House Price Predictions 2025: A Comprehensive Analysis

Related Articles: House Price Predictions 2025: A Comprehensive Analysis

- Mahadbt 2025 Application Form: A Comprehensive Guide

- BMW X5 2025 Vs X5 2026: A Comprehensive Comparison

- The Great Revival Of America: A Vision For 2025

- Upcoming Cinematic Delights: A Glimpse Into The Movie Releases Of 2025

- Air Force General War 2025: A Vision Of The Future

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to House Price Predictions 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about House Price Predictions 2025: A Comprehensive Analysis

House Price Predictions 2025: A Comprehensive Analysis

Introduction

The real estate market is a complex and dynamic landscape, influenced by a myriad of economic, social, and political factors. As we approach 2025, it becomes imperative to analyze the potential trajectory of house prices and anticipate the challenges and opportunities that lie ahead. This article aims to provide a comprehensive analysis of house price predictions for 2025, exploring the underlying factors and offering insights for investors, homeowners, and policymakers.

Factors Influencing House Prices

- Economic Growth: A strong economy, characterized by high employment rates and rising incomes, typically leads to increased demand for housing and higher prices.

- Interest Rates: Low interest rates make it more affordable for buyers to borrow money, boosting demand and pushing up prices. Conversely, higher interest rates can dampen demand and slow price growth.

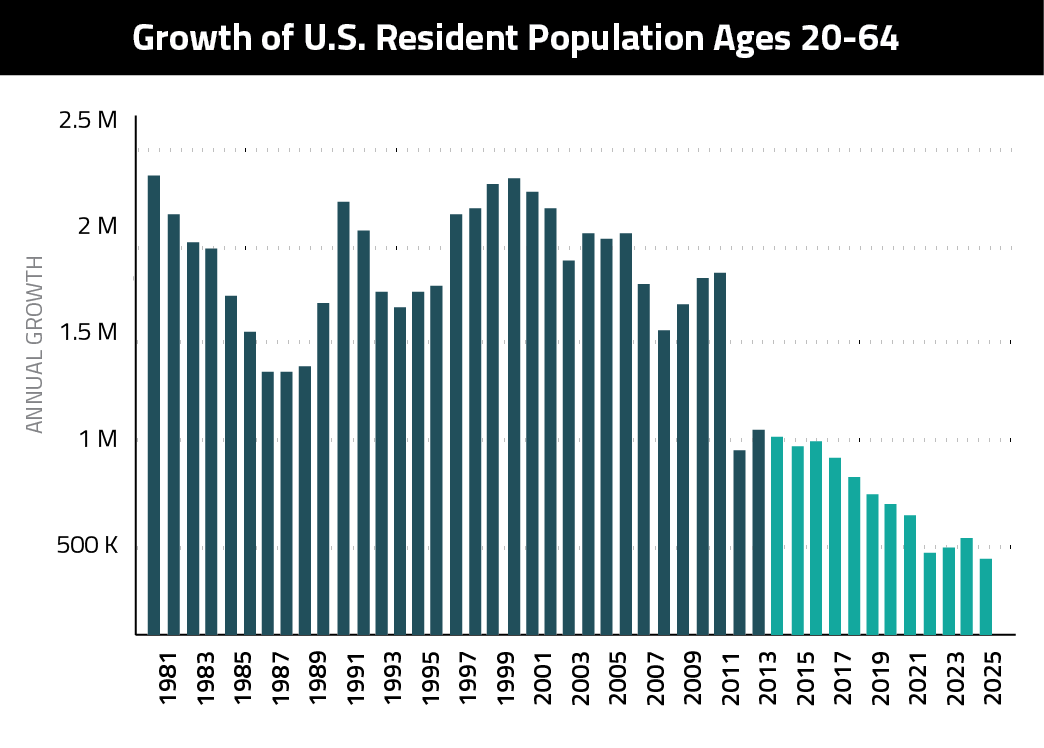

- Demographics: Population growth and age distribution impact housing demand. An aging population may lead to reduced demand for larger homes, while a growing millennial population could increase demand for smaller, affordable units.

