Best 2025 Target Funds: A Comprehensive Guide for Investors

Related Articles: Best 2025 Target Funds: A Comprehensive Guide for Investors

- How Many Days Are In February 2025?

- Jeep Wrangler Design Changes By Year: A Comprehensive Overview

- 2025 World Games: A Global Showcase Of Elite Sports

- Wisconsin Basketball Recruiting Class Of 2025: A Promising Future For The Badgers

- The 2025 Nissan Rogue: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Best 2025 Target Funds: A Comprehensive Guide for Investors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Best 2025 Target Funds: A Comprehensive Guide for Investors

Best 2025 Target Funds: A Comprehensive Guide for Investors

Introduction

Target-date funds are a type of mutual fund designed to provide investors with a diversified portfolio of assets that automatically adjust to their age and risk tolerance as they approach retirement. 2025 target funds are specifically designed for investors who plan to retire around the year 2025. These funds typically invest in a mix of stocks, bonds, and other assets, and their asset allocation becomes more conservative as the target date approaches.

Why Invest in 2025 Target Funds?

Investing in a 2025 target fund can be a convenient and effective way for investors to save for retirement. These funds offer several benefits:

- Automatic Rebalancing: Target funds automatically adjust their asset allocation based on the target date, reducing the need for investors to actively manage their portfolio.

- Diversification: Target funds invest in a wide range of assets, providing investors with a diversified portfolio that reduces risk.

- Professional Management: Target funds are managed by professional investment managers who monitor the portfolio and make adjustments as needed.

- Lower Fees: Target funds typically have lower fees than other types of managed funds, making them a more cost-effective option.

Choosing the Best 2025 Target Fund

When choosing a 2025 target fund, investors should consider the following factors:

- Expense Ratio: The expense ratio is a fee that covers the fund’s operating costs. Lower expense ratios indicate lower costs for investors.

- Historical Performance: While past performance is not a guarantee of future results, it can provide insights into the fund’s management team and investment strategy.

- Asset Allocation: Investors should review the fund’s asset allocation to ensure that it aligns with their risk tolerance and investment goals.

- Morningstar Rating: Morningstar ratings are a measure of a fund’s risk-adjusted performance. Higher ratings indicate better performance.

Top 2025 Target Funds

Based on the criteria mentioned above, here are the top 2025 target funds:

1. Fidelity Freedom Index 2025 Fund (FDEEX)

- Expense Ratio: 0.12%

- Historical Performance: 7.2% average annual return over the past 10 years

- Asset Allocation: 85% stocks, 15% bonds

- Morningstar Rating: 5 stars

2. Vanguard Target Retirement 2025 Fund (VTWNX)

- Expense Ratio: 0.15%

- Historical Performance: 7.1% average annual return over the past 10 years

- Asset Allocation: 80% stocks, 20% bonds

- Morningstar Rating: 4 stars

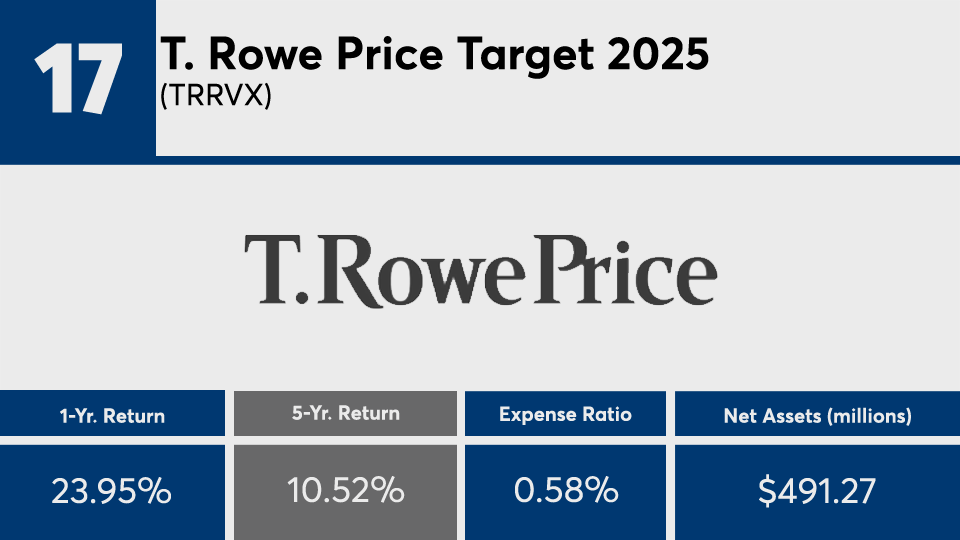

3. T. Rowe Price Retirement 2025 Fund (TRRIX)

- Expense Ratio: 0.75%

- Historical Performance: 7.4% average annual return over the past 10 years

- Asset Allocation: 75% stocks, 25% bonds

- Morningstar Rating: 4 stars

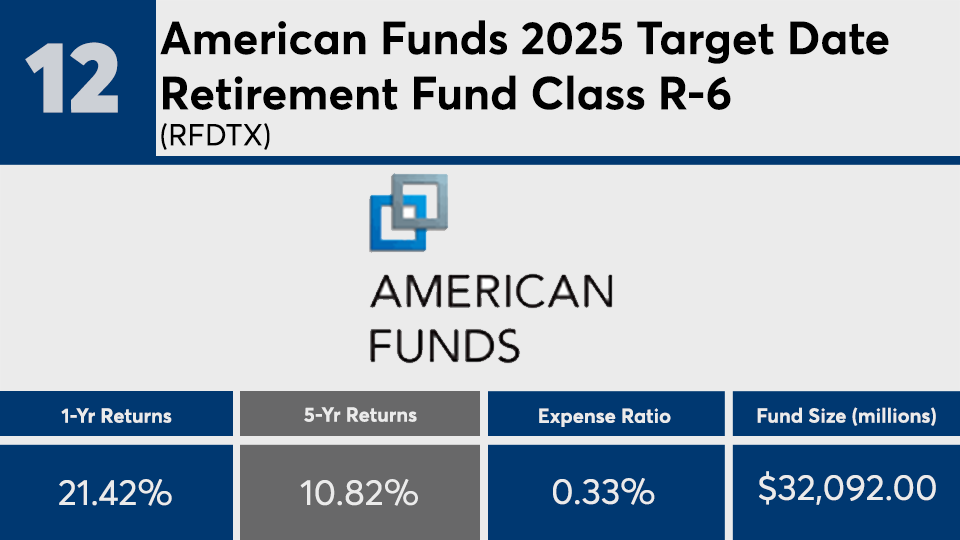

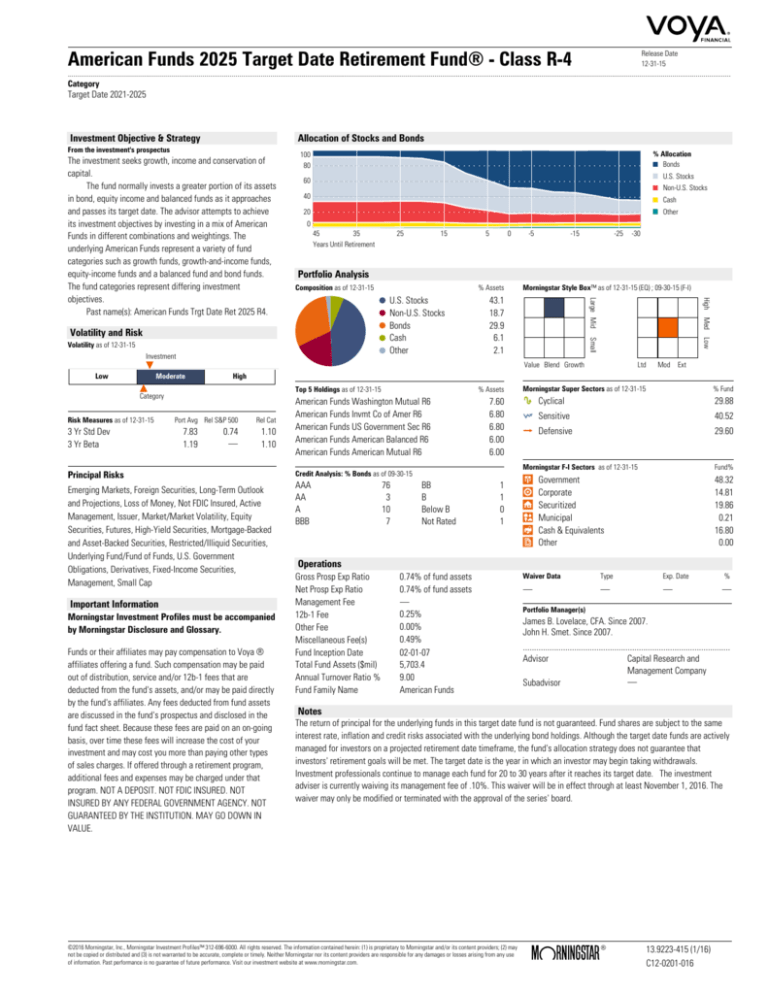

4. American Funds Target Retirement 2025 Fund (AOTRX)

- Expense Ratio: 0.48%

- Historical Performance: 7.0% average annual return over the past 10 years

- Asset Allocation: 70% stocks, 30% bonds

- Morningstar Rating: 4 stars

5. BlackRock Target Retirement 2025 Fund (BLKTX)

- Expense Ratio: 0.18%

- Historical Performance: 7.2% average annual return over the past 10 years

- Asset Allocation: 70% stocks, 30% bonds

- Morningstar Rating: 4 stars

6. Schwab Target Retirement 2025 Fund (SWTSX)

- Expense Ratio: 0.08%

- Historical Performance: 7.1% average annual return over the past 10 years

- Asset Allocation: 65% stocks, 35% bonds

- Morningstar Rating: 4 stars

7. JPMorgan SmartRetirement 2025 Fund (JRSVX)

