ACA Income Limits for Subsidies 2025 Chart: Understanding Eligibility and Savings

Related Articles: ACA Income Limits for Subsidies 2025 Chart: Understanding Eligibility and Savings

- Canada Immigration Levels Plan 2025 To 2026: A Path To A Stronger And More Resilient Future

- Winter Classic Future Sites: A Glimpse Into The Future Of Outdoor Hockey

- Leave Year End 2025: A Comprehensive Guide

- 22025 Seagull Street: A Coastal Paradise In Rodanthe, North Carolina

- 2025 Calendar Printable PDF With Holidays: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to ACA Income Limits for Subsidies 2025 Chart: Understanding Eligibility and Savings. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about ACA Income Limits for Subsidies 2025 Chart: Understanding Eligibility and Savings

ACA Income Limits for Subsidies 2025 Chart: Understanding Eligibility and Savings

The Affordable Care Act (ACA), also known as Obamacare, is a comprehensive health care reform law enacted in the United States in 2010. One of the key provisions of the ACA is the provision of subsidies to help low- and moderate-income individuals and families afford health insurance coverage. These subsidies are available through the Health Insurance Marketplace, a government-run website where individuals and families can shop for and enroll in health insurance plans.

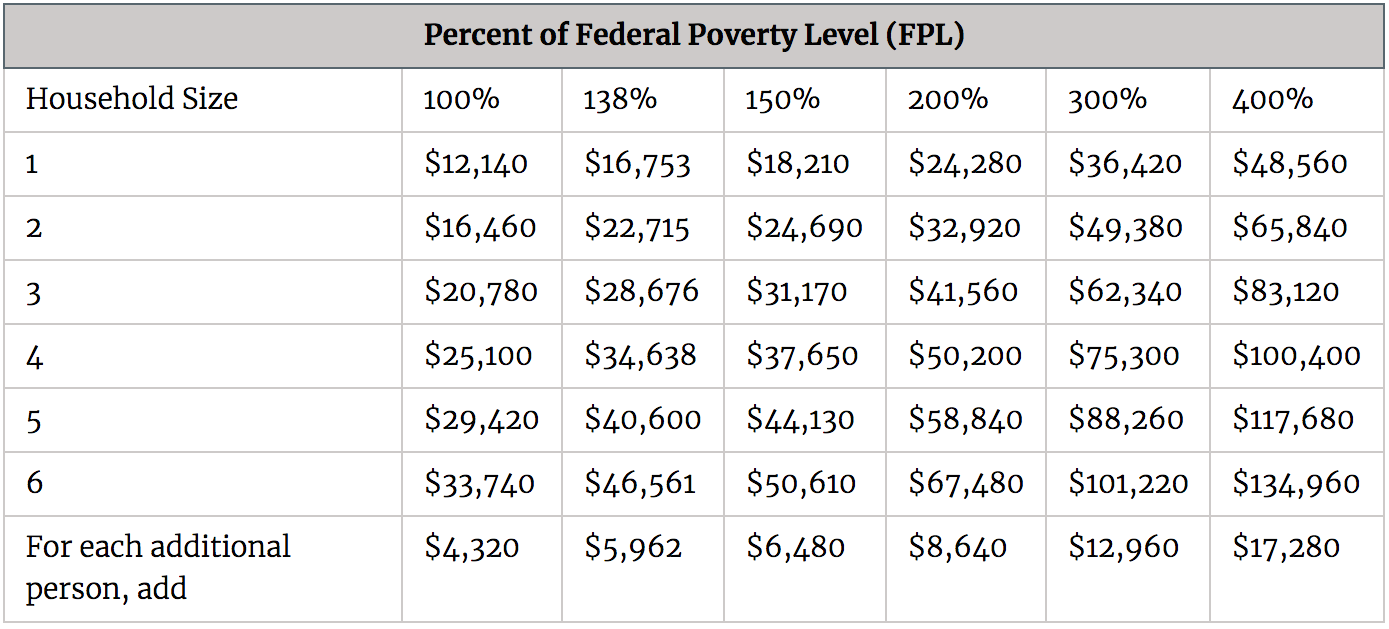

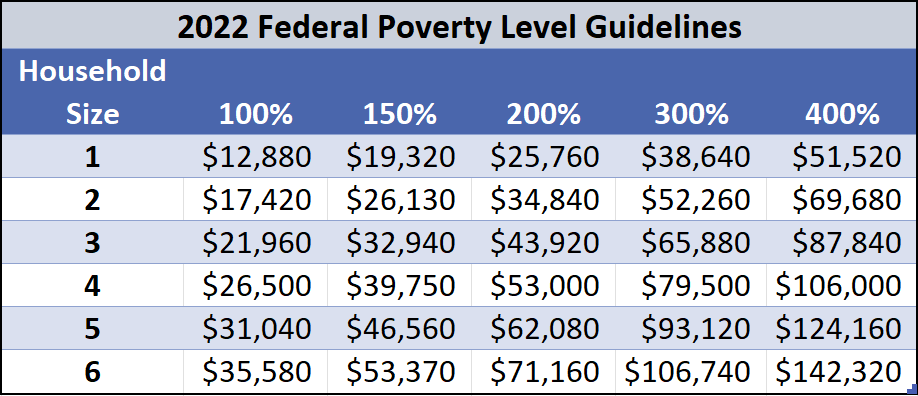

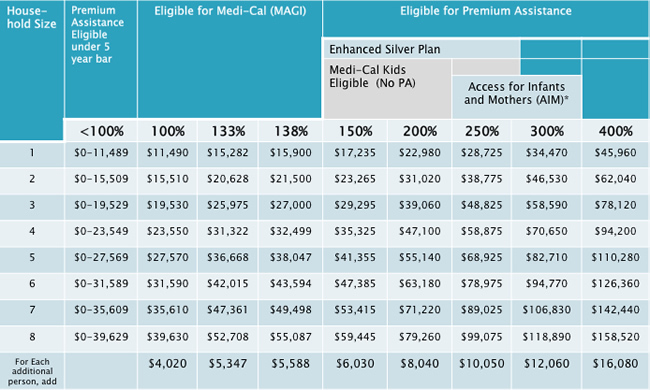

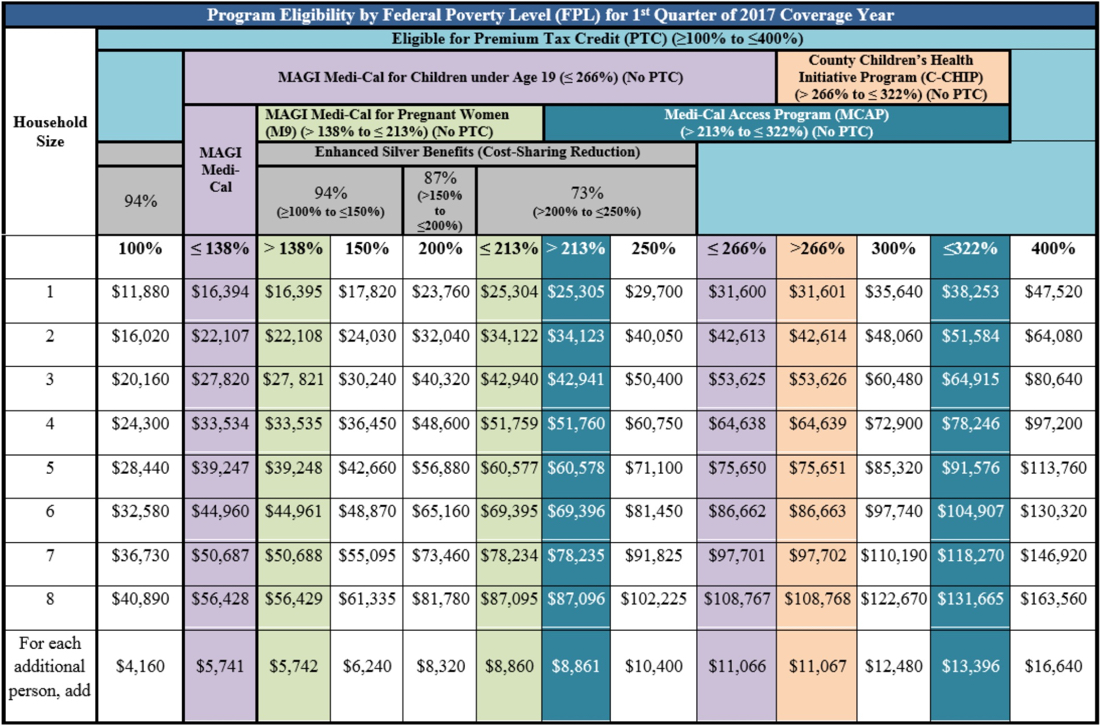

The eligibility for ACA subsidies is based on income. The income limits for subsidies vary depending on the year and the size of the household. For 2025, the income limits for subsidies are as follows:

| Household Size | Income Limit for Subsidy Eligibility | Percentage of Federal Poverty Level |

|---|---|---|

| 1 | $53,920 | 400% |

| 2 | $73,120 | 400% |

| 3 | $92,320 | 400% |

| 4 | $111,520 | 400% |

| 5 | $130,720 | 400% |

| 6 | $149,920 | 400% |

| 7 | $169,120 | 400% |

| 8 | $188,320 | 400% |

How to Determine Your Eligibility for Subsidies

To determine if you are eligible for ACA subsidies, you need to compare your household income to the income limits for your household size. If your household income is below the income limit, you may be eligible for subsidies.

