NVIDIA Stock Price Prediction 2025: A Comprehensive Analysis of Growth Drivers and Challenges

Related Articles: NVIDIA Stock Price Prediction 2025: A Comprehensive Analysis of Growth Drivers and Challenges

- Difference Between 2025 And 2025 Ioniq 5

- Victoria Day: A Celebration Of Canada’s History And Heritage

- Visual Studio 2025 Community: A Comprehensive Overview

- The 2025 Kia Forte: A Symphony Of Style, Technology, And Performance

- Where Is The Next Ryder Cup 2025: A Comprehensive Guide To The Prestigious Golf Tournament

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to NVIDIA Stock Price Prediction 2025: A Comprehensive Analysis of Growth Drivers and Challenges. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about NVIDIA Stock Price Prediction 2025: A Comprehensive Analysis of Growth Drivers and Challenges

NVIDIA Stock Price Prediction 2025: A Comprehensive Analysis of Growth Drivers and Challenges

Introduction

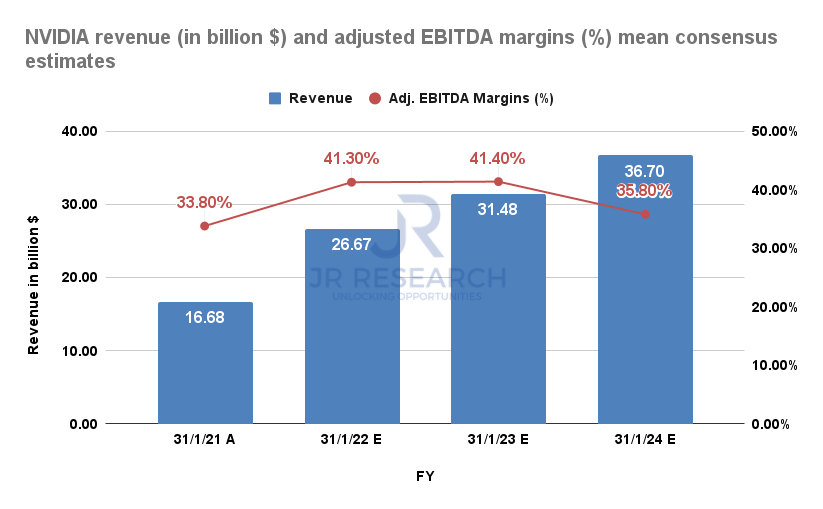

NVIDIA Corporation (NVDA) is a leading semiconductor company specializing in the design and manufacture of graphics processing units (GPUs). Its products are used in various industries, including gaming, data centers, automotive, and artificial intelligence (AI). The company has witnessed significant growth in recent years, and investors are keen to understand its future prospects. This article provides a comprehensive analysis of the key factors that will shape NVIDIA’s stock price prediction for 2025.

Growth Drivers

1. Gaming: A Major Revenue Generator

Gaming remains a significant revenue generator for NVIDIA, accounting for over 50% of its total sales. The company’s GeForce GPUs are highly sought after by gamers due to their superior performance and features. The growing popularity of esports and the emergence of cloud gaming are expected to further fuel demand for NVIDIA’s gaming products.

2. Data Center Dominance

NVIDIA has established a strong position in the data center market with its high-performance GPUs used in AI and machine learning applications. The exponential growth of data and the increasing adoption of AI in various industries are driving demand for NVIDIA’s data center solutions.

3. Automotive Revolution

The automotive industry is undergoing a significant transformation, with autonomous driving and electric vehicles becoming increasingly prevalent. NVIDIA’s DRIVE platform provides the essential hardware and software for self-driving cars, positioning the company as a key player in this emerging market.

4. AI and Machine Learning

AI and machine learning are revolutionizing various industries, and NVIDIA’s GPUs are at the heart of this transformation. The company’s CUDA platform provides a comprehensive software ecosystem for AI development, making it a preferred choice for researchers and developers worldwide.

