Interest Rate Projection 2025: A Comprehensive Outlook

Related Articles: Interest Rate Projection 2025: A Comprehensive Outlook

- Top High School Girls Basketball Players To Watch In 2025

- Ohio High School Football Prospects: A Deep Dive Into The Buckeye State’s Elite

- Father’s Day 2025: The Ultimate Gift Guide For Extraordinary Dads

- Batman: The Brave And The Bold 2025: A Triumphant Return To Animation

- Solar Storm 2025: When Will It Hit And What To Expect

Introduction

With great pleasure, we will explore the intriguing topic related to Interest Rate Projection 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Interest Rate Projection 2025: A Comprehensive Outlook

Interest Rate Projection 2025: A Comprehensive Outlook

Introduction

Interest rates play a crucial role in the economy, influencing investment, consumption, and overall economic activity. Central banks, such as the Federal Reserve in the United States, use interest rate adjustments as a primary monetary policy tool to manage inflation, stabilize economic growth, and maintain financial stability. Understanding the trajectory of interest rates is essential for businesses, investors, and policymakers to make informed decisions. This article provides a comprehensive projection of interest rates in 2025, based on an analysis of current economic conditions, market trends, and expert forecasts.

Current Economic Landscape

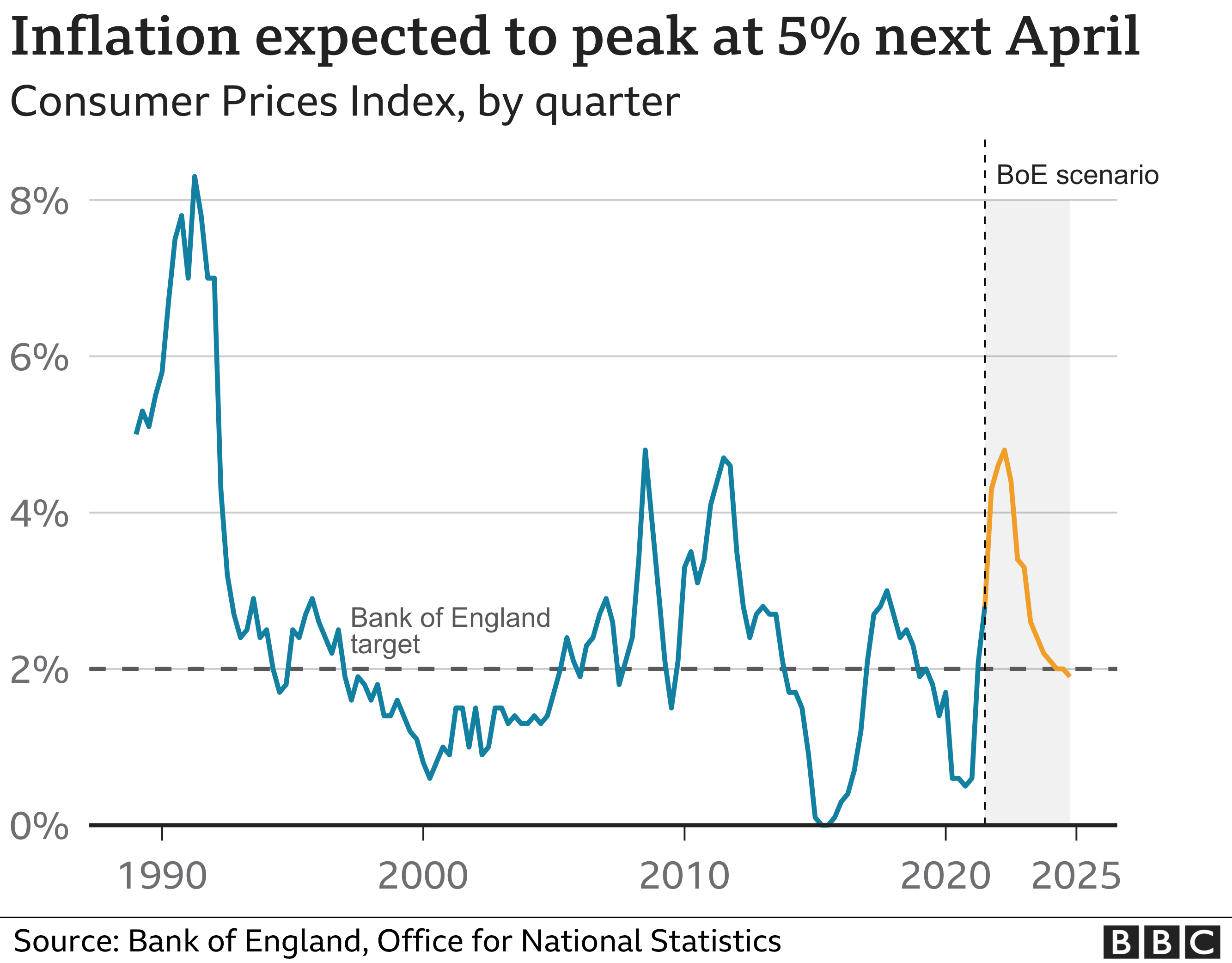

The global economy is currently facing a confluence of challenges, including the ongoing COVID-19 pandemic, supply chain disruptions, geopolitical tensions, and rising inflation. These factors have contributed to a period of heightened uncertainty and volatility in financial markets. Central banks worldwide have responded by raising interest rates to combat inflation and support economic recovery.

