Ethereum Price Prediction 2025: A Comprehensive Analysis

Related Articles: Ethereum Price Prediction 2025: A Comprehensive Analysis

- Map Of USA 2025: A Projection Of America’s Future

- 2025 World Exposition: A Vision Of Human Ingenuity And Collaboration

- The 2025 Playbook: A Blueprint For A Thriving And Sustainable Future

- Public Holidays In 2025: A Comprehensive Guide

- Youngstown State Football Schedule 2025: A Comprehensive Preview

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Ethereum Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Ethereum Price Prediction 2025: A Comprehensive Analysis

Ethereum Price Prediction 2025: A Comprehensive Analysis

Introduction

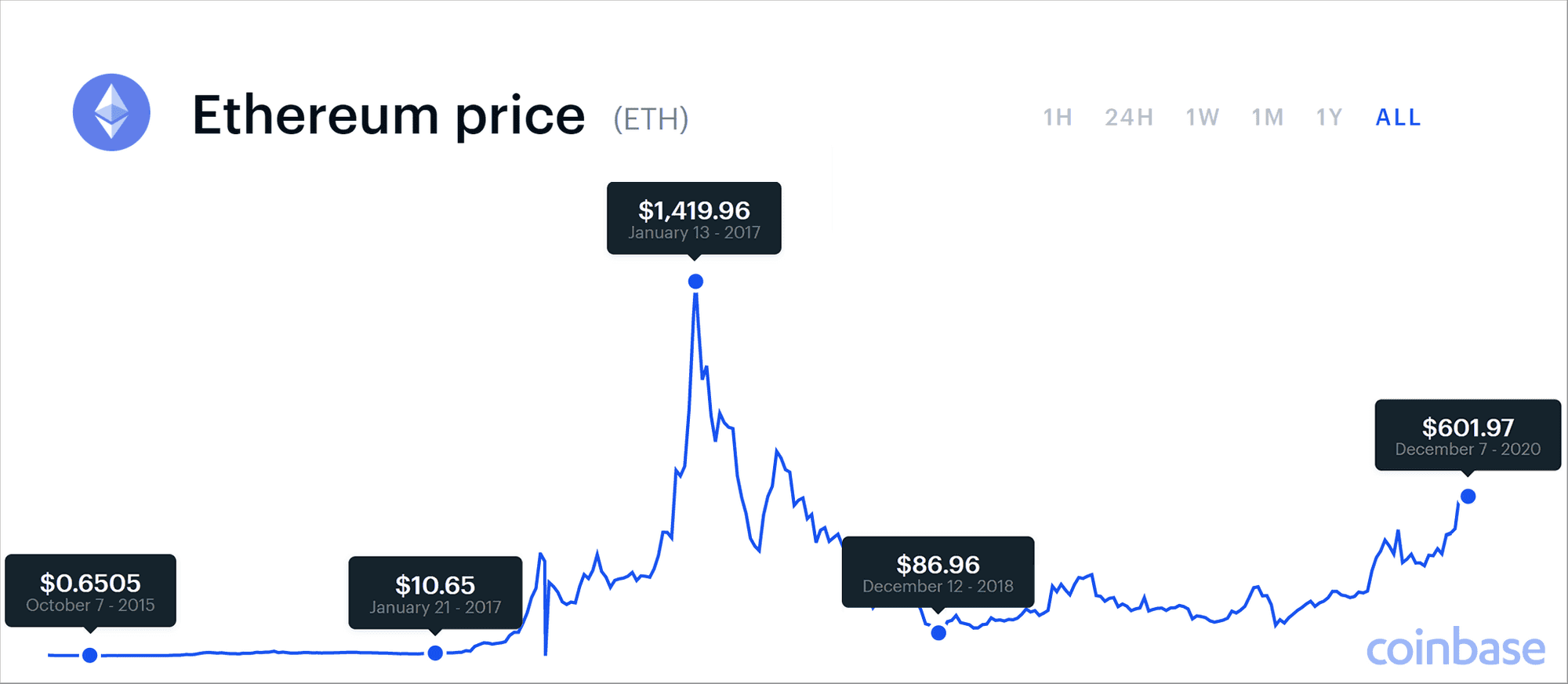

Ethereum, the second-largest cryptocurrency by market capitalization, has witnessed a remarkable surge in value over the past few years. As the blockchain technology powering the Ethereum network continues to evolve and gain adoption, investors are eagerly anticipating the future trajectory of ETH prices. This comprehensive analysis delves into the factors influencing ETH’s price and provides a detailed Ethereum price prediction for 2025, exploring potential scenarios and long-term growth prospects.

