IRMAA Brackets for 2024 and 2025: What You Need to Know

Related Articles: IRMAA Brackets for 2024 and 2025: What You Need to Know

- The 2025 Project: A Comprehensive Plan For Transforming Education

- When Will I Get Married? Unveiling The Mystery

- 2025 Lexus GS: A Glimpse Into The Future Of Automotive Luxury

- 2025 Ford Mustang GTD: A Thunderbolt For The Modern Era

- The African Cup Of Nations 2025: A Preview Of The Continent’s Premier Football Tournament

Introduction

With great pleasure, we will explore the intriguing topic related to IRMAA Brackets for 2024 and 2025: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IRMAA Brackets for 2024 and 2025: What You Need to Know

IRMAA Brackets for 2024 and 2025: What You Need to Know

Introduction

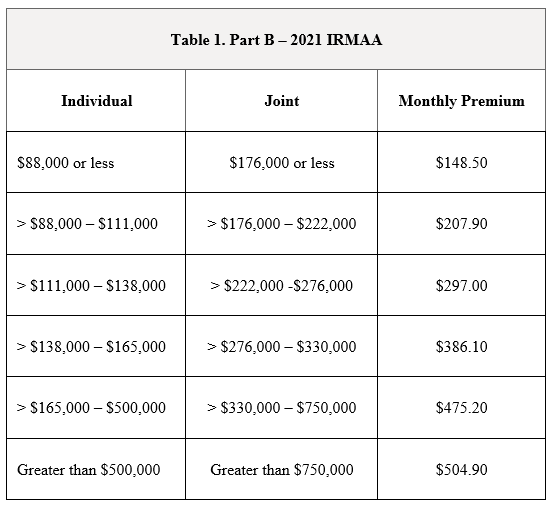

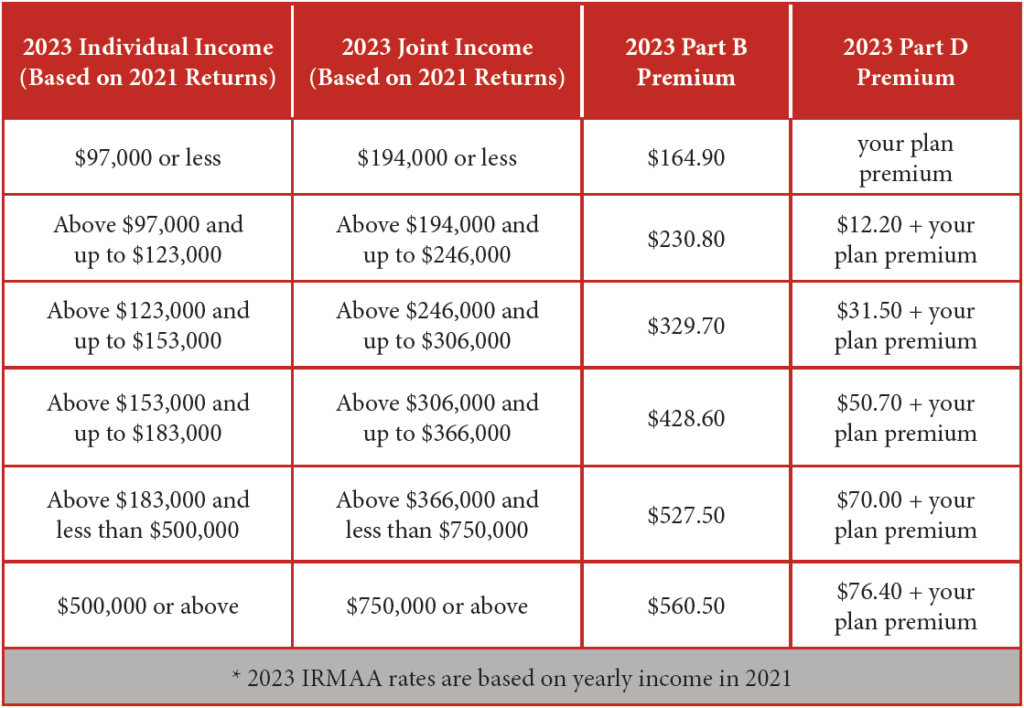

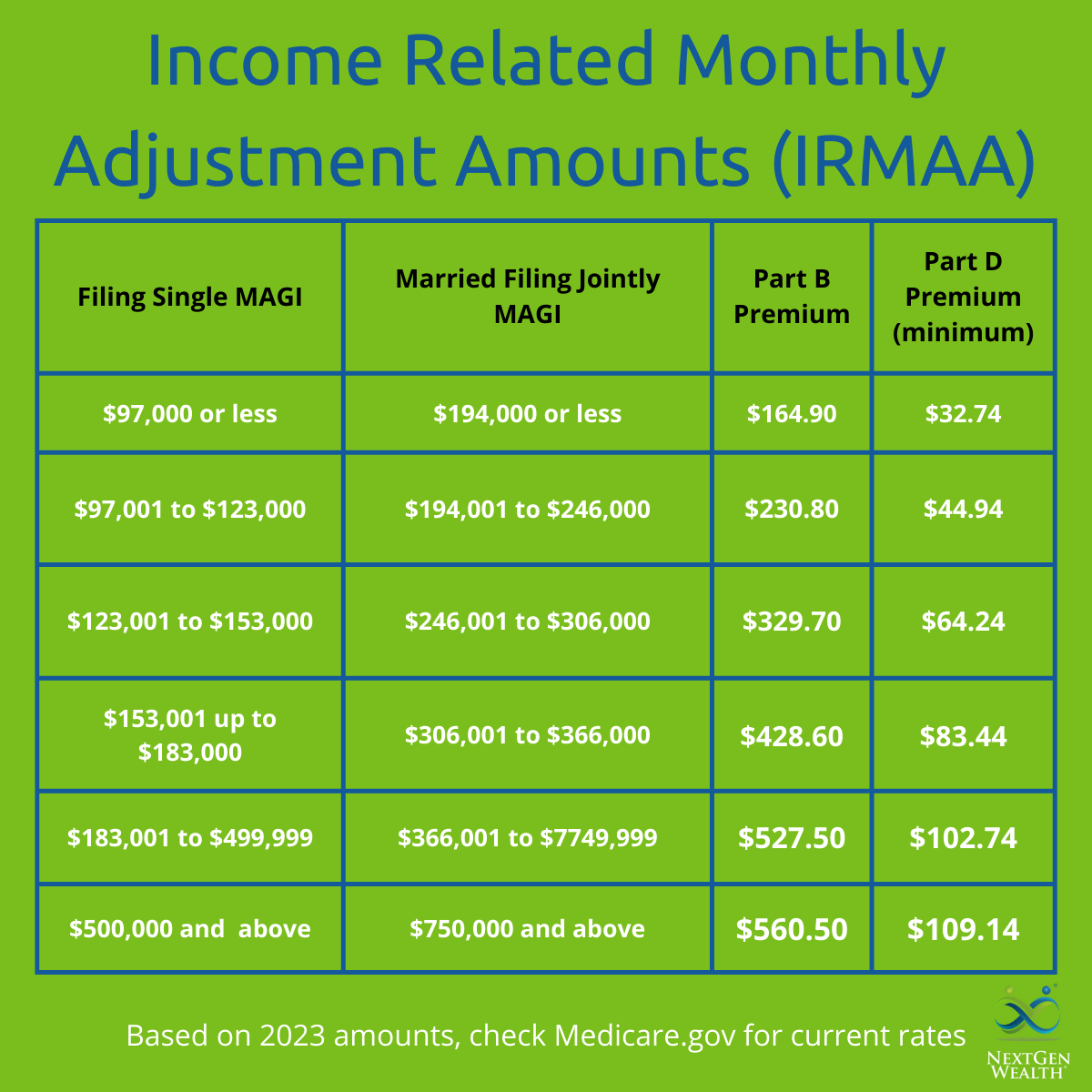

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge that is added to Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. For 2024 and 2025, the IRMAA brackets have been updated, resulting in changes to the amount of surcharge that some individuals will pay.

Understanding IRMAA

IRMAA is a way for Medicare to ensure that everyone pays their fair share of the program’s costs. Individuals with higher incomes are able to contribute more to the program through the IRMAA surcharge. The surcharge is calculated based on the individual’s modified adjusted gross income (MAGI), which is their adjusted gross income (AGI) plus any tax-exempt interest.

IRMAA Brackets for 2024 and 2025

The IRMAA brackets for 2024 and 2025 are as follows:

| Filing Status | 2024 MAGI | 2025 MAGI |

|---|---|---|

| Single | $97,000 | $101,000 |

| Married filing jointly | $194,000 | $202,000 |

| Married filing separately | $97,000 | $101,000 |

