Countdown to June 30, 2025: A Comprehensive Analysis of the End of the Current Economic Cycle

Related Articles: Countdown to June 30, 2025: A Comprehensive Analysis of the End of the Current Economic Cycle

- License Plate Stickers 2025: Everything You Need To Know

- IRMAA Brackets For 2024 And 2025: What You Need To Know

- Ski Holidays 2025: The Ultimate Guide To Unforgettable Winter Escapes

- Buying A House Now Or Wait: Weighing The Pros And Cons

- Berkeley 250 City Road: A Landmark Of Innovation And Sustainability

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Countdown to June 30, 2025: A Comprehensive Analysis of the End of the Current Economic Cycle. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Countdown to June 30, 2025: A Comprehensive Analysis of the End of the Current Economic Cycle

Countdown to June 30, 2025: A Comprehensive Analysis of the End of the Current Economic Cycle

Introduction

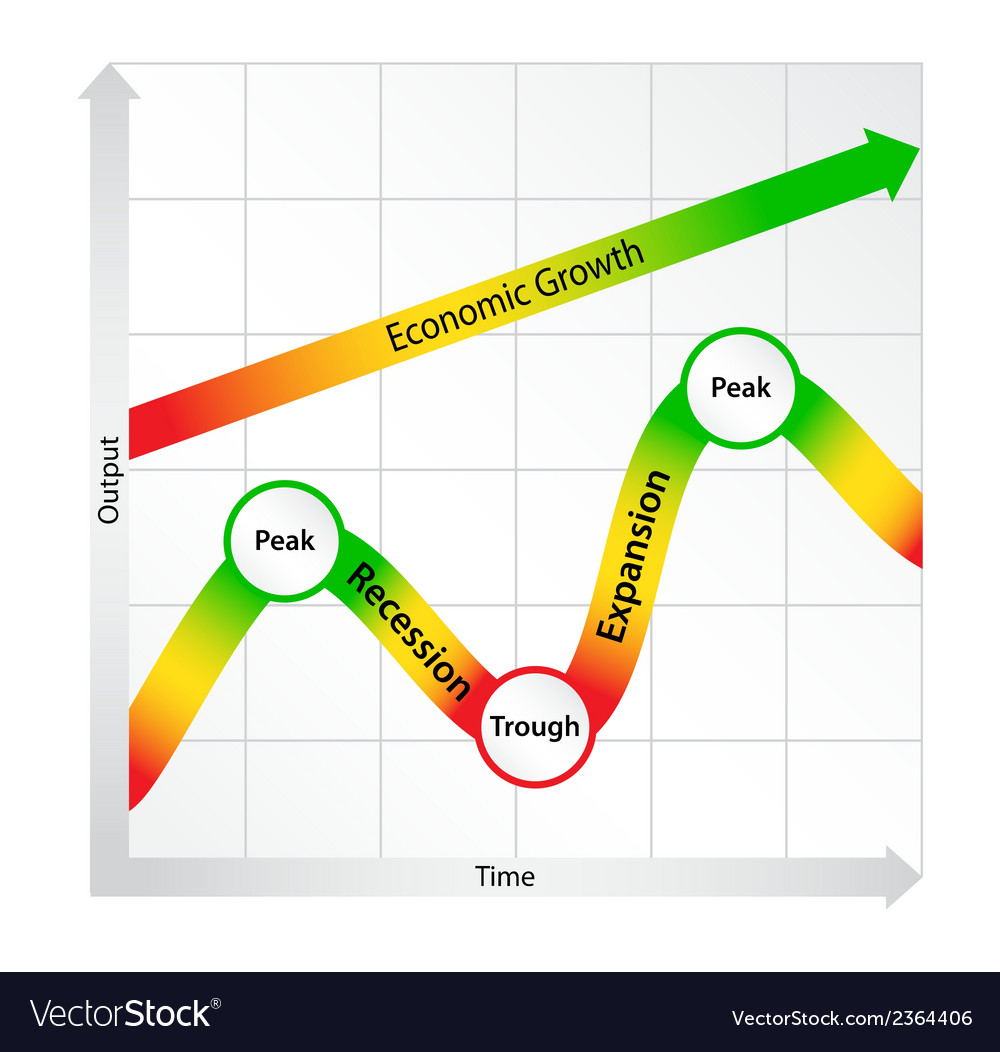

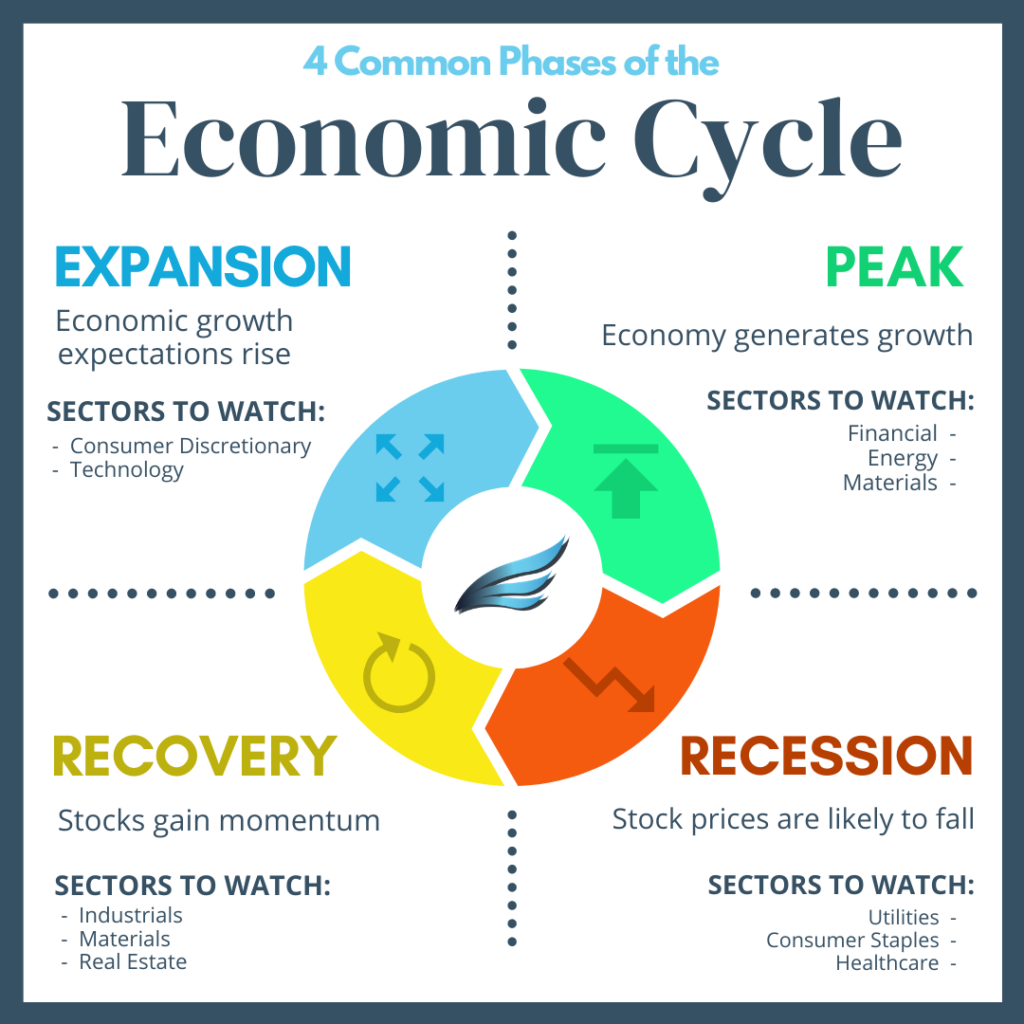

The global economy has been on a steady upward trajectory for the past decade, with record-low interest rates and strong consumer spending driving growth. However, all economic cycles eventually come to an end, and there are growing signs that the current cycle is nearing its peak. The countdown to June 30, 2025, marks the end of the current economic cycle, as determined by the National Bureau of Economic Research (NBER). This article will provide a comprehensive analysis of the factors leading up to this pivotal date and explore the potential implications for businesses, investors, and policymakers.

Economic Indicators Pointing to a Potential Slowdown

- Rising Inflation: Inflation has been steadily rising in recent months, fueled by supply chain disruptions, labor shortages, and geopolitical tensions. The Federal Reserve has begun raising interest rates to combat inflation, but it remains unclear whether these measures will be sufficient to bring it under control.

- Slowing Economic Growth: Economic growth has slowed in many countries around the world, as the post-pandemic recovery loses momentum. Factors such as the war in Ukraine, rising energy prices, and ongoing supply chain issues are weighing on business activity and consumer confidence.

- Declining Corporate Earnings: Corporate earnings have begun to decline in recent quarters, as companies face rising costs and weaker demand. This trend is likely to continue as the economy slows down.