Fed Policy Outlook

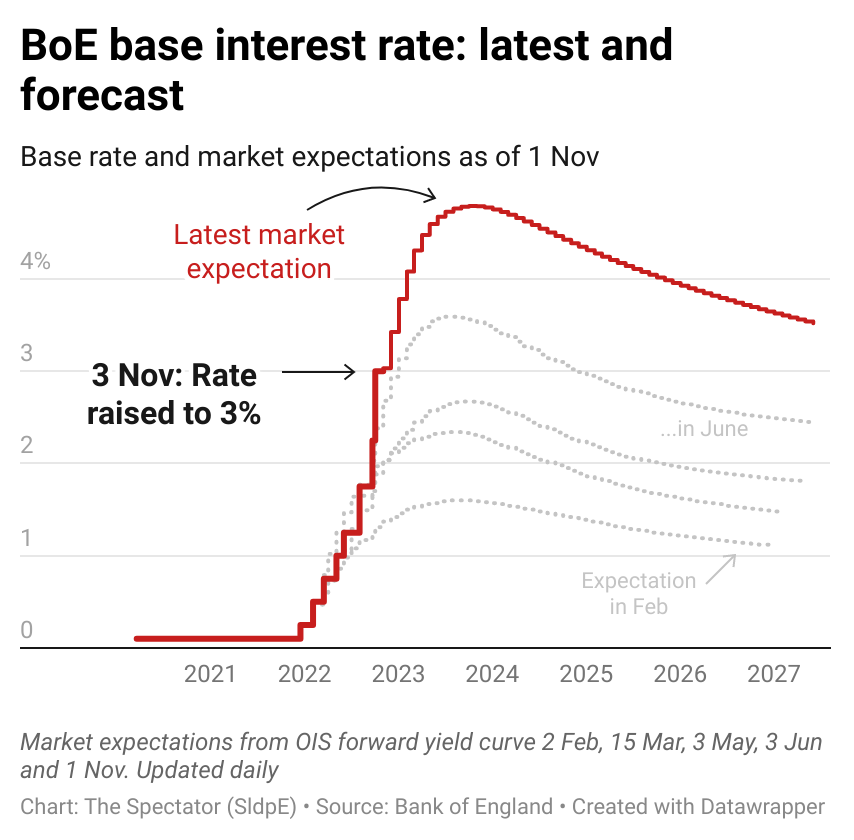

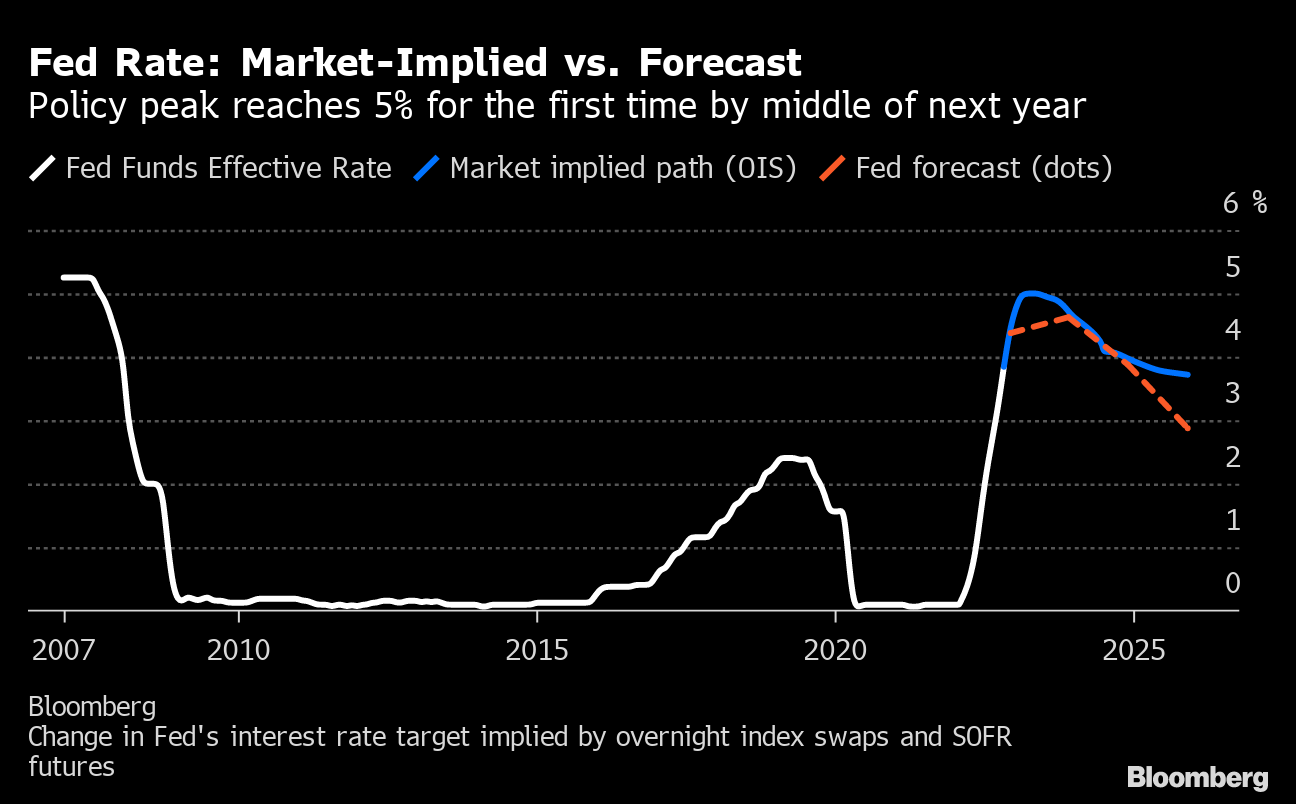

The Federal Reserve has adopted a hawkish stance on monetary policy, signaling its commitment to bringing inflation under control. The central bank has already implemented several interest rate hikes in 2022 and has indicated that further increases are likely in the coming months. Market participants expect the Fed to continue raising rates until inflation falls back to its target of 2%.

