Fiscal Year 2025: A Quarterly Breakdown

Related Articles: Fiscal Year 2025: A Quarterly Breakdown

- Undertale: The Movie (2025)

- The Land Before Time 25: Return To The Great Valley

- 2025 Truck Models: A Comprehensive Overview Of The Future Of Trucking

- 2025 E New Orleans Ave, Tampa, FL 33610: A Comprehensive Overview

- Top 20250 Banks By Revenue: A Comprehensive Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Fiscal Year 2025: A Quarterly Breakdown. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year 2025: A Quarterly Breakdown

Fiscal Year 2025: A Quarterly Breakdown

Introduction

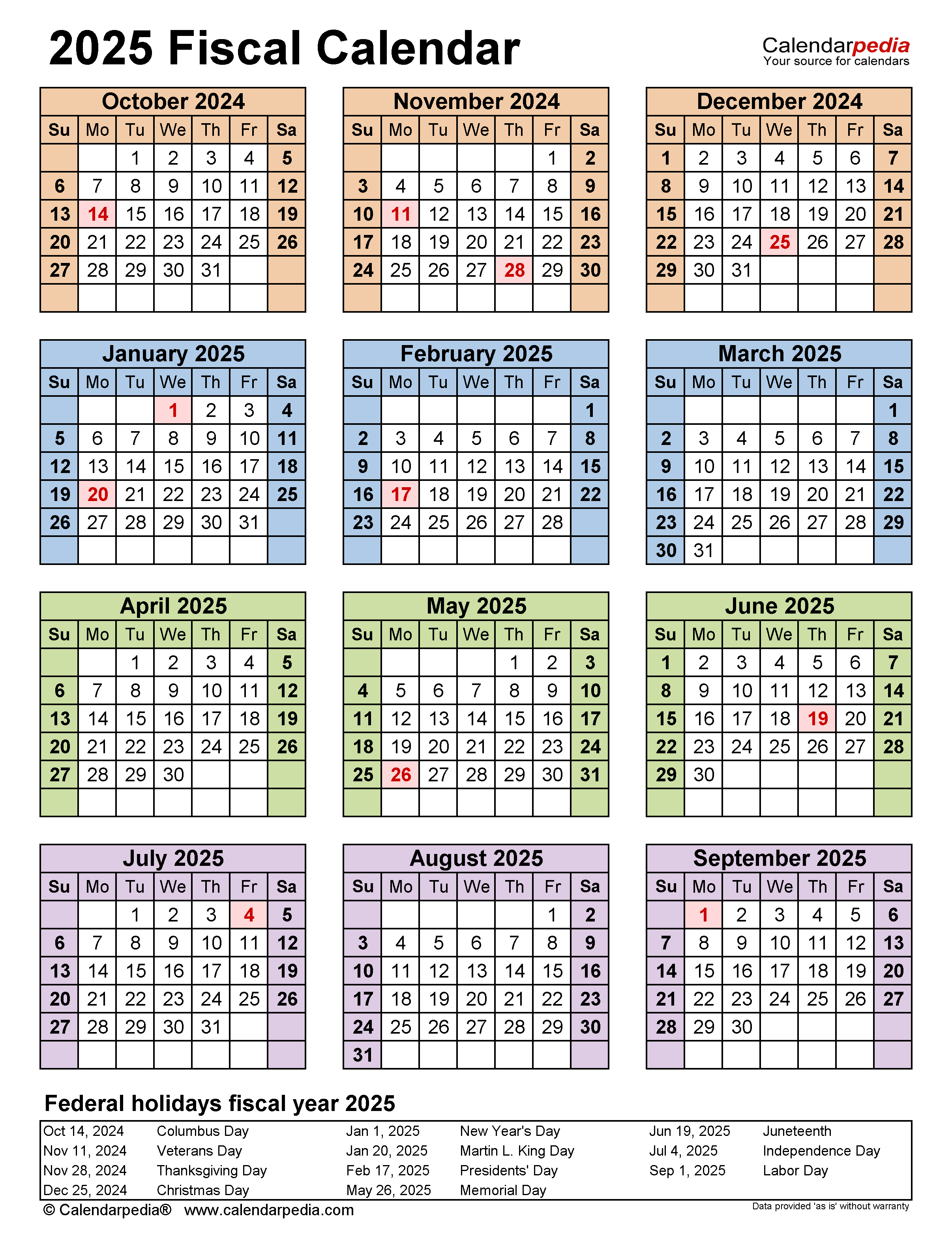

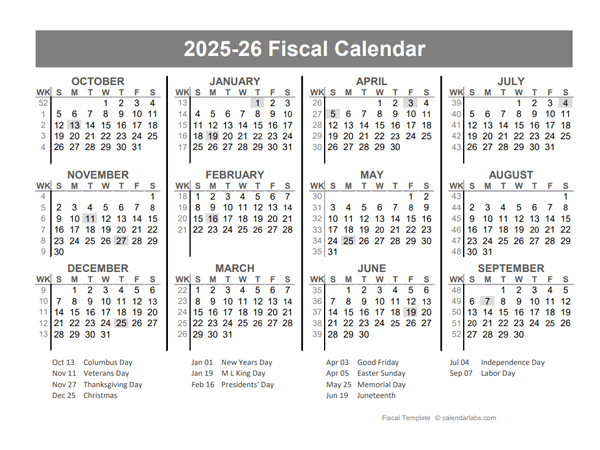

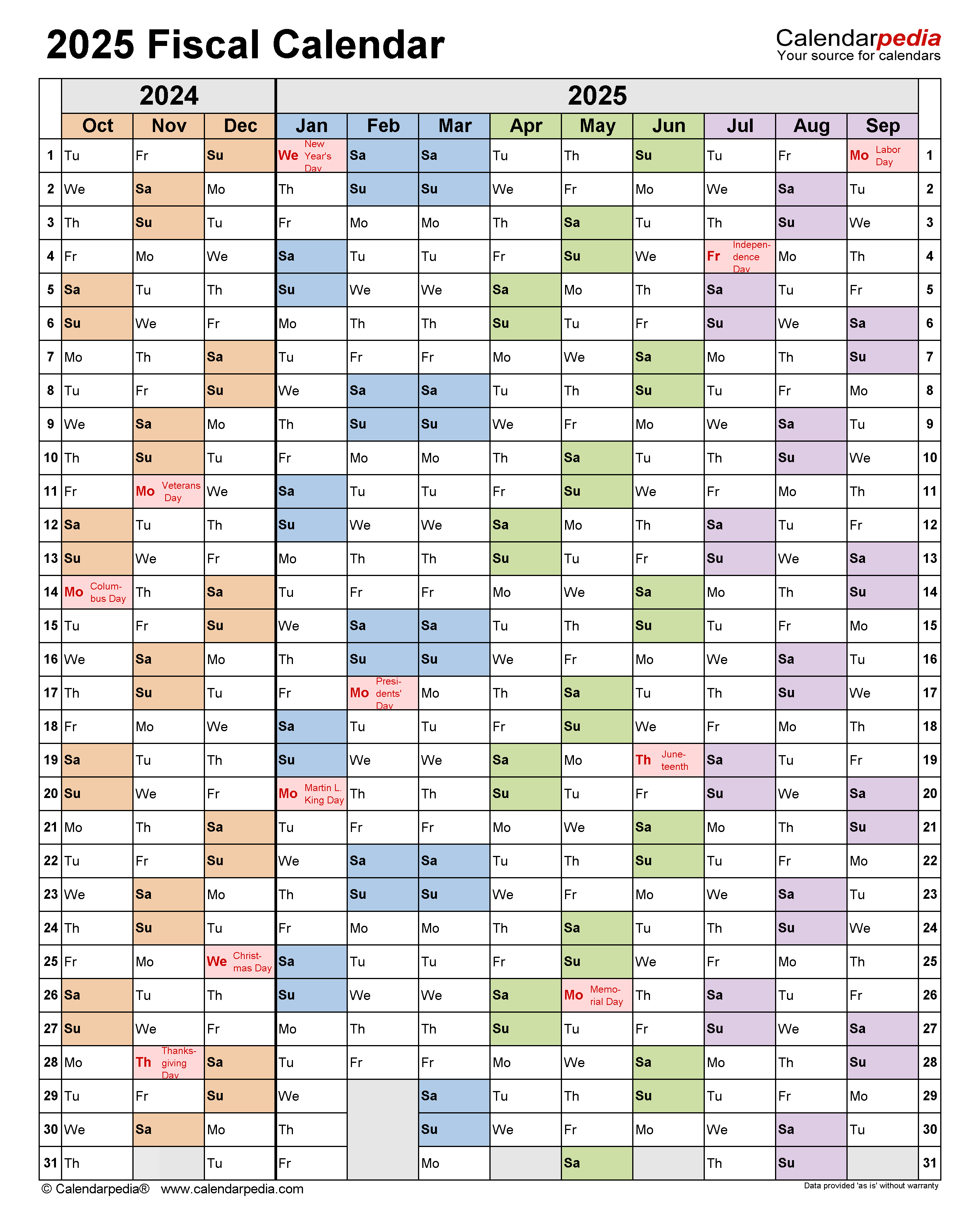

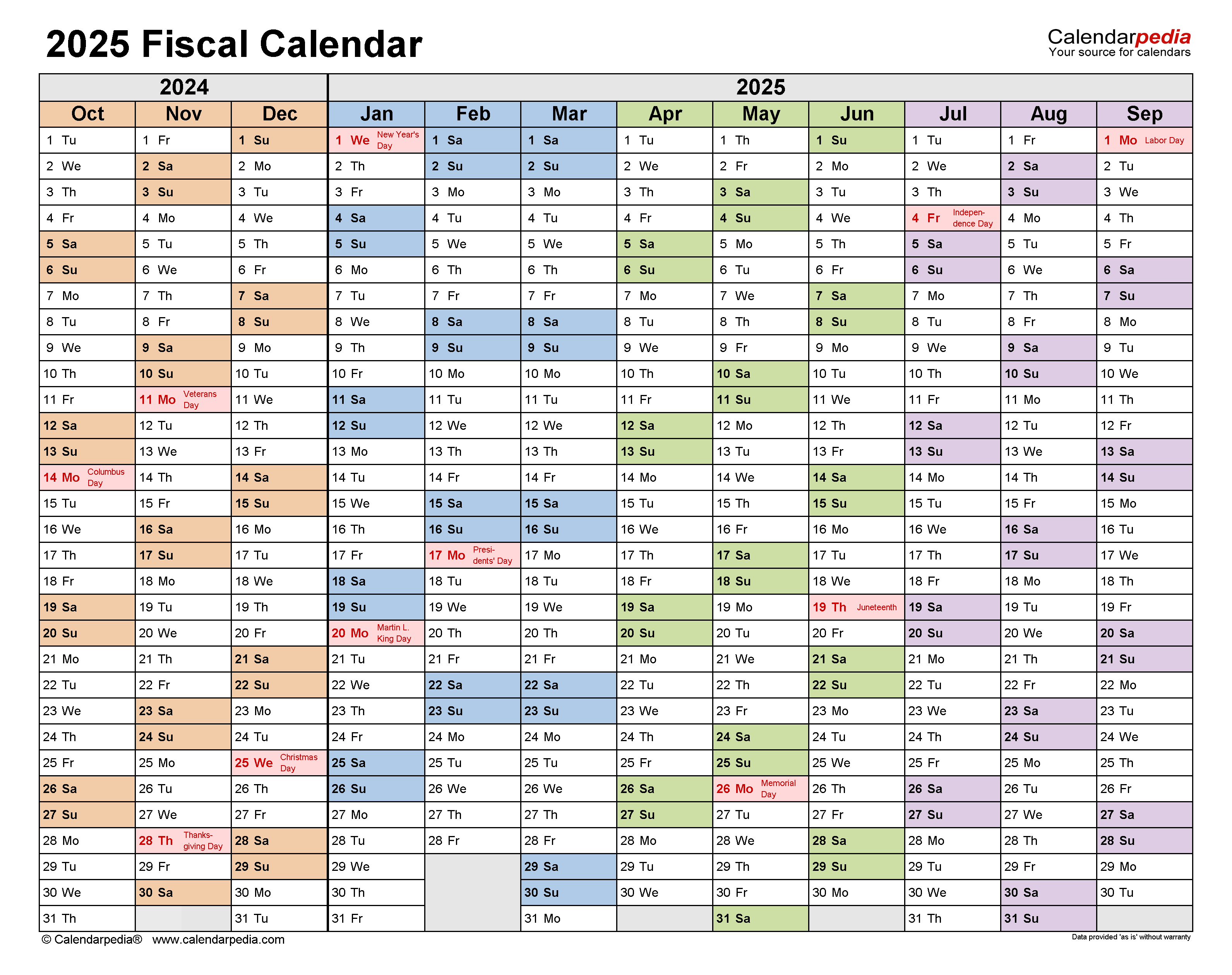

Fiscal year (FY) 2025, which begins on October 1, 2024, and ends on September 30, 2025, is a pivotal year for businesses and organizations. By understanding the key financial and economic trends expected during each quarter, businesses can plan effectively and make informed decisions. This article provides a comprehensive breakdown of FY 2025 by quarter, highlighting the anticipated events and potential opportunities and challenges.

Q1 (October – December 2024)

- Economic Outlook: The global economy is expected to continue its recovery from the COVID-19 pandemic, with moderate growth projected in major regions.

- Business Environment: Businesses will focus on rebuilding inventory levels and meeting pent-up demand from consumers.

- Earnings Expectations: Companies are likely to report strong earnings growth as economic activity picks up.

-

Key Events:

- Q3 2024 earnings season

- Holiday shopping season

- Potential interest rate increases by central banks

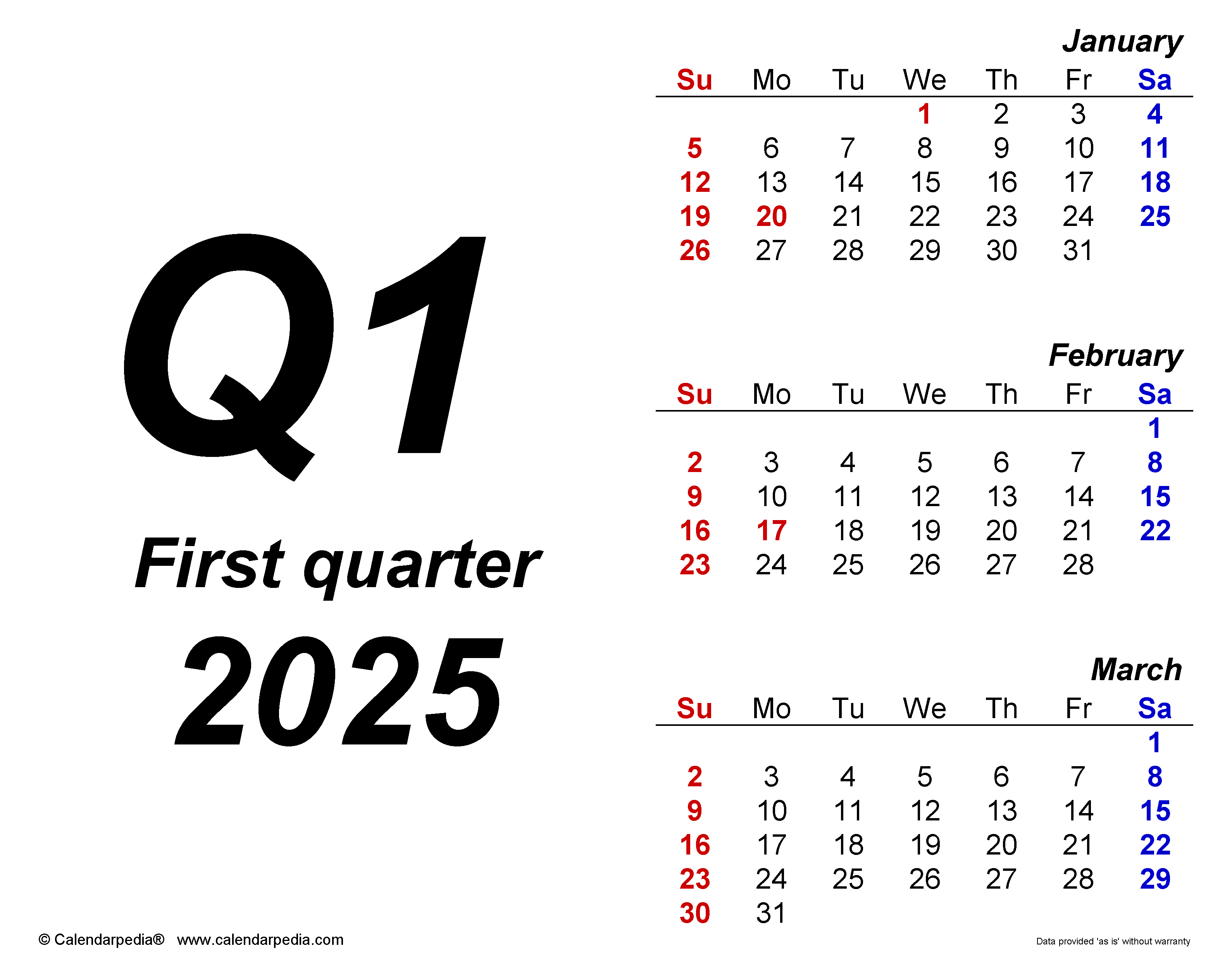

Q2 (January – March 2025)

- Economic Outlook: Economic growth is expected to moderate slightly as the recovery from the pandemic stabilizes.

- Business Environment: Businesses will continue to adjust to the post-pandemic operating environment, with a focus on cost optimization and efficiency.

- Earnings Expectations: Earnings growth may slow down compared to Q1, but companies are still expected to perform well.

-

Key Events:

- Q4 2024 earnings season

- Tax filing season

- Potential geopolitical events

Q3 (April – June 2025)

- Economic Outlook: The global economy may face some headwinds, including potential inflationary pressures and rising interest rates.

- Business Environment: Businesses will need to navigate challenges such as rising input costs and supply chain disruptions.

- Earnings Expectations: Earnings growth may be more muted as economic conditions become more challenging.

-

Key Events:

- Q1 2025 earnings season

- Potential interest rate adjustments

- Summer vacation period

Q4 (July – September 2025)

- Economic Outlook: The economic outlook for Q4 is subject to uncertainty, with potential risks such as a slowdown in global growth or geopolitical tensions.

- Business Environment: Businesses will need to adapt to changing economic conditions and adjust their operations accordingly.

- Earnings Expectations: Earnings growth may vary depending on the overall economic environment.

-

Key Events:

- Q2 2025 earnings season

- Back-to-school shopping season

- Potential fiscal policy changes

Opportunities and Challenges

Opportunities:

- Economic Recovery: The expected economic recovery presents opportunities for businesses to grow and expand.

