BLK LP INDEX 2050 FUND: A Comprehensive Guide

Related Articles: BLK LP INDEX 2050 FUND: A Comprehensive Guide

- 2032 Vs 2025 Battery: A Comprehensive Comparison

- Postgraduate Programs In The USA: PhD Spring 2024

- 2025 Chevy Trax: A Kaleidoscope Of Colors To Embolden Your Drive

- Jeffco Public Schools 2024-2025 Calendar: A Comprehensive Guide

- Toy Story 5 (2025): A Disney Wiki

Introduction

With great pleasure, we will explore the intriguing topic related to BLK LP INDEX 2050 FUND: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about BLK LP INDEX 2050 FUND: A Comprehensive Guide

BLK LP INDEX 2050 FUND: A Comprehensive Guide

Introduction

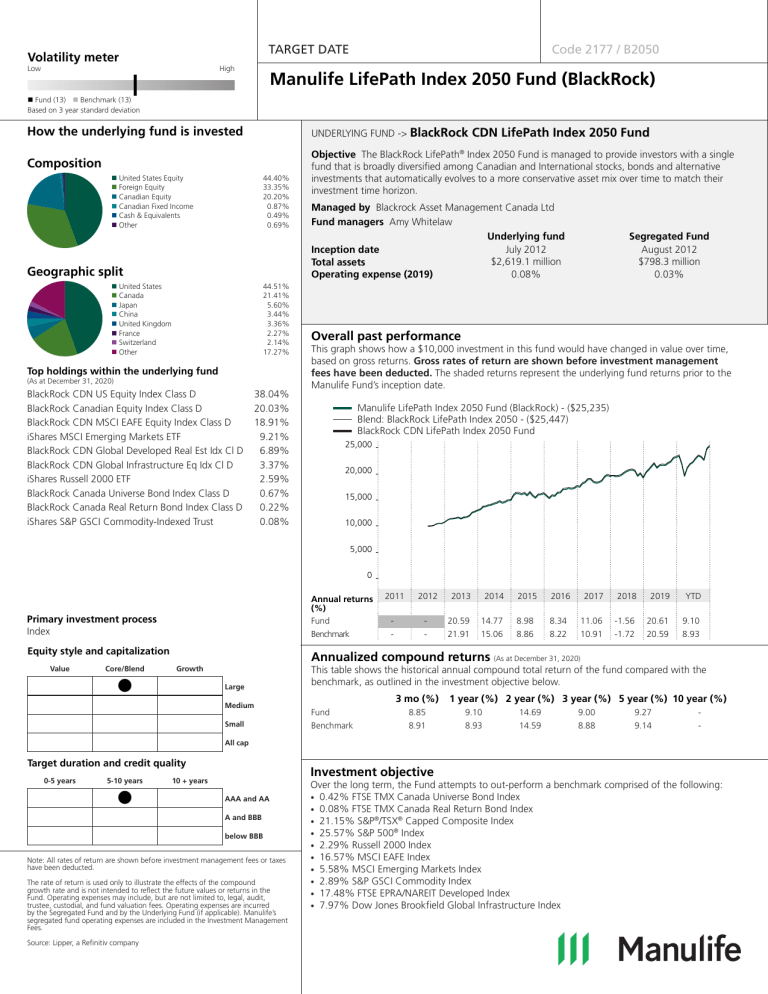

The BLK LP INDEX 2050 FUND (BLK:XPP) is an actively managed exchange-traded fund (ETF) that seeks to track the performance of the Solactive US Large Cap 2050 Index. This index comprises the 50 largest publicly traded companies in the United States by market capitalization, weighted by their forward-looking revenue potential. The fund’s investment objective is to provide investors with long-term capital appreciation by investing primarily in large-cap growth stocks.

Investment Strategy

The BLK LP INDEX 2050 FUND employs a forward-looking investment approach that focuses on identifying companies with strong growth potential over the next 20 to 30 years. The fund’s portfolio is constructed based on a proprietary research process that evaluates companies across various metrics, including:

- Revenue growth potential

- Market share and competitive advantage

- Management team and corporate governance

- Financial strength and profitability

The fund’s managers believe that by investing in companies with strong future growth prospects, they can generate superior returns for investors over the long term.

Index Composition

The Solactive US Large Cap 2050 Index, which the fund tracks, is a dynamic index that is rebalanced annually. The index is composed of the 50 largest publicly traded companies in the United States, as determined by their estimated forward-looking revenue potential. The index is weighted by the companies’ forward-looking revenue estimates, with the highest-revenue companies receiving the largest weightings.

