Interest Rate Predictions for 2025: Navigating an Uncertain Economic Landscape

Related Articles: Interest Rate Predictions for 2025: Navigating an Uncertain Economic Landscape

- FOMC Meeting May 2025: Policy Tightening Intensifies Amidst Economic Uncertainty

- Chinese Zodiac Sign For 2025: The Year Of The Snake

- Nissan Titan: Future Plans And Innovations

- Fashion Trends From 2010 To 2025: A Chronological Evolution

- Willow Creek Apartments: Luxurious Living In The Heart Of Prescott, Arizona

Introduction

With great pleasure, we will explore the intriguing topic related to Interest Rate Predictions for 2025: Navigating an Uncertain Economic Landscape. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Interest Rate Predictions for 2025: Navigating an Uncertain Economic Landscape

Interest Rate Predictions for 2025: Navigating an Uncertain Economic Landscape

Introduction

Interest rates, the cost of borrowing money, play a pivotal role in shaping economic activity. They influence consumer spending, business investment, and overall economic growth. As the world grapples with the aftermath of the COVID-19 pandemic, unprecedented monetary policy measures have been implemented to stimulate economic recovery. However, as economies recover and inflation emerges as a growing concern, central banks face the delicate task of normalizing interest rates without derailing the fragile recovery. This article delves into the factors influencing interest rate predictions for 2025, providing insights into the potential trajectory of monetary policy and its implications for the global economy.

Economic Outlook and Inflationary Pressures

The economic outlook for 2025 remains uncertain, with numerous factors shaping the trajectory of growth and inflation. The ongoing COVID-19 pandemic continues to pose risks to economic recovery, while geopolitical tensions and supply chain disruptions add to the uncertainty.

