IonQ Stock Forecast 2025: Unlocking the Potential of Quantum Computing

Related Articles: IonQ Stock Forecast 2025: Unlocking the Potential of Quantum Computing

- HP 2025 Cartridge: An In-Depth Analysis For Optimal Printing Performance

- Junior Hockey World Cup 2025: A Global Showcase Of Rising Hockey Stars

- Weeks Until February 15, 2025: A Comprehensive Timeline And Countdown

- When Is The Vernal Equinox 2025?

- Postgraduate Programs In The USA: PhD Spring 2024

Introduction

With great pleasure, we will explore the intriguing topic related to IonQ Stock Forecast 2025: Unlocking the Potential of Quantum Computing. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IonQ Stock Forecast 2025: Unlocking the Potential of Quantum Computing

IonQ Stock Forecast 2025: Unlocking the Potential of Quantum Computing

Introduction

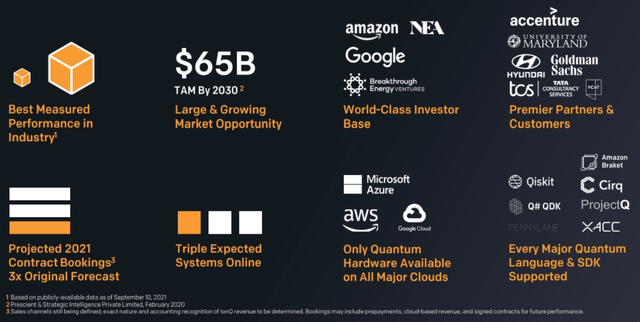

IonQ, Inc. is a leading developer of quantum computers, a transformative technology poised to revolutionize various industries. As the company continues to make significant advancements in its quantum computing platform, investors are eagerly anticipating the potential upside of its stock in the coming years. This article provides an in-depth analysis of IonQ’s stock forecast for 2025, considering key factors that could influence its future performance.

