2025 IRMAA Brackets for Medicare

Related Articles: 2025 IRMAA Brackets for Medicare

- IR 2025: Novas Regras Para O Mercado De Seguro De Automóveis

- 2025 Ontario Cleveland, OH: A Vision For A Thriving City

- 2025 Chevrolet Traverse Specs: A Comprehensive Guide

- Will 2025 Be A Leap Year?

- 2025 UK Free Printable Calendar: Plan Your Year Ahead With Ease

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 IRMAA Brackets for Medicare. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRMAA Brackets for Medicare

2025 IRMAA Brackets for Medicare

Introduction

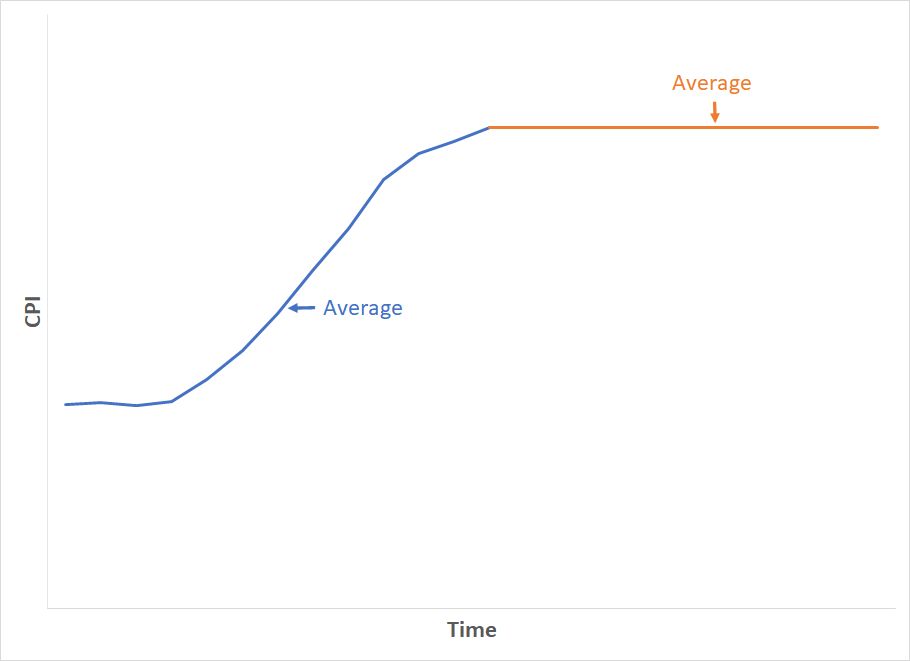

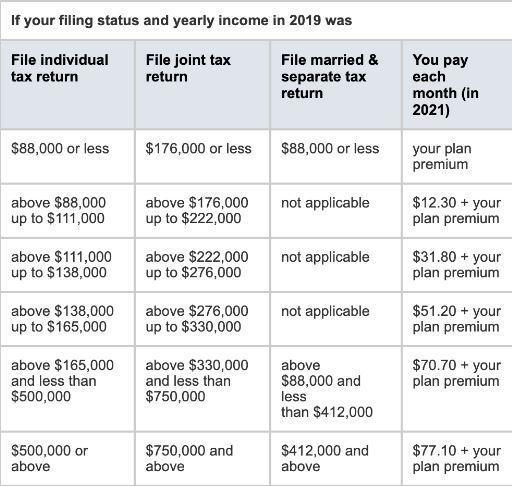

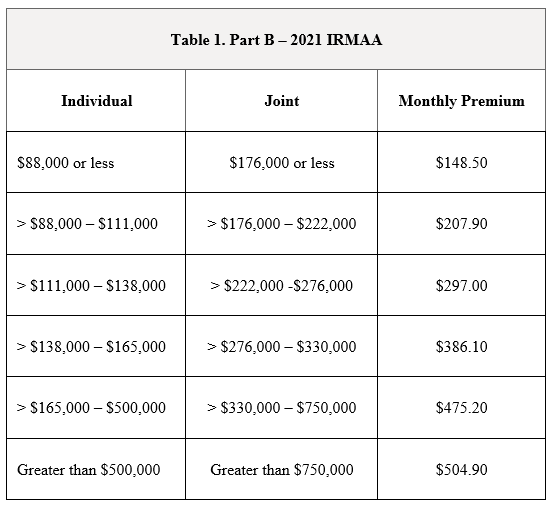

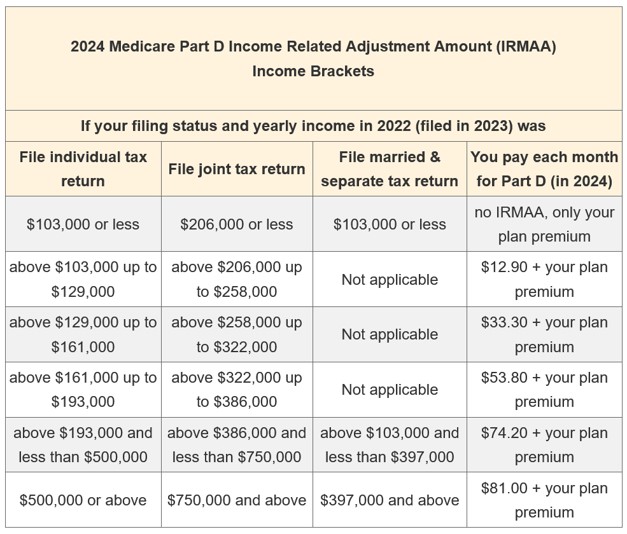

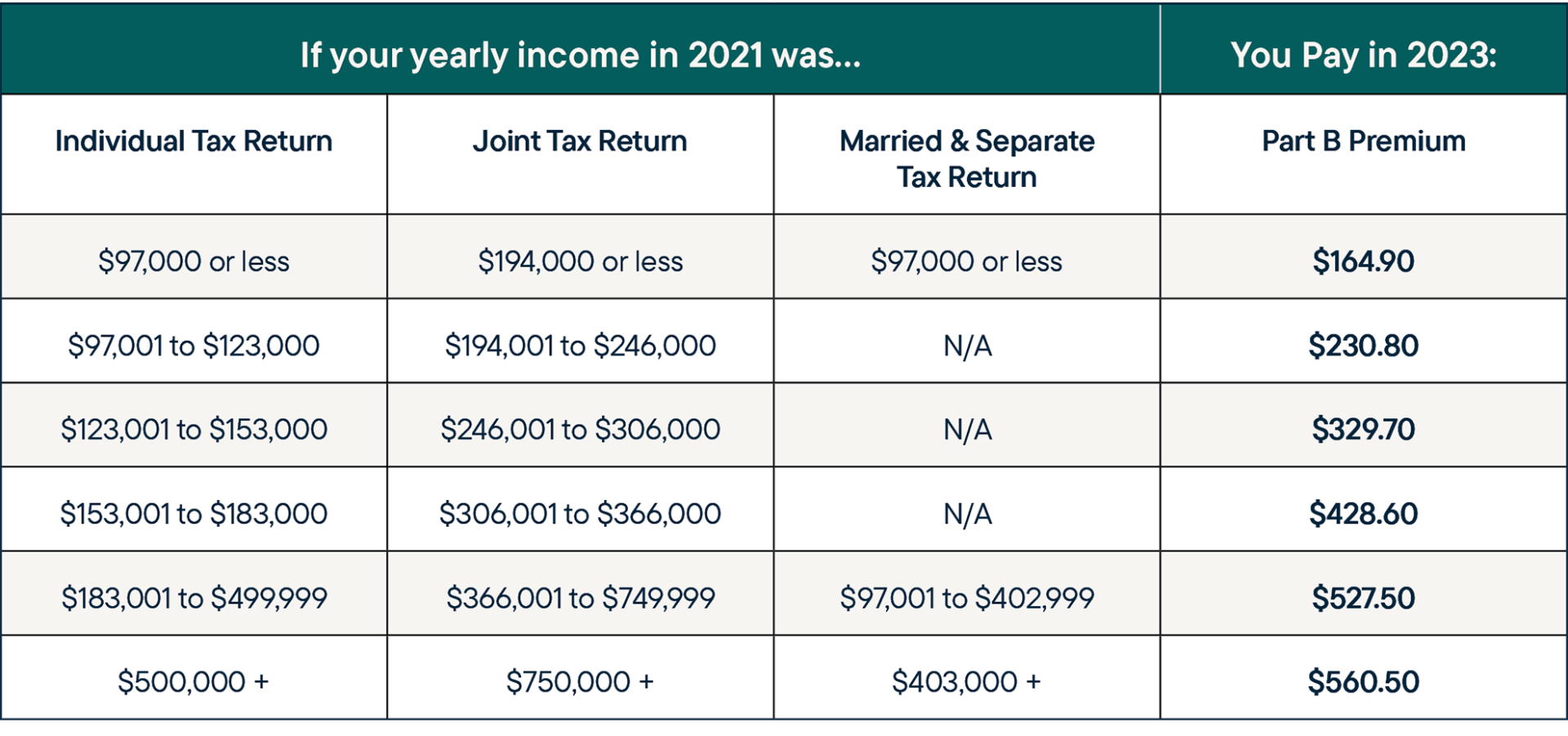

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge added to Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. For 2025, the IRMAA brackets have been updated to account for inflation.

