Apple Stock 2025 Forecast: A Comprehensive Analysis

Related Articles: Apple Stock 2025 Forecast: A Comprehensive Analysis

- Volvo XC60 2025: A Comprehensive Overview Of Its Specifications

- New Cars Coming Out In 2025: A Comprehensive Guide To The Future Of Automotive Innovation

- 2025 Nissan Kicks AWD: A Compact SUV With Refined Style And Enhanced Performance

- Current Design Trends 2025: Shaping The Future Of User Experience

- The 2025 Chevrolet Silverado: A Beast Of A Truck With Advanced Technology

Introduction

With great pleasure, we will explore the intriguing topic related to Apple Stock 2025 Forecast: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Apple Stock 2025 Forecast: A Comprehensive Analysis

Apple Stock 2025 Forecast: A Comprehensive Analysis

Introduction

Apple Inc., the global tech behemoth, has consistently dominated the consumer electronics market with its innovative products and services. As the company embarks on a new era of growth, investors are eagerly anticipating the future performance of Apple stock. This comprehensive forecast delves into the key factors that will shape Apple’s stock trajectory in the years leading up to 2025.

Current Market Dynamics

Apple stock has experienced remarkable growth in recent years, consistently outperforming the broader market. As of March 2023, the stock trades around $175, near its all-time high. This growth has been driven by strong demand for the company’s iPhone, Mac, and iPad products, as well as its expanding services ecosystem.

Key Growth Drivers

Several key growth drivers are expected to continue fueling Apple’s success in the coming years:

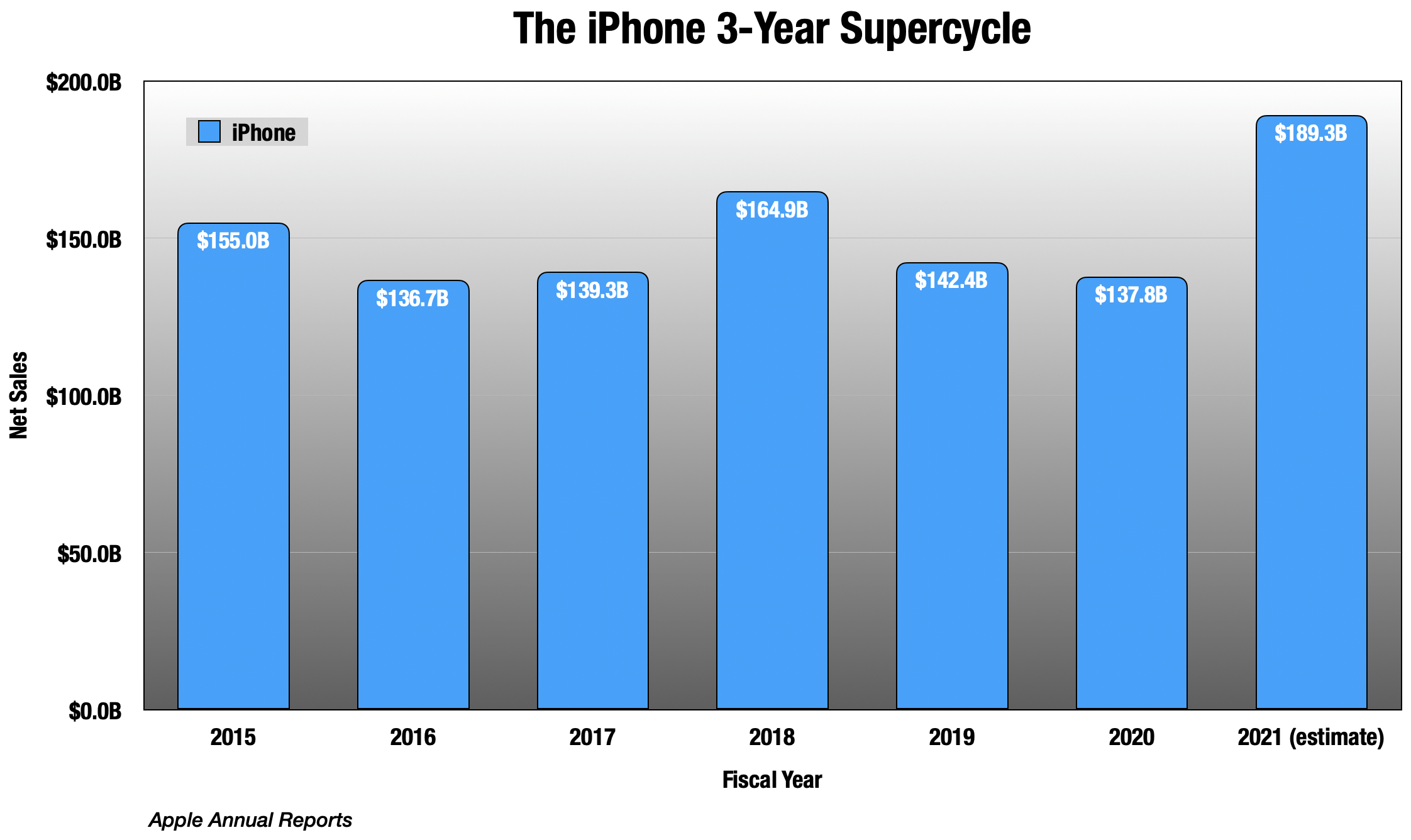

- iPhone: The iPhone remains Apple’s flagship product, accounting for the majority of its revenue. The company is expected to release new iPhone models with advanced features and enhanced performance, maintaining its dominance in the smartphone market.

- Services: Apple’s services business, including the App Store, Apple Music, and iCloud, has become a significant revenue generator. The company is investing heavily in expanding its services offerings, which provide recurring revenue streams.

- Wearables: Apple Watch and AirPods have become popular accessories, complementing the company’s smartphone ecosystem. Continued innovation in wearables is expected to drive growth in this segment.

- Healthcare: Apple has made significant strides in the healthcare sector with products like the Apple Watch Series 8 and its Health app. The company is expected to continue exploring opportunities in healthcare, leveraging its technology to improve patient outcomes.

- Augmented Reality (AR): Apple is reportedly developing an AR headset, which could potentially revolutionize the way users interact with technology. AR has the potential to create new revenue streams and expand Apple’s product portfolio.

