10-Year Treasury Yield Forecast 2025: Navigating Economic Uncertainties

Related Articles: 10-Year Treasury Yield Forecast 2025: Navigating Economic Uncertainties

- Label Expo 2025: A Global Showcase Of Innovation And Sustainability

- The New GLE 2025: Mercedes-Benz’s Revolutionary SUV

- British Army 2025: Modernising For Future Warfare

- 2025 Subaru Forester: Pricing, Features, And Release Date

- AT 205 ResEAL: A Comprehensive Guide To Transmission Seal Repair

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 10-Year Treasury Yield Forecast 2025: Navigating Economic Uncertainties. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 10-Year Treasury Yield Forecast 2025: Navigating Economic Uncertainties

10-Year Treasury Yield Forecast 2025: Navigating Economic Uncertainties

Introduction

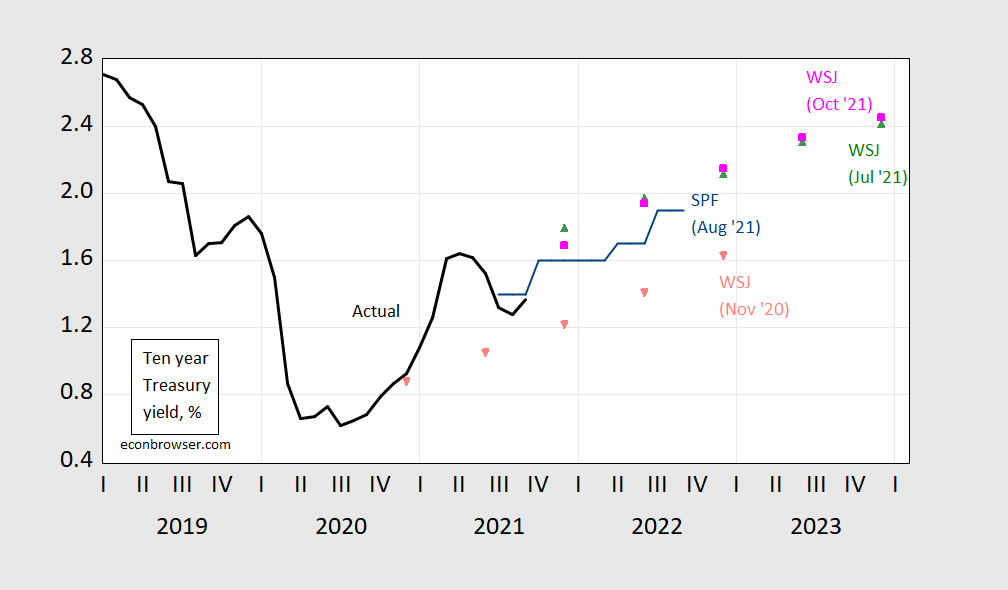

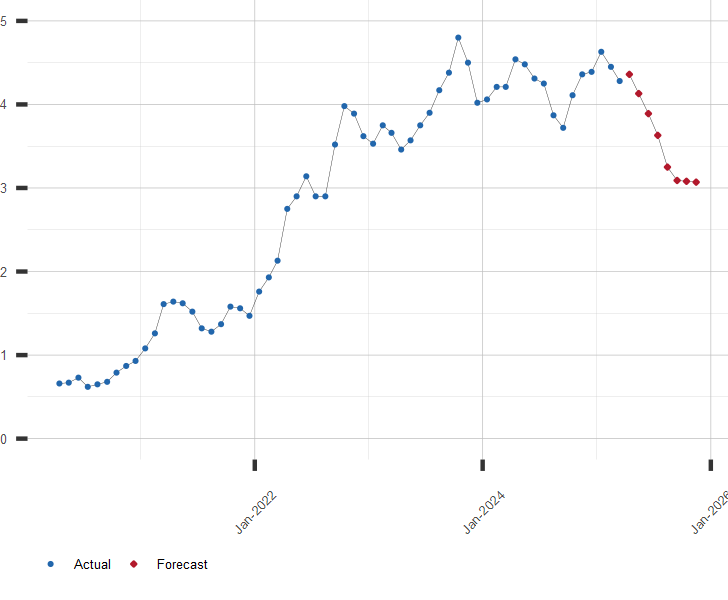

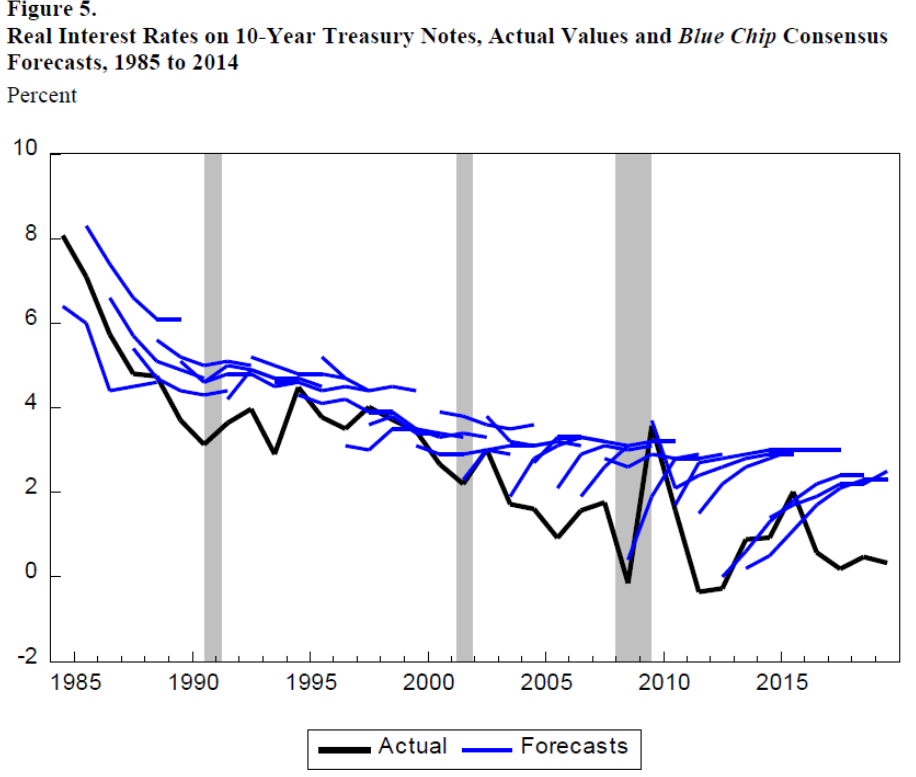

