CG-2025 Form: A Comprehensive Guide for International Trade

Related Articles: CG-2025 Form: A Comprehensive Guide for International Trade

- 2025 NFL Mock Draft: Projecting The Top Prospects For The Upcoming Draft

- October 5, 2025: A Glimpse Into The Future

- 2025 1st Avenue: A Comprehensive Overview

- Upcoming Horror Movies Of 2025: A Spine-Tingling Preview

- 2025 BMW Z4: A Vision Of The Future

Introduction

With great pleasure, we will explore the intriguing topic related to CG-2025 Form: A Comprehensive Guide for International Trade. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about CG-2025 Form: A Comprehensive Guide for International Trade

CG-2025 Form: A Comprehensive Guide for International Trade

Introduction

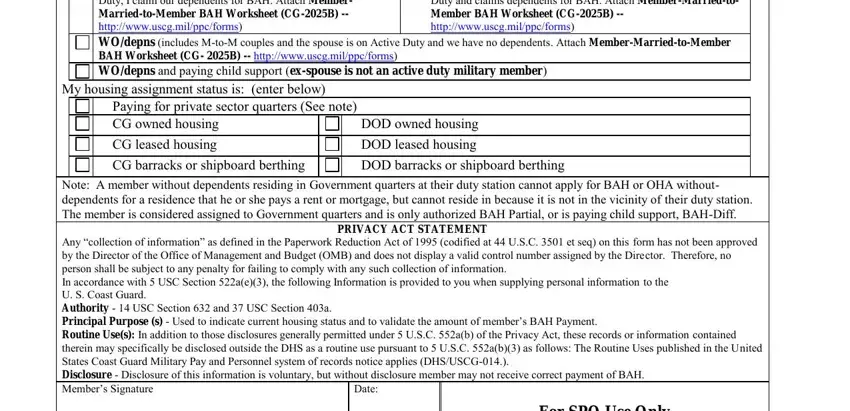

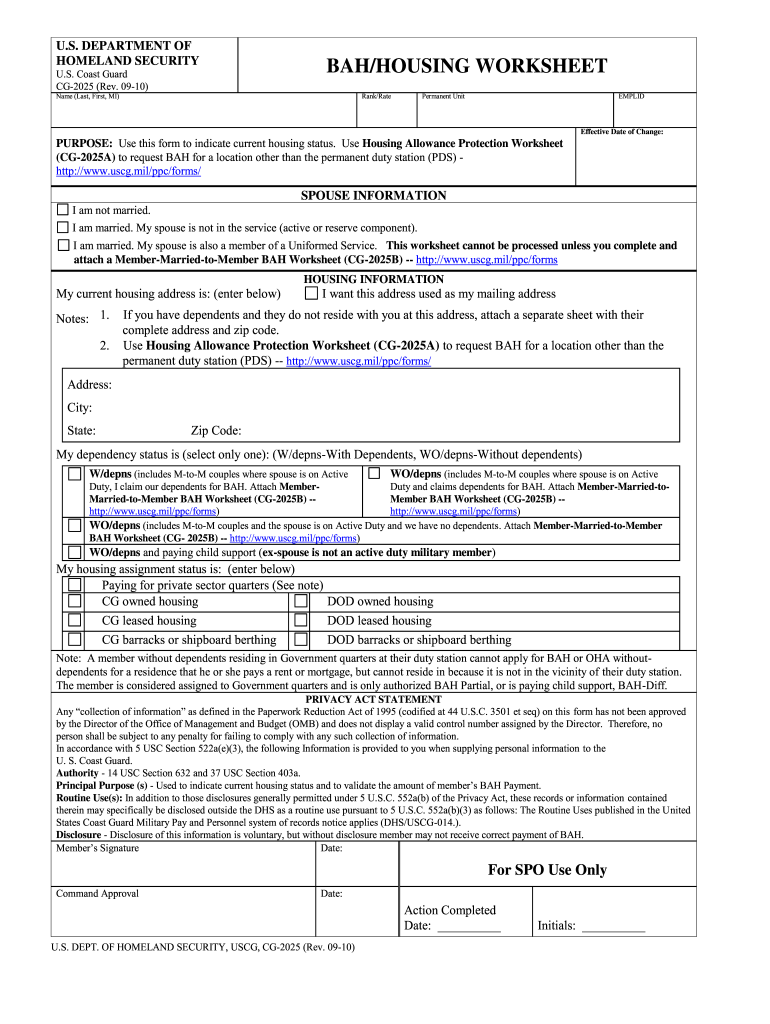

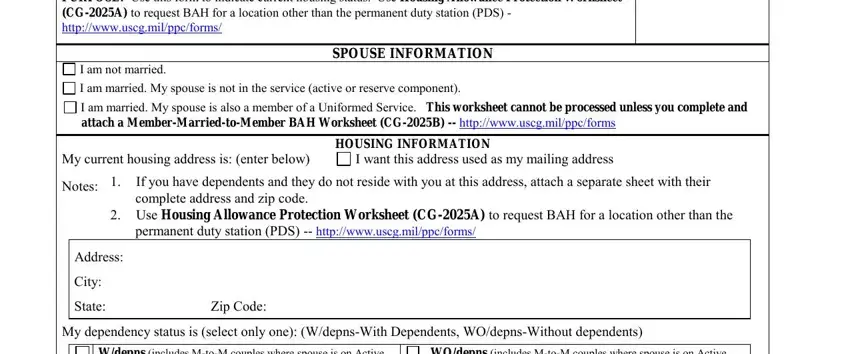

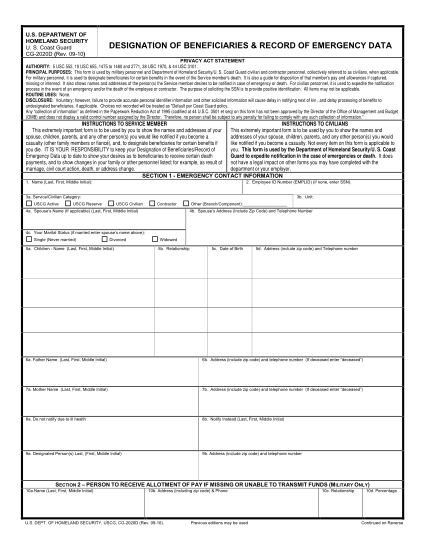

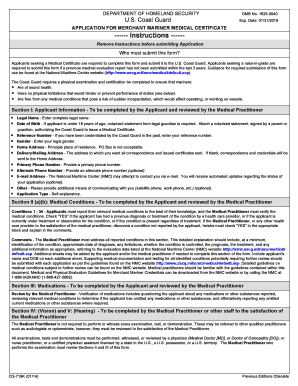

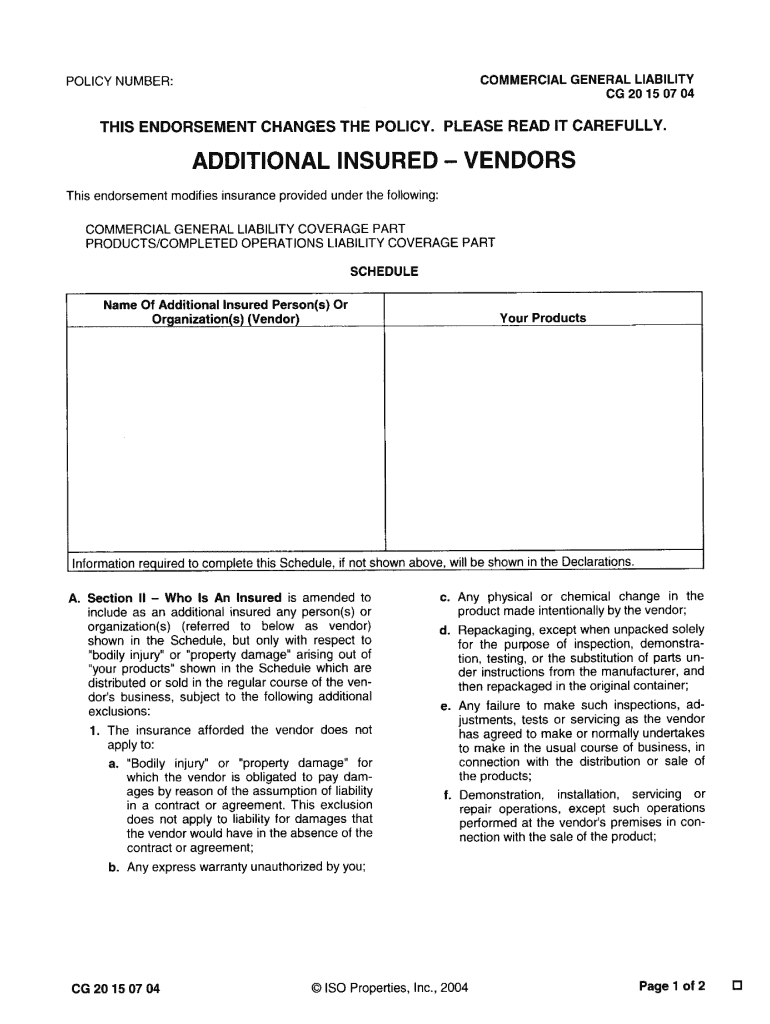

The CG-2025 form, also known as the Foreign Import and Exchange Control Declaration, is a crucial document required for the import and export of goods in various countries. It serves as a declaration of the value, origin, and other relevant details of the goods being traded. This article provides a comprehensive guide to the CG-2025 form, its purpose, requirements, and the process of filling it out.

Purpose of the CG-2025 Form

The primary purpose of the CG-2025 form is to facilitate the exchange of information between customs authorities and other relevant agencies involved in international trade. It serves as a tool to:

- Declare the value and quantity of imported or exported goods