Financial Performance Forecast

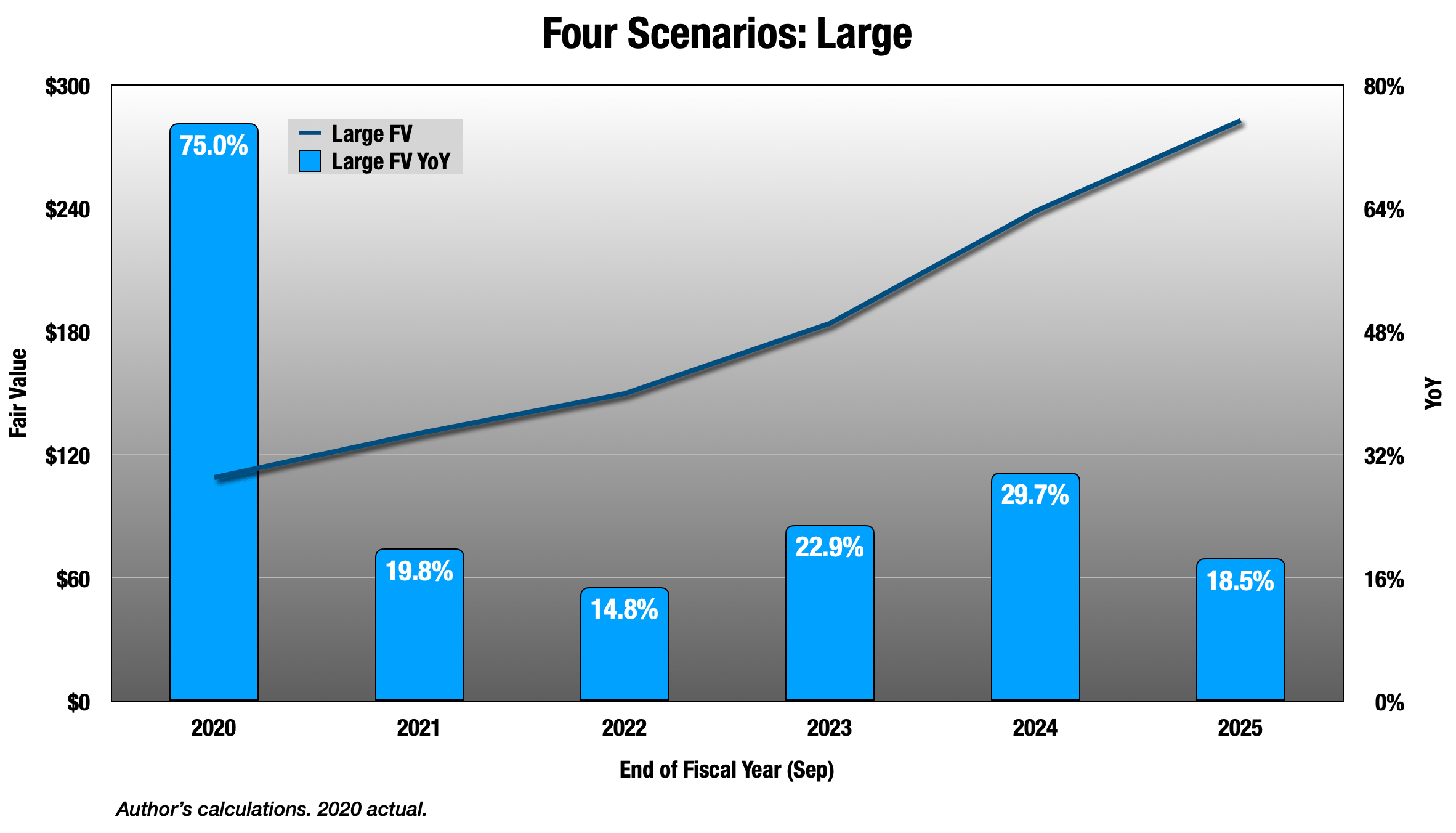

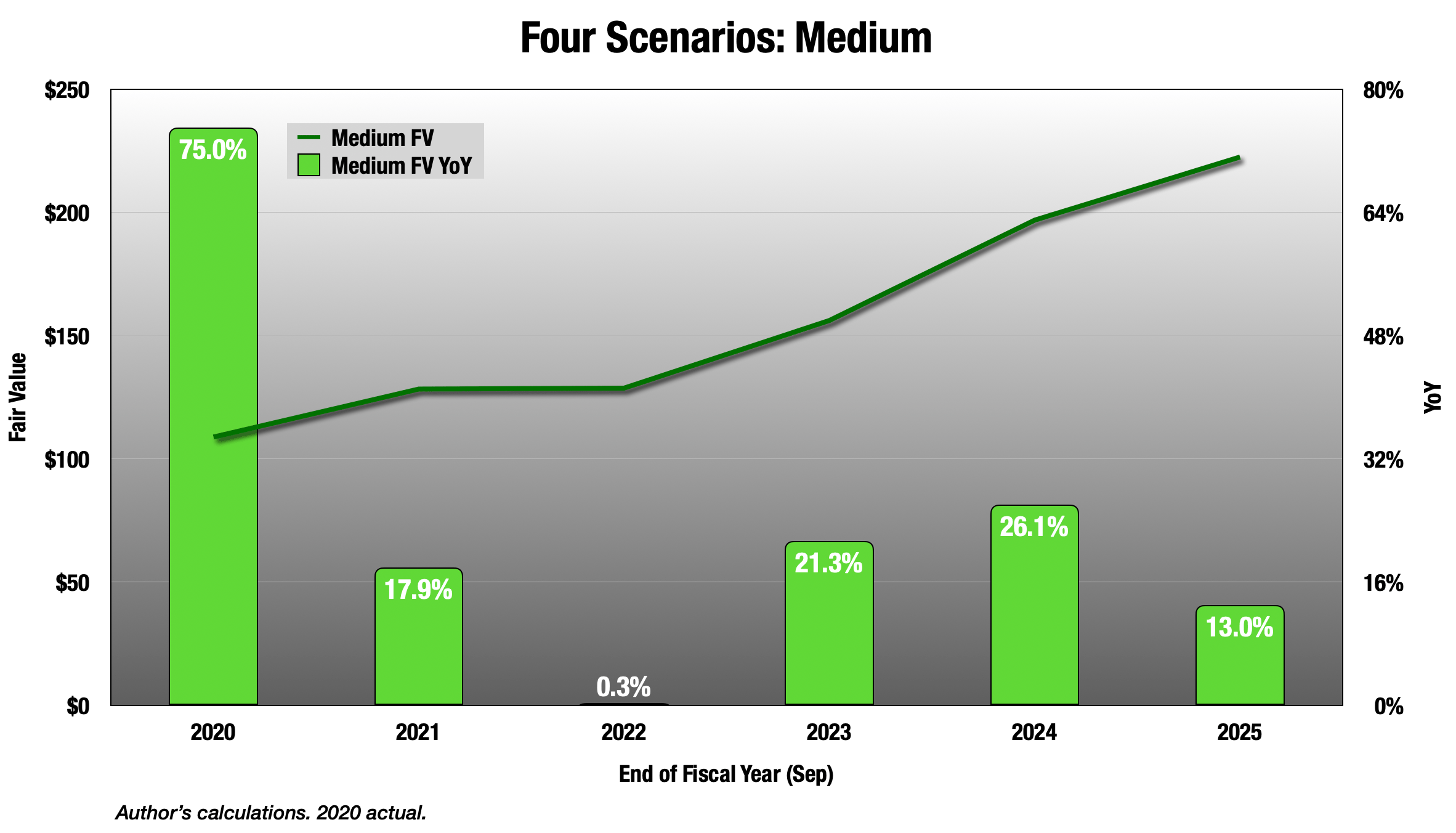

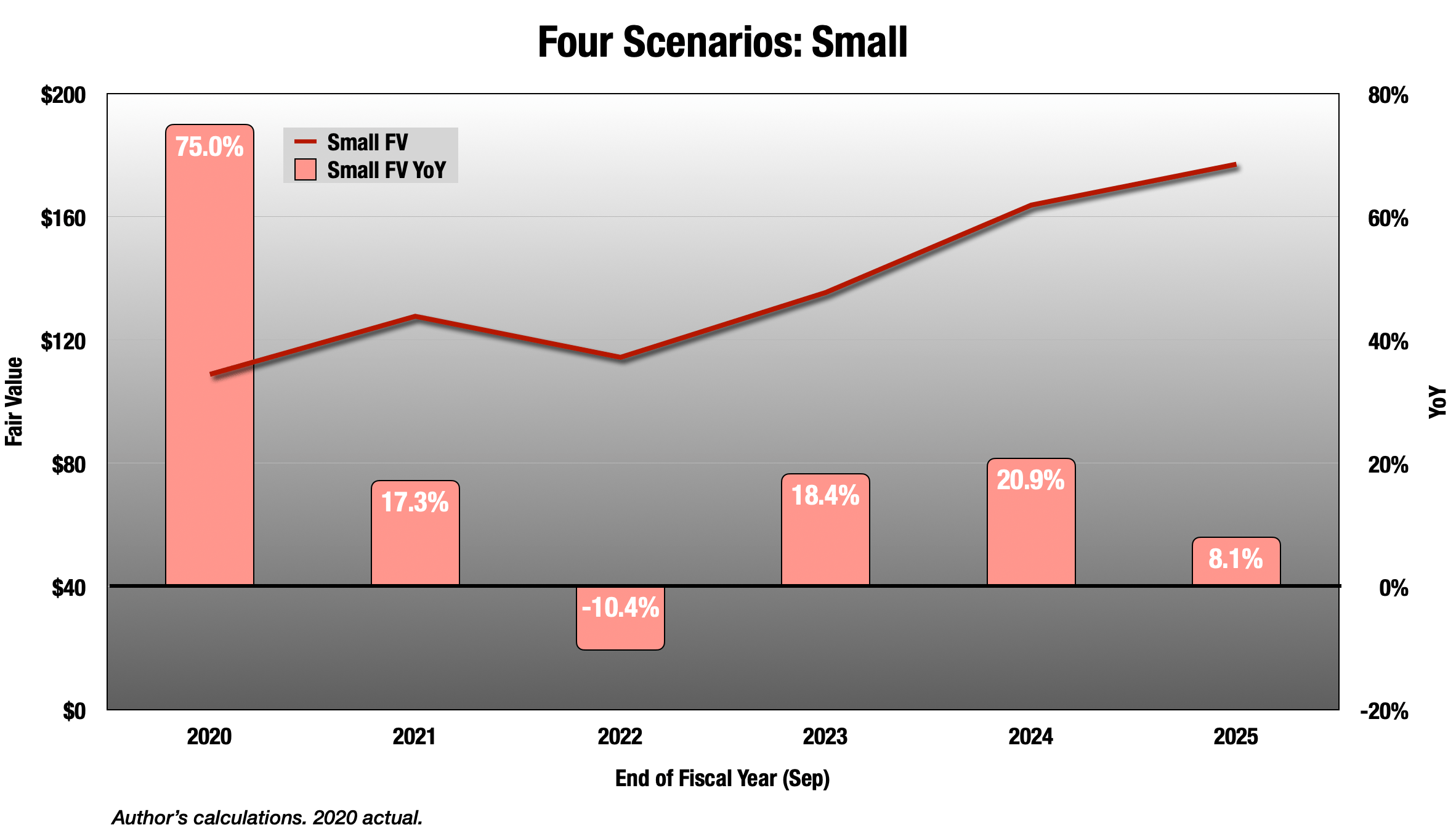