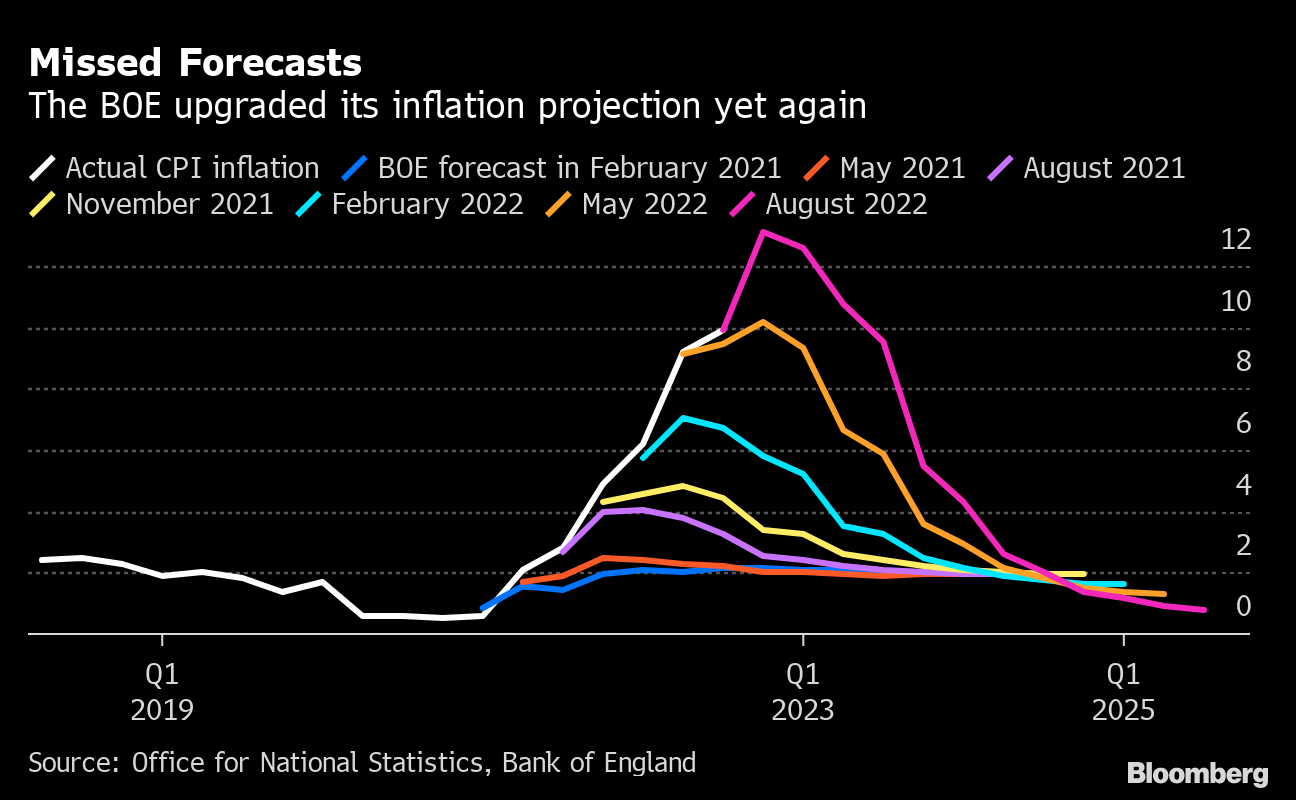

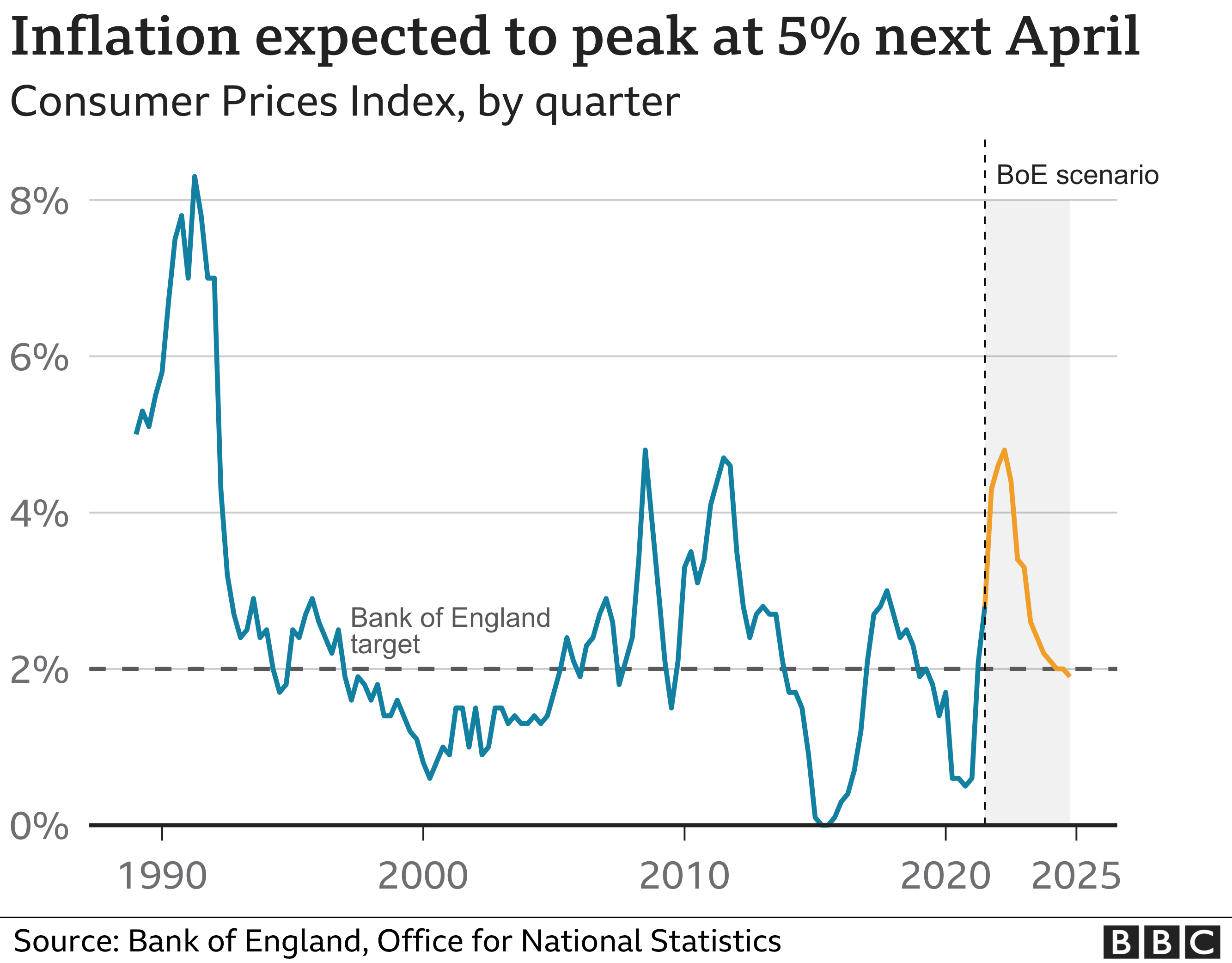

Inflation has emerged as a major concern, with rising consumer prices eroding purchasing power and threatening economic stability. Central banks are tasked with maintaining price stability, and elevated inflation may necessitate tighter monetary policy to curb inflationary pressures. The extent and duration of inflation will significantly influence interest rate predictions for 2025.

