2025 Federal Income Tax Tables: A Comprehensive Guide

Related Articles: 2025 Federal Income Tax Tables: A Comprehensive Guide

- Oregon Legislative Session 2025: End Date And Key Outcomes

- Fargo, ND Events: July 2025

- Square Root Of 2025 By Estimation

- WASA 2025: Shaping The Future Of Water And Sanitation

- 2025 Kia Soul EV: A Revolutionary Leap In Electric Mobility

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 Federal Income Tax Tables: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Federal Income Tax Tables: A Comprehensive Guide

2025 Federal Income Tax Tables: A Comprehensive Guide

Introduction

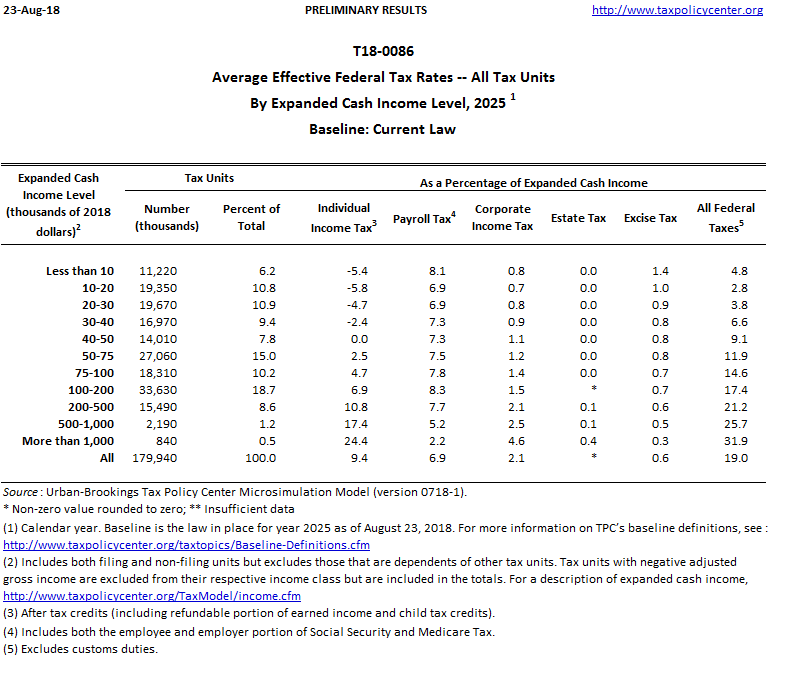

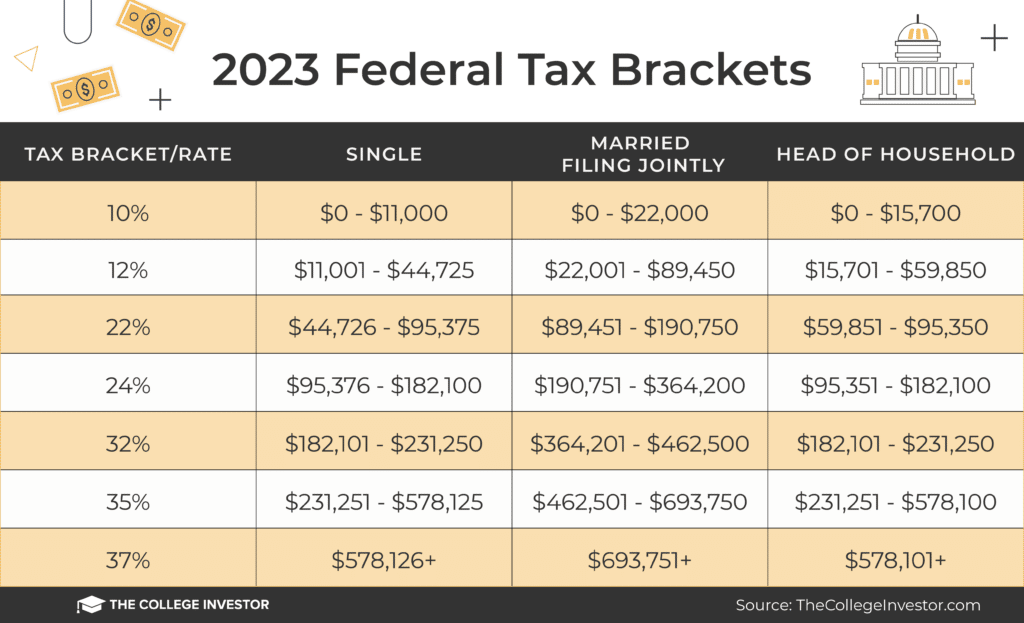

The federal income tax tables are a crucial tool for individuals to calculate their tax liability accurately. These tables outline the tax rates and corresponding taxable income ranges for each filing status. The Internal Revenue Service (IRS) adjusts these tables