Current Market Landscape

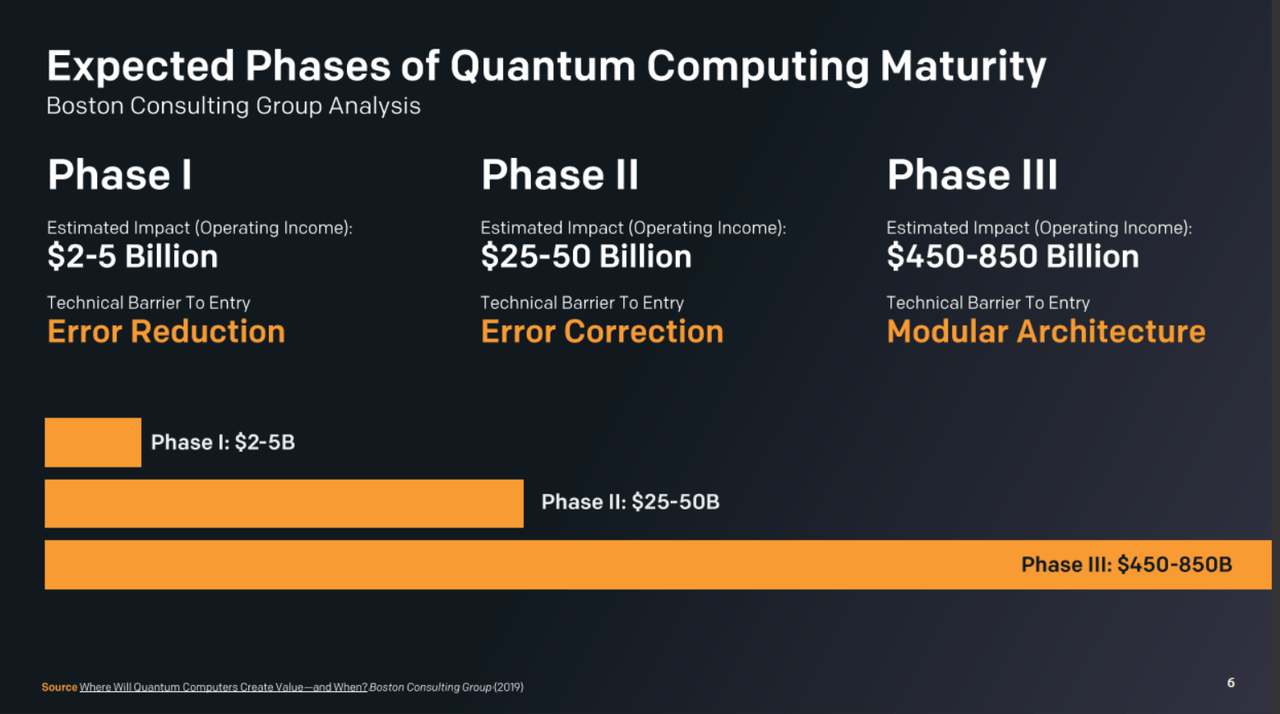

IonQ has made substantial progress in recent years, securing partnerships with major technology companies such as Google, Amazon, and Microsoft. The company’s quantum computers are already being used for various research and development projects, demonstrating their practical applications. The global quantum computing market is projected to grow exponentially in the coming years, driven by increasing demand from industries such as pharmaceuticals, materials science, and financial services.

