IRMAA 2024, 2025, and 2026: What You Need to Know

Related Articles: IRMAA 2024, 2025, and 2026: What You Need to Know

- Subaru Forester 2014-2015: A Comprehensive Overview

- 2025: The Year Of Immersive Reality

- Wyoming License Plate Options: Express Yourself On The Road

- 2025 Nissan Murano Specs: A Comprehensive Overview

- 2025 World Junior Ice Hockey Championships: A Preview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to IRMAA 2024, 2025, and 2026: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IRMAA 2024, 2025, and 2026: What You Need to Know

IRMAA 2024, 2025, and 2026: What You Need to Know

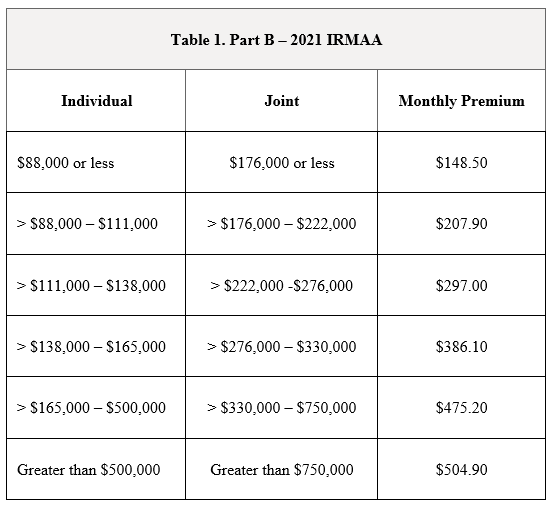

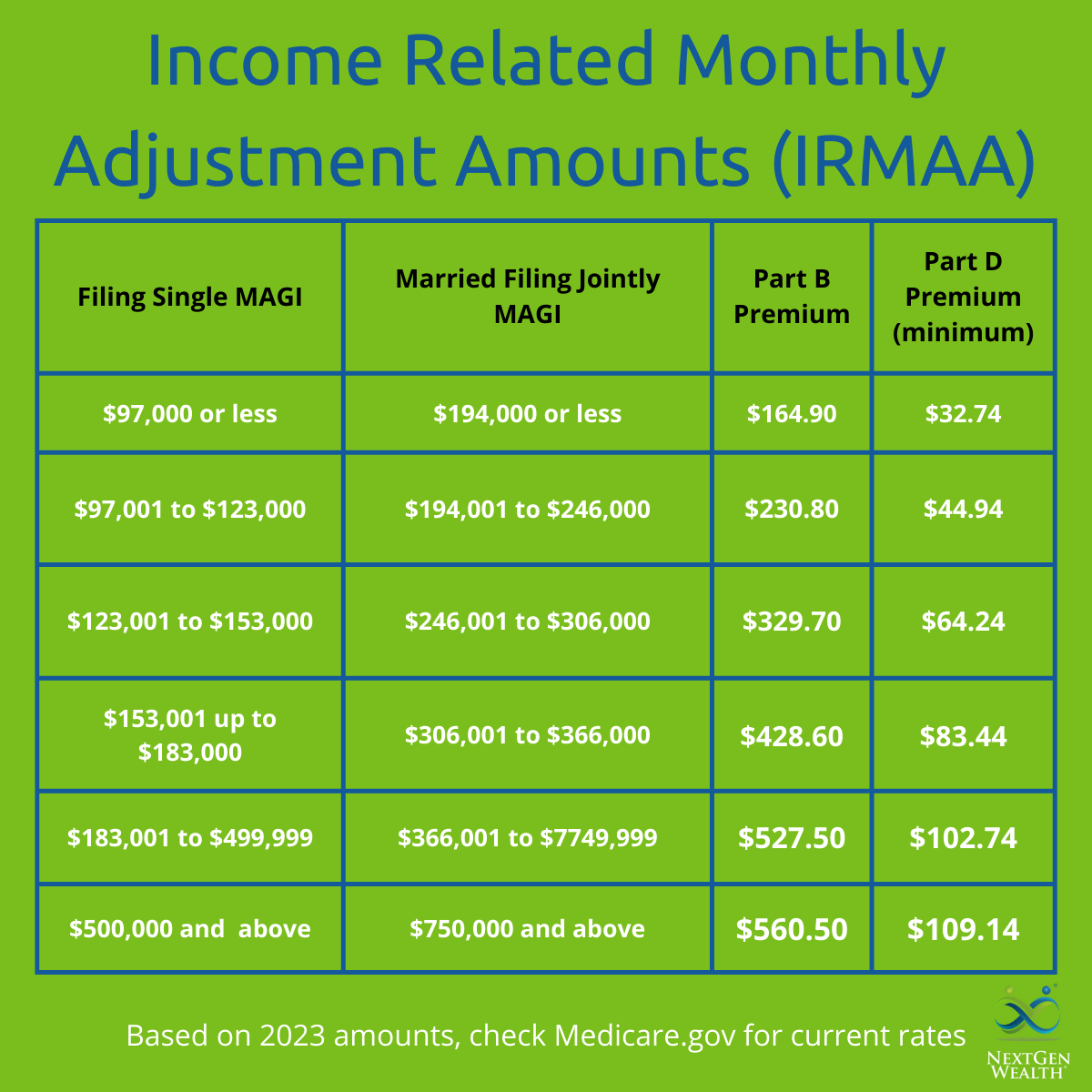

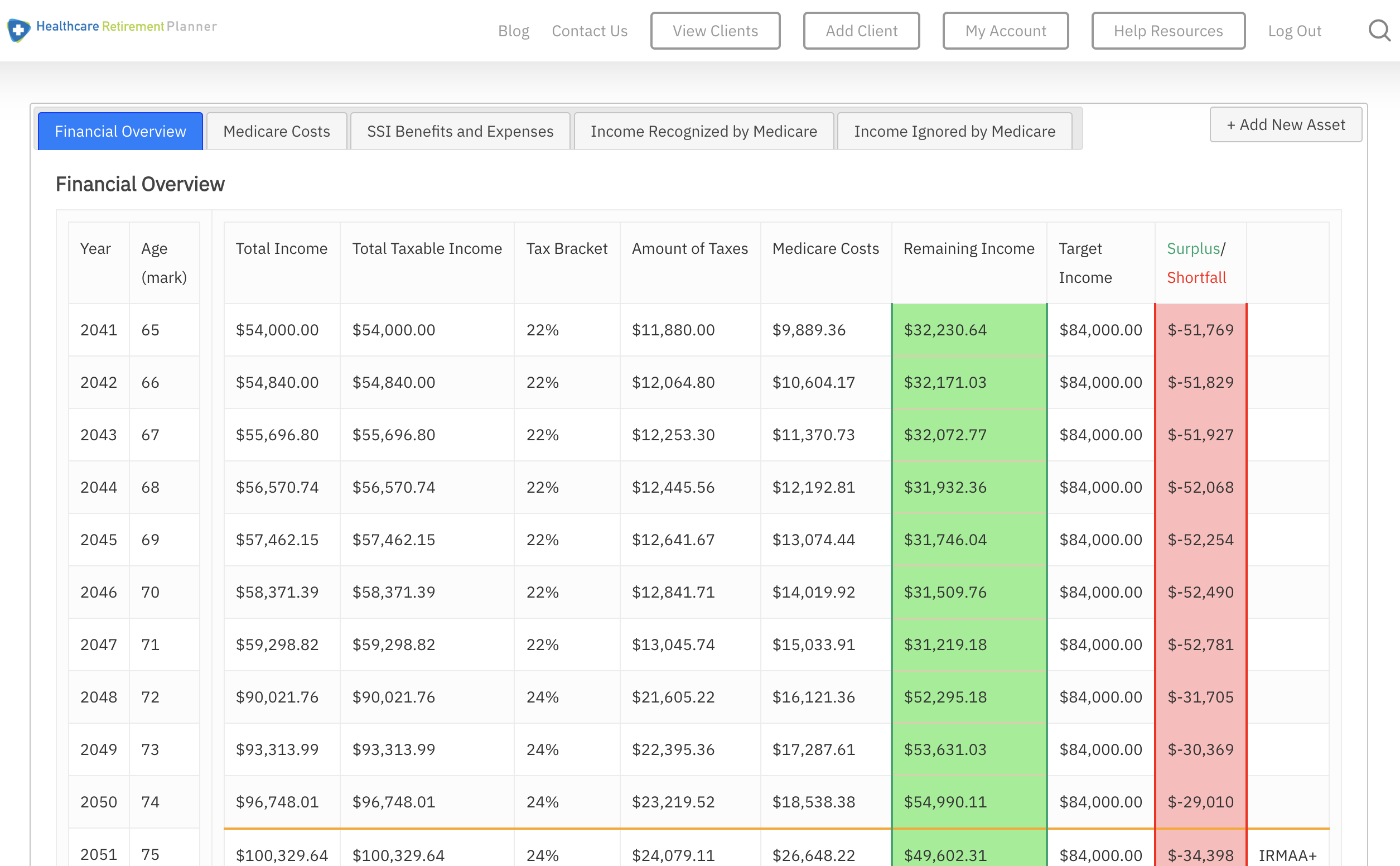

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge that is added to the Medicare Part B and Part D premiums of high-income individuals and couples. The IRMAA is designed to help cover the costs of Medicare for low-income beneficiaries.

The IRMAA is based on your modified adjusted gross income (MAGI) from two years ago. For example, the IRMAA for 2024 is based on your MAGI from 2022.

The IRMAA is divided into five income brackets. The higher your MAGI, the higher your IRMAA surcharge will be.