Central Bank Policy Stance

Central banks play a critical role in setting interest rates. The Federal Reserve (Fed), the European Central Bank (ECB), and other major central banks have implemented ultra-low interest rates and quantitative easing programs to support economic growth during the pandemic. As economies recover, central banks are facing the challenge of unwinding these extraordinary measures and normalizing interest rates.

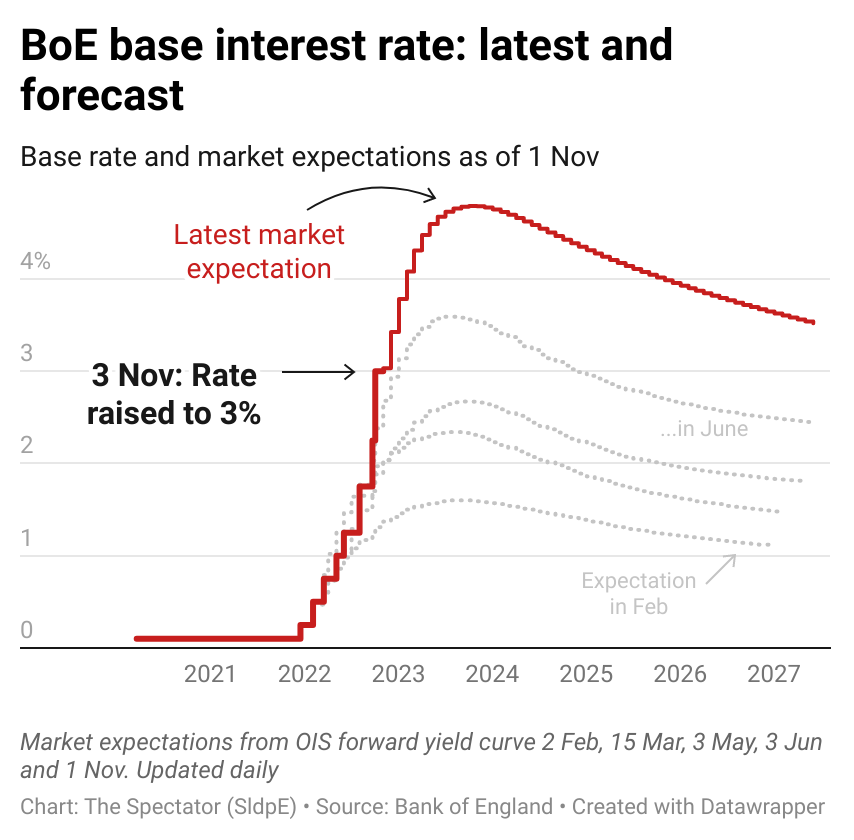

The pace and timing of interest rate increases will vary depending on the economic outlook and inflation dynamics in each region. The Fed has indicated that it will begin raising rates in 2023, while the ECB has signaled a more cautious approach. The stance of central banks will have a substantial impact on interest rate predictions for 2025.

