Predicted Interest Rates in 2025: A Comprehensive Outlook

Related Articles: Predicted Interest Rates in 2025: A Comprehensive Outlook

- Next DV Lottery Registration 2025: A Comprehensive Guide To The Upcoming Draw

- What Will Interest Rates Be In 2025 UK?

- 2025 Battery Specs: A Comprehensive Outlook Into The Future Of Energy Storage

- Label Expo 2025: A Global Showcase Of Innovation And Sustainability

- Next-Generation Volvo XC60: A Technological Tour De Force

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Predicted Interest Rates in 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Predicted Interest Rates in 2025: A Comprehensive Outlook

Predicted Interest Rates in 2025: A Comprehensive Outlook

Introduction

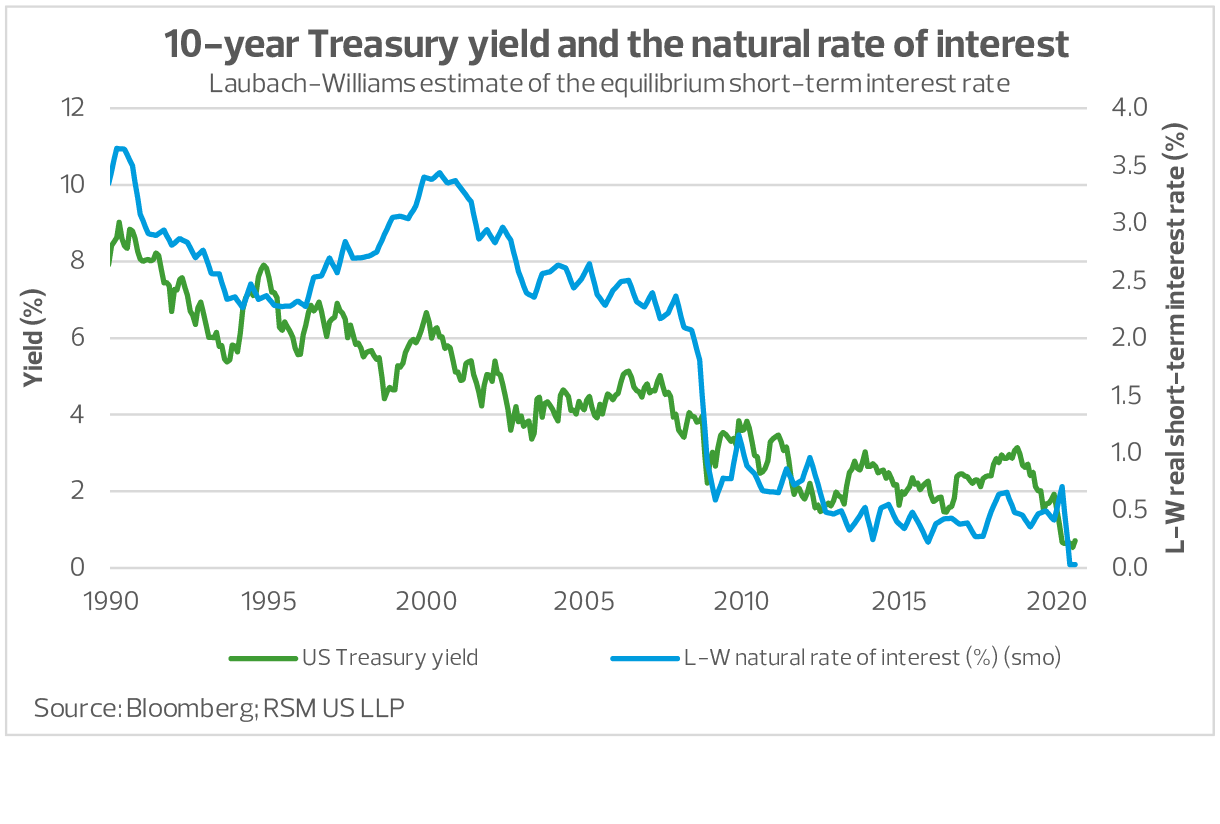

Interest rates, a fundamental aspect of financial markets, play a pivotal role in shaping economic growth, inflation, and investment decisions. As the global economy navigates the aftermath of the COVID-19 pandemic and geopolitical uncertainties, understanding the trajectory of interest rates in the coming years becomes crucial. This article aims to provide a comprehensive outlook on predicted interest rates in 2025, analyzing factors that will likely influence their direction and potential implications for various economic sectors.