Factors Influencing ETH Price

1. Network Adoption and Usage:

The adoption and usage of the Ethereum network are crucial drivers of ETH demand. The number of active users, transactions, and decentralized applications (dApps) built on Ethereum directly correlates with the value of the cryptocurrency. As Ethereum’s ecosystem expands and gains traction, demand for ETH is expected to increase, potentially boosting its price.

2. Decentralized Finance (DeFi):

DeFi applications built on Ethereum have gained significant popularity, allowing users to lend, borrow, and trade cryptocurrencies without intermediaries. The growth of DeFi protocols has increased the demand for ETH as a payment and collateral asset, further supporting its price.

3. Non-Fungible Tokens (NFTs):

The surge in popularity of NFTs, digital collectibles and assets stored on the Ethereum blockchain, has also contributed to ETH’s value. The demand for NFTs and the associated transaction fees on Ethereum have positively impacted the cryptocurrency’s price.

4. Institutional Adoption:

Institutional investors, such as hedge funds and pension funds, have begun to allocate a portion of their portfolios to cryptocurrencies, including Ethereum. As institutional adoption grows, ETH’s liquidity and stability increase, potentially driving its price higher.

5. Competition and Alternatives:

The competitive landscape in the cryptocurrency market also influences ETH’s price. The emergence of other blockchain platforms offering similar services, such as Solana and Binance Smart Chain, can impact Ethereum’s market share and potentially affect its price.

