ACA Premium Subsidy Table in 2025

Related Articles: ACA Premium Subsidy Table in 2025

- 2025 Ford Expedition: The Ultimate Adventure SUV

- 2025 GMC Yukon: A Premium SUV With Unparalleled Capability And Style

- Fast & Furious 11: A Nitrous-Fueled Saga Reaches Its Climax

- The Big Ten 2025 Teams: A Comprehensive Overview

- Latest Trends In Kitchen Design 2025: A Culinary Revolution

Introduction

With great pleasure, we will explore the intriguing topic related to ACA Premium Subsidy Table in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about ACA Premium Subsidy Table in 2025

ACA Premium Subsidy Table in 2025

Introduction

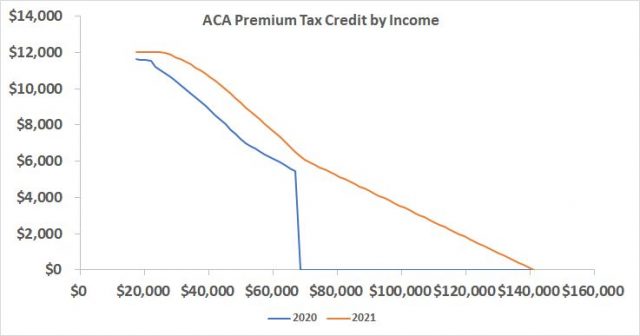

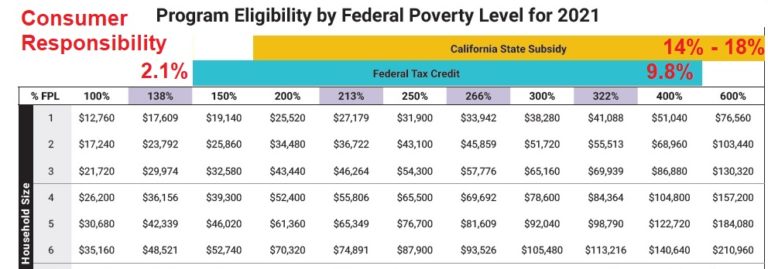

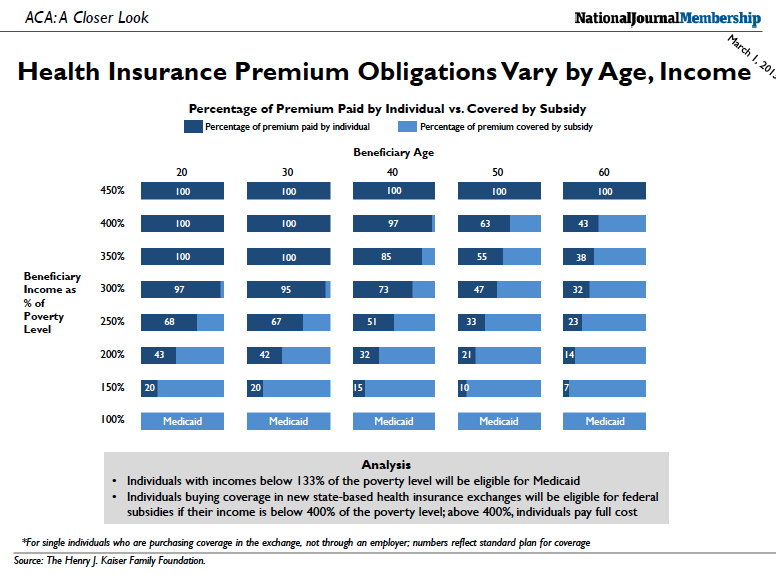

The Affordable Care Act (ACA), also known as Obamacare, has been a controversial piece of legislation since its inception in 2010. One of the key components of the ACA is the premium subsidy program, which helps low- and middle-income Americans afford health insurance. The premium subsidy table for 2025 has recently been released, and it shows that the subsidies will continue to be available to a wide range of Americans.

How the Premium Subsidy Works

The premium subsidy is a tax credit that is applied to the cost of health insurance premiums. The amount of the subsidy is based on the taxpayer’s income, family size, and the cost of the health insurance plan. The subsidy is available to individuals and families who purchase health insurance through the Health Insurance Marketplace.

Who is Eligible for the Premium Subsidy?