- Inverted Yield Curve: The yield curve, which plots the interest rates on government bonds of different maturities, has inverted. This is a classic recession indicator, as it suggests that investors expect interest rates to fall in the future.

Potential Implications of a Recession

- Job Losses: Recessions typically lead to job losses, as businesses cut costs to weather the downturn. This can have a devastating impact on individuals and families, leading to financial hardship and reduced spending.

- Reduced Economic Activity: Overall economic activity slows down during a recession, as businesses and consumers reduce spending. This can lead to a decline in output, investment, and employment.

- Financial Market Volatility: Recessions often trigger volatility in financial markets, as investors seek to protect their assets. Stock prices can fall sharply, and bond yields can rise.

- Government Intervention: Governments may intervene to mitigate the impact of a recession by providing stimulus measures, such as tax cuts or increased spending. However, this can lead to higher levels of government debt.

Preparing for the End of the Economic Cycle

- Businesses: Businesses should prepare for a potential recession by reducing costs, building up cash reserves, and diversifying their revenue streams. They should also consider hedging against risks such as currency fluctuations and rising interest rates.

- Investors: Investors should adjust their portfolios to reduce risk and prepare for potential market volatility. This may involve reducing exposure to stocks and increasing exposure to bonds or other defensive assets.

- Policymakers: Policymakers should monitor economic indicators closely and be prepared to take action to mitigate the impact of a recession. This may include providing stimulus measures or implementing monetary or fiscal policies to support the economy.

Conclusion

The countdown to June 30, 2025, marks the end of the current economic cycle. While there is no guarantee that a recession will occur, the economic indicators are pointing to a potential slowdown. Businesses, investors, and policymakers should prepare for the end of the cycle by taking steps to mitigate the potential impact. By understanding the factors leading up to a recession and the potential implications, we can better prepare for the challenges ahead and emerge stronger on the other side.

Closure

Thus, we hope this article has provided valuable insights into Countdown to June 30, 2025: A Comprehensive Analysis of the End of the Current Economic Cycle. We thank you for taking the time to read this article. See you in our next article!