Property Market Predictions 2025: A Comprehensive Outlook

Related Articles: Property Market Predictions 2025: A Comprehensive Outlook

- Difference Between Cr2032 And 2032 Battery

- Ryder Cup 2025: Dates, Venue, And All You Need To Know

- Leave Year End 2025: A Comprehensive Guide

- 2025 Golfway Dr. St Charles

- Are 2032 And 2016 Batteries Interchangeable? A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Property Market Predictions 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Property Market Predictions 2025: A Comprehensive Outlook

Property Market Predictions 2025: A Comprehensive Outlook

Introduction

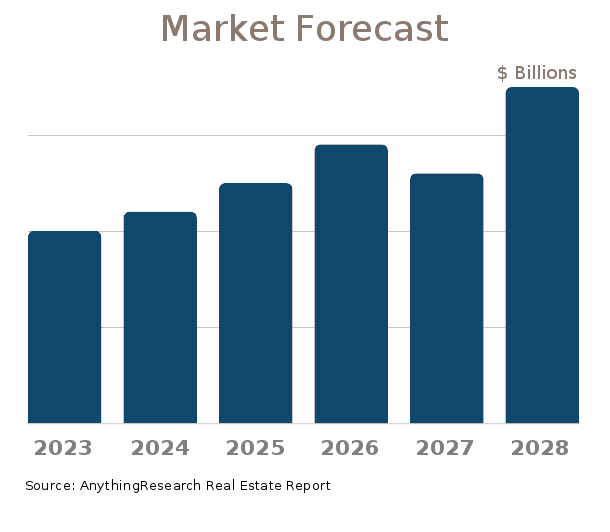

The global property market is a complex and ever-evolving landscape, influenced by a myriad of economic, social, and political factors. As we approach 2025, it is crucial to gain insights into the potential trajectories and challenges that lie ahead for this vital industry. This comprehensive article delves into the key predictions for the property market in 2025, providing valuable guidance for investors, homeowners, and industry professionals alike.