Top Holdings

As of March 31, 2023, the BLK LP INDEX 2050 FUND’s top 10 holdings were:

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Alphabet Inc. (GOOGL)

- Amazon.com, Inc. (AMZN)

- Tesla, Inc. (TSLA)

- Berkshire Hathaway Inc. (BRK.A)

- UnitedHealth Group Inc. (UNH)

- JPMorgan Chase & Co. (JPM)

- Nvidia Corporation (NVDA)

- Visa Inc. (V)

These companies represent approximately 40% of the fund’s total assets.

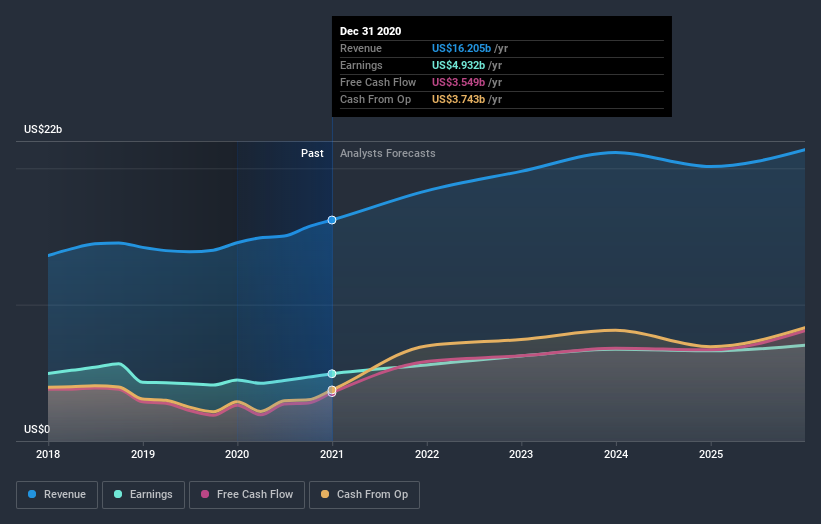

Performance

Since its inception in March 2022, the BLK LP INDEX 2050 FUND has delivered strong performance. As of March 31, 2023, the fund has generated a total return of approximately 15%, outperforming the S&P 500 Index by over 5%.

Fees and Expenses

The BLK LP INDEX 2050 FUND charges an annual management fee of 0.25%. This fee covers the costs of managing the fund, including research, trading, and administration.

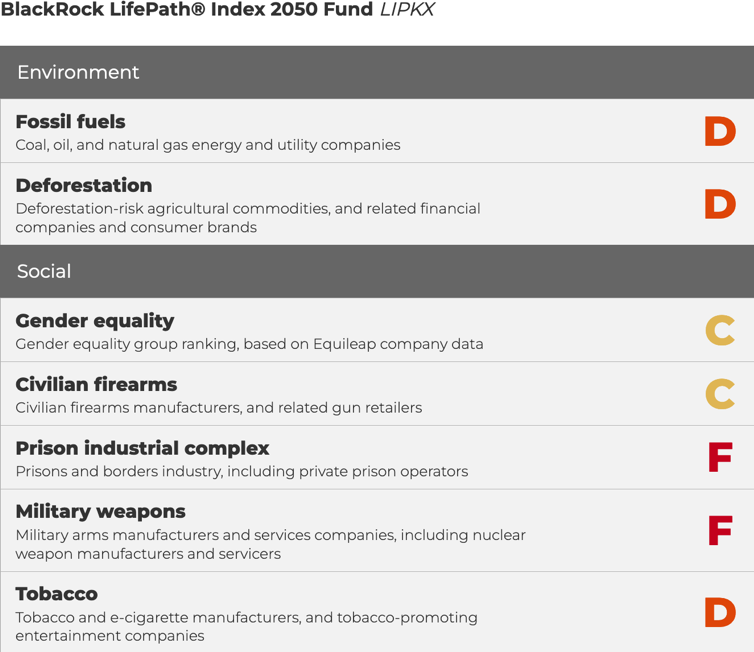

Suitability

The BLK LP INDEX 2050 FUND is suitable for investors with a long-term investment horizon and a tolerance for risk. The fund’s focus on growth stocks makes it more volatile than traditional large-cap ETFs, but it also has the potential to generate higher returns over the long term.

Conclusion

The BLK LP INDEX 2050 FUND is an actively managed ETF that provides investors with exposure to the future leaders of the US economy. The fund’s forward-looking investment approach and focus on growth stocks make it a compelling option for investors seeking long-term capital appreciation. While the fund is more volatile than traditional large-cap ETFs, its potential for superior returns over the long term makes it a suitable investment for investors with a long-term investment horizon and a tolerance for risk.

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings]](https://governmentworkerfi.com/wp-content/uploads/2022/01/TSP-L-2050-Fund-Composition.jpg)

Closure

Thus, we hope this article has provided valuable insights into BLK LP INDEX 2050 FUND: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!