| MAGI Range | IRMAA Surcharge |

|---|---|

| $97,000 – $128,000 (single) | $59.10 per month |

| $128,001 – $158,000 (single) | $118.20 per month |

| $158,001 – $198,000 (single) | $177.30 per month |

| $198,001 – $238,000 (single) | $236.40 per month |

| Over $238,000 (single) | $295.50 per month |

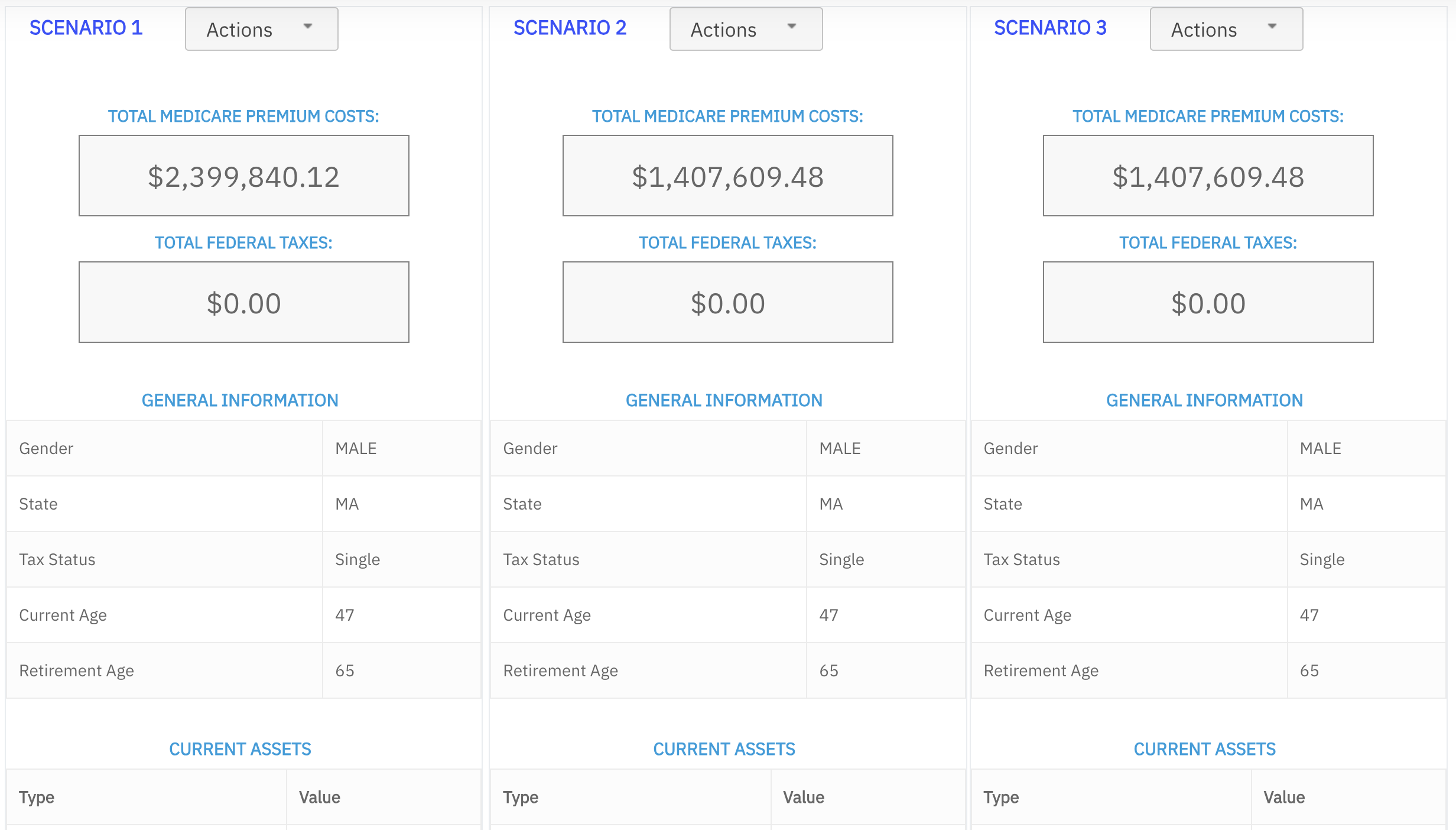

How to Avoid the IRMAA

There are a few ways to avoid the IRMAA. One way is to lower your MAGI. You can do this by contributing to a traditional IRA or 401(k) plan. Another way to avoid the IRMAA is to delay claiming Social Security benefits.

The IRMAA and Medicare Part D

The IRMAA also applies to Medicare Part D prescription drug plans. The IRMAA surcharge for Part D is based on your MAGI from the current year.

The IRMAA surcharge for Part D is divided into four income brackets. The higher your MAGI, the higher your IRMAA surcharge will be.

| MAGI Range | IRMAA Surcharge |

|---|---|

| $91,000 – $116,000 (single) | $12.40 per month |

| $116,001 – $146,000 (single) | $24.80 per month |

| $146,001 – $176,000 (single) | $37.20 per month |

| Over $176,000 (single) | $49.60 per month |

The IRMAA and the Affordable Care Act

The Affordable Care Act (ACA) made some changes to the IRMAA. One change is that the IRMAA is now phased in over a longer period of time. This means that the IRMAA surcharge will be lower for some individuals and couples.

Another change is that the ACA created a new income bracket for the IRMAA. This new income bracket is for individuals and couples with MAGIs over $250,000. The IRMAA surcharge for this income bracket is $59.10 per month for Part B and $12.40 per month for Part D.

The IRMAA and You

The IRMAA is a complex issue. If you are concerned about the IRMAA, you should speak with a financial advisor or tax professional.

Closure

Thus, we hope this article has provided valuable insights into IRMAA 2024, 2025, and 2026: What You Need to Know. We thank you for taking the time to read this article. See you in our next article!