North Carolina Income Tax Rate 2025: A Comprehensive Guide

Related Articles: North Carolina Income Tax Rate 2025: A Comprehensive Guide

- Beldex Coin Price Prediction 2025: A Comprehensive Analysis

- Will Anything Happen To The Sun In 2025?

- How Much More Days Until 2025? A Comprehensive Countdown

- Will 2025 Be A Leap Year?

- Newest Design Trends 2025: Embracing Innovation And Sustainability

Introduction

With great pleasure, we will explore the intriguing topic related to North Carolina Income Tax Rate 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about North Carolina Income Tax Rate 2025: A Comprehensive Guide

North Carolina Income Tax Rate 2025: A Comprehensive Guide

Introduction

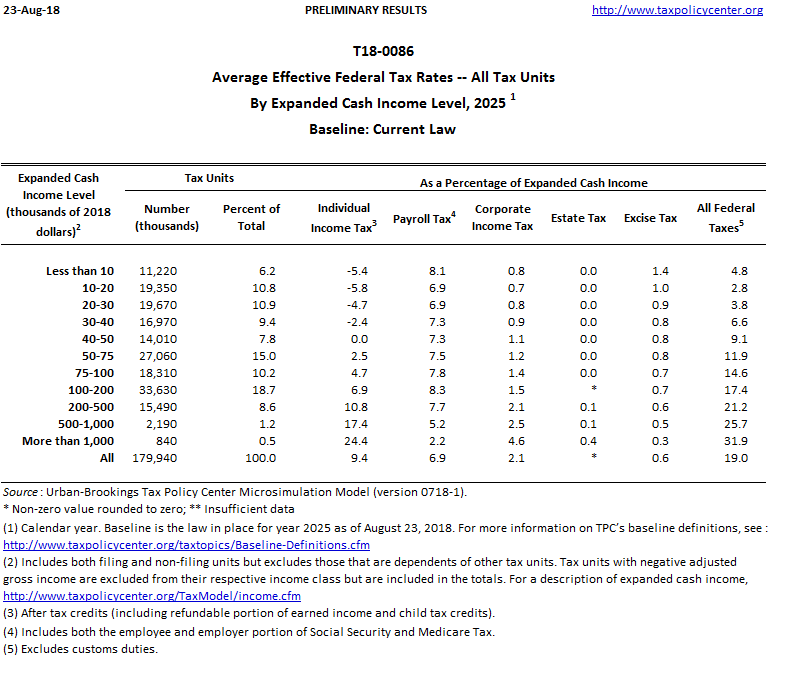

The state of North Carolina levies an income tax on its residents and non-residents who earn income within the state. The tax is calculated based on a progressive rate structure, meaning that the higher your income, the higher the percentage of your income that you will pay in taxes.