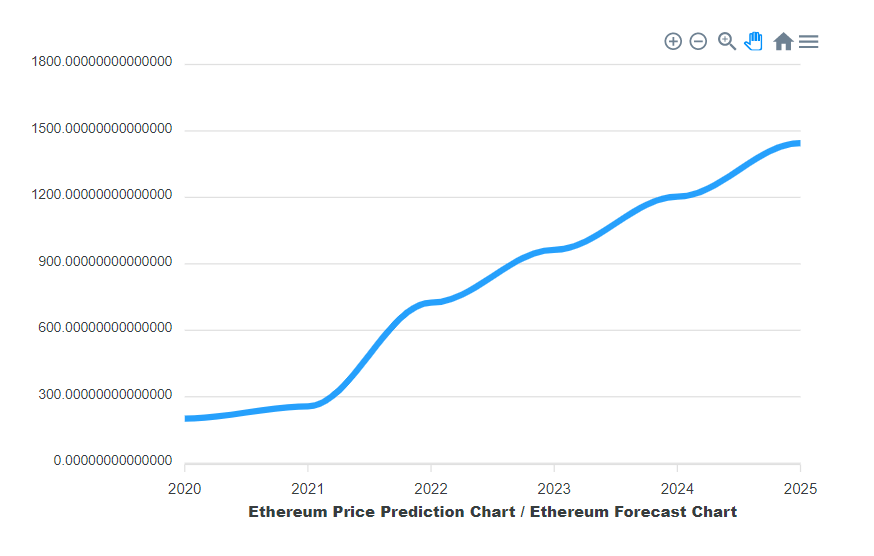

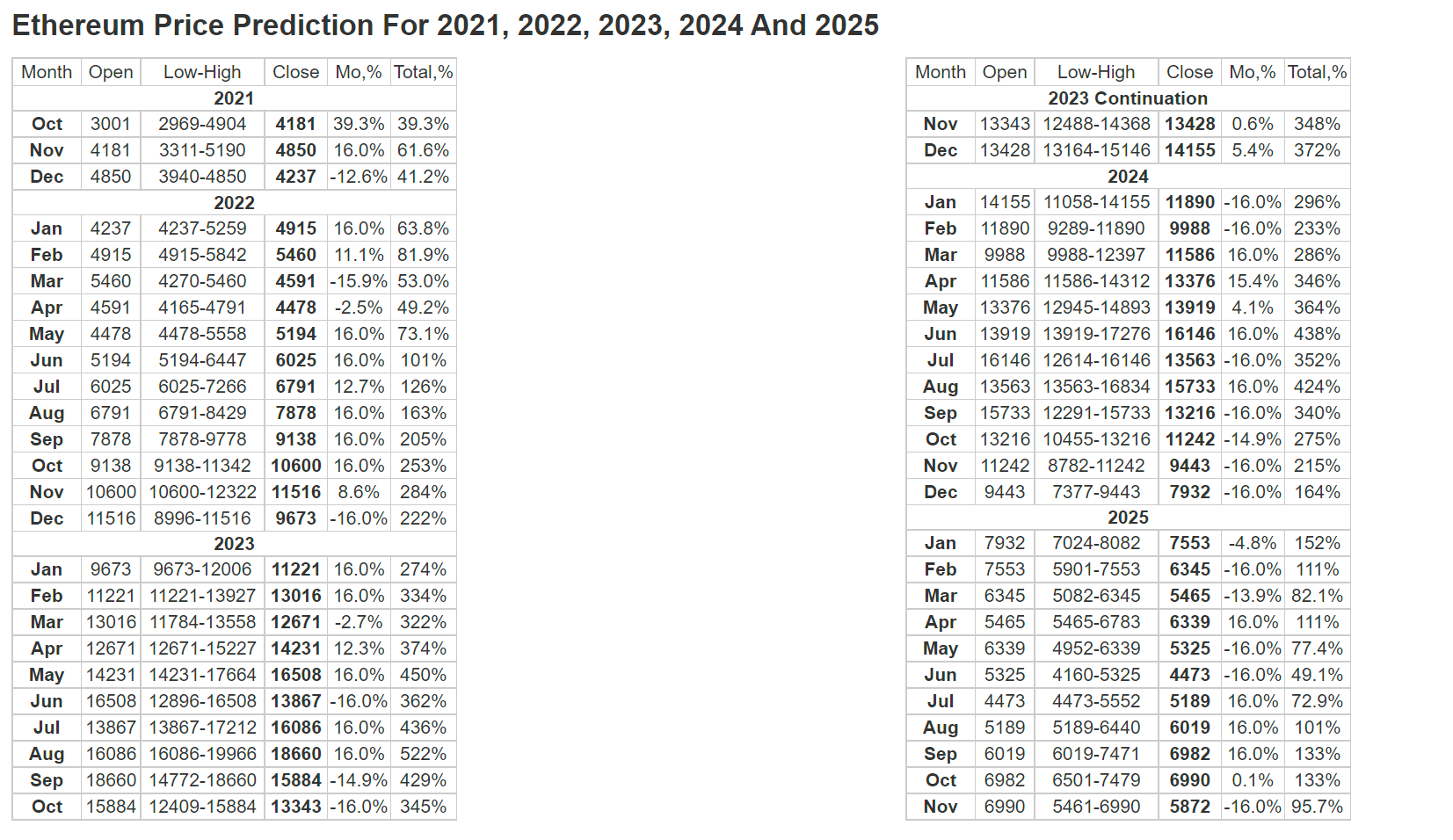

Ethereum Price Prediction 2025

Scenario 1: Bullish Outlook

In a bullish scenario, Ethereum’s network adoption and usage continue to expand at a rapid pace. The number of active users and transactions on the network grows significantly, driven by the increasing adoption of DeFi applications and NFTs. Institutional investors continue to allocate funds to Ethereum, recognizing its long-term potential. Additionally, the overall cryptocurrency market experiences a period of growth and stability. Under this scenario, ETH’s price could potentially reach or exceed $10,000 by 2025.

Scenario 2: Bearish Outlook

In a bearish scenario, Ethereum faces challenges in maintaining its market share. Competing blockchain platforms gain significant traction, offering faster transaction speeds and lower fees. The cryptocurrency market experiences a downturn, leading to a decline in demand for ETH. Furthermore, regulatory uncertainties and negative news events impact investor sentiment. Under this scenario, ETH’s price could potentially drop below $2,000 by 2025.

Scenario 3: Moderate Outlook

In a moderate scenario, Ethereum experiences steady growth but faces some competition from alternative platforms. The adoption of DeFi and NFTs continues, but at a slower pace. Institutional adoption remains cautious, and the cryptocurrency market exhibits moderate volatility. Under this scenario, ETH’s price could potentially range between $5,000 and $7,000 by 2025.

Long-Term Growth Prospects

Beyond 2025, Ethereum’s long-term growth prospects appear promising. The Ethereum 2.0 upgrade, currently in progress, is expected to significantly improve the network’s scalability and transaction efficiency. Additionally, the development of new applications and protocols on Ethereum could further drive its adoption and usage.

The increasing demand for digital assets, the growing adoption of blockchain technology, and the potential for Ethereum to become a global settlement layer suggest that ETH has the potential for sustained long-term growth. However, it is important to note that the cryptocurrency market is highly volatile, and future price predictions are subject to change.

Conclusion

Ethereum’s price in 2025 is influenced by a complex interplay of factors, including network adoption, DeFi and NFT growth, institutional adoption, competition, and regulatory developments. While the future is uncertain, the combination of a robust ecosystem, ongoing upgrades, and long-term growth potential suggests that ETH remains a compelling investment opportunity for those willing to embrace the risks and rewards of the cryptocurrency market.

Closure

Thus, we hope this article has provided valuable insights into Ethereum Price Prediction 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!