To be eligible for the premium subsidy, you must meet the following requirements:

- You must be a U.S. citizen or legal resident.

- You must not be incarcerated.

- You must not be eligible for Medicare or Medicaid.

- Your income must be below a certain level.

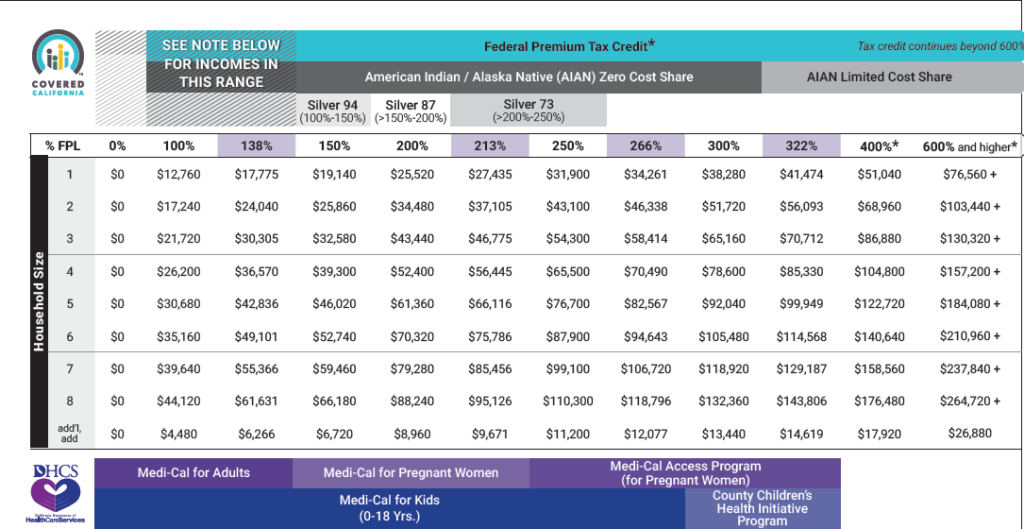

The income limit for the premium subsidy varies depending on your family size. For 2025, the income limit for a single person is $51,520. For a family of four, the income limit is $106,000.

How to Apply for the Premium Subsidy

To apply for the premium subsidy, you must complete the Form 8962, Premium Tax Credit. You can download the form from the IRS website or you can get it from your health insurance provider. You can also apply for the premium subsidy when you file your taxes.

The Premium Subsidy Table for 2025

The premium subsidy table for 2025 shows the amount of the subsidy that is available to taxpayers based on their income and family size. The table is divided into two sections: one for individuals and one for families.

Individuals

| Income | Subsidy Percentage |

|---|---|

| $0 – $17,000 | 100% |

| $17,001 – $21,000 | 95% |

| $21,001 – $25,000 | 90% |

| $25,001 – $29,000 | 85% |

| $29,001 – $33,000 | 80% |

| $33,001 – $37,000 | 75% |

| $37,001 – $41,000 | 70% |

| $41,001 – $45,000 | 65% |

| $45,001 – $49,000 | 60% |

| $49,001 – $51,520 | 55% |

Families

| Income | Subsidy Percentage |

|---|---|

| $0 – $25,500 | 100% |

| $25,501 – $31,500 | 95% |

| $31,501 – $37,500 | 90% |

| $37,501 – $43,500 | 85% |

| $43,501 – $49,500 | 80% |

| $49,501 – $55,500 | 75% |

| $55,501 – $61,500 | 70% |

| $61,501 – $67,500 | 65% |

| $67,501 – $73,500 | 60% |

| $73,501 – $79,500 | 55% |

| $79,501 – $85,500 | 50% |

| $85,501 – $91,500 | 45% |

| $91,501 – $97,500 | 40% |

| $97,501 – $103,500 | 35% |

| $103,501 – $106,000 | 30% |

Conclusion

The premium subsidy is a valuable tax credit that can help low- and middle-income Americans afford health insurance. The premium subsidy table for 2025 shows that the subsidies will continue to be available to a wide range of Americans. If you are eligible for the premium subsidy, you should apply for it when you file your taxes.

Closure

Thus, we hope this article has provided valuable insights into ACA Premium Subsidy Table in 2025. We hope you find this article informative and beneficial. See you in our next article!