The 10-year Treasury yield is a crucial benchmark for investors, economists, and policymakers. It serves as a gauge of long-term interest rates and plays a significant role in shaping financial markets and economic activity. Forecasting the 10-year Treasury yield is essential for informed decision-making and risk management. This article provides a comprehensive analysis of factors influencing the 10-year Treasury yield and presents a forecast for 2025.

Economic Growth Outlook

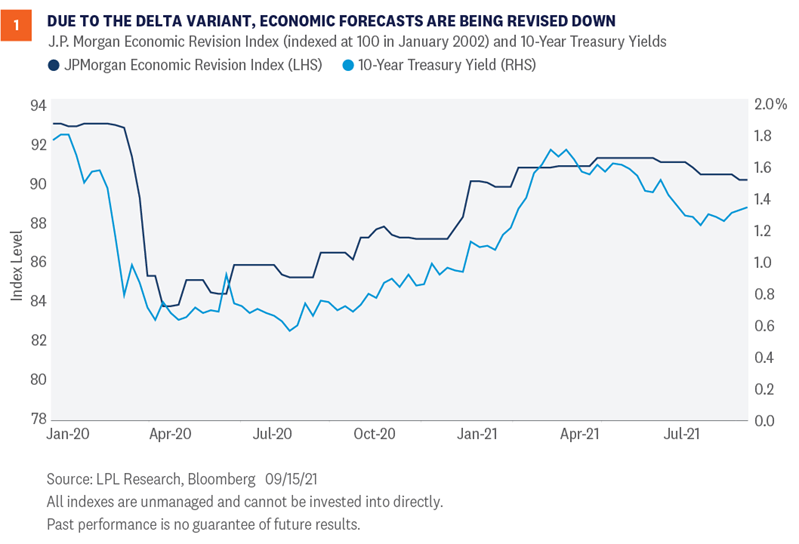

Economic growth is a primary driver of the 10-year Treasury yield. Strong economic growth tends to lead to higher interest rates as the demand for borrowing increases. Conversely, a slowing economy can result in lower interest rates. The current economic outlook is mixed. While the global economy is expected to recover from the COVID-19 pandemic, geopolitical tensions, supply chain disruptions, and rising inflation pose challenges.