You can use the following formula to calculate your household income:

Household Income = Total Income of All Household MembersTypes of Subsidies Available

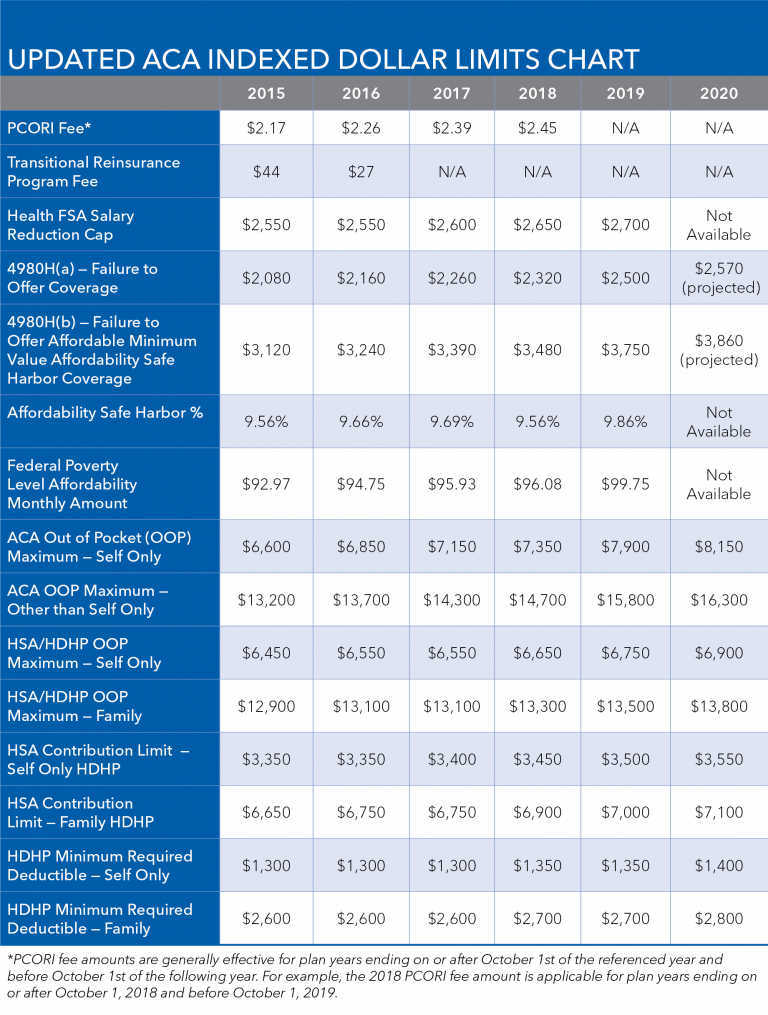

There are two types of ACA subsidies available:

- Premium tax credits: These subsidies help you pay for your monthly health insurance premiums.

- Cost-sharing reductions: These subsidies help you pay for out-of-pocket costs, such as deductibles, copayments, and coinsurance.

How to Apply for Subsidies

You can apply for ACA subsidies when you enroll in a health insurance plan through the Health Insurance Marketplace. You can apply online, by phone, or by mail.

When you apply for subsidies, you will need to provide information about your household income and other factors that affect your eligibility. You will also need to provide proof of your income, such as a pay stub or tax return.

How Much Can You Save with Subsidies?

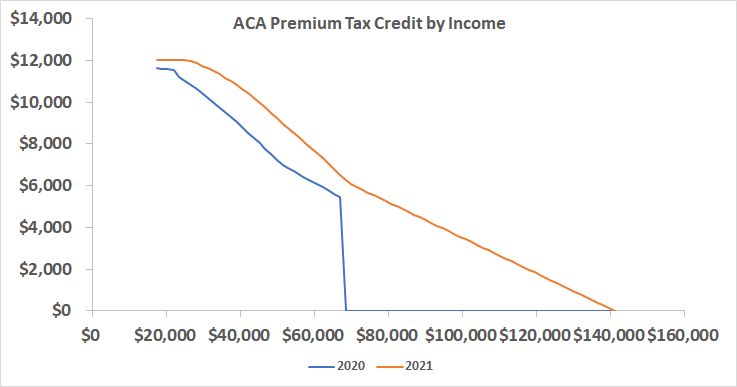

The amount of savings you can get with ACA subsidies depends on your income and the type of health insurance plan you choose. However, subsidies can significantly reduce the cost of health insurance coverage.

For example, a family of four with an income of $50,000 could save an average of $5,000 per year on health insurance premiums with ACA subsidies.

Conclusion

ACA subsidies are a valuable resource for low- and moderate-income individuals and families who need help affording health insurance coverage. If you are eligible for subsidies, you can significantly reduce the cost of your health insurance premiums and out-of-pocket costs.

To learn more about ACA subsidies and how to apply, visit the Health Insurance Marketplace website or contact a health insurance agent.

Closure

Thus, we hope this article has provided valuable insights into ACA Income Limits for Subsidies 2025 Chart: Understanding Eligibility and Savings. We appreciate your attention to our article. See you in our next article!