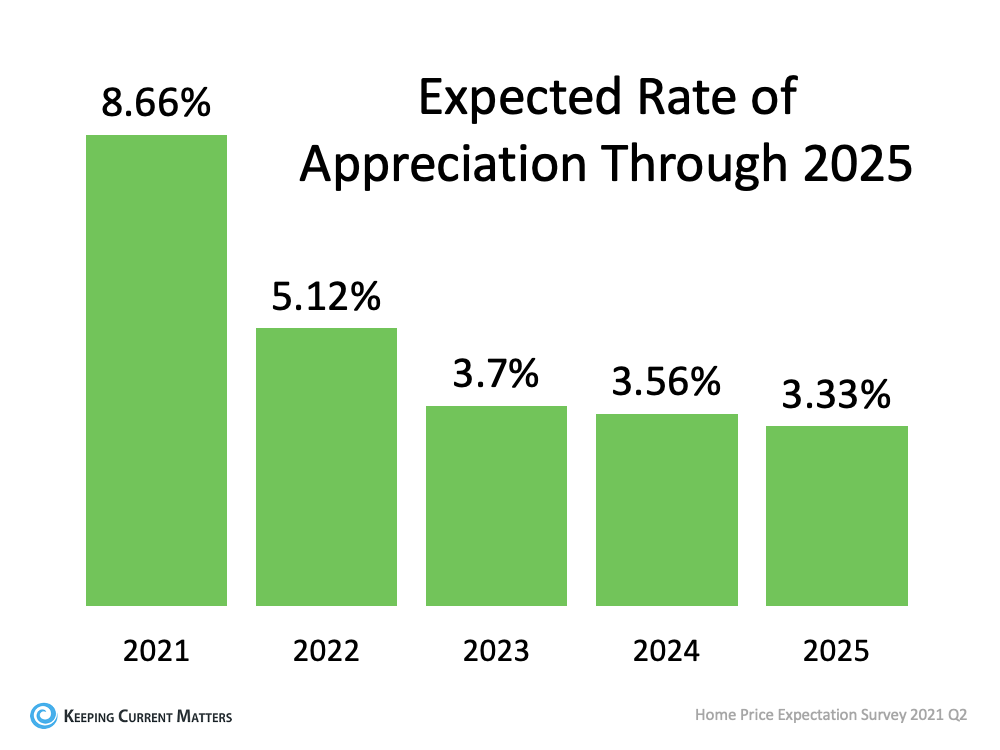

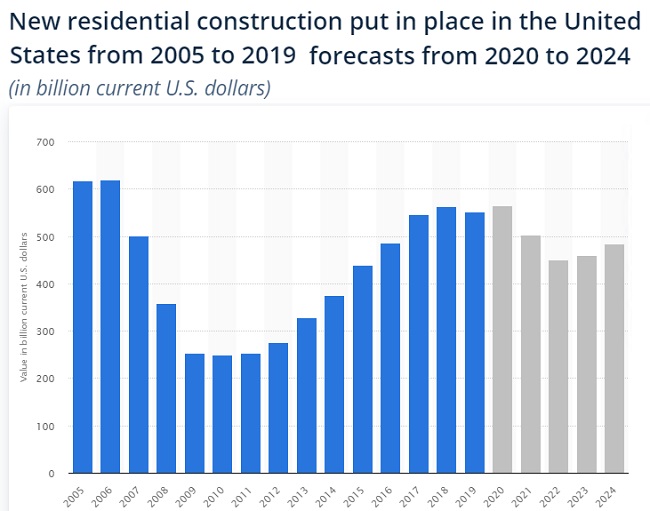

- Historical trends: Past property price movements can provide valuable insights into potential future trends.

- Economic indicators: Monitoring economic indicators, such as interest rates, inflation, and GDP growth, can help gauge the overall health of the economy and its impact on property prices.

- Market sentiment: Investor sentiment and expectations can influence property prices. Positive sentiment can lead to increased demand and higher prices, while negative sentiment can have the opposite effect.

- Local market conditions: It is crucial to consider local market conditions, such as supply and demand dynamics, population trends, and regulatory policies, when making property price forecasts.

Conclusion

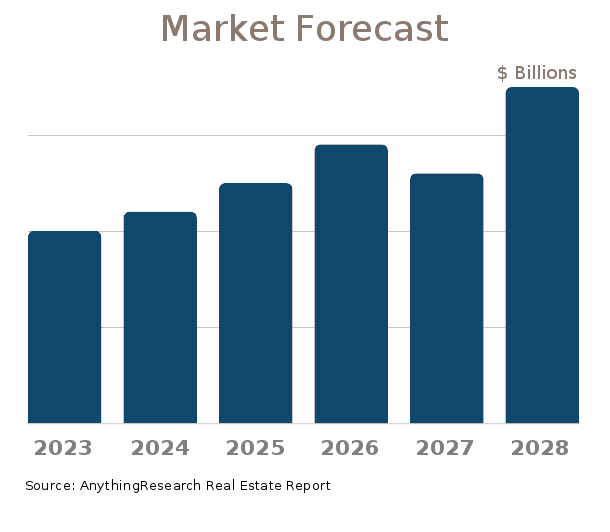

Property price forecasts for 2025 are subject to a range of economic, demographic, and market factors. While it is difficult to predict future prices with absolute certainty, a comprehensive analysis of these factors can provide valuable insights into potential price movements. By considering the factors discussed in this article, investors can make more informed decisions regarding their property investments.

Closure

Thus, we hope this article has provided valuable insights into Property Price Forecast 2025: A Comprehensive Outlook. We hope you find this article informative and beneficial. See you in our next article!