Government Fiscal Year 2025: An Overview

Related Articles: Government Fiscal Year 2025: An Overview

- Shiba Inu Coin Expected Price In 2025: A Comprehensive Analysis

- 2025 South African School Calendar: A Comprehensive Guide

- EA 2025 Corporate Strategy: Embracing Innovation And Redefining The Future Of Entertainment

- Ohio High School Football Prospects: A Deep Dive Into The Buckeye State’s Elite

- 2025 BMW X2: A Compact SUV With Bold Design And Advanced Technology

Introduction

With great pleasure, we will explore the intriguing topic related to Government Fiscal Year 2025: An Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Government Fiscal Year 2025: An Overview

Government Fiscal Year 2025: An Overview

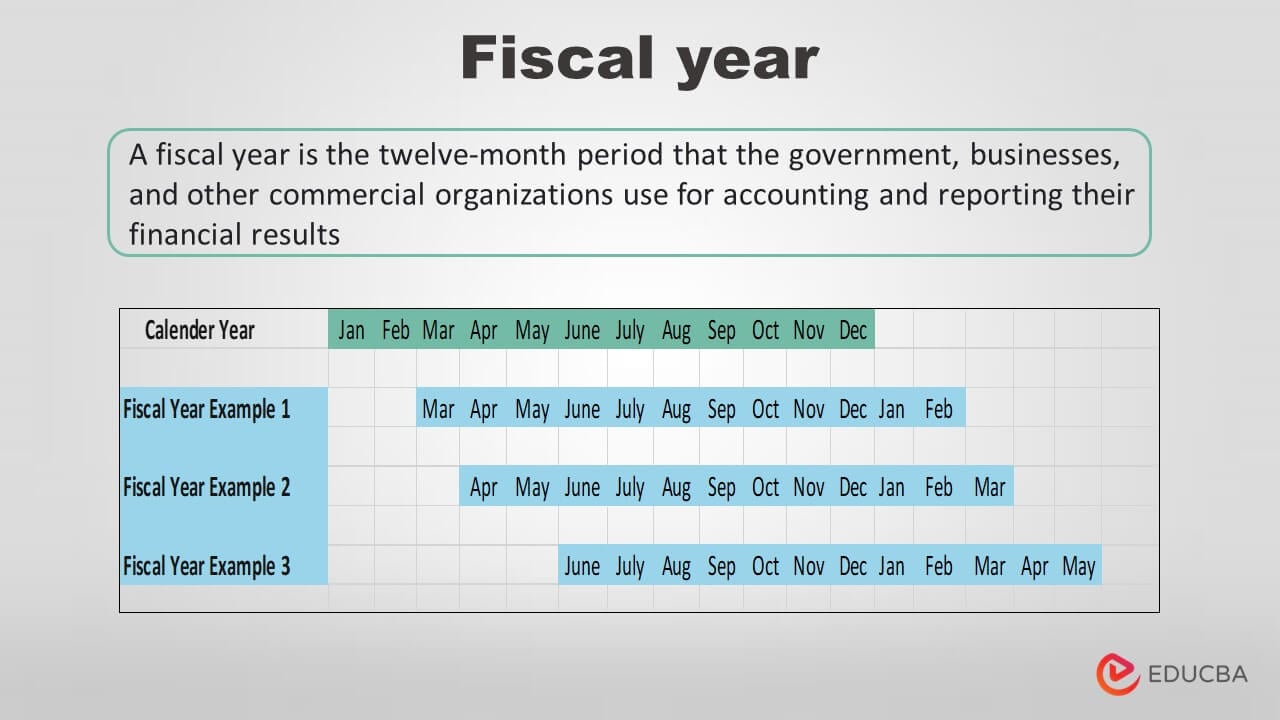

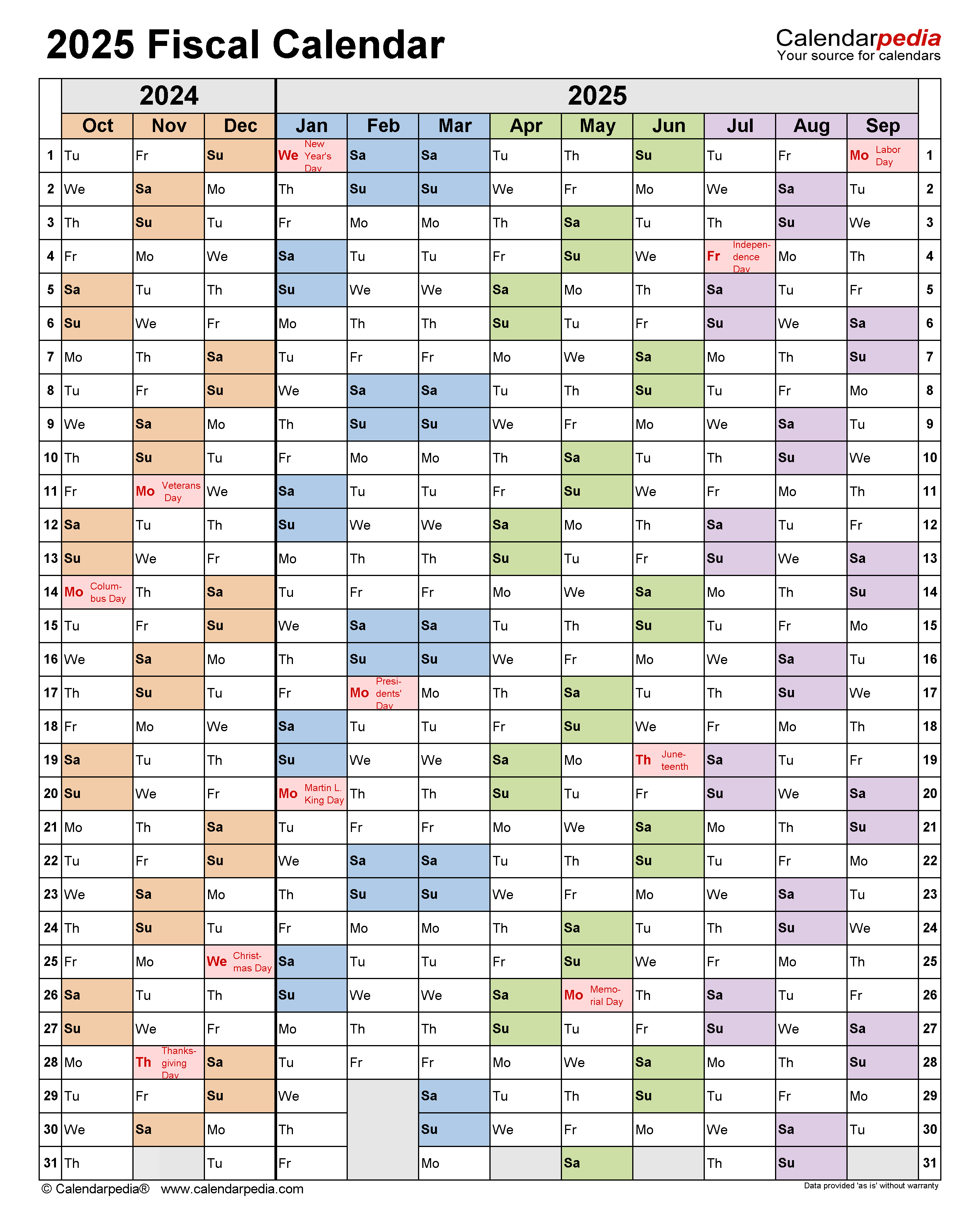

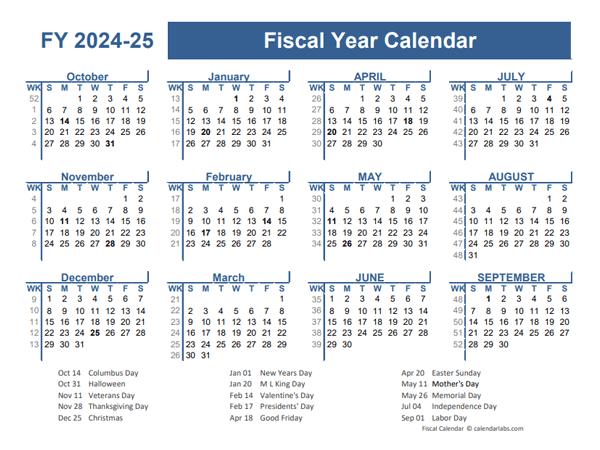

The government fiscal year (FY) 2025 will begin on October 1, 2024, and end on September 30, 2025. The federal budget for FY 2025 is still under development, but the Biden administration has proposed a $5.8 trillion spending plan.

The proposed budget includes significant increases in funding for education, healthcare, and climate change initiatives. It also includes a number of tax cuts for middle-class families and small businesses.

The budget has been met with mixed reactions from Congress. Some lawmakers have praised the proposed increases in spending for social programs, while others have criticized the proposed tax cuts.

The budget is likely to undergo significant changes before it is finally approved by Congress. However, the proposed budget provides a glimpse into the Biden administration’s priorities for FY 2025.