Factors Influencing Interest Rates

- Economic Growth: A robust economy, characterized by high levels of employment and consumer spending, typically leads to higher interest rates as central banks attempt to curb inflation and prevent overheating.

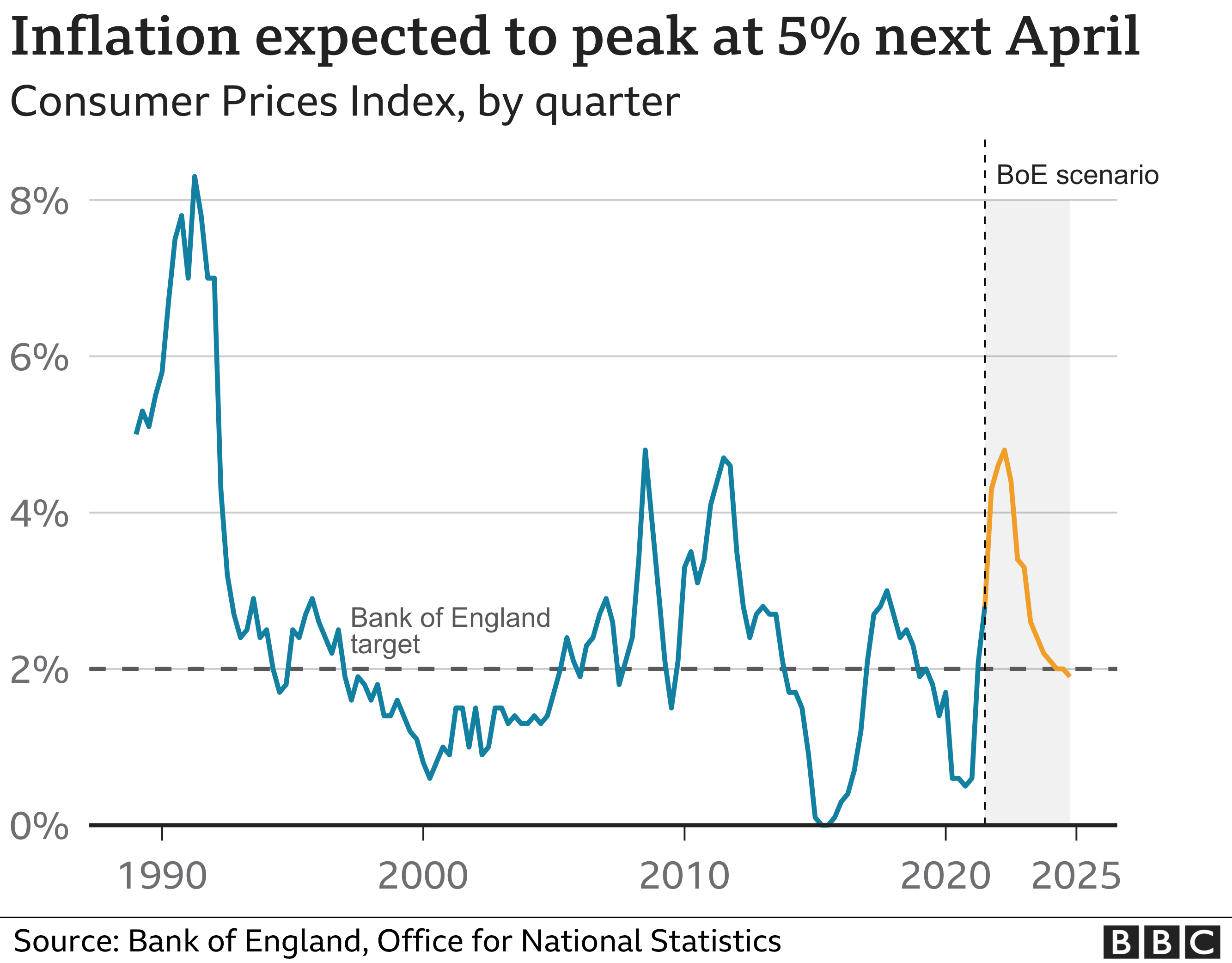

- Inflation: Central banks raise interest rates to combat rising inflation, as higher interest rates make borrowing more expensive and thus reduce demand.

- Fiscal Policy: Government spending and borrowing can impact interest rates. Large fiscal deficits often lead to higher interest rates as the government competes with private borrowers for funds.

- Monetary Policy: Central banks use monetary policy tools, such as adjusting short-term interest rates, to influence the overall level of interest rates in the economy.

- Global Economic Conditions: International economic conditions, such as interest rate movements in other major economies, can also affect domestic interest rates.