Market Expectations

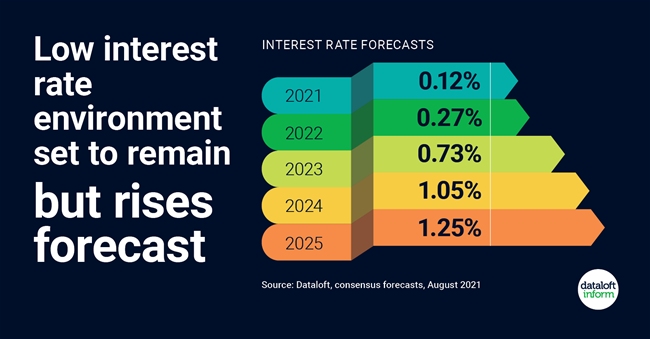

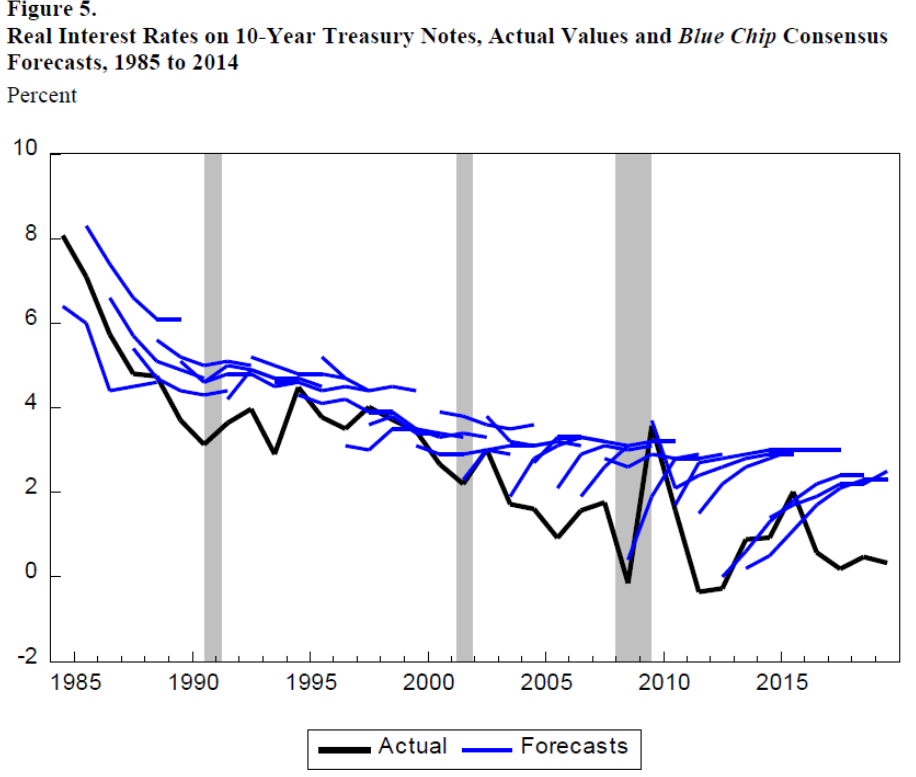

According to the latest survey of market participants conducted by Bloomberg, the median forecast for the federal funds rate at the end of 2025 is 3.5%. This suggests that the market anticipates the Fed will raise rates by approximately 1.5% over the next three years. However, there is considerable uncertainty surrounding this projection, with some analysts predicting higher rates and others expecting a more moderate pace of tightening.

Factors Influencing Interest Rate Projections

Several factors will influence the path of interest rates in the coming years, including:

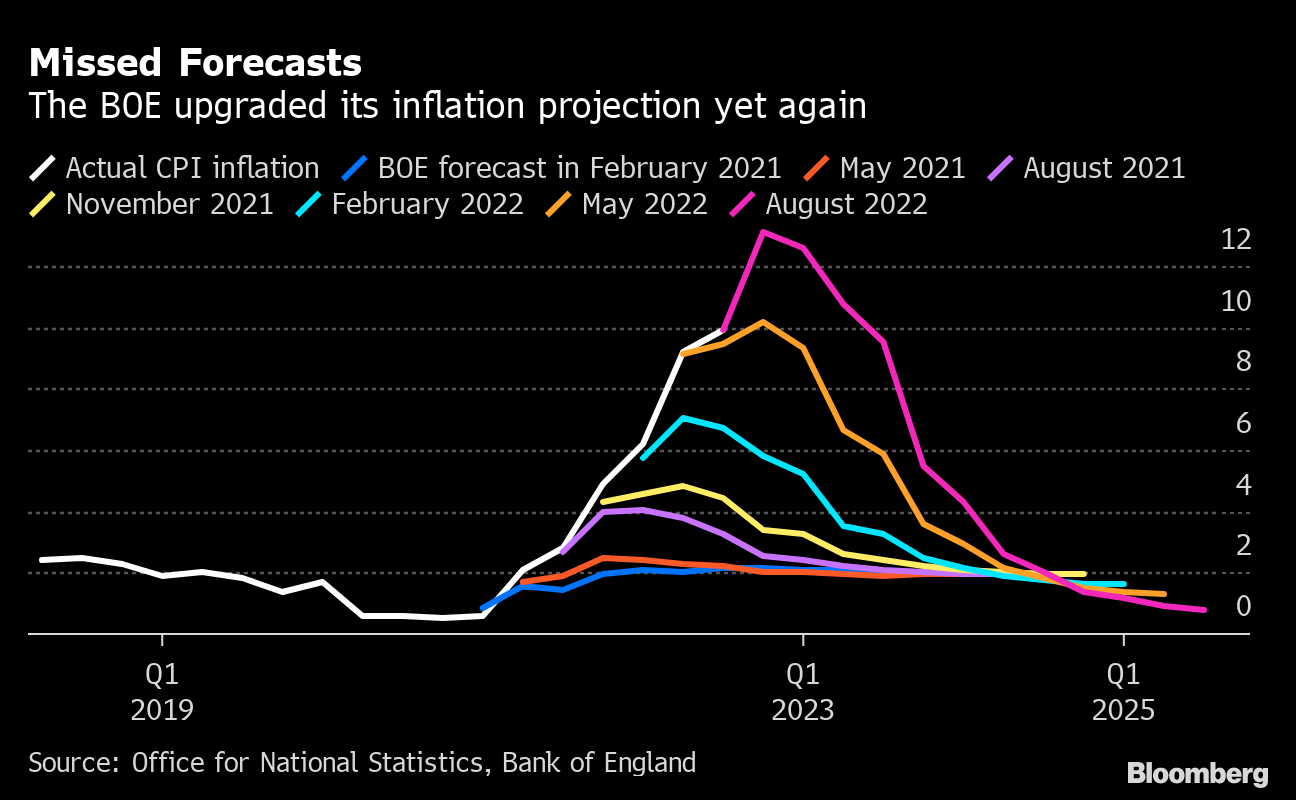

- Inflation: The trajectory of inflation will be a key determinant of interest rate policy. If inflation remains persistently high, central banks may need to raise rates more aggressively to bring it under control.

- Economic growth: The pace of economic growth will also impact interest rate decisions. If the economy slows down, central banks may pause or reverse rate hikes to support growth.

- Financial stability: Central banks will need to balance their inflation-fighting efforts with maintaining financial stability. Too rapid or excessive rate increases could destabilize financial markets and harm economic growth.

- Global economic conditions: The global economic outlook will also play a role in interest rate projections. If global growth slows or geopolitical tensions escalate, central banks may adopt a more dovish stance on monetary policy.