Market Expectations

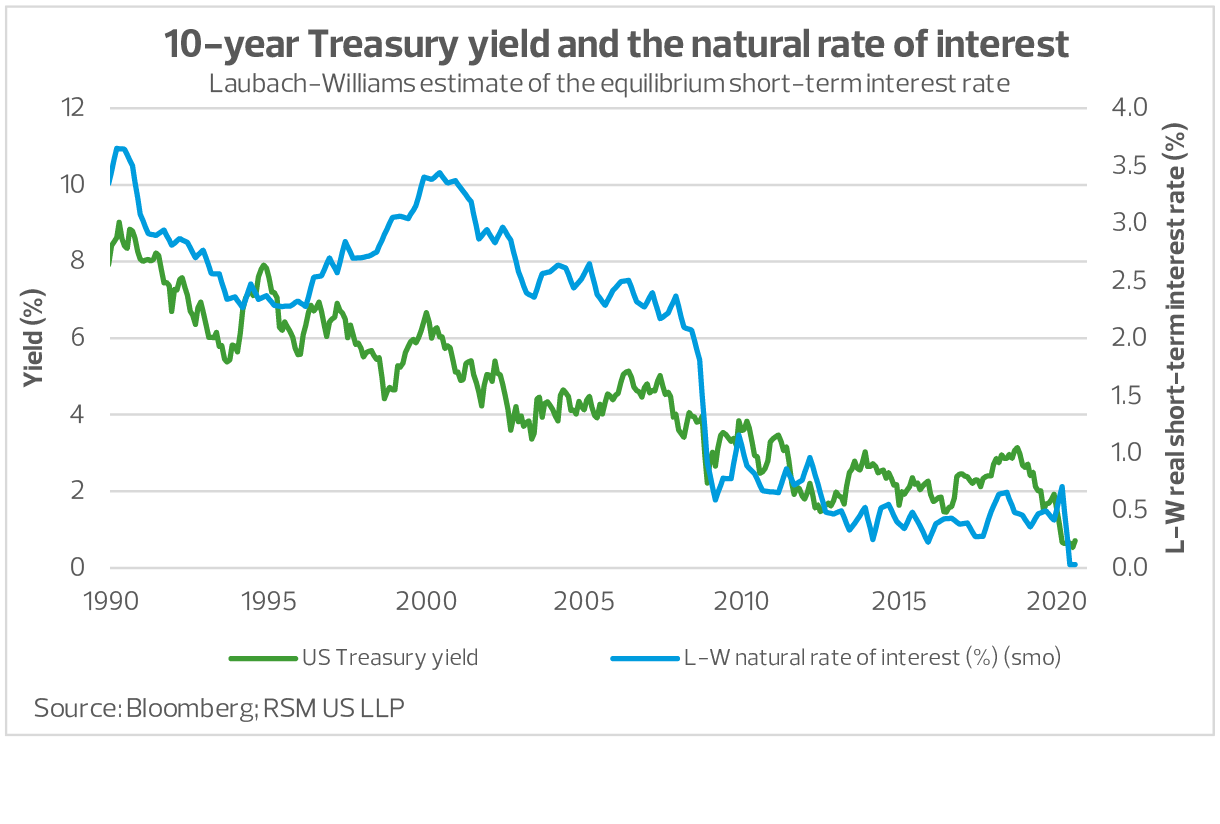

Financial markets play a crucial role in shaping interest rate expectations. The yield curve, which reflects market expectations of future interest rates, provides insights into the market’s outlook for monetary policy. Currently, the yield curve is steepening, indicating that investors expect interest rates to rise in the coming years.

Market expectations are influenced by a variety of factors, including economic data, central bank statements, and geopolitical events. As the economic outlook and inflation dynamics evolve, market expectations of interest rates will adjust accordingly.

Potential Trajectory of Interest Rates

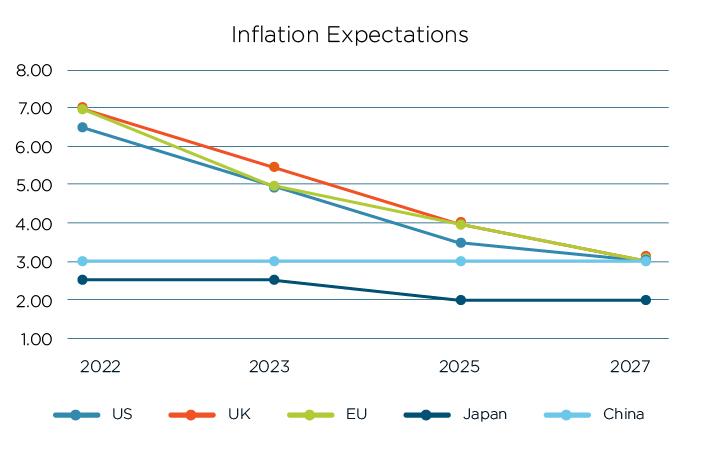

Based on the current economic outlook, inflationary pressures, central bank policy stance, and market expectations, the following potential trajectory for interest rates in 2025 can be outlined:

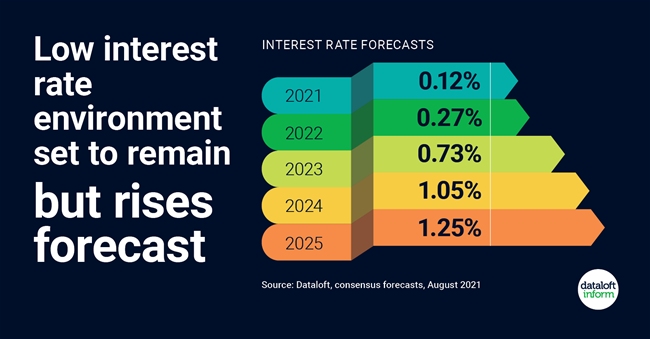

- 2023: Central banks begin raising interest rates gradually, with the Fed taking the lead.

- 2024: Interest rates continue to rise, but at a slower pace, as economic growth moderates.