Predicted Interest Rates in 2025

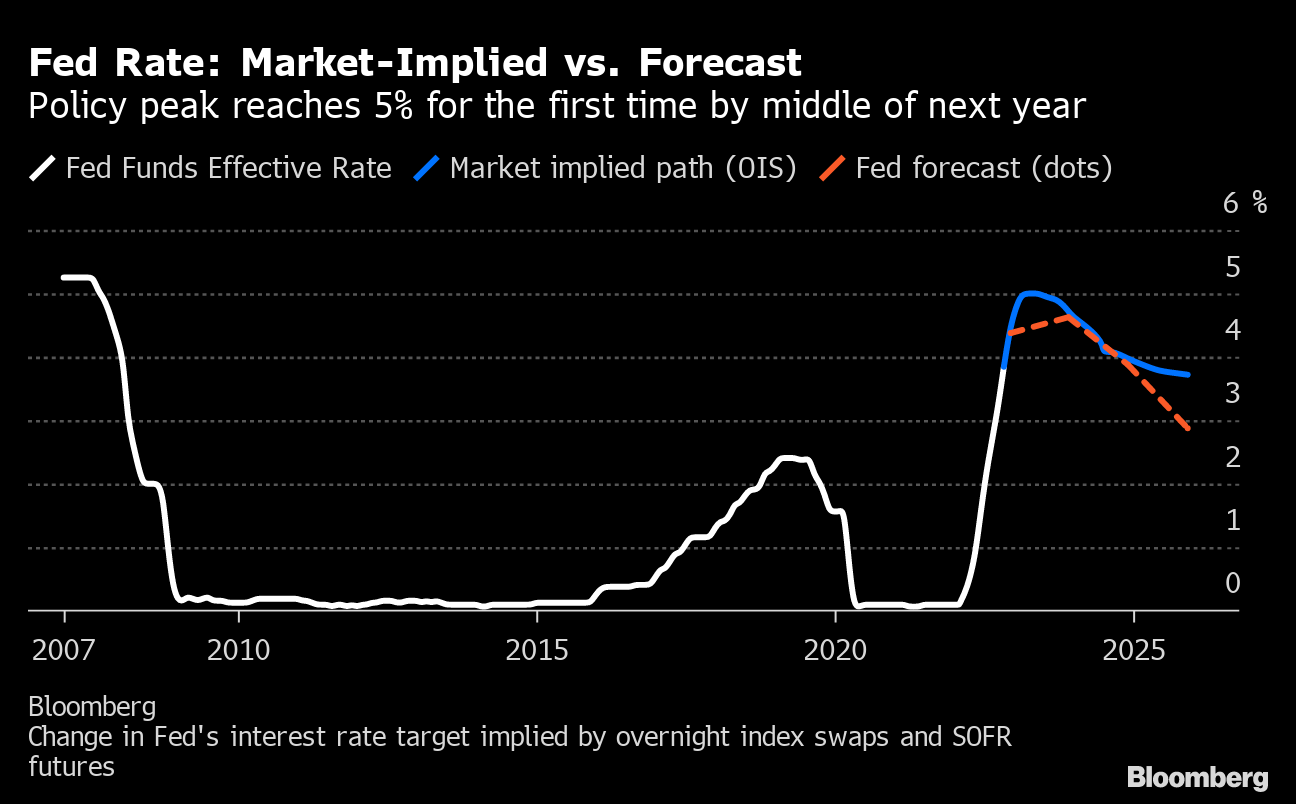

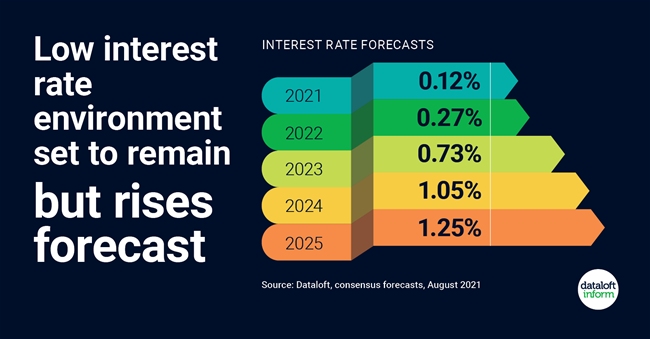

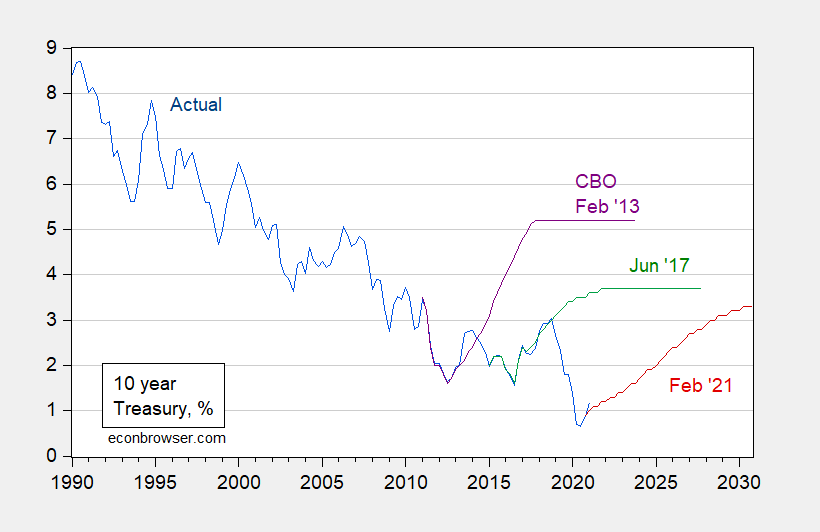

Based on current economic forecasts and market expectations, interest rates in 2025 are predicted to be higher than their current levels. Several factors contribute to this projection:

- Post-Pandemic Recovery: As the global economy recovers from the COVID-19 pandemic, economic growth is expected to accelerate, putting upward pressure on inflation and interest rates.