Long-Term Interest Rate Outlook

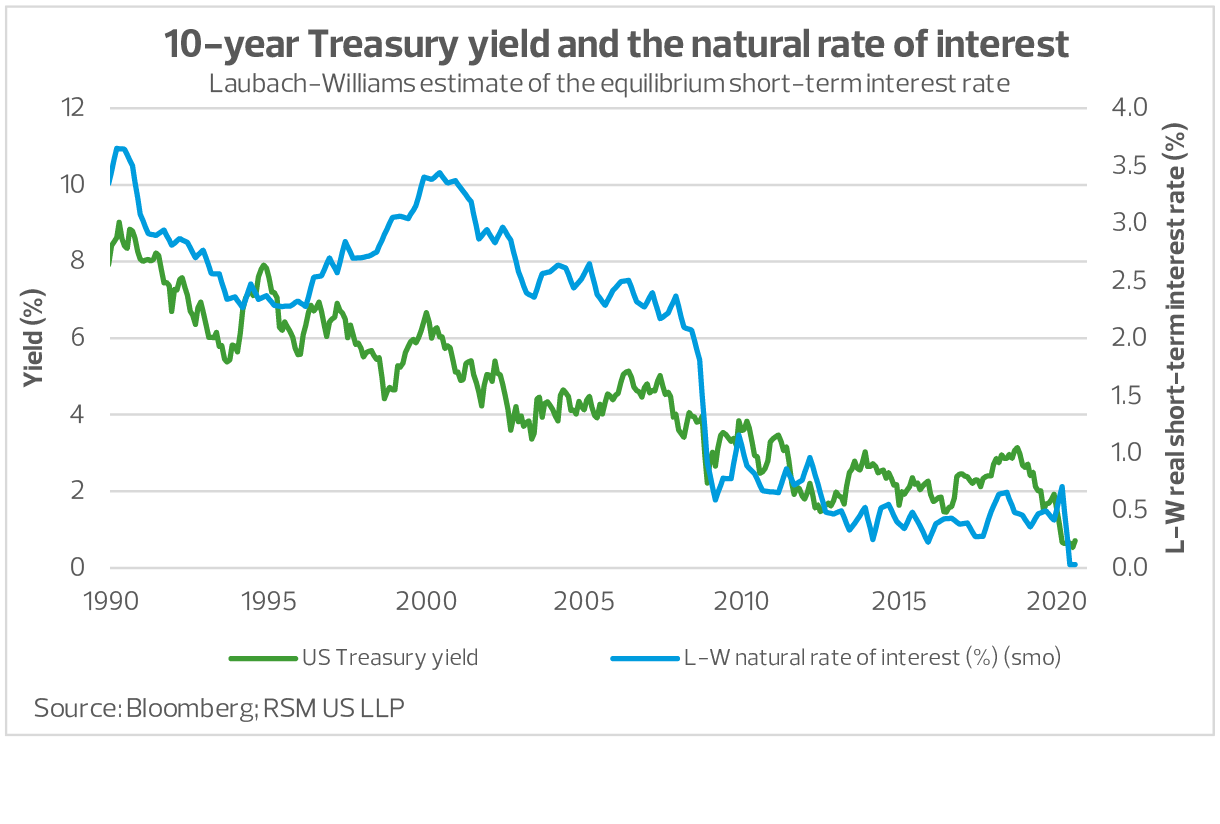

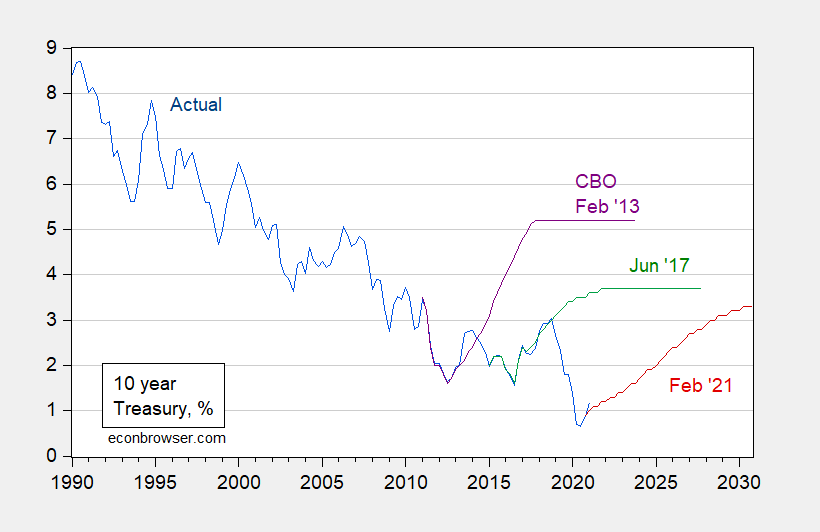

In addition to the short-term interest rate projections discussed above, it is also important to consider the long-term outlook for interest rates. Historically, interest rates have tended to move in cycles, with periods of high rates followed by periods of low rates. The current period of rising rates is likely to continue for some time, but it is eventually expected to give way to a period of lower rates in the future.

Implications for Businesses and Investors

The projected interest rate trajectory has significant implications for businesses and investors. Businesses should prepare for higher borrowing costs in the near term, which could impact investment and expansion plans. Investors should consider adjusting their portfolios to reflect the changing interest rate environment, potentially shifting towards investments that are less sensitive to rate fluctuations.

Conclusion

Interest rate projections are crucial for understanding the future economic landscape. While there is always uncertainty involved in forecasting, the analysis presented in this article provides a comprehensive outlook for interest rates in 2025. By considering the factors influencing interest rate decisions and the long-term outlook, businesses and investors can make informed decisions and prepare for the changing economic environment.

Closure

Thus, we hope this article has provided valuable insights into Interest Rate Projection 2025: A Comprehensive Outlook. We hope you find this article informative and beneficial. See you in our next article!