Bitcoin Price Prediction 2025: A Comprehensive Analysis

Related Articles: Bitcoin Price Prediction 2025: A Comprehensive Analysis

- 2025 SHOT Show Dates Announced: Industry Gathers For Innovation And Networking

- 2025 UK Free Printable Calendar: Plan Your Year Ahead With Ease

- 2025 BMW X2: A Compact SUV With Bold Design And Advanced Technology

- IR 2025: A Vision For The Future Of Industrial Revolution

- 2025 Toyota 4Runner Interior: A Comprehensive Exploration

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Bitcoin Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Bitcoin Price Prediction 2025: A Comprehensive Analysis

Bitcoin Price Prediction 2025: A Comprehensive Analysis

Introduction

Bitcoin, the pioneering cryptocurrency, has revolutionized the financial landscape since its inception in 2009. Its decentralized nature, limited supply, and increasing adoption have fueled its meteoric rise in value. As we approach 2025, market analysts and industry experts are eagerly speculating about the potential trajectory of Bitcoin’s price. This comprehensive analysis aims to provide an in-depth assessment of Bitcoin’s price prediction for 2025, considering various factors that could influence its future performance.

Historical Performance and Market Trends

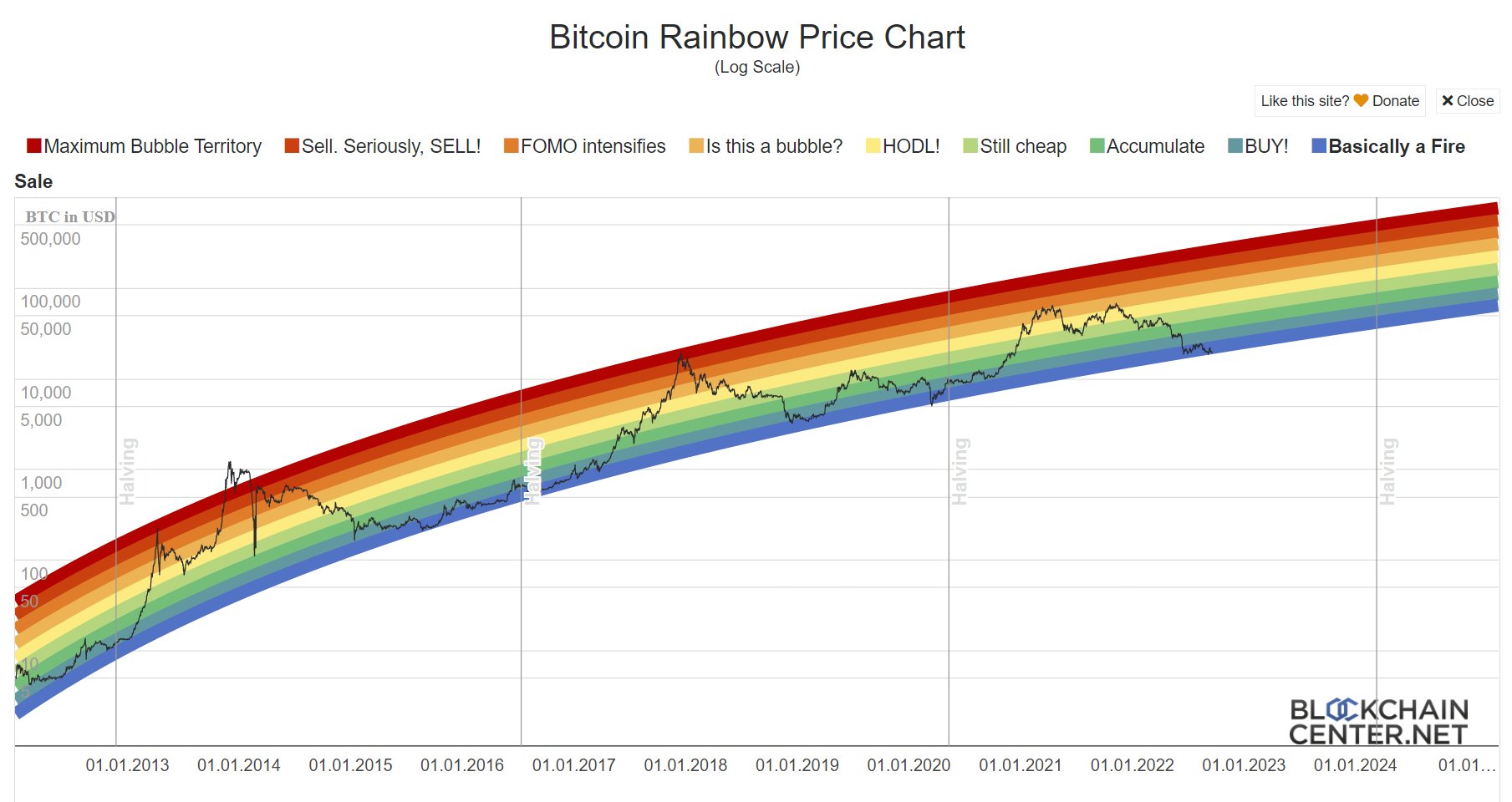

To understand the potential future price of Bitcoin, it is essential to examine its historical performance and key market trends. Since its launch, Bitcoin has experienced significant price fluctuations, including both parabolic rallies and sharp corrections. However, over the long term, it has demonstrated a remarkable growth trajectory.

