Current Lifetime Gift Tax Exemption 2025: A Comprehensive Guide

Related Articles: Current Lifetime Gift Tax Exemption 2025: A Comprehensive Guide

- Lakewood Ranch Cinemas Coming Soon: A Cinematic Oasis In The Heart Of Sarasota

- ICC Champions Trophy 2016: A Triumph For West Indies

- Willow Creek Apartments: Luxurious Living In The Heart Of Prescott, Arizona

- Super Bowl 2025: A Halftime Extravaganza

- Toyota Camry 2025: A Sedan Reimagined For The Modern Era

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Current Lifetime Gift Tax Exemption 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Current Lifetime Gift Tax Exemption 2025: A Comprehensive Guide

Current Lifetime Gift Tax Exemption 2025: A Comprehensive Guide

Introduction

The lifetime gift tax exemption is a crucial element of estate planning that allows individuals to transfer assets to others during their lifetime without incurring gift taxes. This exemption is subject to periodic adjustments to account for inflation, and the current exemption amount is scheduled to change in 2025. This article provides a comprehensive overview of the current lifetime gift tax exemption, its implications for estate planning, and the anticipated changes in 2025.

Current Lifetime Gift Tax Exemption

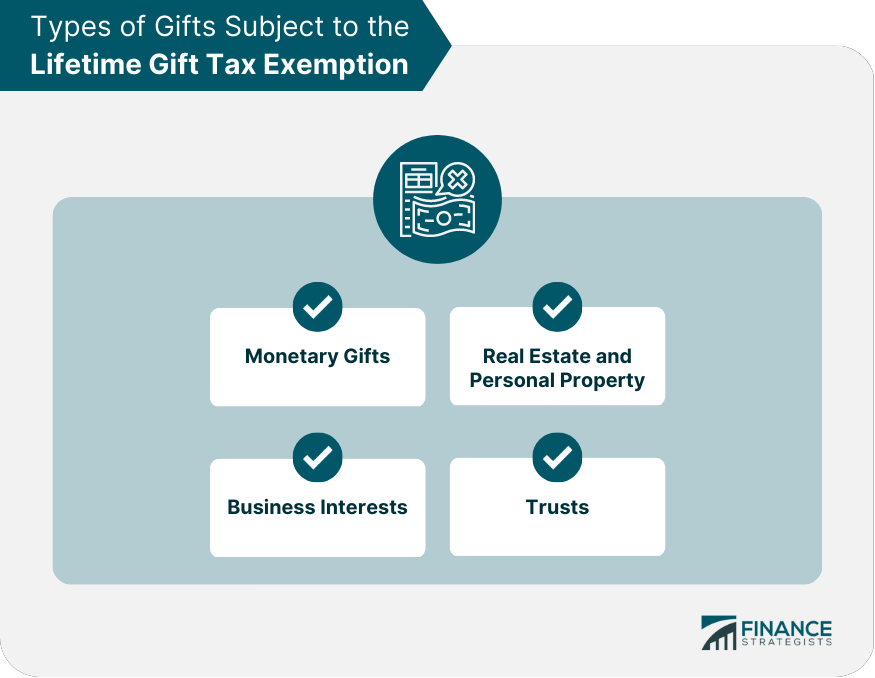

As of 2023, the federal lifetime gift tax exemption is $12,925,000 per individual. This means that an individual can give up to this amount during their lifetime without being subject to gift taxes. The exemption applies to all types of gifts, including cash, property, and other assets.

Significance of the Lifetime Gift Tax Exemption

The lifetime gift tax exemption plays a vital role in estate planning. By utilizing this exemption, individuals can effectively reduce the size of their taxable estate and minimize the amount of estate taxes owed upon their death. Additionally, making gifts during one’s lifetime can provide financial assistance to loved ones, reduce the burden of probate, and avoid potential disputes over inheritance.

Estate Planning Strategies Utilizing the Lifetime Gift Tax Exemption

There are several strategies that individuals can employ to maximize the benefits of the lifetime gift tax exemption. These include:

- Annual Gift Exclusion: Each individual can give up to $17,000 per person, per year, without using any of their lifetime exemption. This exclusion is a valuable tool for making small gifts to multiple recipients.

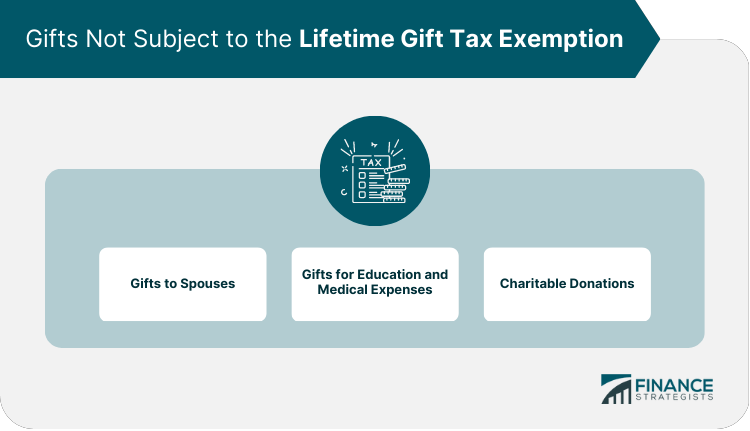

- Gifts to Spouse: Unlimited gifts can be made to a spouse who is a U.S. citizen or resident. This is a particularly effective strategy for married couples looking to reduce their combined estate tax liability.

- Charitable Gifts: Gifts to qualified charities are not subject to gift taxes. This provides an opportunity to support charitable causes while also reducing the size of one’s taxable estate.

- Irrevocable Trusts: Irrevocable trusts, such as generation-skipping trusts and grantor retained annuity trusts, can be used to transfer assets out of one’s estate while retaining certain benefits.

Anticipated Changes in 2025

The current lifetime gift tax exemption is scheduled to revert to $5 million, indexed for inflation, in 2026. However, the Tax Cuts and Jobs Act of 2017 temporarily doubled the exemption amount to $12,925,000 per individual. This increase is set to expire at the end of 2025.

The potential reduction in the lifetime gift tax exemption has significant implications for estate planning. Individuals who wish to take advantage of the higher exemption should consider making gifts prior to 2026 to minimize the potential impact of the lower exemption.

Implications for Estate Planning

The anticipated changes to the lifetime gift tax exemption in 2025 require careful consideration for estate planning purposes. Individuals should consult with experienced estate planning attorneys to assess their current situation and develop strategies to minimize the impact of the reduced exemption.

- Review Existing Estate Plans: Existing estate plans should be reviewed to determine if they still meet the desired goals in light of the potential changes to the exemption.

- Consider Making Gifts Prior to 2026: Individuals who wish to make substantial gifts should consider doing so before the end of 2025 to take advantage of the higher exemption amount.

- Utilize Other Estate Planning Techniques: Other estate planning techniques, such as revocable trusts and life insurance, can be used to supplement the lifetime gift tax exemption and reduce estate taxes.

Conclusion

The current lifetime gift tax exemption of $12,925,000 per individual is a valuable tool for estate planning. By utilizing this exemption, individuals can reduce the size of their taxable estate and minimize the amount of estate taxes owed. However, the anticipated changes to the exemption in 2025 require careful consideration and may necessitate adjustments to existing estate plans. Consulting with experienced estate planning attorneys is essential to ensure that individuals are taking advantage of the current exemption and planning for the future in a tax-efficient manner.

Closure

Thus, we hope this article has provided valuable insights into Current Lifetime Gift Tax Exemption 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!