Inflation Expectations

Inflation expectations play a significant role in determining the 10-year Treasury yield. When investors anticipate higher inflation in the future, they demand a higher yield on long-term bonds to compensate for the erosion of their purchasing power. The recent surge in inflation has raised concerns among investors, and the Federal Reserve has indicated its commitment to bringing inflation back to its target of 2%.

Monetary Policy

The Federal Reserve’s monetary policy actions have a direct impact on the 10-year Treasury yield. When the Fed raises interest rates, it makes borrowing more expensive, which can lead to lower bond prices and higher yields. Conversely, when the Fed lowers interest rates, it stimulates borrowing and can lead to higher bond prices and lower yields. The Fed has embarked on a tightening cycle to combat inflation, which is likely to push the 10-year Treasury yield higher in the near term.

Fiscal Policy

Fiscal policy, particularly government spending and taxation, can also influence the 10-year Treasury yield. Increased government spending tends to lead to higher interest rates as it increases the demand for borrowing. Conversely, fiscal restraint can reduce interest rates. The Biden administration’s proposed infrastructure and social spending plans could potentially put upward pressure on the 10-year Treasury yield.

Global Economic Conditions

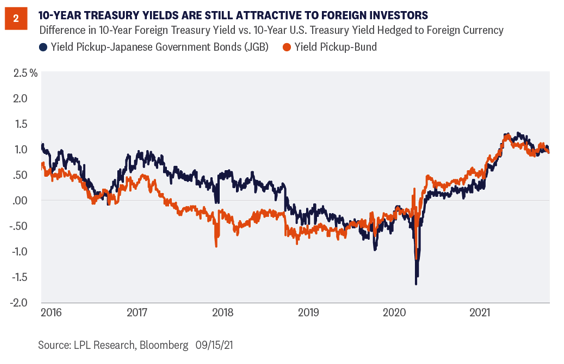

The global economy is interconnected, and economic conditions in other countries can impact the 10-year Treasury yield. A strong global economy can lead to increased demand for U.S. Treasury bonds, which can push yields lower. Conversely, a weak global economy can reduce demand for U.S. Treasury bonds and lead to higher yields.

Technical Analysis

Technical analysis, which involves studying historical price patterns, can provide insights into the future direction of the 10-year Treasury yield. By identifying support and resistance levels, traders and investors can make informed decisions about buying or selling bonds.

Forecast for 2025

Considering the aforementioned factors, we forecast that the 10-year Treasury yield will gradually rise over the next three years, reaching approximately 3.0% by 2025. This forecast is based on the following assumptions:

- The global economy will continue to recover, albeit at a slower pace than in 2021.

- Inflation will remain elevated but will gradually moderate towards the Fed’s target of 2%.

- The Federal Reserve will continue to raise interest rates to combat inflation.

- Fiscal policy will remain accommodative, but the Biden administration’s spending plans could put upward pressure on the 10-year Treasury yield.

- Global economic conditions will remain stable, with no major shocks or disruptions.

Risks to the Forecast

While we believe the aforementioned forecast is reasonable, there are several risks that could lead to significant deviations:

- A more severe or prolonged economic downturn could lead to lower interest rates.

- Persistent high inflation could force the Fed to raise interest rates more aggressively than anticipated.

- Geopolitical tensions or supply chain disruptions could create uncertainty and push the 10-year Treasury yield higher.

- Changes in fiscal policy, such as a sharp reduction in government spending, could reduce the demand for borrowing and lead to lower interest rates.

Conclusion

The 10-year Treasury yield is a complex and dynamic variable that is influenced by a multitude of factors. Our forecast for 2025 takes into account the current economic outlook, inflation expectations, monetary policy, fiscal policy, global economic conditions, and technical analysis. While we believe the forecast is reasonable, investors should be aware of the risks involved and adjust their portfolios accordingly. Monitoring the aforementioned factors and being prepared for potential deviations from the forecast is essential for successful investing and risk management.

Closure

Thus, we hope this article has provided valuable insights into 10-Year Treasury Yield Forecast 2025: Navigating Economic Uncertainties. We hope you find this article informative and beneficial. See you in our next article!