2025 IRMAA Brackets and Premiums: What You Need to Know

Related Articles: 2025 IRMAA Brackets and Premiums: What You Need to Know

- The 2025 Presidential Transition Project: Ensuring A Smooth And Effective Transfer Of Power

- Us Federal Holidays For 2025

- Solana: A Comprehensive Analysis And 2025 Price Prediction

- The 2025 Chevrolet Impala: A Revolutionary Interior

- Cheap Caribbean Cruises 2025: Sail Away To Unforgettable Adventures At Affordable Prices

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 IRMAA Brackets and Premiums: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRMAA Brackets and Premiums: What You Need to Know

2025 IRMAA Brackets and Premiums: What You Need to Know

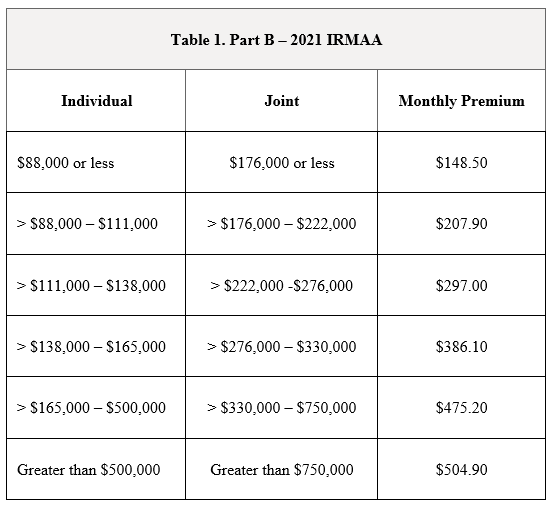

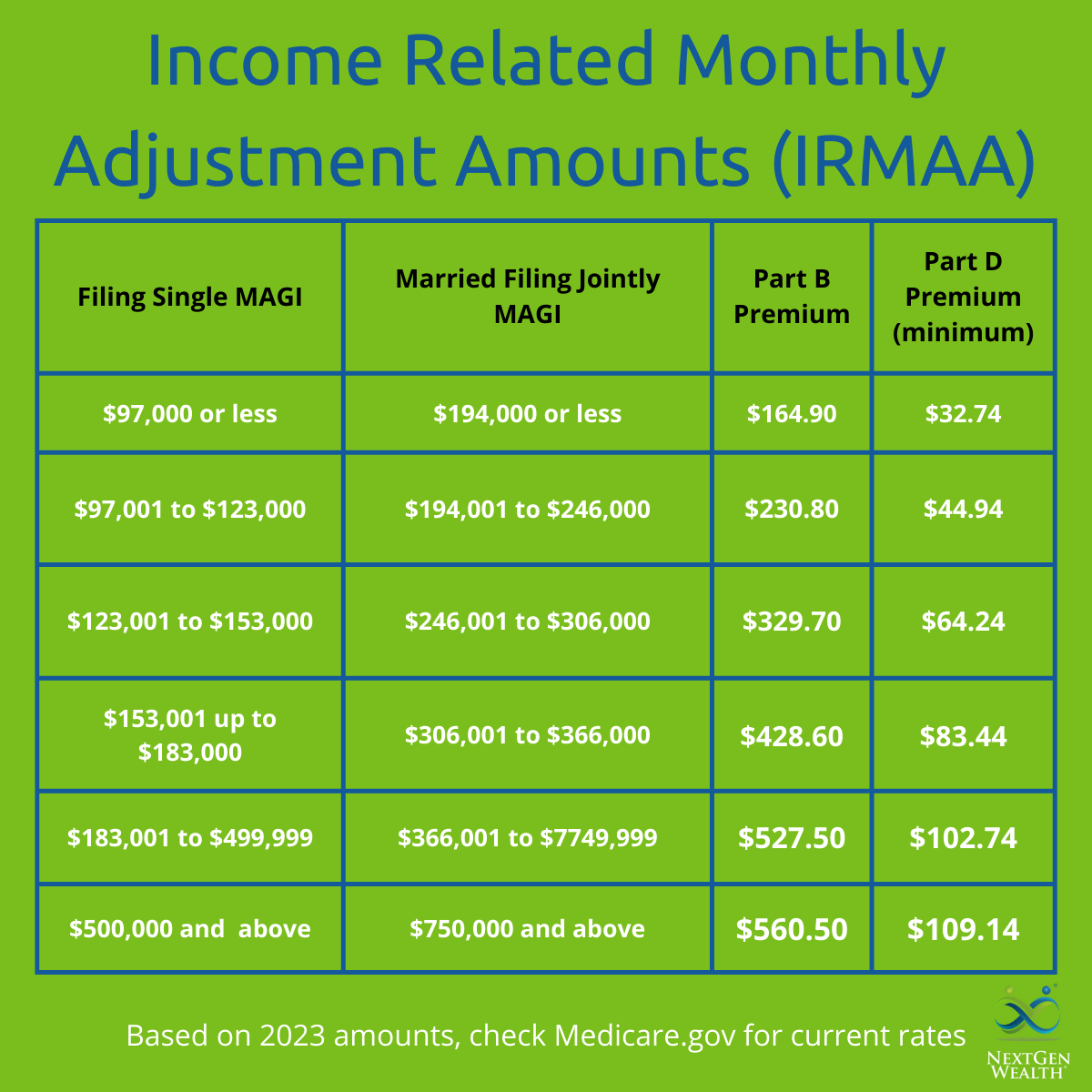

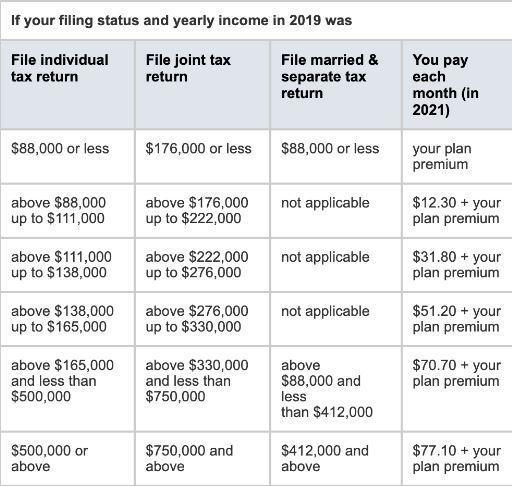

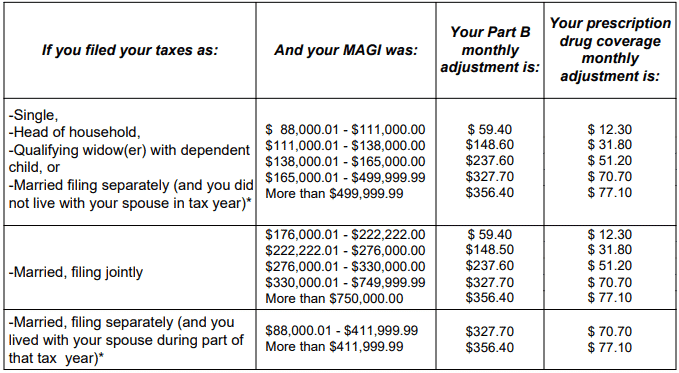

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge that is added to Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets and premiums are adjusted annually to reflect changes in the cost of living.

For 2025, the IRMAA brackets and premiums are as follows:

| Filing Status | Modified Adjusted Gross Income (MAGI) | Part B Premium | Part D Premium |

|---|---|---|---|

| Single | Up to $97,000 | $170.10 | $32.60 |

| Single | $97,001 to $129,000 | $228.60 | $54.30 |

| Single | $129,001 to $161,000 | $335.70 | $77.10 |

| Single | $161,001 or more | $564.70 | $121.80 |

| Married Filing Jointly | Up to $194,000 | $170.10 | $32.60 |

| Married Filing Jointly | $194,001 to $258,000 | $228.60 | $54.30 |

| Married Filing Jointly | $258,001 to $322,000 | $335.70 | $77.10 |

| Married Filing Jointly | $322,001 or more | $564.70 | $121.80 |

