Best 2035 Target-Date Funds: A Comprehensive Guide

Related Articles: Best 2035 Target-Date Funds: A Comprehensive Guide

- November 2025 Holiday Calendar

- Nissan Titan: A Powerhouse Redefined For 2025

- Price Prediction 2025: Unlocking The Future Of Cryptocurrency

- Oregon Ducks Football Schedule 2025

- The 2025 Dodge Charger Black: A Demon Unleashed

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Best 2035 Target-Date Funds: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Best 2035 Target-Date Funds: A Comprehensive Guide

Best 2035 Target-Date Funds: A Comprehensive Guide

Introduction

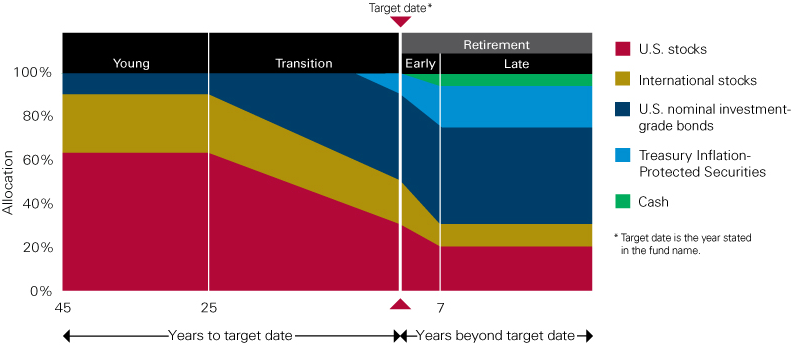

Target-date funds are a type of investment fund designed to help investors reach their retirement goals. These funds automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches. This makes them a convenient and hands-off option for retirement planning.

For investors planning to retire around 2035, selecting the right target-date fund is crucial. Here, we present a comprehensive analysis of the best 2035 target-date funds, providing detailed information on their performance, fees, and investment strategies.