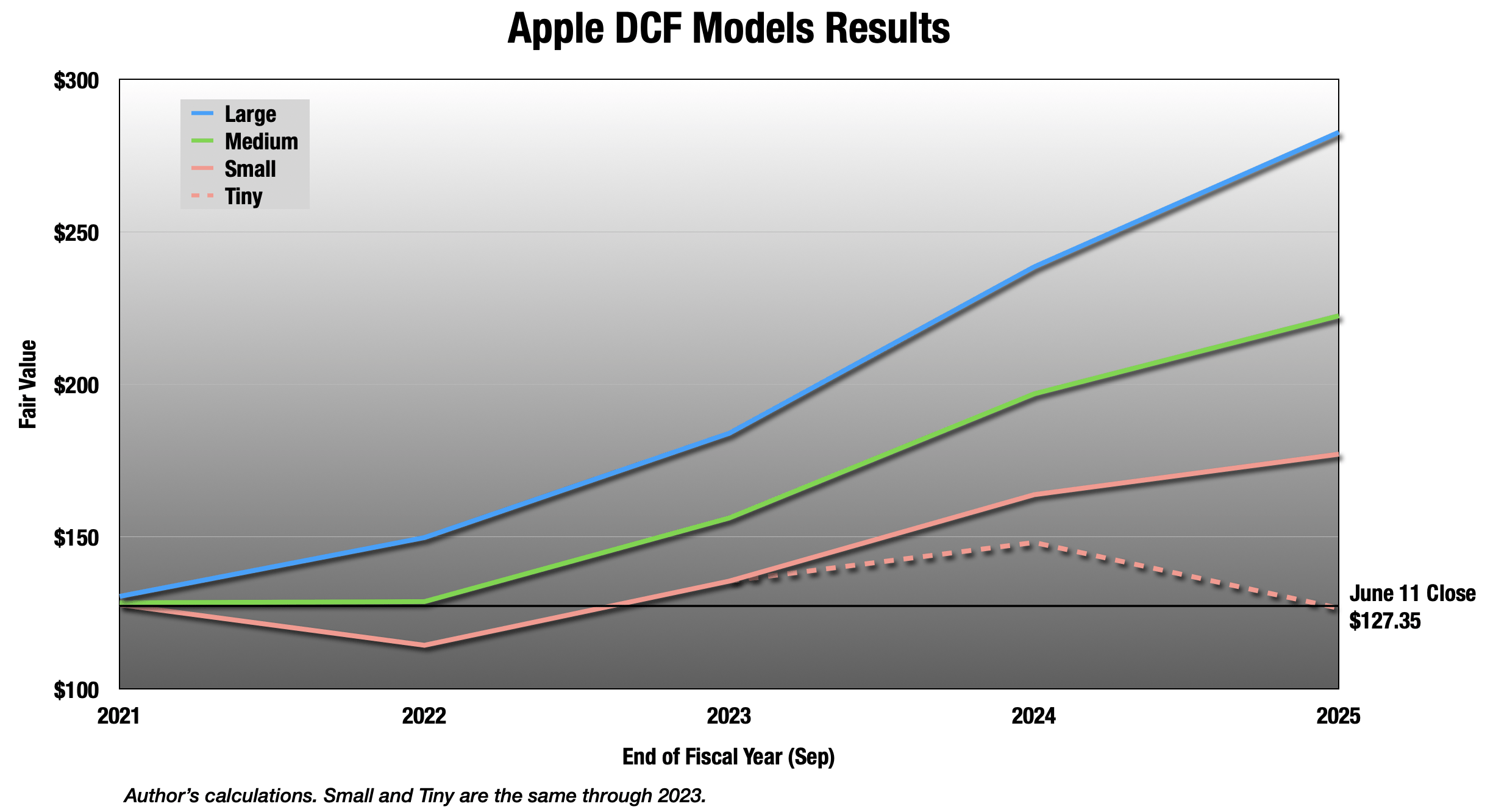

Based on current market dynamics and growth drivers, analysts project strong financial performance for Apple in the years leading up to 2025. Revenue is expected to grow at a compound annual growth rate (CAGR) of approximately 5%, driven by the aforementioned growth drivers. Earnings per share (EPS) are also expected to increase at a similar rate, reflecting the company’s continued profitability.