- 2025: Interest rates reach a neutral level, neither stimulating nor constraining economic activity.

It is important to note that this is a potential trajectory and actual interest rates may deviate from this path depending on economic developments and central bank actions.

Implications for the Global Economy

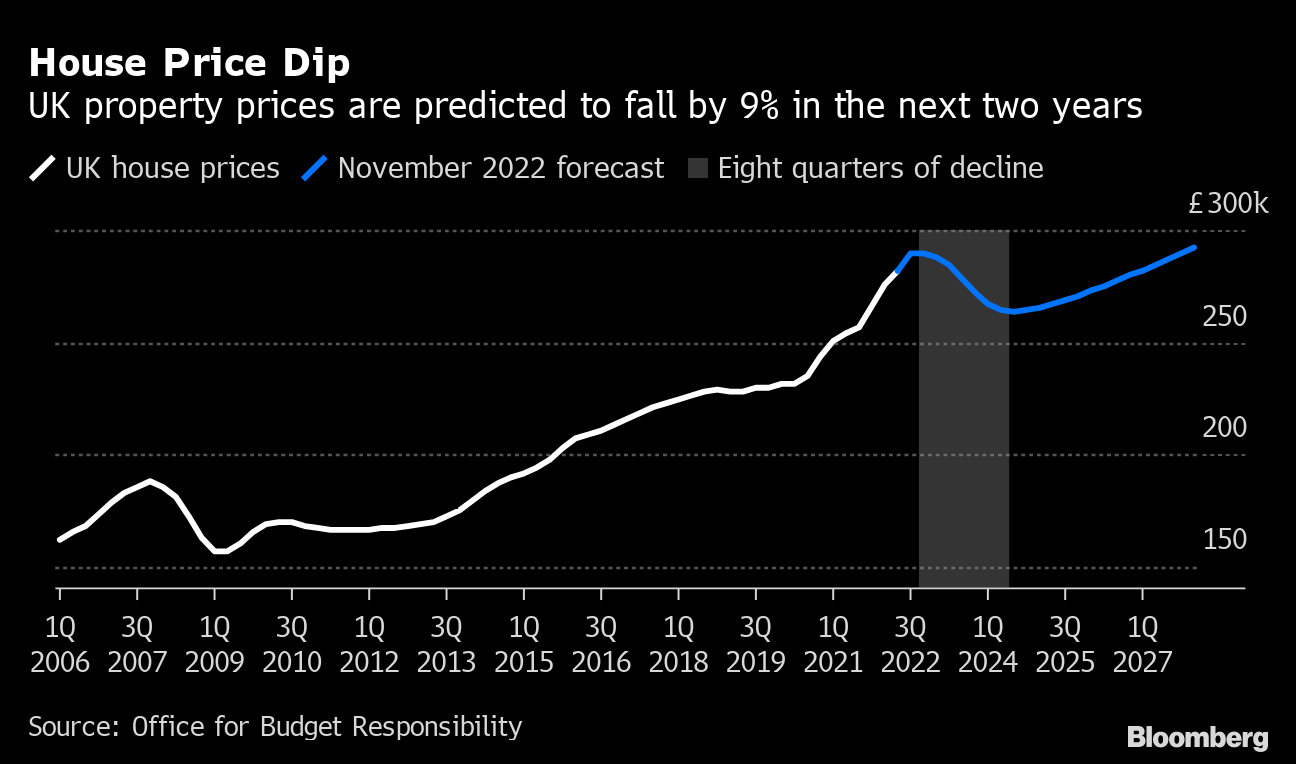

The trajectory of interest rates in 2025 will have significant implications for the global economy. Higher interest rates can slow economic growth by reducing consumer spending and business investment. However, they can also help to curb inflation and stabilize financial markets.

Developing countries are particularly vulnerable to changes in interest rates, as capital flows can be sensitive to monetary policy decisions in major economies. Higher interest rates in developed countries can lead to capital outflows from emerging markets, putting pressure on their currencies and economic growth.

Conclusion

Interest rate predictions for 2025 are inherently uncertain, given the complex and evolving economic landscape. However, by considering the economic outlook, inflationary pressures, central bank policy stance, and market expectations, we can gain insights into the potential trajectory of monetary policy. Central banks face the delicate task of normalizing interest rates without derailing the fragile economic recovery, and the decisions they make will have significant implications for global economic growth and stability.

Closure

Thus, we hope this article has provided valuable insights into Interest Rate Predictions for 2025: Navigating an Uncertain Economic Landscape. We appreciate your attention to our article. See you in our next article!