In 2021, Bitcoin reached its all-time high of approximately $69,000. This surge was largely driven by institutional adoption, increasing retail investor interest, and the perception of Bitcoin as a safe haven asset during market uncertainty. However, in 2022, the cryptocurrency market experienced a significant correction, with Bitcoin’s price falling below $20,000. This decline was attributed to a combination of factors, including macroeconomic headwinds, regulatory concerns, and the collapse of several major cryptocurrency exchanges and lending platforms.

Factors Influencing Bitcoin’s Price

The future price of Bitcoin will be determined by a complex interplay of various factors, including:

- Institutional Adoption: The increasing adoption of Bitcoin by institutional investors, such as hedge funds, asset managers, and corporations, is a significant factor driving its price. Institutional investors typically have a long-term investment horizon and can provide stability to the market.

- Regulatory Environment: The regulatory landscape surrounding Bitcoin and other cryptocurrencies is still evolving. Clear and supportive regulations can enhance investor confidence and facilitate institutional adoption, while unfavorable regulations can hinder growth.

- Macroeconomic Conditions: Bitcoin’s price can be influenced by macroeconomic factors such as inflation, interest rates, and economic growth. During periods of economic uncertainty, investors may seek alternative assets like Bitcoin, which can potentially act as a hedge against inflation.

- Technological Developments: The ongoing development of Bitcoin’s underlying technology, including scalability improvements, privacy enhancements, and smart contract functionality, can impact its value. Innovations that increase Bitcoin’s usability and accessibility can attract new users and drive demand.

- Market Sentiment: The overall sentiment in the cryptocurrency market can significantly influence Bitcoin’s price. Positive sentiment, driven by factors such as bullish news, technical analysis, and social media hype, can lead to price rallies. Conversely, negative sentiment can trigger sell-offs and price declines.

Price Prediction Models and Expert Opinions

Various price prediction models and expert opinions provide insights into the potential future value of Bitcoin. These models employ different methodologies, such as technical analysis, fundamental analysis, and machine learning, to forecast future price movements.

- Technical Analysis: Technical analysts study historical price data to identify patterns and trends. Based on these patterns, they attempt to predict future price movements. Many technical analysts believe that Bitcoin is currently in a bull market and could potentially reach new highs in the coming years.

- Fundamental Analysis: Fundamental analysts evaluate the underlying value of an asset by considering factors such as adoption, network growth, and development activity. Based on these factors, some analysts believe that Bitcoin is still undervalued and has significant growth potential.

- Expert Opinions: Industry experts and analysts provide their own price predictions based on their knowledge, experience, and market insights. While expert opinions can be valuable, it is important to note that they are subject to individual biases and may not always be accurate.

Bitcoin Price Prediction for 2025

Based on the analysis of historical performance, market trends, influencing factors, price prediction models, and expert opinions, the following Bitcoin price predictions for 2025 can be formulated:

- Conservative Estimate: Some analysts predict that Bitcoin could reach a conservative price of around $50,000 to $75,000 by 2025. This estimate is based on a continuation of the current adoption trend and moderate market growth.

- Moderate Estimate: Others predict a more moderate price range of $100,000 to $200,000 by 2025. This estimate assumes a significant increase in institutional adoption and favorable regulatory developments.

- Bullish Estimate: Some bullish analysts predict that Bitcoin could potentially reach $500,000 or even $1 million by 2025. This estimate is based on the belief that Bitcoin will become a mainstream asset class and a widely accepted medium of exchange.

Conclusion

The future price of Bitcoin remains uncertain, as it is influenced by a complex interplay of various factors. However, based on the analysis presented in this article, it is evident that Bitcoin has the potential to continue its growth trajectory in the coming years. While conservative estimates predict a price range of $50,000 to $75,000 by 2025, more bullish estimates suggest that Bitcoin could potentially reach significantly higher levels. The actual price will ultimately be determined by market forces, technological developments, regulatory changes, and the overall sentiment in the cryptocurrency space.

It is important to note that all price predictions are speculative and should be treated with caution. Investors should conduct thorough research, understand the risks involved, and make informed decisions based on their own financial circumstances and investment goals.

![[New Research] Bitcoin Price Prediction 2025: Bitcoin In 5 Years](https://img.currency.com/imgs/articles/1472xx/shutterstock_763067344.jpg)

Closure

Thus, we hope this article has provided valuable insights into Bitcoin Price Prediction 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!