Top 2035 Target-Date Funds

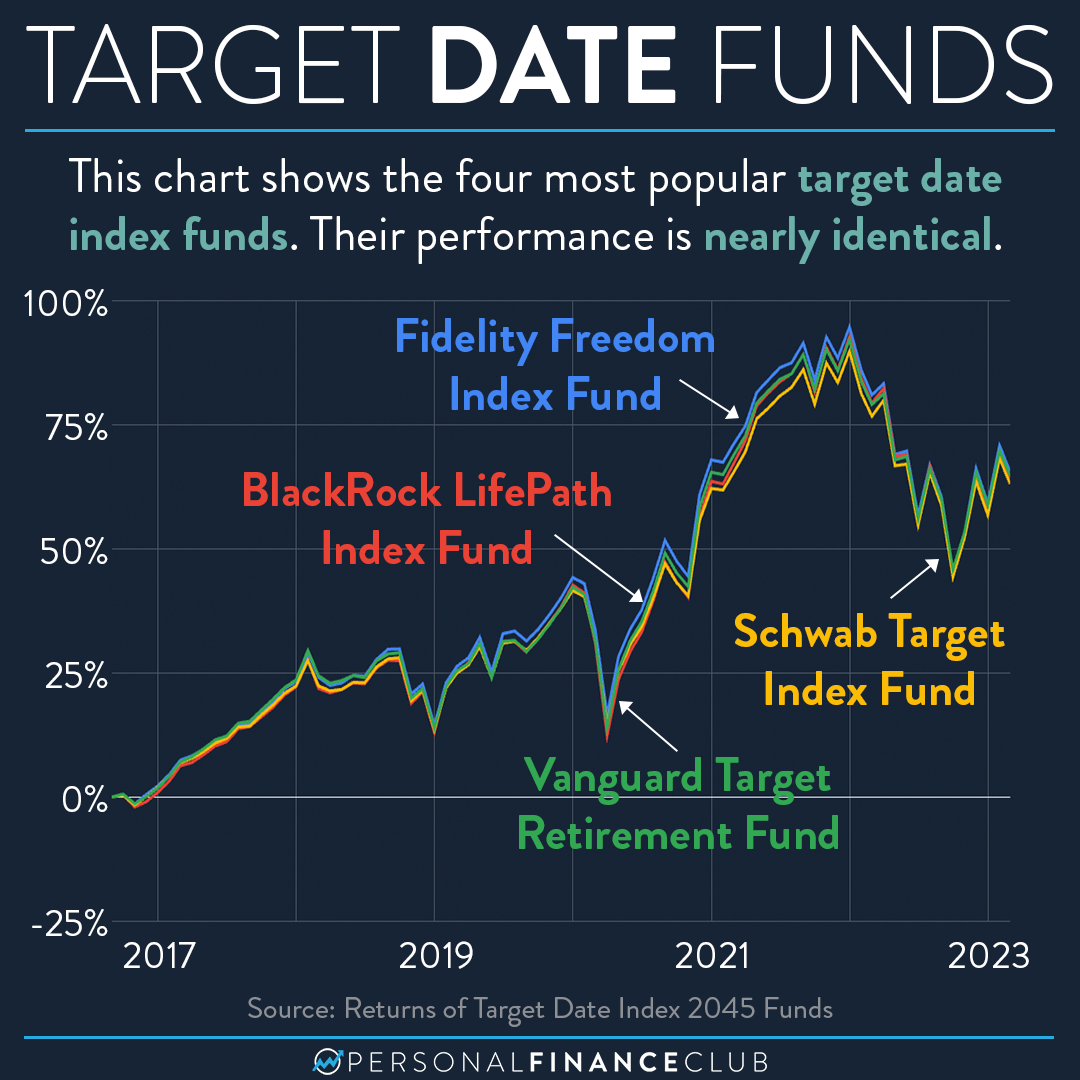

1. Fidelity Freedom Index 2035 Fund (FFIAX)

- Expense ratio: 0.12%

- Performance (annualized, 10 years): 10.12%

- Asset allocation: 85% stocks, 15% bonds

Fidelity’s Freedom Index 2035 Fund is a low-cost, index-tracking fund that provides broad exposure to the global stock and bond markets. Its low expense ratio and strong performance make it an attractive option for investors seeking a passive and cost-effective retirement solution.

2. Vanguard Target Retirement 2035 Fund (VFFVX)

- Expense ratio: 0.15%

- Performance (annualized, 10 years): 10.35%

- Asset allocation: 85% stocks, 15% bonds

Vanguard’s Target Retirement 2035 Fund is another excellent choice for investors seeking low fees and broad market exposure. Its slightly higher expense ratio is offset by its slightly better performance over the past decade.

3. T. Rowe Price Retirement 2035 Fund (TRRIX)

- Expense ratio: 0.65%

- Performance (annualized, 10 years): 10.52%

- Asset allocation: 75% stocks, 25% bonds

T. Rowe Price’s Retirement 2035 Fund has a higher expense ratio than the previous two funds, but it also offers a more active investment approach. The fund’s managers actively manage the asset allocation, seeking to outperform the benchmark.

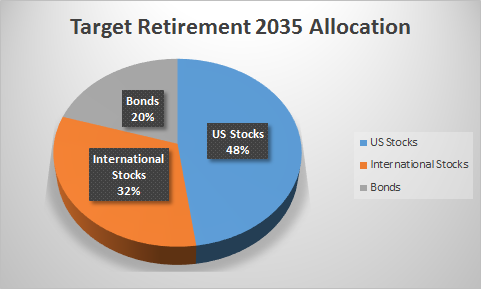

4. BlackRock Target Retirement 2035 Fund (BRATX)

- Expense ratio: 0.15%

- Performance (annualized, 10 years): 9.87%

- Asset allocation: 80% stocks, 20% bonds

BlackRock’s Target Retirement 2035 Fund is a solid option for investors seeking a balanced approach between active and passive management. The fund combines index-tracking investments with active stock selection to achieve its target asset allocation.