| Married Filing Separately | Up to $97,000 | $170.10 | $32.60 |

| Married Filing Separately | $97,001 to $129,000 | $228.60 | $54.30 |

| Married Filing Separately | $129,001 to $161,000 | $335.70 | $77.10 |

| Married Filing Separately | $161,001 or more | $564.70 | $121.80 |

The IRMAA surcharges are applied to the standard Part B and Part D premiums. The standard Part B premium for 2025 is $164.90 per month. The standard Part D premium for 2025 is $31.50 per month.

Individuals who are subject to the IRMAA surcharge will see their Part B and Part D premiums increase by the applicable amount. For example, a single individual with a MAGI of $129,001 to $161,000 will pay a Part B premium of $335.70 per month and a Part D premium of $77.10 per month.

The IRMAA surcharges are designed to help offset the cost of providing Medicare benefits to individuals with higher incomes. The surcharges are based on the assumption that individuals with higher incomes can afford to pay more for their Medicare coverage.

Individuals who are subject to the IRMAA surcharge can take steps to reduce their premiums. One option is to lower their MAGI. This can be done by increasing their deductions or by contributing more to a retirement account. Another option is to switch to a Medicare Advantage plan. Medicare Advantage plans are offered by private insurers and typically have lower premiums than traditional Medicare.

If you are subject to the IRMAA surcharge, it is important to understand your options and make the best decision for your financial situation.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRMAA Brackets and Premiums: What You Need to Know. We thank you for taking the time to read this article. See you in our next article!