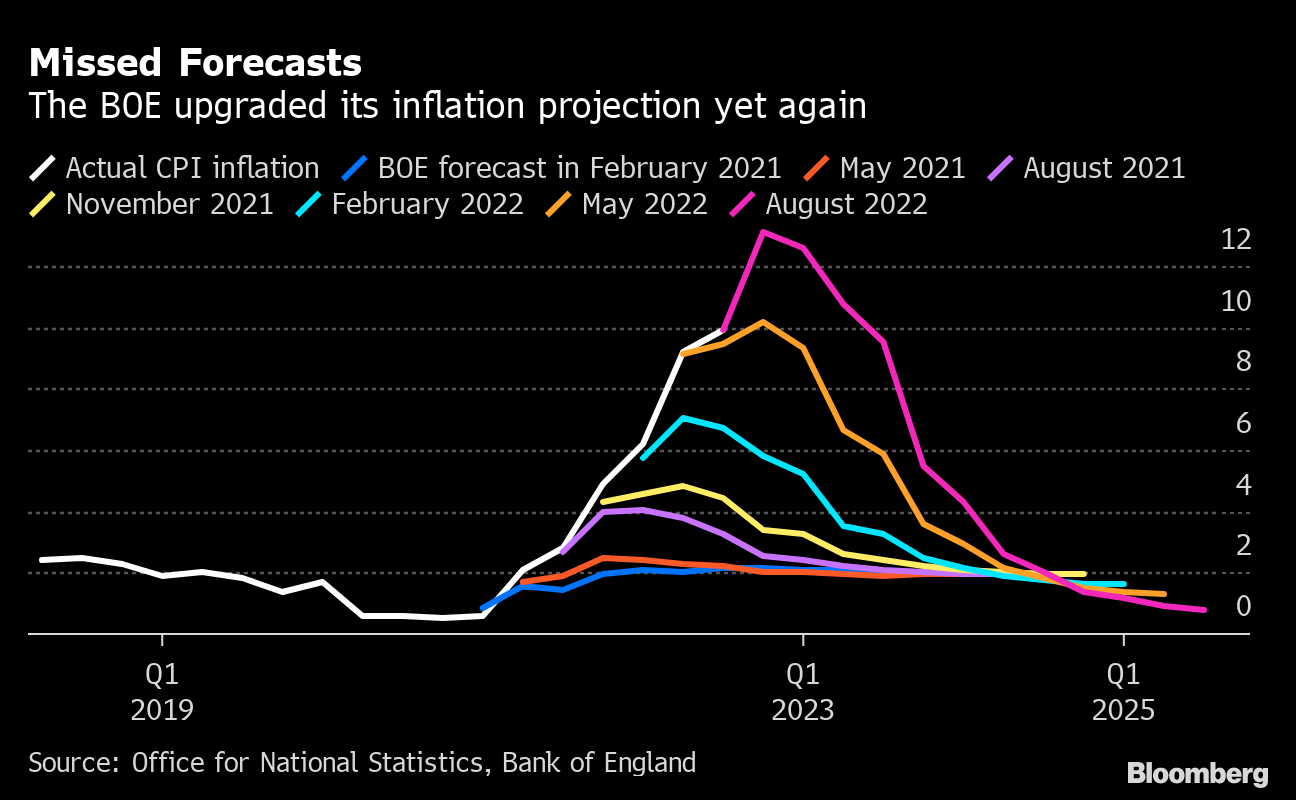

- Inflationary Pressures: Supply chain disruptions, rising energy prices, and labor shortages are contributing to persistent inflationary pressures. Central banks will likely continue raising interest rates to bring inflation under control.

- Quantitative Tightening: Major central banks, including the Federal Reserve and the European Central Bank, are expected to continue unwinding their quantitative easing programs, which will lead to a reduction in the supply of money and potentially higher interest rates.

Implications for Economic Sectors

Borrowers: Higher interest rates increase the cost of borrowing for businesses and consumers. This can impact investment decisions, consumer spending, and overall economic growth.

Savers: Rising interest rates provide higher returns on savings, making them more attractive for investors. This can lead to increased savings and reduced consumer spending.