Technological Advancements

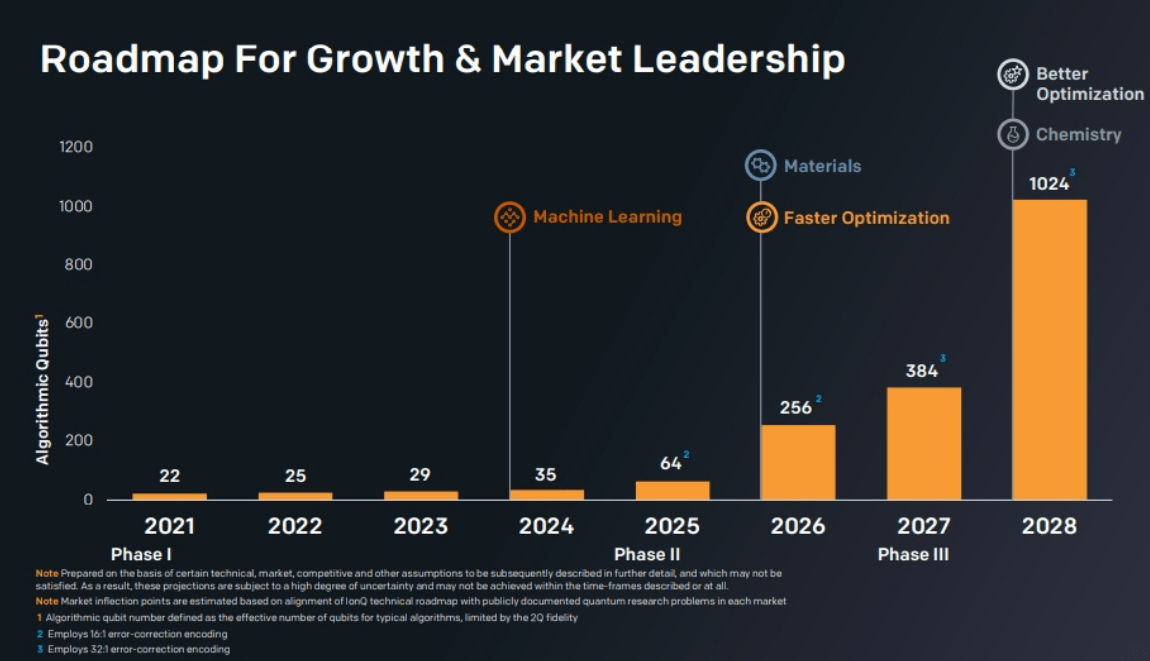

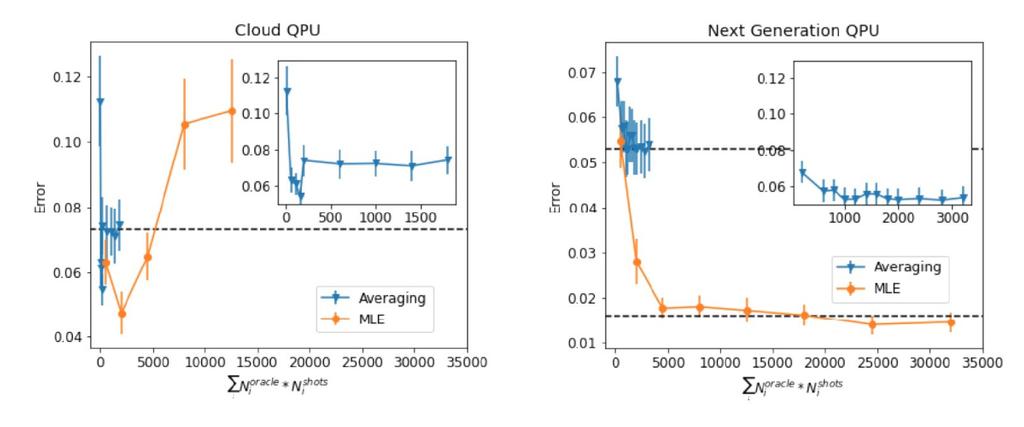

IonQ’s proprietary trapped-ion technology is a key differentiator in the quantum computing landscape. Trapped-ion qubits are less susceptible to decoherence, a major challenge in quantum computing. The company has also developed novel quantum algorithms and software tools, enhancing the usability and accessibility of its platform.

Financial Performance

IonQ’s financial performance has been steadily improving. In the first half of 2023, the company reported a 40% increase in revenue compared to the same period in 2022. IonQ has also secured significant funding through private investments and government grants, providing a solid financial foundation for future growth.

Industry Outlook

The quantum computing industry is expected to witness significant consolidation in the coming years. IonQ’s strategic partnerships and technological leadership position it well to emerge as a major player in this evolving market. The company’s focus on developing practical applications and building an ecosystem around its platform will further strengthen its competitive advantage.

Stock Forecast

Based on the analysis of key factors influencing IonQ’s future performance, analysts project a positive stock forecast for 2025. The company’s strong technological foundation, strategic partnerships, and improving financial performance are expected to drive significant growth in its stock value.

Target Price

Analysts have set a target price range for IonQ stock in 2025 of $30-$50 per share. This represents a significant upside potential from its current price of around $15 per share. The target price is based on the company’s expected revenue growth, technological advancements, and industry outlook.

Risks and Considerations

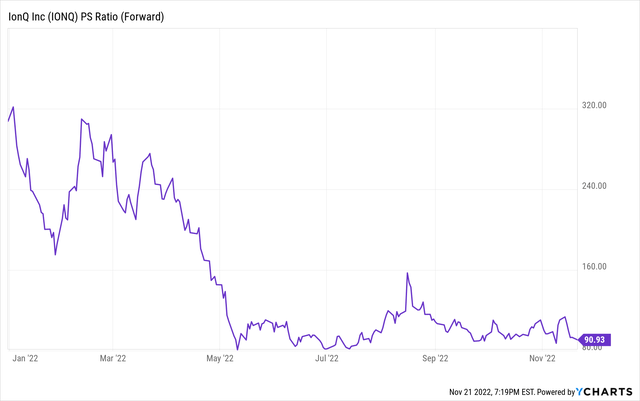

While the stock forecast for IonQ is promising, it is important to consider potential risks and uncertainties. The quantum computing industry is still in its early stages, and technological breakthroughs or regulatory changes could impact the company’s performance. Additionally, competition from established technology giants and emerging startups could intensify in the future.

Investment Strategy

Investors seeking exposure to the transformative potential of quantum computing should consider adding IonQ stock to their portfolio. A long-term investment strategy is recommended, as the company’s stock value is expected to appreciate gradually over time. However, investors should monitor the industry landscape and company updates closely to assess any changes in the risk-reward profile.

Conclusion

IonQ’s stock forecast for 2025 is highly promising, reflecting the company’s strong technological foundation, strategic partnerships, and improving financial performance. The exponential growth potential of the quantum computing industry and IonQ’s position as a leading player support the bullish outlook for its stock. However, investors should be aware of potential risks and consider a long-term investment strategy to maximize their returns.

Closure

Thus, we hope this article has provided valuable insights into IonQ Stock Forecast 2025: Unlocking the Potential of Quantum Computing. We appreciate your attention to our article. See you in our next article!