annually to account for inflation and changes in tax laws. This article provides a comprehensive overview of the 2025 federal income tax tables, including detailed explanations of the various filing statuses, taxable income brackets, and tax rates.

Filing Statuses

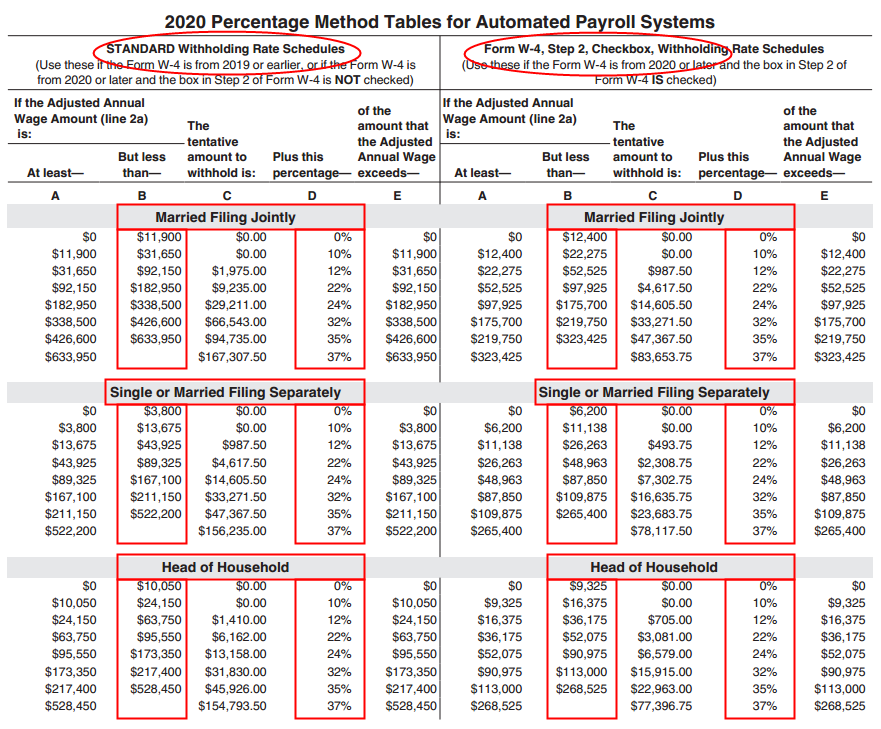

The first step in using the tax tables is to determine your filing status. This status determines which set of tax rates and brackets you will use. The five filing statuses are:

- Single: Individuals who are not married or considered married filing separately.

- Married filing jointly: Married couples who file a joint tax return.

- Married filing separately: Married couples who file separate tax returns.

- Head of household: Unmarried individuals who pay more than half the costs of keeping up a home for themselves and their dependents.

- Qualifying widow(er): Individuals who meet specific criteria, such as being unmarried and having a dependent child.