- Pent-up Demand: Consumers are likely to spend more as the economy recovers, creating opportunities for retailers and service providers.

- Technology Advancements: Continued technological advancements can drive innovation and create new business models.

Challenges:

- Inflationary Pressures: Rising inflation can erode profit margins and consumer purchasing power.

- Interest Rate Hikes: Central banks may raise interest rates to combat inflation, increasing borrowing costs for businesses.

- Supply Chain Disruptions: Ongoing supply chain disruptions can lead to shortages and price increases.

- Geopolitical Risks: Geopolitical events can disrupt global trade and economic stability.

Planning and Preparation

To prepare for FY 2025, businesses should consider the following steps:

- Monitor Economic Data: Stay updated on economic indicators and forecasts to assess potential risks and opportunities.

- Adjust Business Strategy: Review and adjust business strategies to align with changing economic conditions.

- Control Costs: Implement cost-saving measures to mitigate the impact of inflation and supply chain disruptions.

- Invest in Technology: Leverage technology to improve efficiency, reduce costs, and create new revenue streams.

- Manage Cash Flow: Ensure adequate cash flow to support operations and expansion plans.

Conclusion

Fiscal year 2025 is a critical period for businesses, with both opportunities and challenges. By understanding the quarterly breakdown and preparing accordingly, businesses can position themselves for success in the post-pandemic operating environment. By embracing adaptability, innovation, and sound financial management, businesses can navigate the uncertainties of FY 2025 and emerge stronger.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year 2025: A Quarterly Breakdown. We thank you for taking the time to read this article. See you in our next article!