| Head of household | $145,500 | $152,000 |

Impact of the IRMAA Brackets

The updated IRMAA brackets for 2024 and 2025 will result in changes to the amount of surcharge that some individuals will pay. Individuals with MAGIs above the threshold amounts will pay a higher surcharge, while individuals with MAGIs below the threshold amounts will pay no surcharge.

For example:

- A single individual with a MAGI of $100,000 in 2024 will pay an IRMAA surcharge of $148.50 per month for Part B and $12.40 per month for Part D.

- A married couple filing jointly with a MAGI of $200,000 in 2025 will pay an IRMAA surcharge of $296.90 per month for Part B and $24.80 per month for Part D.

How to Avoid IRMAA

There are a few ways to avoid paying the IRMAA surcharge:

- Reduce your MAGI: This can be done by contributing to tax-advantaged retirement accounts, such as 401(k)s and IRAs.

- Claim deductions and credits: Certain deductions and credits can reduce your MAGI, such as the standard deduction, itemized deductions, and the earned income tax credit.

- Consider a Medicare Savings Account (MSA): MSAs are special savings accounts that can be used to pay for Medicare Part B premiums. If you have an MSA, you will not be subject to the IRMAA surcharge.

Conclusion

The IRMAA brackets for 2024 and 2025 have been updated, resulting in changes to the amount of surcharge that some individuals will pay. It is important to understand the IRMAA brackets and how they affect you so that you can plan accordingly. If you are concerned about paying the IRMAA surcharge, there are steps you can take to avoid it.

Closure

Thus, we hope this article has provided valuable insights into IRMAA Brackets for 2024 and 2025: What You Need to Know. We thank you for taking the time to read this article. See you in our next article!