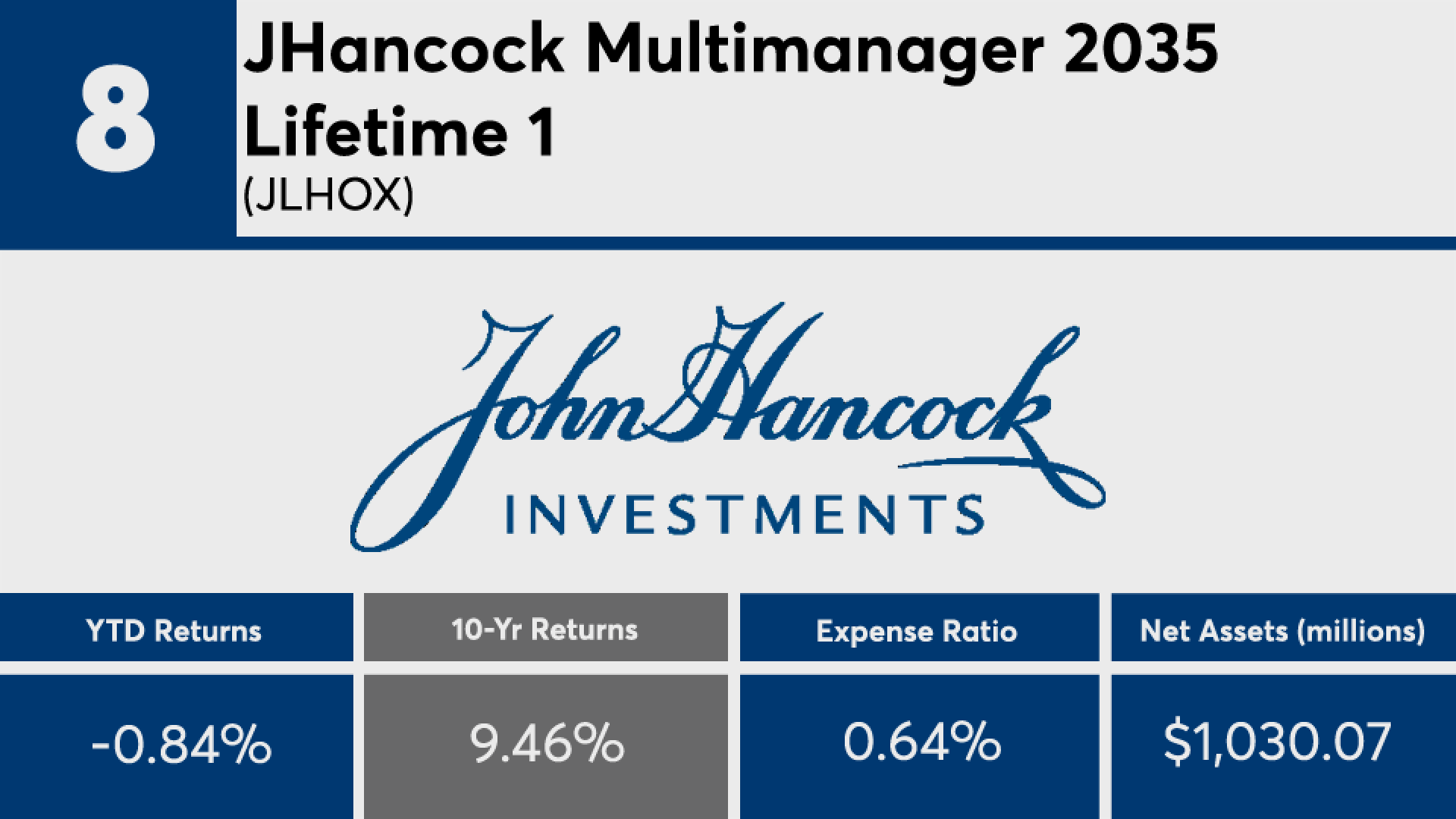

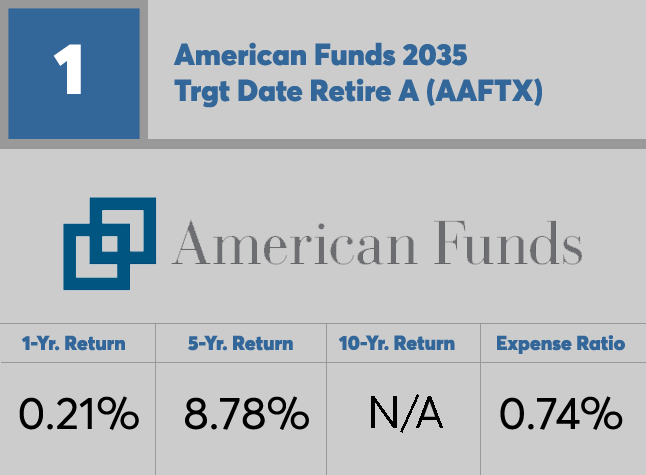

5. American Funds Target Retirement 2035 Fund (AORAX)

- Expense ratio: 0.52%

- Performance (annualized, 10 years): 9.95%

- Asset allocation: 75% stocks, 25% bonds

American Funds’ Target Retirement 2035 Fund offers a more conservative asset allocation than the previous funds. The fund’s managers prioritize capital preservation and stability over aggressive growth.

Factors to Consider When Choosing a 2035 Target-Date Fund

1. Expense ratio: The expense ratio is a key factor to consider, as it represents the annual fee charged by the fund. Lower expense ratios translate to higher returns over time.

2. Performance: The fund’s historical performance is an important indicator of its future potential. However, it’s essential to remember that past performance is not a guarantee of future results.

3. Asset allocation: The asset allocation of the fund determines its risk and return profile. Investors should choose a fund that aligns with their risk tolerance and time horizon.

4. Investment strategy: Target-date funds can employ different investment strategies, ranging from passive index tracking to active management. Investors should consider their preferences and investment goals when selecting a strategy.

5. Retirement date: The target retirement date of the fund should closely align with the investor’s expected retirement date. This ensures that the fund’s asset allocation will adjust appropriately over time.

Conclusion

Choosing the right 2035 target-date fund is a crucial step in retirement planning. By carefully considering the factors outlined above, investors can select a fund that meets their individual needs and helps them achieve their retirement goals. The funds presented in this article represent some of the best options available, offering a range of fees, performance, and investment strategies.

Closure

Thus, we hope this article has provided valuable insights into Best 2035 Target-Date Funds: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!