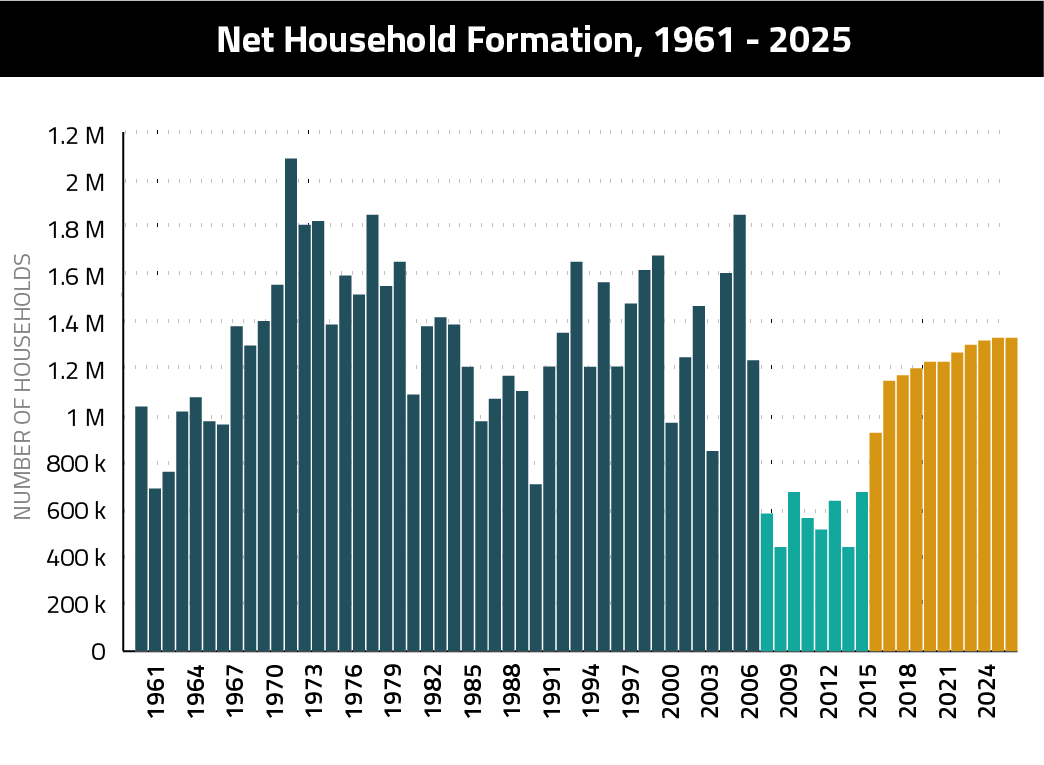

- Supply and Demand: The balance between housing supply and demand is crucial. A shortage of homes can lead to price increases, while an oversupply can exert downward pressure on prices.

- Government Policies: Government policies, such as tax incentives or subsidies, can influence housing demand and prices. Regulations related to zoning and land use can also impact supply.