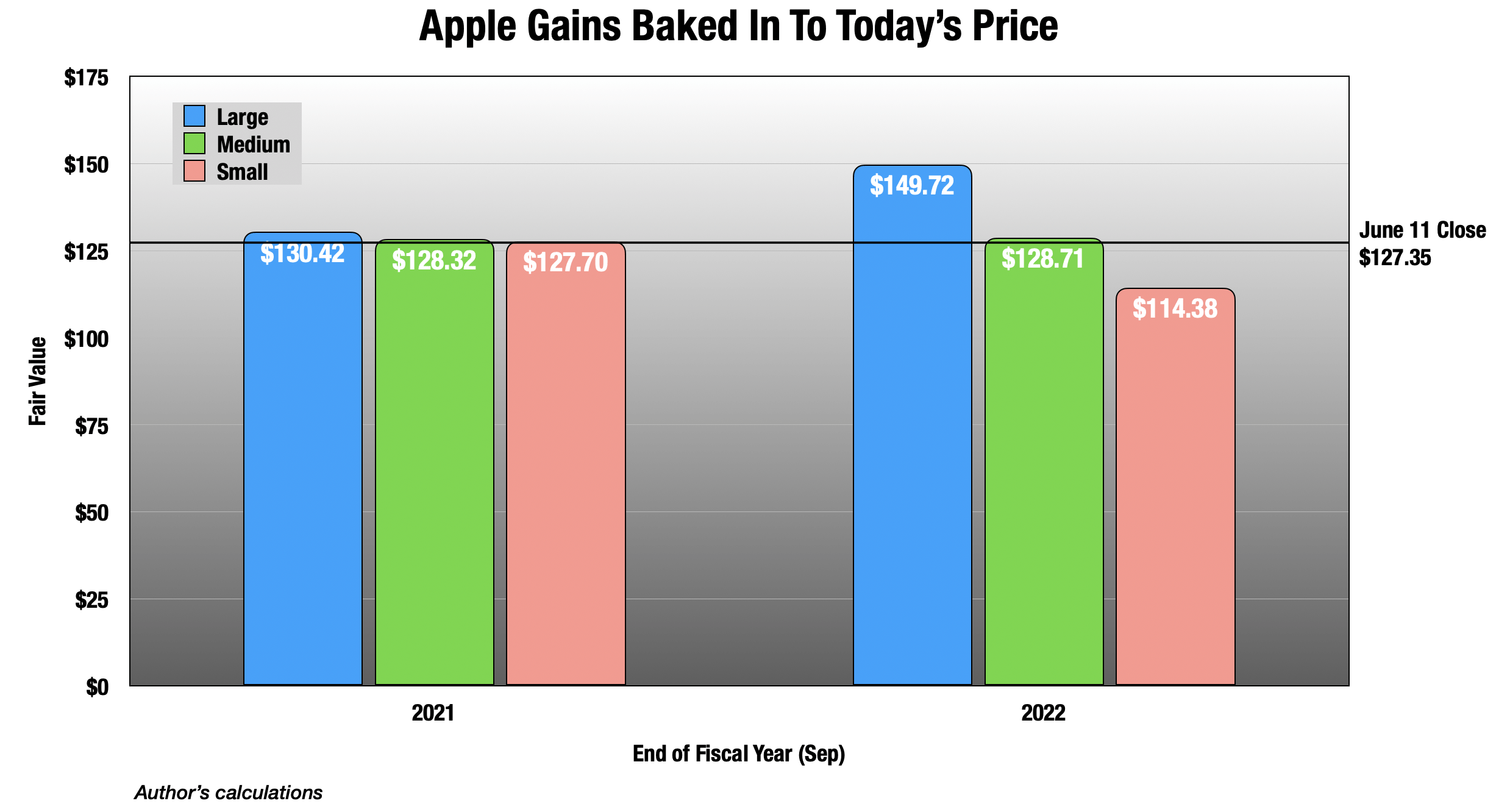

Stock Price Forecast

Analysts’ stock price forecasts for Apple in 2025 vary, but most predict continued growth. The average price target among analysts is around $250, representing a potential upside of over 40% from current levels. This forecast is based on the company’s strong financial performance, growth drivers, and the belief that Apple will continue to innovate and expand its product portfolio.

Risks and Challenges

While Apple’s prospects appear promising, the company faces several risks and challenges that could impact its stock performance:

- Economic Downturn: A global economic slowdown could reduce consumer spending on Apple products, impacting revenue and earnings.

