2025 IRMAA Brackets Part D

Related Articles: 2025 IRMAA Brackets Part D

- World Population 2025: Projections, Trends, And Implications

- How To Sync Your 2025 Calendar With Your Devices

- Best 2025 Target Funds: A Comprehensive Guide For Investors

- Pasco County School Calendar 2024-2025: A Comprehensive Overview

- 2025 Aston Martin Vantage: A Vision Of Performance And Precision

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 IRMAA Brackets Part D. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRMAA Brackets Part D

2025 IRMAA Brackets Part D

Introduction

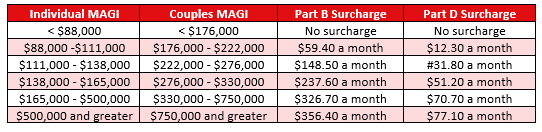

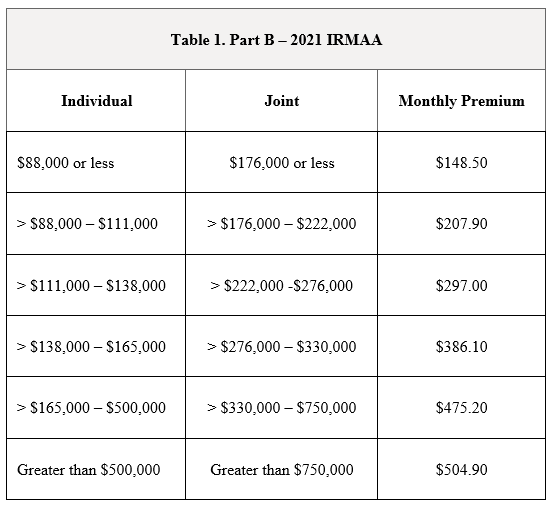

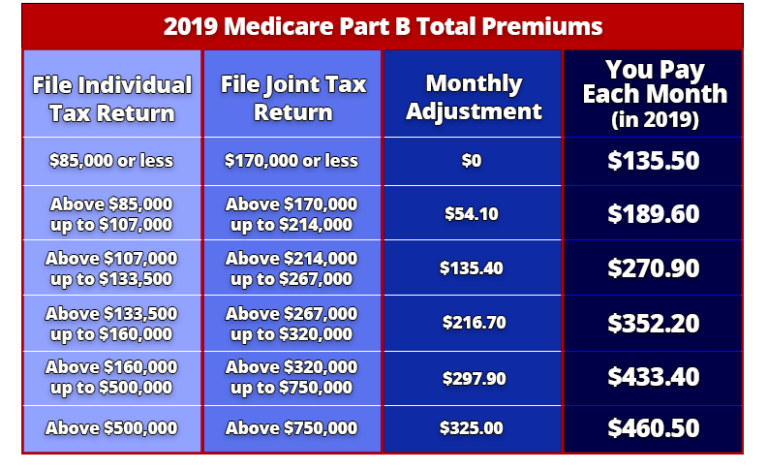

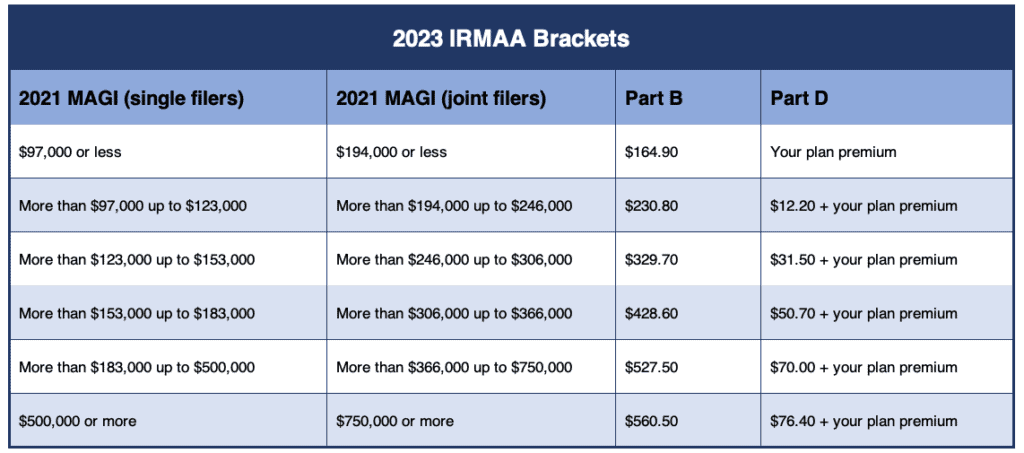

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge added to Part D prescription drug plan premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually based on the Social Security Administration’s (SSA) cost-of-living adjustments (COLAs). For 2025, the IRMAA brackets have been increased slightly from 2024.

2025 IRMAA Brackets

The 2025 IRMAA brackets for Part D premiums are as follows:

| Filing Status | Income Threshold | IRMAA Surcharge |

|---|---|---|

| Single | $97,000 | $12.60 per month |

| Married Filing Jointly | $194,000 | $12.60 per month |

| Married Filing Separately | $97,000 | $6.30 per month |

| Head of Household | $145,500 | $12.60 per month |

How IRMAA is Calculated

IRMAA is calculated based on the modified adjusted gross income (MAGI) reported on your federal income tax return. MAGI is your adjusted gross income (AGI) plus certain tax-exempt income, such as municipal bond interest.

To determine your IRMAA bracket, you will need to compare your MAGI to the income thresholds listed above. If your MAGI exceeds the threshold for your filing status, you will be subject to the IRMAA surcharge.

IRMAA Surcharge Amounts

The IRMAA surcharge is a flat amount that is added to your Part D premium each month. The surcharge amount varies depending on your income and filing status.

For 2025, the IRMAA surcharge amounts are as follows:

| Income Threshold | Surcharge Amount |

|---|---|

| $97,000 – $112,000 | $12.60 per month |

| $112,000 – $127,000 | $37.80 per month |

| $127,000 – $142,000 | $63.00 per month |

| $142,000 – $157,000 | $88.20 per month |

| Over $157,000 | $113.40 per month |

Exceptions to IRMAA

There are a few exceptions to the IRMAA surcharge. You may not be subject to IRMAA if you:

- Are eligible for Medicaid

- Are enrolled in a Medicare Savings Account (MSA)

- Are a low-income beneficiary (LIB)

- Have certain disabilities or chronic illnesses

Impact of IRMAA on Part D Premiums

IRMAA can significantly increase the cost of Part D prescription drug coverage. For individuals with higher incomes, the IRMAA surcharge can add hundreds of dollars to their annual premiums.

If you are subject to IRMAA, it is important to shop around for a Part D plan that offers low premiums and deductibles. You may also want to consider enrolling in a Medicare Advantage plan, which may offer lower out-of-pocket costs for prescription drugs.

Conclusion

The 2025 IRMAA brackets have been adjusted slightly from 2024. Individuals with higher incomes should be aware of the potential impact of IRMAA on their Part D premiums. By understanding the IRMAA brackets and exceptions, you can make informed decisions about your prescription drug coverage.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRMAA Brackets Part D. We appreciate your attention to our article. See you in our next article!