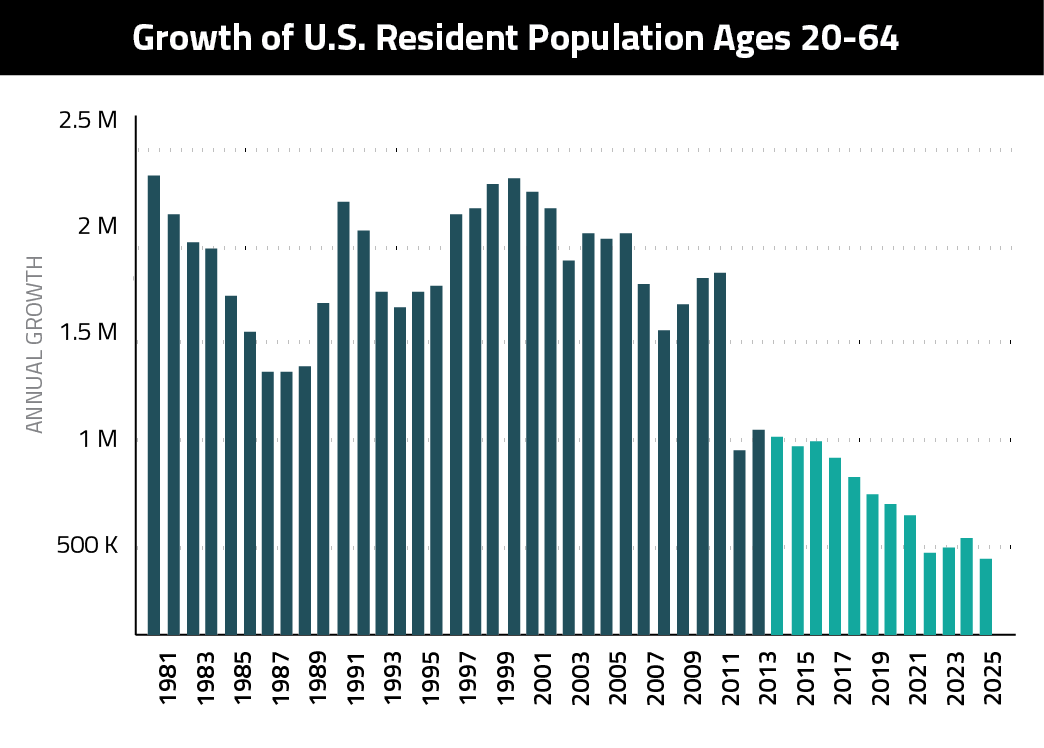

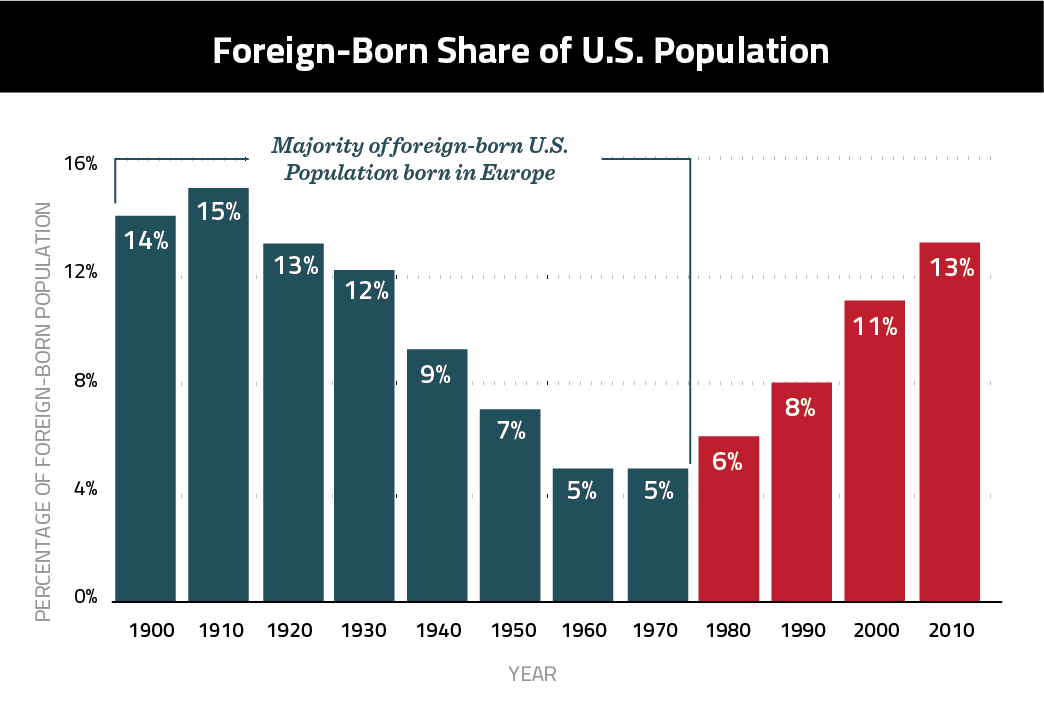

1. Continued Urbanization and Population Growth

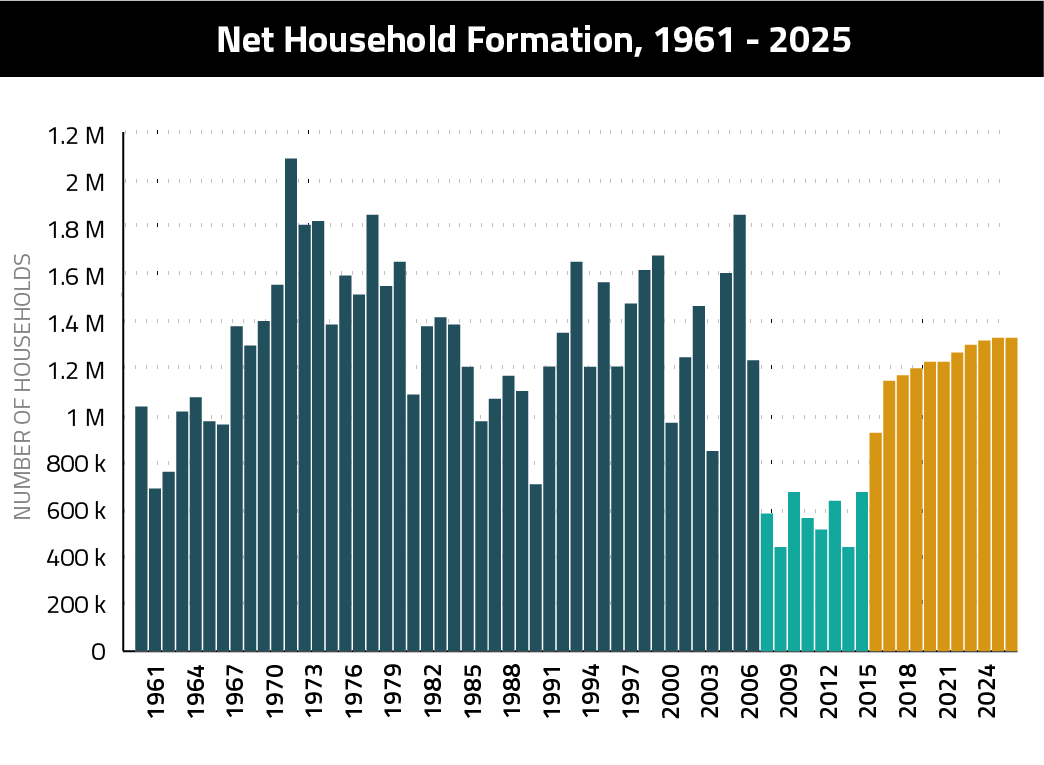

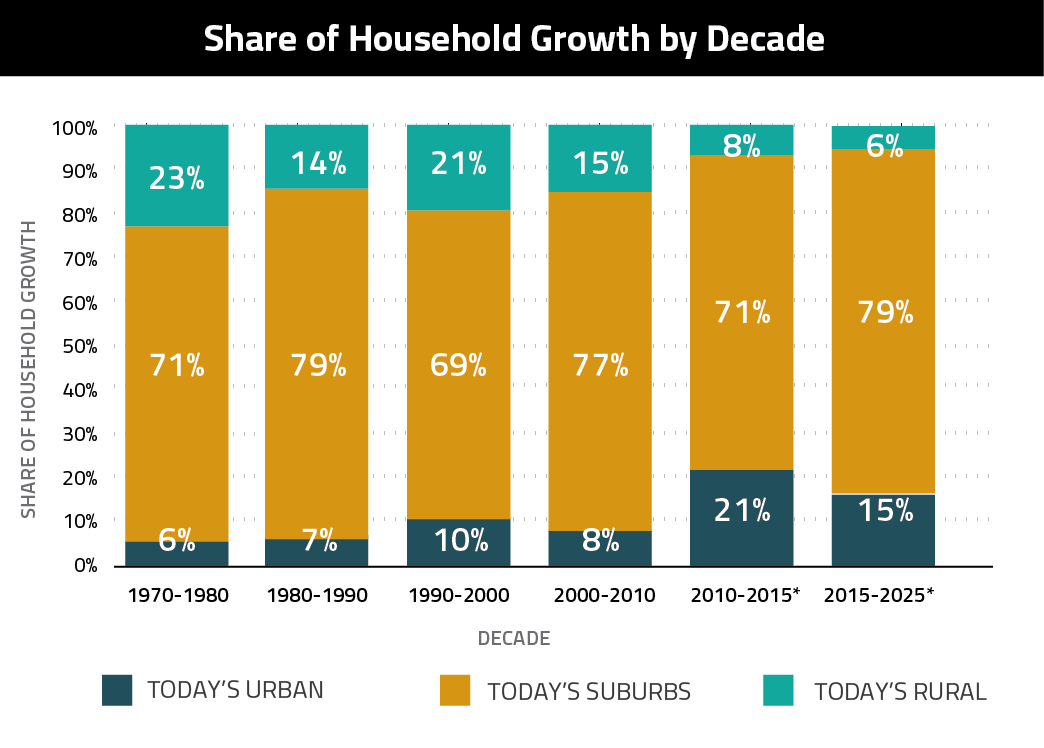

Urbanization remains a dominant trend worldwide, with an increasing proportion of the population moving to cities in search of better job opportunities, education, and healthcare. This influx of urban dwellers will continue to drive demand for housing, particularly in major metropolitan areas. By 2025, the United Nations estimates that 68% of the global population will reside in urban areas, up from 56% in 2020.