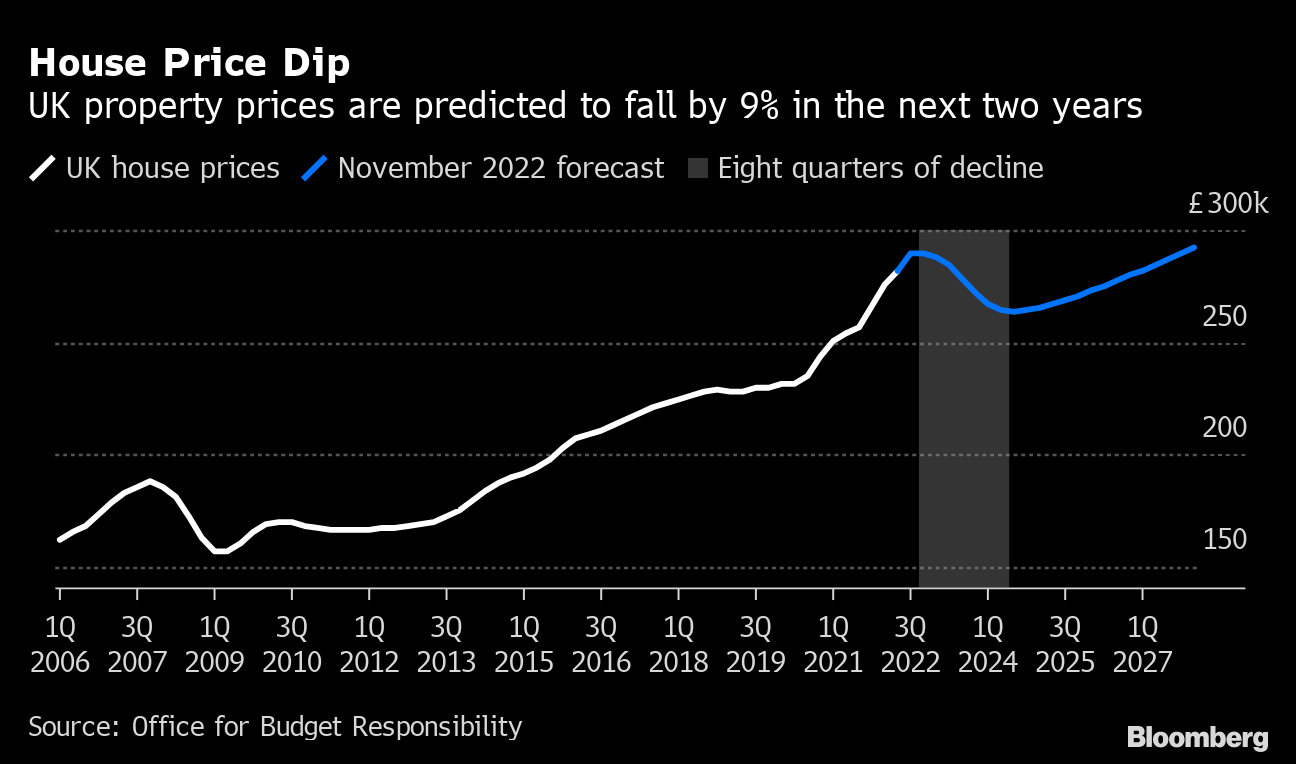

Housing Market: Higher interest rates make mortgages more expensive, potentially slowing down the housing market and reducing demand for real estate.

Stock Market: Interest rate increases can affect stock valuations, as higher interest rates make bonds and other fixed-income investments more attractive relative to equities.

Regional Interest Rate Differentials

Interest rates are not expected to move in lockstep across different regions of the world. The following are some key regional predictions:

- United States: The Federal Reserve is expected to continue raising interest rates in 2025, bringing the target range to 3.25-3.50%.

- Eurozone: The European Central Bank is predicted to raise interest rates more gradually, with a target range of 1.50-2.00% in 2025.

- United Kingdom: The Bank of England is expected to increase interest rates more aggressively, with a target range of 2.50-3.00% in 2025.

- Japan: The Bank of Japan is expected to maintain its ultra-low interest rate policy in 2025, with a target range of -0.10% to 0.10%.

Conclusion

Predicted interest rates in 2025 are likely to be higher than current levels. Factors such as economic growth, inflation, and monetary policy will drive this increase. Higher interest rates will have implications for various economic sectors, including borrowers, savers, the housing market, and the stock market. It is important for businesses and individuals to monitor interest rate movements and adjust their financial strategies accordingly. As the global economy continues to evolve, the trajectory of interest rates in 2025 remains subject to uncertainty, but the factors outlined in this article provide a solid foundation for understanding the potential direction of interest rates in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Predicted Interest Rates in 2025: A Comprehensive Outlook. We thank you for taking the time to read this article. See you in our next article!