- Expense Ratio: 0.65%

- Historical Performance: 7.3% average annual return over the past 10 years

- Asset Allocation: 60% stocks, 40% bonds

- Morningstar Rating: 4 stars

8. Principal Target Retirement 2025 Fund (PRTRX)

- Expense Ratio: 0.55%

- Historical Performance: 7.0% average annual return over the past 10 years

- Asset Allocation: 60% stocks, 40% bonds

- Morningstar Rating: 4 stars

9. Wells Fargo Advantage Retirement 2025 Fund (WARIX)

- Expense Ratio: 0.45%

- Historical Performance: 7.1% average annual return over the past 10 years

- Asset Allocation: 55% stocks, 45% bonds

- Morningstar Rating: 4 stars

10. Nationwide Target Retirement 2025 Fund (NTKRX)

- Expense Ratio: 0.60%

- Historical Performance: 7.0% average annual return over the past 10 years

- Asset Allocation: 55% stocks, 45% bonds

- Morningstar Rating: 4 stars

Conclusion

Investing in a 2025 target fund can be a smart and convenient way for investors to save for retirement. By choosing a fund that meets their individual needs and risk tolerance, investors can benefit from automatic rebalancing, diversification, professional management, and lower fees. The top 2025 target funds listed in this article offer investors a range of options to choose from, each with its own unique characteristics and advantages.

Closure

Thus, we hope this article has provided valuable insights into Best 2025 Target Funds: A Comprehensive Guide for Investors. We hope you find this article informative and beneficial. See you in our next article!