House Price Predictions for 2025

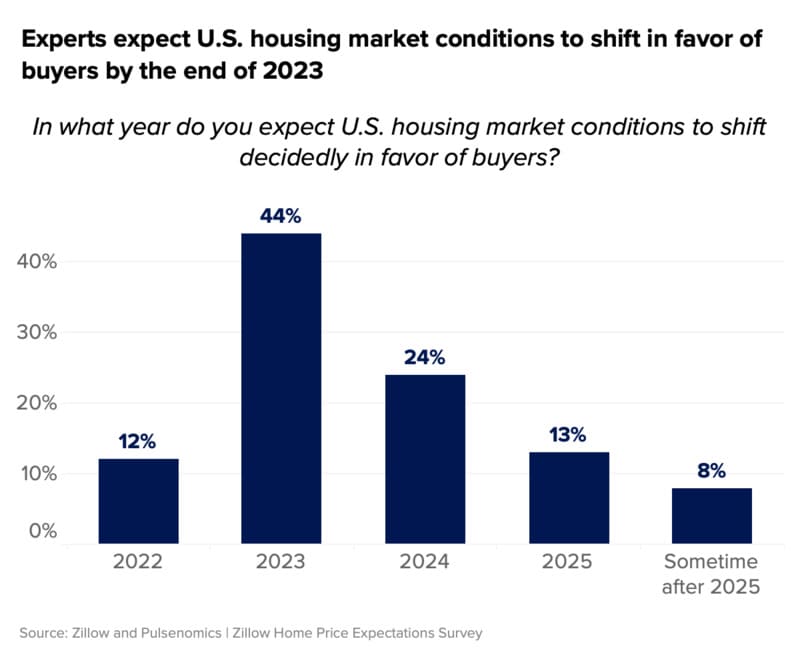

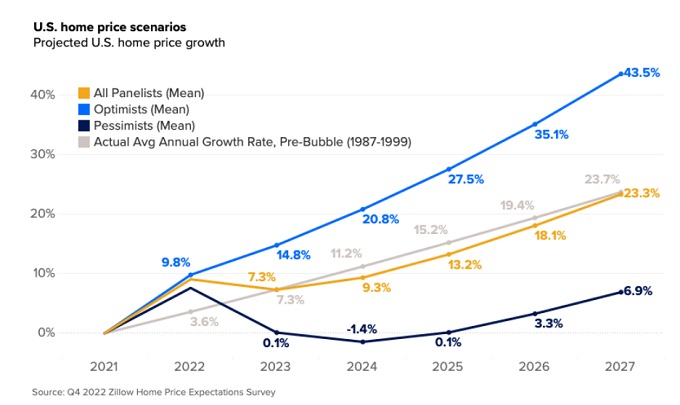

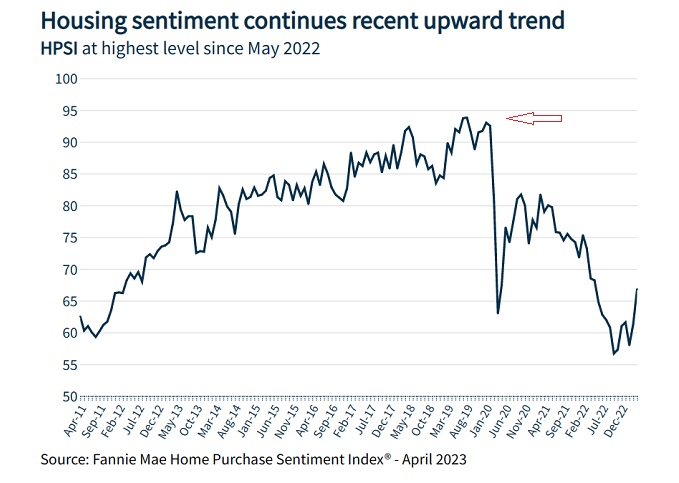

Various organizations and analysts have released their predictions for house price growth in the coming years. While there is some variation in the specific estimates, the overall consensus suggests that house prices are expected to continue rising, albeit at a slower pace than in recent years.

- National Association of Realtors (NAR): The NAR predicts a 5% increase in national home prices in 2025.

- Zillow: Zillow’s forecast suggests a 10% increase in home values over the next four years.

- CoreLogic: CoreLogic projects a 6.5% increase in home prices by 2025.

Factors Driving Price Growth

- Economic Outlook: The global economy is expected to continue growing, albeit at a moderate pace. This growth will support demand for housing and contribute to price increases.

- Interest Rates: While interest rates are likely to rise gradually, they are still expected to remain historically low, making it affordable for buyers to borrow money.

- Supply Constraints: The supply of housing is expected to remain tight in many markets, particularly in urban areas. This shortage will continue to put upward pressure on prices.

- Demographic Trends: The millennial generation is expected to become the largest homebuying cohort in the coming years, increasing demand for affordable housing.

Challenges and Opportunities

- Affordability: Rising house prices may make it increasingly difficult for first-time buyers and low-income households to afford a home. This could lead to a widening wealth gap.

- Overvaluation: In some markets, house prices may become overvalued, creating a risk of a market correction. Investors and homeowners should be cautious of potential bubbles.

- Government Intervention: Governments may implement policies to address affordability concerns and prevent excessive price increases. This could include measures such as rent control or increased housing supply.

- Technological Advancements: Advancements in technology, such as virtual reality and online home tours, could enhance the homebuying experience and potentially reduce transaction costs.

Recommendations for Investors and Homeowners

- Investors: Consider investing in markets with strong economic growth and a limited housing supply. Diversify your portfolio by investing in a mix of property types and locations.

- Homeowners: Take advantage of low interest rates to refinance or purchase a new home. Consider home improvement projects to increase the value of your property.

- Policymakers: Focus on policies that promote affordability, increase housing supply, and prevent market bubbles. Implement measures to assist first-time buyers and low-income households.

Conclusion

House prices are expected to continue rising in the coming years, albeit at a slower pace than in recent history. Economic growth, low interest rates, supply constraints, and demographic trends will be the key drivers of price growth. However, challenges such as affordability concerns and potential overvaluation warrant attention. Investors, homeowners, and policymakers should carefully consider the factors influencing house prices and make informed decisions to navigate the market effectively. By understanding the underlying dynamics and anticipating future trends, we can better prepare for the opportunities and challenges that lie ahead in the housing market.

Closure

Thus, we hope this article has provided valuable insights into House Price Predictions 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!