Taxable Income Brackets

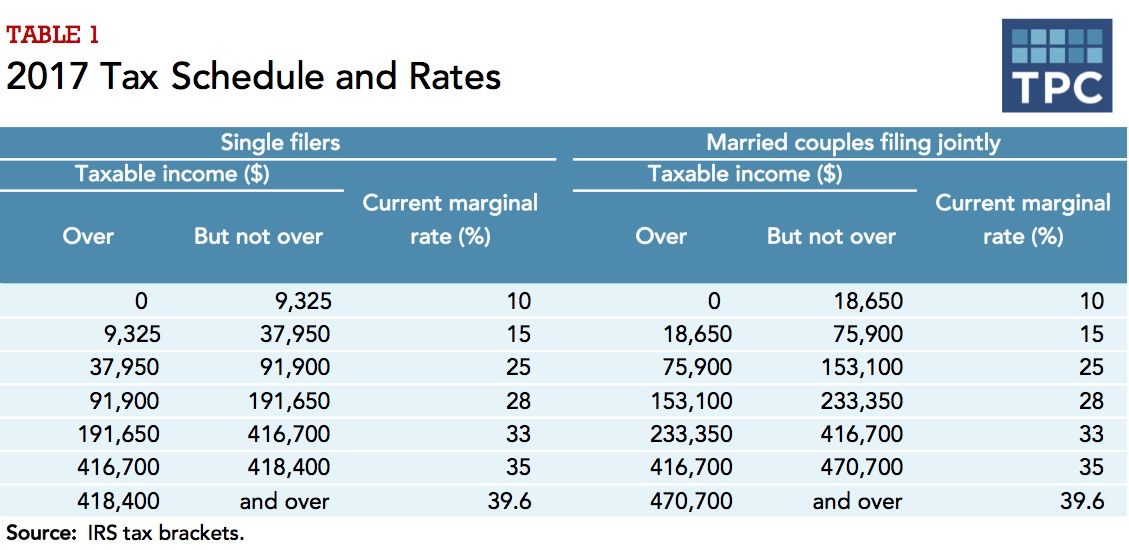

The next step is to determine your taxable income, which is your total income minus allowable deductions and exemptions. The tax tables are divided into taxable income brackets, each with its corresponding tax rate. The taxable income brackets for 2025 are as follows:

| **Filing Status | Taxable Income Brackets** | ||||||

|---|---|---|---|---|---|---|---|

| Single | $0-$10,275 | $10,275-$41,775 | $41,775-$89,075 | $89,075-$170,500 | $170,500-$215,950 | $215,950-$539,900 | $539,900+ |

| Married filing jointly | $0-$20,550 | $20,550-$83,550 | $83,550-$178,150 | $178,150-$272,950 | $272,950-$431,900 | $431,900-$539,900 | $539,900+ |

| Married filing separately | $0-$10,275 | $10,275-$41,775 | $41,775-$89,075 | $89,075-$136,475 | $136,475-$215,950 | $215,950-$431,900 | $431,900+ |

| Head of household | $0-$13,850 | $13,850-$52,850 | $52,850-$82,500 | $82,500-$144,200 | $144,200-$215,950 | $215,950-$431,900 | $431,900+ |

| Qualifying widow(er) | $0-$20,550 | $20,550-$83,550 | $83,550-$178,150 | $178,150-$272,950 | $272,950-$431,900 | $431,900-$539,900 | $539,900+ |

Tax Rates

The tax rates for 2025 are as follows:

| **Taxable Income | Tax Rate** |

|---|---|

| $0-$10,275 | 10% |

| $10,275-$41,775 | 12% |

| $41,775-$89,075 | 22% |

| $89,075-$170,500 | 24% |

| $170,500-$215,950 | 32% |

| $215,950-$539,900 | 35% |

| $539,900+ | 37% |

Example

To illustrate how to use the tax tables, consider the following example:

- Filing status: Single

- Taxable income: $50,000

Using the tax table for single filers, we find that the taxable income range for $50,000 falls within the $41,775-$89,075 bracket. The corresponding tax rate for this bracket is 22%. Therefore, the individual’s tax liability would be:

Tax liability = Taxable income x Tax rate

Tax liability = $50,000 x 0.22

Tax liability = $11,000Additional Considerations

In addition to the standard tax tables, the IRS also provides special tables for certain situations, such as:

- Alternative Minimum Tax (AMT): An alternative tax calculation that ensures high-income taxpayers pay a minimum amount of tax.

- Child Tax Credit: A tax credit for eligible families with children.

- Earned Income Tax Credit (EITC): A tax credit for low- and moderate-income working individuals and families.

Conclusion

The 2025 federal income tax tables are an essential tool for accurately calculating tax liability. Understanding the different filing statuses, taxable income brackets, and tax rates is crucial for ensuring compliance with tax laws. By utilizing these tables effectively, individuals can minimize their tax burden and maximize their tax savings. It is important to note that tax laws and regulations are subject to change, and it is recommended to consult the IRS website or a tax professional for the most up-to-date information.

Closure

Thus, we hope this article has provided valuable insights into 2025 Federal Income Tax Tables: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!