2025 04 30 Bank Code: A Comprehensive Guide

Related Articles: 2025 04 30 Bank Code: A Comprehensive Guide

- Youngstown 2025: A Vision For The Future

- 2025 UK Free Printable Calendar: Plan Your Year Ahead With Ease

- Project 2025 Immigration: A Comprehensive Blueprint For The Future Of Immigration Policy

- Trends Of The Future In Design

- The Ford Edge 2025: A Vision Of The Future

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 04 30 Bank Code: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 04 30 Bank Code: A Comprehensive Guide

2025 04 30 Bank Code: A Comprehensive Guide

Introduction

The 2025 04 30 bank code is a unique identifier assigned to financial institutions by the American Bankers Association (ABA). This code plays a crucial role in facilitating electronic funds transfers, such as wire transfers and direct deposits. Understanding the purpose and format of the bank code is essential for seamless financial transactions.

Purpose of the Bank Code

The 2025 04 30 bank code serves several important purposes:

- Identification: It uniquely identifies a specific bank or financial institution.

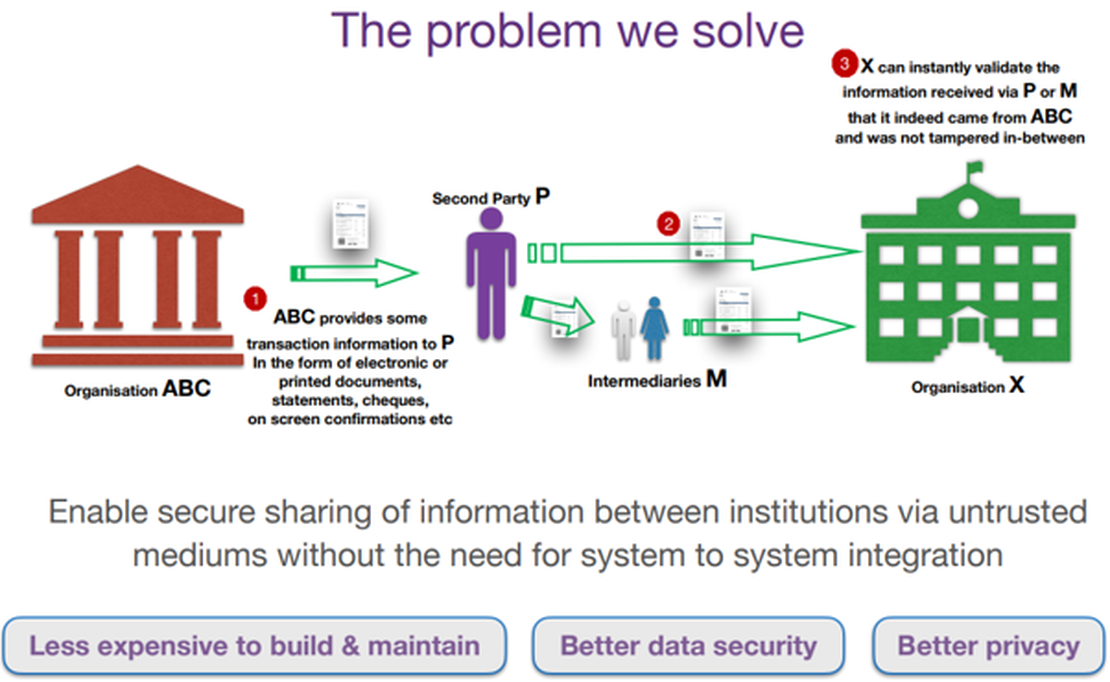

- Routing: It provides instructions to financial networks on how to route funds to the correct destination account.

- Validation: It ensures that the recipient bank is a legitimate financial institution.

Format of the Bank Code

The 2025 04 30 bank code consists of nine digits, divided into three parts:

- First four digits: Represent the Federal Reserve Bank (FRB) district where the bank is located.

- Second two digits: Identify the bank within the FRB district.

- Last three digits: Serve as a check digit to verify the accuracy of the code.

Example: 2025 04 30

Breaking down the example bank code:

- 2025: Indicates the Fifth FRB District (Richmond, Virginia).

- 04: Identifies the bank as Bank of America.

- 30: Serves as the check digit.