5. Metaverse and Virtual Reality

The metaverse and virtual reality (VR) are gaining momentum, and NVIDIA’s GPUs are essential for creating immersive and realistic virtual environments. The company’s Omniverse platform offers a comprehensive suite of tools for building and simulating virtual worlds, providing significant growth potential in the future.

Challenges

1. Semiconductor Supply Chain Disruptions

The global semiconductor industry has been facing supply chain disruptions due to various factors, including the COVID-19 pandemic, geopolitical tensions, and natural disasters. These disruptions have impacted NVIDIA’s production and delivery schedules, potentially affecting its revenue and profitability.

2. Competition from Intel and AMD

NVIDIA faces intense competition from Intel and AMD, both of which offer competing GPU products. These companies are investing heavily in research and development, and their advancements could erode NVIDIA’s market share.

3. Cryptocurrency Market Volatility

NVIDIA’s gaming revenue is partially dependent on the cryptocurrency market. The volatility of cryptocurrency prices can impact demand for the company’s GPUs, as miners often purchase high-end GPUs for mining operations.

4. Rising Costs and Inflation

The rising costs of raw materials, labor, and transportation have put pressure on NVIDIA’s margins. Inflation can also reduce consumer spending, potentially impacting demand for the company’s products.

5. Regulatory Scrutiny

NVIDIA has come under regulatory scrutiny in recent years, with investigations into potential anti-competitive practices. Adverse regulatory actions could affect the company’s operations and financial performance.

NVIDIA Stock Price Prediction 2025

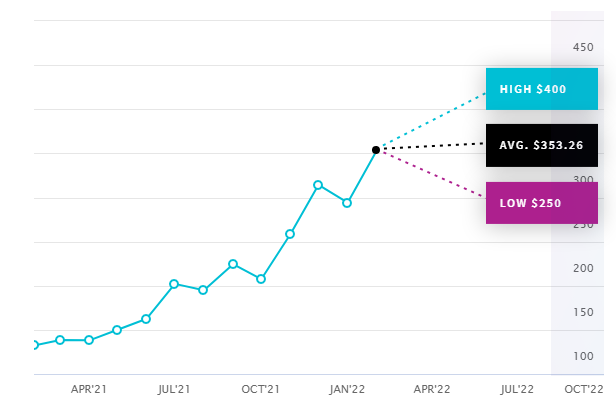

Based on the analysis of growth drivers and challenges, analysts have provided a range of NVIDIA stock price predictions for 2025. The consensus estimate is that the stock could reach between $350 and $450 per share by 2025, representing a potential upside of 30-60% from its current price.

Factors Supporting the Bullish Outlook

- Strong growth in gaming, data center, and automotive markets

- Continued dominance in AI and machine learning

- Metaverse and VR opportunities

- Potential for new product launches and acquisitions

Factors Supporting the Bearish Outlook

- Semiconductor supply chain disruptions

- Competition from Intel and AMD

- Cryptocurrency market volatility

- Rising costs and inflation

- Regulatory scrutiny

Investment Considerations

Investors considering investing in NVIDIA stock should carefully consider both the growth drivers and challenges discussed above. The company has a strong track record of innovation and market leadership, but it also faces significant competition and external factors that could impact its performance.

Conclusion

NVIDIA Corporation is a leading semiconductor company with significant growth potential in the years ahead. The company’s strong position in gaming, data centers, automotive, AI, and the metaverse provides a solid foundation for future growth. However, investors should be aware of the challenges the company faces, including supply chain disruptions, competition, and regulatory scrutiny. By carefully considering the factors discussed in this article, investors can make informed decisions about investing in NVIDIA stock and potentially benefit from its long-term growth prospects.

Closure

Thus, we hope this article has provided valuable insights into NVIDIA Stock Price Prediction 2025: A Comprehensive Analysis of Growth Drivers and Challenges. We appreciate your attention to our article. See you in our next article!