Iowa Income Tax Rates 2025: A Comprehensive Guide

Related Articles: Iowa Income Tax Rates 2025: A Comprehensive Guide

- The Ford Expedition Raptor 2025: A Beast Of A Family Hauler

- Infiniti QX80 Luxe 2025: A Pinnacle Of Luxury And Off-Road Prowess

- 2025 Yukon Denali: The Pinnacle Of Luxury And Capability

- License Plate Stickers 2025: Everything You Need To Know

- Guinness World Records 2025: Extraordinary Feats And Unbreakable Records

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Iowa Income Tax Rates 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Iowa Income Tax Rates 2025: A Comprehensive Guide

Iowa Income Tax Rates 2025: A Comprehensive Guide

Introduction

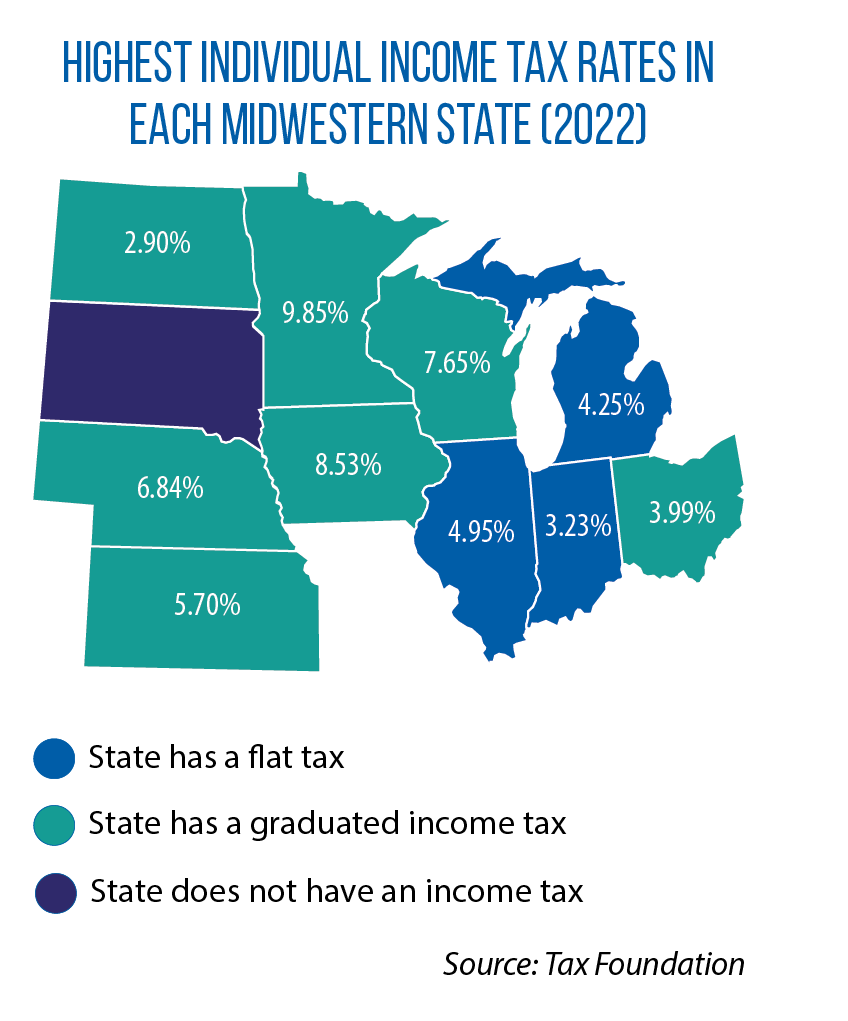

The Iowa income tax system is a progressive tax system, meaning that the tax rate increases as the taxable income increases. The tax rates for 2025 have been recently released by the Iowa Department of Revenue. This article provides a comprehensive overview of the Iowa income tax rates for 2025, including the various brackets, deductions, and credits.

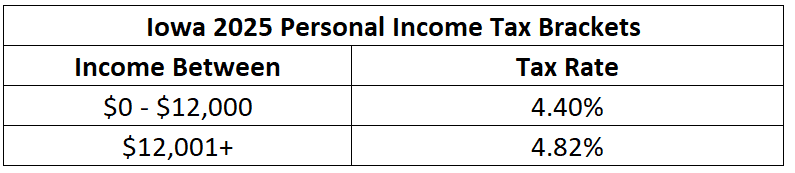

Tax Brackets

The Iowa income tax rates for 2025 are divided into nine brackets, with each bracket having a different tax rate. The brackets and their corresponding tax rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| $0 – $1,460 | 0.36% |

| $1,461 – $3,400 | 0.72% |

| $3,401 – $6,600 | 2.43% |

| $6,601 – $14,650 | 4.20% |

| $14,651 – $23,700 | 6.27% |

| $23,701 – $36,900 | 7.44% |

| $36,901 – $50,200 | 8.53% |

| $50,201 – $73,900 | 9.62% |

| Over $73,900 | 10.73% |

Deductions

Iowa allows a variety of deductions from taxable income, including:

- Standard Deduction: The standard deduction for 2025 is $2,400 for single filers and $4,800 for married couples filing jointly.

- Itemized Deductions: Itemized deductions allow taxpayers to deduct certain expenses from their taxable income, such as mortgage interest, charitable contributions, and state and local taxes.

- Personal Exemptions: Personal exemptions allow taxpayers to reduce their taxable income by a certain amount for each dependent. The personal exemption for 2025 is $3,200.

Credits

Iowa also offers a number of tax credits, including:

- Earned Income Tax Credit (EITC): The EITC is a refundable tax credit for low- and moderate-income working individuals and families.

- Child and Dependent Care Credit: This credit helps offset the cost of child care expenses for working parents.

- Property Tax Credit: This credit provides relief to homeowners and renters who pay property taxes.

Calculating Iowa Income Tax

To calculate your Iowa income tax for 2025, you will need to:

- Determine your taxable income by subtracting deductions from your gross income.

- Identify the tax bracket that your taxable income falls into.

- Multiply your taxable income by the corresponding tax rate.

- Subtract any applicable tax credits from the calculated tax amount.

Example Calculation

Consider a single taxpayer with a taxable income of $25,000 in 2025.

- Taxable Income: $25,000

- Tax Bracket: $14,651 – $23,700

- Tax Rate: 6.27%

- Calculated Tax: $25,000 x 0.0627 = $1,567.50

- Tax Due: $1,567.50 (no applicable tax credits)

Due Dates

The due date for filing your Iowa income tax return is April 30, 2025. However, you can request an extension to file until October 15, 2025.

Conclusion

The Iowa income tax system for 2025 is designed to be fair and equitable for taxpayers of all income levels. By understanding the tax brackets, deductions, and credits available, you can accurately calculate your tax liability and ensure that you are paying the correct amount of taxes.

Closure

Thus, we hope this article has provided valuable insights into Iowa Income Tax Rates 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!