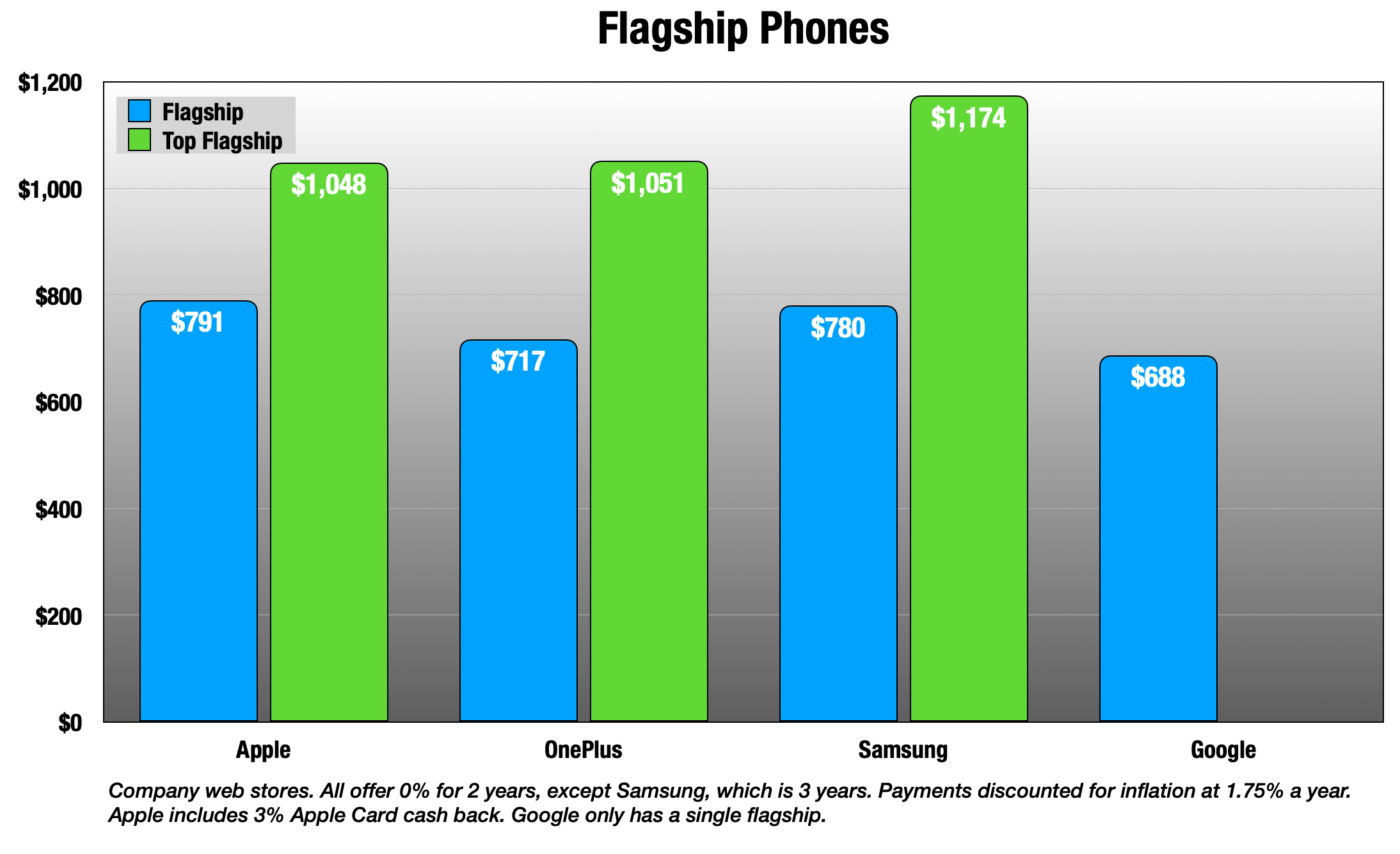

- Competition: Apple faces intense competition from other tech giants, including Samsung, Google, and Amazon. Increased competition could erode market share and margins.

- Supply Chain Disruptions: Apple’s reliance on global supply chains poses risks to production and delivery of its products. Supply chain disruptions can lead to shortages, delays, and increased costs.

- Regulatory Scrutiny: Apple has faced increased regulatory scrutiny in recent years, including antitrust investigations and data privacy concerns. Regulatory actions could impact the company’s operations and profitability.

Investment Thesis

Despite the risks and challenges, Apple stock remains a compelling investment opportunity for the following reasons:

- Strong Brand Recognition: Apple has one of the most recognizable and trusted brands in the world, giving it a competitive advantage in the consumer electronics market.

- Innovative Products and Services: Apple’s history of innovation and its ability to create new products and services that meet consumer needs will continue to drive growth.

- Loyal Customer Base: Apple has cultivated a loyal customer base that is willing to pay a premium for its products and services.

- Strong Financial Position: Apple has a strong balance sheet with ample cash reserves, providing it with financial flexibility and the ability to invest in growth initiatives.

Conclusion

Apple’s stock is expected to continue its upward trajectory in the years leading up to 2025. Driven by strong growth drivers, financial performance, and a loyal customer base, the company is well-positioned to maintain its dominance in the consumer electronics market. While risks and challenges exist, Apple’s strong brand recognition, innovative products, and financial strength make it a compelling investment opportunity for long-term investors.

Closure

Thus, we hope this article has provided valuable insights into Apple Stock 2025 Forecast: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!