Key Features of the Proposed Budget

- Increases in spending for education, healthcare, and climate change initiatives. The proposed budget includes significant increases in funding for a variety of programs, including education, healthcare, and climate change initiatives. For example, the budget includes $100 billion for universal pre-kindergarten, $200 billion for affordable housing, and $500 billion for clean energy investments.

- Tax cuts for middle-class families and small businesses. The proposed budget also includes a number of tax cuts for middle-class families and small businesses. For example, the budget would increase the child tax credit, provide a tax credit for first-time homebuyers, and reduce the corporate tax rate.

- Increased deficit spending. The proposed budget would increase the federal deficit by $1.8 trillion over the next 10 years. The deficit is the difference between the government’s spending and its revenue.

Congressional Reaction to the Proposed Budget

The proposed budget has been met with mixed reactions from Congress. Some lawmakers have praised the proposed increases in spending for social programs, while others have criticized the proposed tax cuts.

Democrats have generally praised the proposed budget, while Republicans have generally criticized it. Some Democrats have argued that the proposed budget does not go far enough in addressing the needs of the American people. Some Republicans have argued that the proposed budget is too expensive and will lead to higher taxes.

The budget is likely to undergo significant changes before it is finally approved by Congress. However, the proposed budget provides a glimpse into the Biden administration’s priorities for FY 2025.

Potential Impact of the Budget

The proposed budget could have a significant impact on the U.S. economy and society. The increased spending on education, healthcare, and climate change initiatives could lead to improvements in these areas. The tax cuts for middle-class families and small businesses could boost economic growth. However, the increased deficit spending could lead to higher interest rates and inflation.

The overall impact of the budget will depend on a number of factors, including the final version of the budget that is approved by Congress, the state of the economy, and the actions of the Federal Reserve.

Conclusion

The proposed budget for FY 2025 is a significant document that outlines the Biden administration’s priorities for the next fiscal year. The budget includes significant increases in spending for education, healthcare, and climate change initiatives, as well as a number of tax cuts for middle-class families and small businesses. The budget has been met with mixed reactions from Congress, and it is likely to undergo significant changes before it is finally approved. The proposed budget could have a significant impact on the U.S. economy and society, but the overall impact will depend on a number of factors.

Closure

Thus, we hope this article has provided valuable insights into Government Fiscal Year 2025: An Overview. We hope you find this article informative and beneficial. See you in our next article!