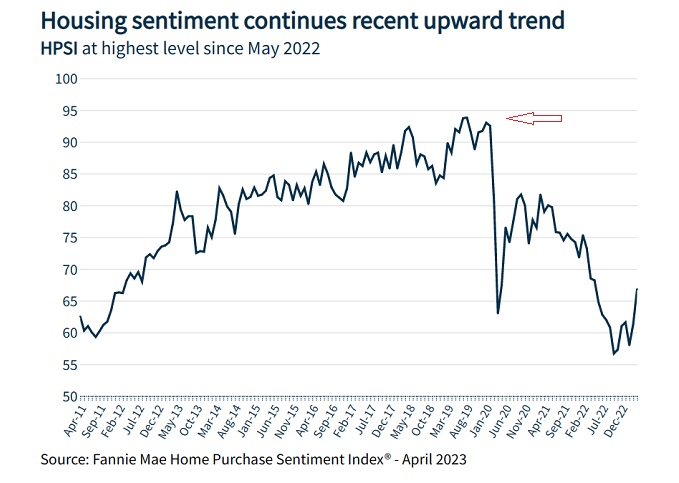

2. Rising Interest Rates and Inflation

The global economy is currently facing inflationary pressures and rising interest rates. Central banks worldwide are implementing monetary tightening measures to curb inflation, which is expected to have a moderate impact on the property market. Higher interest rates make it more expensive to borrow money for mortgages, potentially slowing down the pace of homeownership and reducing demand for properties.

3. Technological Advancements and Smart Homes

Technological advancements are transforming the property market, with the increasing adoption of smart home technologies and automation. Smart homes offer enhanced convenience, security, and energy efficiency, making them more attractive to buyers and renters. By 2025, it is predicted that smart home devices will be installed in over 50% of homes globally.

4. Environmental Sustainability and Green Buildings

Environmental sustainability is becoming increasingly important in the property market. Consumers are demanding more energy-efficient and environmentally friendly homes, leading to a growing demand for green buildings. Green buildings are designed to reduce their environmental impact through the use of sustainable materials, efficient appliances, and renewable energy sources.

5. Flexible and Co-Living Spaces

The changing nature of work and lifestyles is driving demand for more flexible and co-living spaces. Co-living arrangements, such as shared apartments and communal living spaces, offer affordability, flexibility, and a sense of community. By 2025, co-living is expected to account for a significant portion of the rental market in major cities.

6. Emerging Markets and Global Investments

Emerging markets are expected to play a significant role in the global property market in the coming years. Countries such as India, China, and Brazil are experiencing strong economic growth and a growing middle class, leading to increased demand for housing and investment opportunities. Global investors are also expected to continue seeking diversification in their property portfolios by investing in emerging markets.

7. Impact of the COVID-19 Pandemic

The COVID-19 pandemic has had a profound impact on the property market, leading to a shift in preferences and priorities. Remote work and flexible living arrangements have increased demand for suburban and rural properties, while urban areas have experienced a decline in demand. The long-term impact of the pandemic on the property market remains to be seen.

8. Government Policies and Regulations

Government policies and regulations play a crucial role in shaping the property market. Affordable housing initiatives, tax incentives, and rent control measures can significantly impact the supply and demand dynamics. In 2025, it is expected that governments will continue to implement policies aimed at addressing housing affordability and promoting sustainable development.

9. PropTech and Innovation

PropTech (property technology) is revolutionizing the property market, offering innovative solutions for buyers, sellers, and investors. Virtual reality tours, AI-powered property management, and blockchain-based transactions are just a few examples of how PropTech is transforming the industry. By 2025, PropTech is expected to become even more prevalent, enhancing efficiency and transparency in the property market.

10. Geopolitical Risks and Economic Uncertainty

Geopolitical risks and economic uncertainty can have a significant impact on the property market. Wars, trade conflicts, and political instability can lead to market volatility and reduced investor confidence. In 2025, it is important to monitor geopolitical events and their potential impact on the global property market.

Conclusion

The property market is a complex and ever-evolving landscape, influenced by a wide range of factors. As we approach 2025, it is crucial to understand the key predictions and trends that will shape the industry. By staying informed and adapting to these changes, investors, homeowners, and industry professionals can navigate the property market with confidence and make informed decisions. The future of the property market holds both opportunities and challenges, and it is essential to be well-prepared for the road ahead.

![28+ Housing Market Predictions 2021-2025 [Crash Coming?]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/11-More-Housing-Market-Predictions-For-2022-2023-2024-2025-Infographic.png)

Closure

Thus, we hope this article has provided valuable insights into Property Market Predictions 2025: A Comprehensive Outlook. We thank you for taking the time to read this article. See you in our next article!