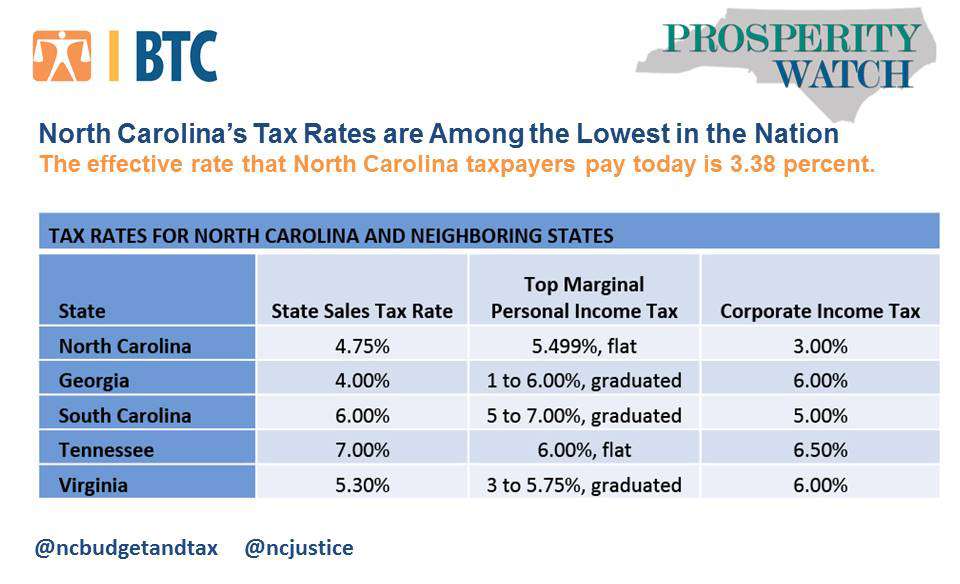

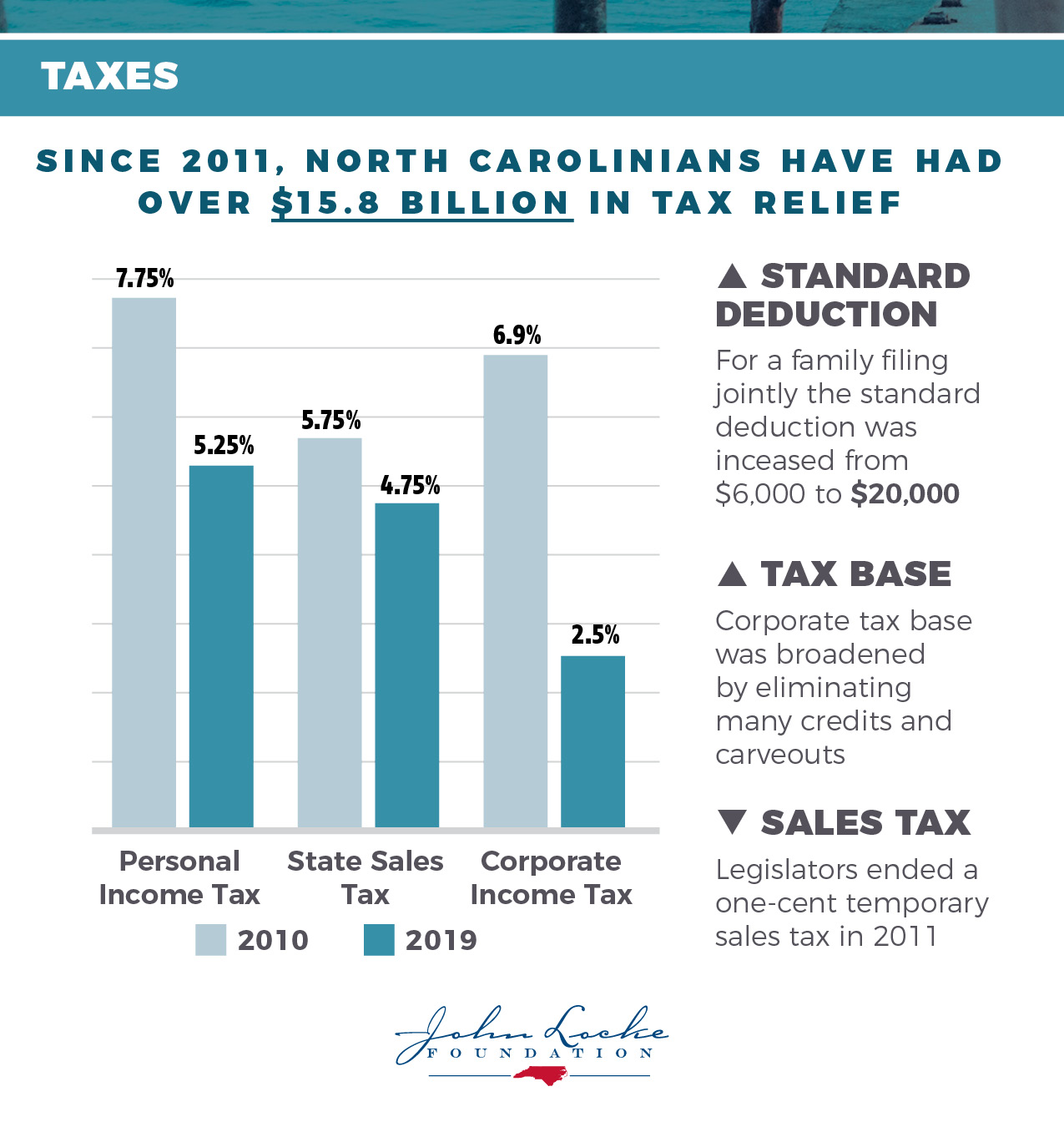

Tax Rates

For the 2025 tax year, the North Carolina income tax rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| $0 – $21,500 | 5.25% |

| $21,501 – $43,000 | 6.25% |

| $43,001 – $75,000 | 6.90% |

| $75,001 – $125,000 | 7.50% |

| $125,001 – $250,000 | 7.75% |

| Over $250,000 | 8.25% |

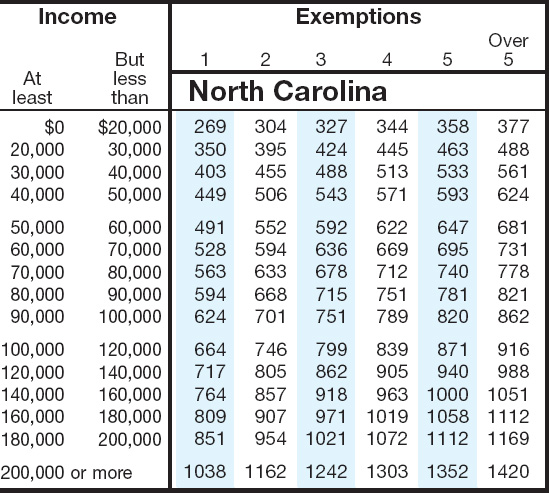

Exemptions and Deductions

There are a number of exemptions and deductions that can reduce your taxable income, including:

- Personal exemption: $2,500 per taxpayer

- Dependent exemption: $2,500 per dependent

- Standard deduction: $10,000 for single filers, $20,000 for married couples filing jointly

- Itemized deductions: These include deductions for mortgage interest, property taxes, charitable contributions, and certain other expenses.

Filing Requirements

You are required to file a North Carolina income tax return if you meet any of the following criteria:

- You are a resident of North Carolina and have a taxable income of more than $2,500.

- You are a non-resident of North Carolina and have earned income from a North Carolina source.

- You owe any North Carolina income tax, even if your income is below the filing threshold.

Due Dates

The due date for filing your North Carolina income tax return is April 15th. However, you can file an extension to October 15th if you need more time.

Payment Options

You can pay your North Carolina income tax online, by mail, or in person at a local tax office.

Penalties and Interest

If you fail to file your North Carolina income tax return or pay your taxes on time, you may be subject to penalties and interest.

Tax Credits

There are a number of tax credits available to North Carolina taxpayers, including:

- Child tax credit: $1,000 per child under the age of 17

- Earned income tax credit: A refundable credit for low- and moderate-income working individuals and families

- Education tax credit: A credit for certain education expenses

- Retirement savings tax credit: A credit for contributions to a retirement account

Estimated Taxes

If you expect to owe more than $1,000 in North Carolina income tax, you are required to make estimated tax payments throughout the year.

Tax Withholding

Your employer will withhold North Carolina income tax from your paycheck based on the information you provide on your W-4 form.

Additional Information

For more information about North Carolina income tax, please visit the North Carolina Department of Revenue website at https://www.ncdor.gov/.

Disclaimer

The information provided in this article is for general informational purposes only and should not be construed as professional tax advice. Please consult with a qualified tax professional for specific advice on your individual situation.

Closure

Thus, we hope this article has provided valuable insights into North Carolina Income Tax Rate 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!