IRMAA Brackets for 2025

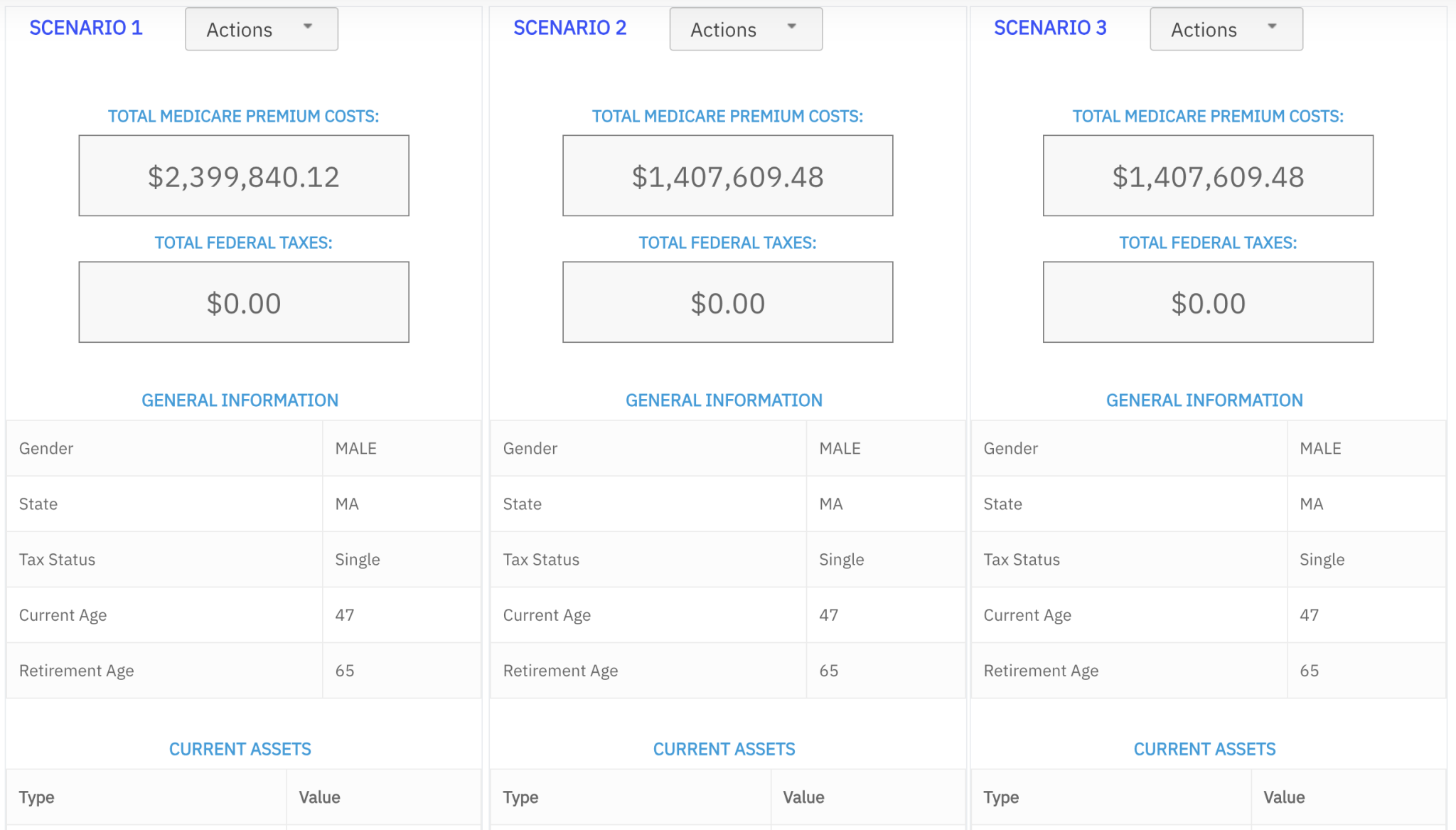

The following table shows the IRMAA brackets for 2025:

| Filing Status | Modified Adjusted Gross Income (MAGI) | Part B Surcharge | Part D Surcharge |

|---|---|---|---|

| Single | $97,000 or more | $230.80 | $77.90 |

| Married filing jointly | $194,000 or more | $230.80 | $77.90 |

| Married filing separately | $97,000 or more | $115.40 | $38.90 |

| Head of household | $133,000 or more | $230.80 | $77.90 |

How to Calculate Your IRMAA

To calculate your IRMAA, you will need to know your modified adjusted gross income (MAGI). Your MAGI is your adjusted gross income (AGI) plus any tax-exempt interest. You can find your AGI on line 8b of your Form 1040.

Once you know your MAGI, you can use the table above to determine your IRMAA bracket. The surcharge amount for your bracket will be added to your Part B and Part D premiums.

Example

Let’s say you are a single taxpayer with a MAGI of $100,000. According to the table above, you would be in the $97,000 or more bracket. This means that you would pay an additional $230.80 per month for Part B and $77.90 per month for Part D.

Paying Your IRMAA

Your IRMAA will be added to your Medicare Part B and Part D premiums. You can pay your premiums by mail, online, or over the phone.

Avoiding the IRMAA

There are a few ways to avoid paying the IRMAA. One way is to lower your MAGI. You can do this by increasing your deductions or by contributing to a tax-advantaged retirement account, such as a 401(k) or IRA.

Another way to avoid the IRMAA is to qualify for a hardship exemption. To qualify for a hardship exemption, you must meet certain criteria, such as having high medical expenses or being unable to work due to a disability.

Conclusion

The IRMAA is a surcharge added to Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. For 2025, the IRMAA brackets have been updated to account for inflation.

If you have a higher income, it is important to be aware of the IRMAA and how it will affect your Medicare premiums. There are a few ways to avoid paying the IRMAA, but it is important to weigh the costs and benefits of each option.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRMAA Brackets for Medicare. We appreciate your attention to our article. See you in our next article!