Finding the Bank Code

There are several ways to locate the 2025 04 30 bank code:

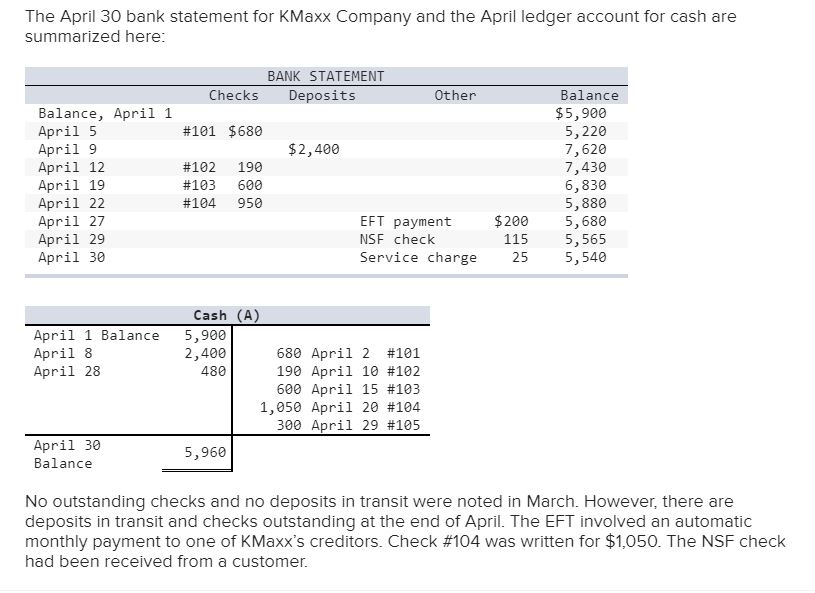

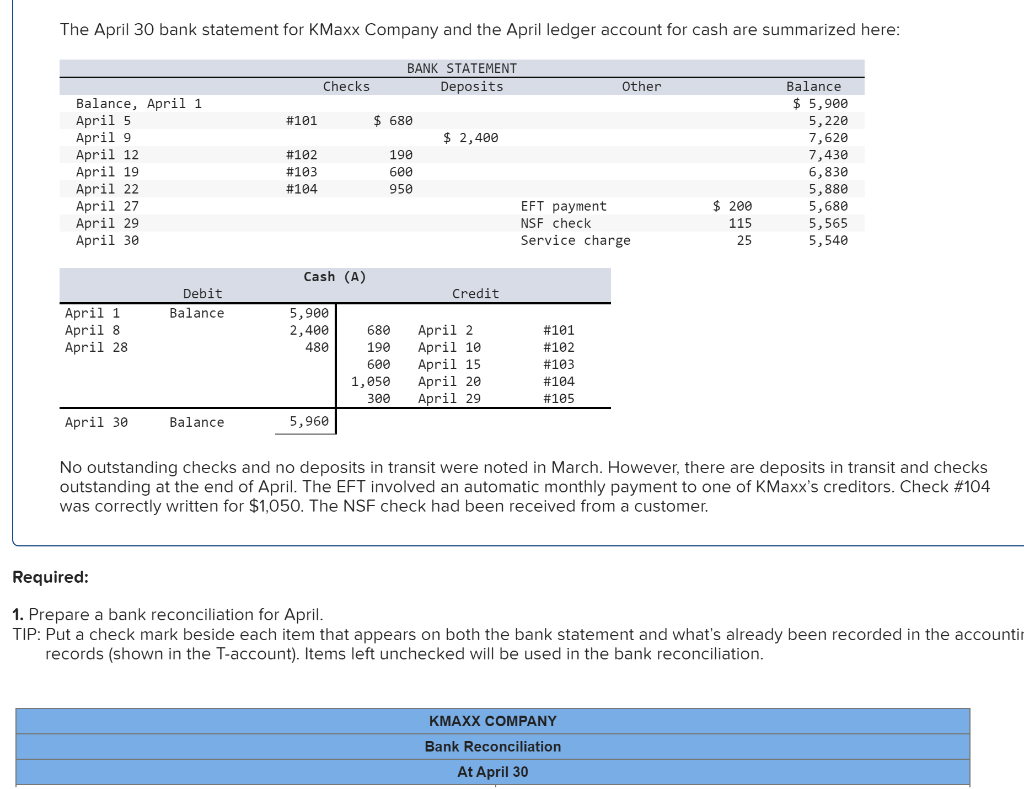

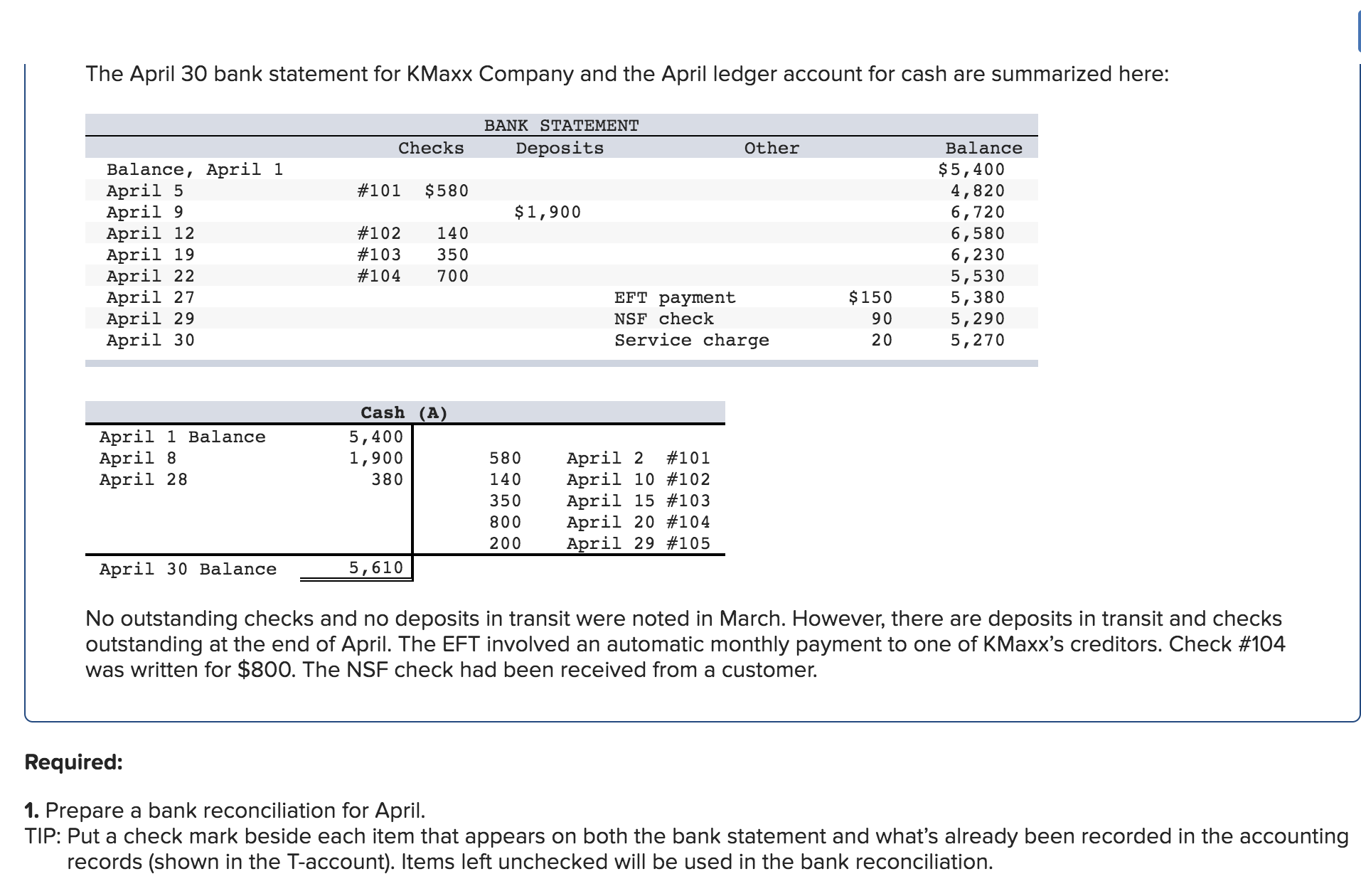

- Checkbook or Bank Statement: The code is typically printed on the bottom of checks or bank statements.

- Online Banking: Access your online banking account and navigate to the account details section.

- ABA Routing Number Database: Use an online database that provides routing numbers for financial institutions.

Importance of Using the Correct Bank Code

Using the correct 2025 04 30 bank code is crucial for the following reasons:

- Accuracy: Ensuring the funds are transferred to the intended recipient account.

- Timeliness: Avoiding delays in processing electronic payments.

- Security: Preventing unauthorized access to funds by ensuring the receiving bank is legitimate.

Conclusion

The 2025 04 30 bank code is a vital tool for facilitating secure and efficient electronic funds transfers. By understanding its purpose, format, and importance, individuals and businesses can ensure the smooth flow of financial transactions. Proper use of the bank code promotes accuracy, timeliness, and security, contributing to the overall integrity of the financial system.

Closure

Thus, we hope this article has provided valuable insights into 2025 04 30 Bank Code: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!