- Provide details on the origin of the goods

- Facilitate the calculation of customs duties and taxes

- Monitor and control the movement of goods across borders

- Prevent illegal activities such as smuggling and money laundering

Who Needs to File the CG-2025 Form?

The CG-2025 form is required for individuals or entities engaged in the import or export of goods. This includes:

- Importers

- Exporters

- Customs brokers

- Freight forwarders

- Manufacturers

- Traders

Requirements for Completing the CG-2025 Form

To complete the CG-2025 form accurately, the following information is required:

- Importer/Exporter Information: Name, address, contact details

- Goods Information: Description, quantity, value, country of origin

- Transaction Information: Invoice number, date, method of payment

- Customs Declarations: Tariff classification, customs duty payable

- Additional Information: Shipping details, insurance details

Steps for Filling Out the CG-2025 Form

The CG-2025 form typically consists of several sections. Here are the steps involved in filling it out:

1. Importer/Exporter Section:

- Provide the name, address, and contact details of the importer or exporter.

- Indicate whether the transaction is an import or export.

2. Goods Section:

- Describe the goods being imported or exported.

- Specify the quantity, unit of measure, and value of the goods.

- Indicate the country of origin.

3. Transaction Section:

- Provide the invoice number and date.

- Specify the method of payment.

4. Customs Declarations Section:

- Classify the goods according to the applicable customs tariff.

- Calculate and declare the customs duty payable.

5. Additional Information Section:

- Provide details on the shipping method, carrier, and insurance.

- Include any other relevant information that may be required.

6. Certification Section:

- Sign and date the form to certify the accuracy of the information provided.

Submission of the CG-2025 Form

The completed CG-2025 form must be submitted to the relevant customs authorities in the country where the goods are being imported or exported. The submission process may vary depending on the country’s regulations. In some cases, it may be submitted online, while in others, it may need to be submitted in person or through a designated intermediary.

Consequences of Incorrect or Incomplete Information

Providing incorrect or incomplete information on the CG-2025 form can result in penalties, delays in the clearance of goods, or even legal consequences. It is essential to ensure that the information provided is accurate and complete to avoid any potential issues.

Conclusion

The CG-2025 form plays a vital role in international trade by facilitating the exchange of information between customs authorities and other relevant agencies. By understanding its purpose, requirements, and the process of filling it out, importers and exporters can ensure smooth and efficient cross-border transactions. Accurate and timely submission of the CG-2025 form contributes to the efficient movement of goods, reduces delays, and helps prevent illegal activities.

Closure

Thus, we hope this article has provided valuable insights into CG-2025 Form: A Comprehensive Guide for International Trade. We appreciate your attention to our article. See you in our next article!